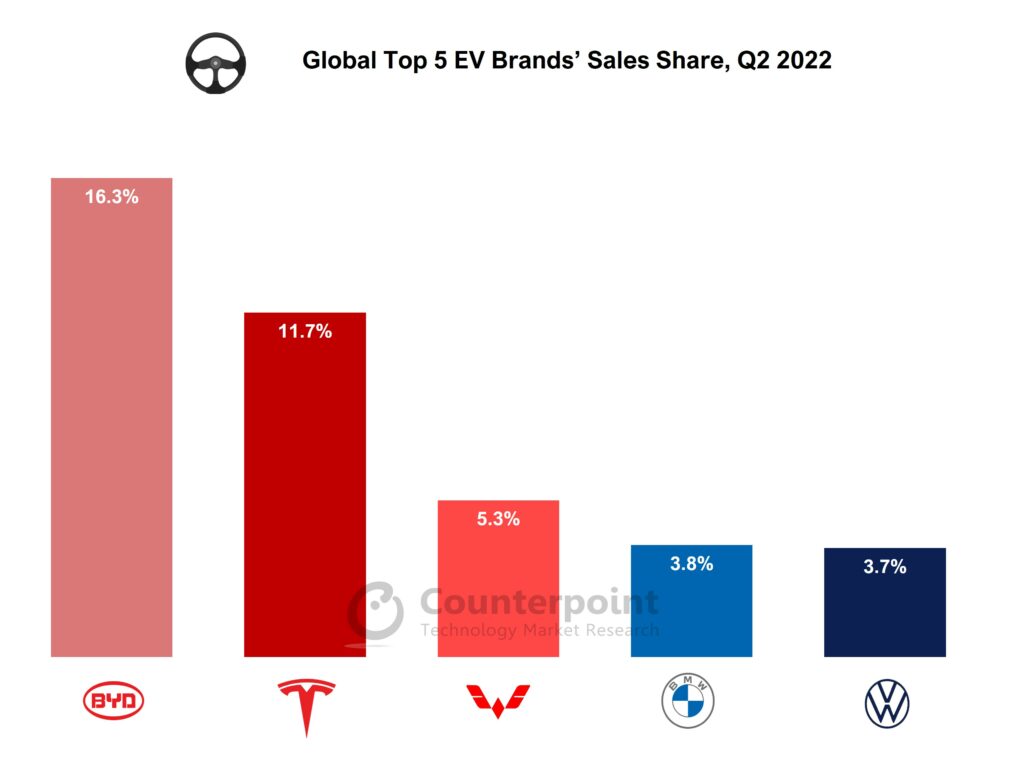

- BYD continued to lead China’s increasingly competitive EV market.

- The market share of foreign brands declined by 4% points.

- EV sales are expected to exceed 8 million units in 2023.

Beijing, New Delhi,London,San Diego, Buenos Aires, Hong Kong, Seoul – June 27, 2023

