Counterpoint Research Weekly Newsletter