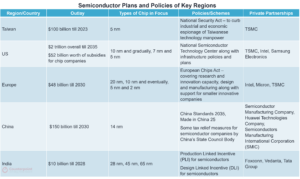

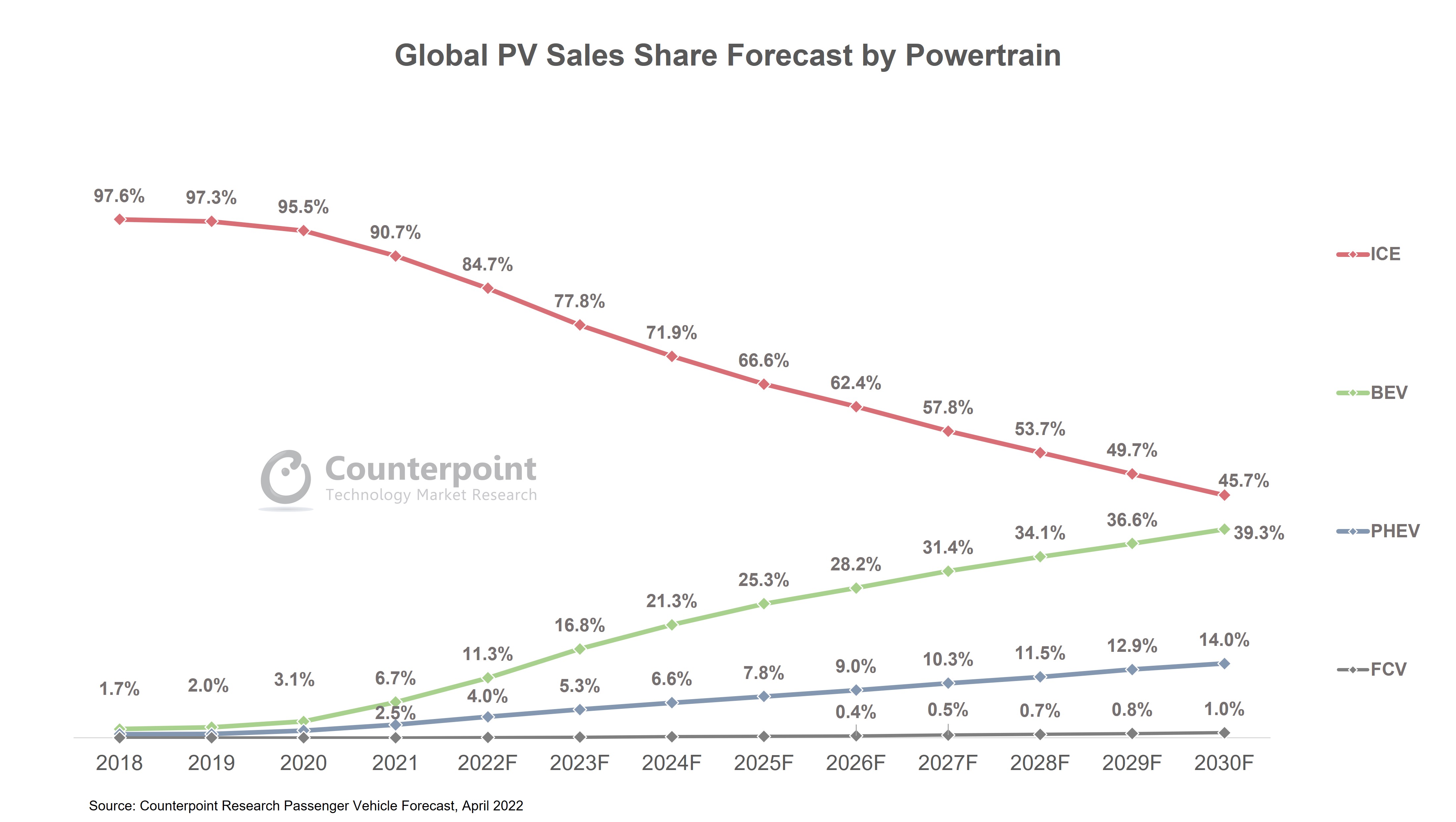

China’s passenger electric vehicle* (EV) sales grew 29% YoY in Q1 2023, according to the latest research from Counterpoint’sChina Passenger Electric Vehicle Model Sales Tracker.Battery EVs(BEVs) made up nearly70%of the sales. There was a remarkable88% YoYsurge inplug-in hybridEV (PHEV) sales as well. Recently, PHEVs have been experiencing increased popularity in China. BYD secured its leading position with 79% sales growth and 9.8% points increase in market share YoY. Thetop 10 automotive groups, encompassing28 brands, collectively accounted for over80%of the totalpassenger EV sales.

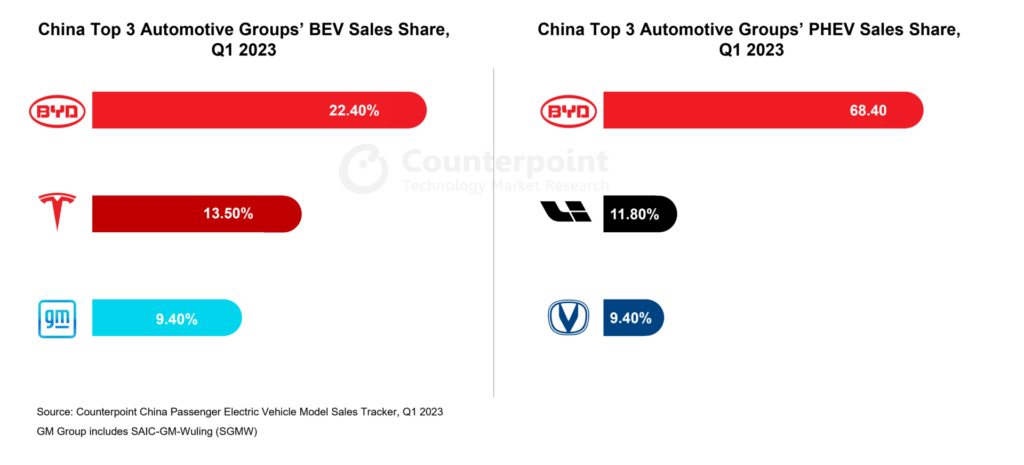

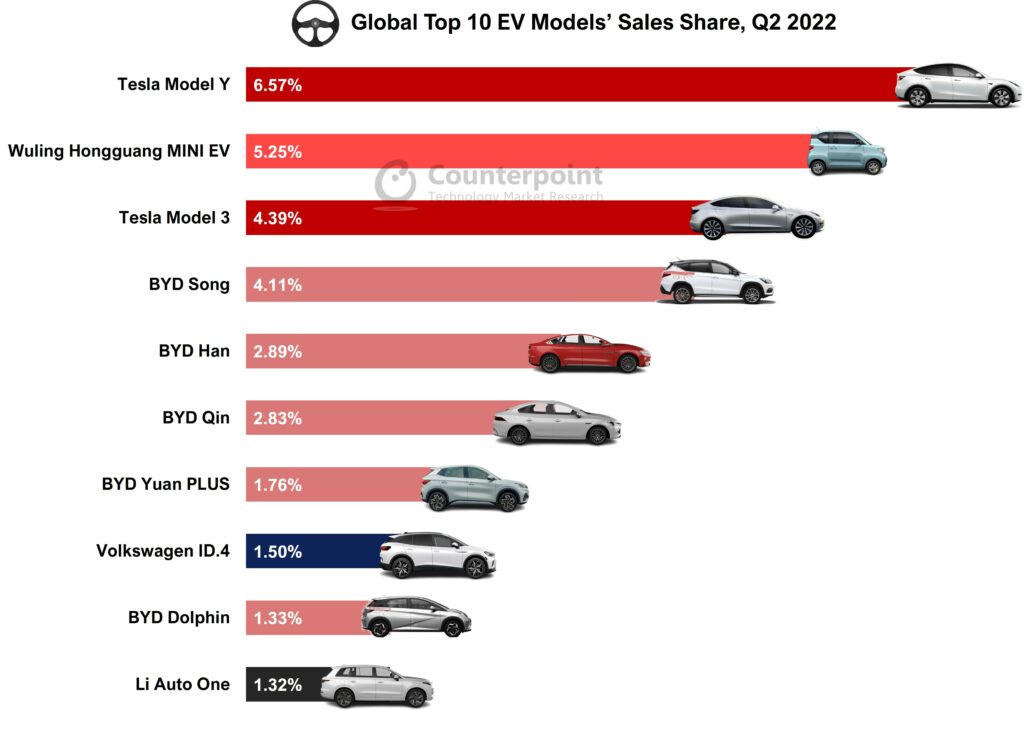

Commenting on the market dynamics,Senior Research Analyst Soumen Mandalsaid, “The discontinuation of the 13-year-old New Energy Vehicle (NEV) purchase subsidy, paired with theTesla-triggered price war, had an adverse impact on domestic EV start-ups. Especially, smart EV brands such asNIO,XpengandNetareported disappointing sales figures compared to the previous quarter. Foreign brands, likeVolkswagen,BMW,Mercedes-Benz,Tesla,HyundaiandNissan, experienced a combined 4% points decrease in market share compared to a year ago. However, Tesla stands out as an exception. Other foreign brands havestruggled to offer strong competitionto domestic brands. Furthermore, Chinese brands such asBYD Auto,Dongfeng Motors,FAW,Great Wall MotorsandGeely Auto冒险超越国内边界建立吗their presence across Europe, Latin America and Asia-Pacific.”

Eight of the top 10best-selling EV models were ofChinese originin Q1 2023. Except Tesla,no foreign modelswere able to secure a position in the top 10. Thetop 10 best-sellingmodelscollectivelyaccounted for46%of China’s passenger EV sales. Moreover, all the top 5 best-selling PHEV models in Q1 2023 were manufactured byBYD Auto.

Discussing the market outlook,Associate Director Brady Wangsaid, “Thegrowth trajectoryof China’s passenger EV market is expected to continuethroughout 2023. Othersupportive policieshave beenimplementedto boost the market’sgrowth内华达州消除后的购买补贴。我n May, China’s Development and Reform Commission released a strategic document aimed at promoting EV adoption in rural areas. This will encourage auto manufacturers to introduce more affordable models, enhance sales systems, and facilitate trade-in services for rural consumers. We expect China’s EV sales toexceed8 millionunits by the end of 2023.”

*Sales refer to wholesale figures, i.e. deliveries from factories by the respective brand/company.

*For EVs, we consider only BEVs and PHEVs. Hybrid EVs and fuel cell vehicles (FCVs) are not included in this study.

The comprehensive and in-depth ‘China Passenger Electric Vehicle Sales Tracker, Q1 2018-Q1 2023’ is now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at press@www.arena-ruc.com for questions regarding our latest research and insights.

Background

对位技术3月ket Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Soumen Mandal

Neil Shah

Brady Wang

Counterpoint Research

Related Posts

- US EV Sales Up 79% YoY in Q1 2023 Helped by Tax Credit Subsidy

- 全球EV Sales Up 32% YoY in Q1 2023 Driven by Price War

- 全球Passenger Electric Vehicle Market Share, Q2 2021 – Q1 2023

- Google Puts Auto Expansion in Top Gear

- Connected Car Sales Grew 12% YoY in 2022 With Volkswagen Group in Lead

- Price Cuts Boost Tesla Revenue in Q1, Profit Slumps Compared to 2022

- 全球Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

- EV Sales in US up 54.5% YoY in 2022; Tesla Market Share at 50.5%

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Tesla Leads US EV Market, Eclipsing Next 15 Brands Combined

- Thailand Leads Southeast Asia EV Market With 60% Share

- Mercedes Fends off VW in Europe EV Market

- BYD Widens Gap with Tesla in Q3 2022, Leads Global EV Market

- A Promising Yet Challenging Market for Self-driving SoCs

- China EV Charging Points Soar 56% YoY in 2021, 42% CAGR Seen for 2022-2026

Commenting on the competitive dynamics,Associate Director

Commenting on the competitive dynamics,Associate Director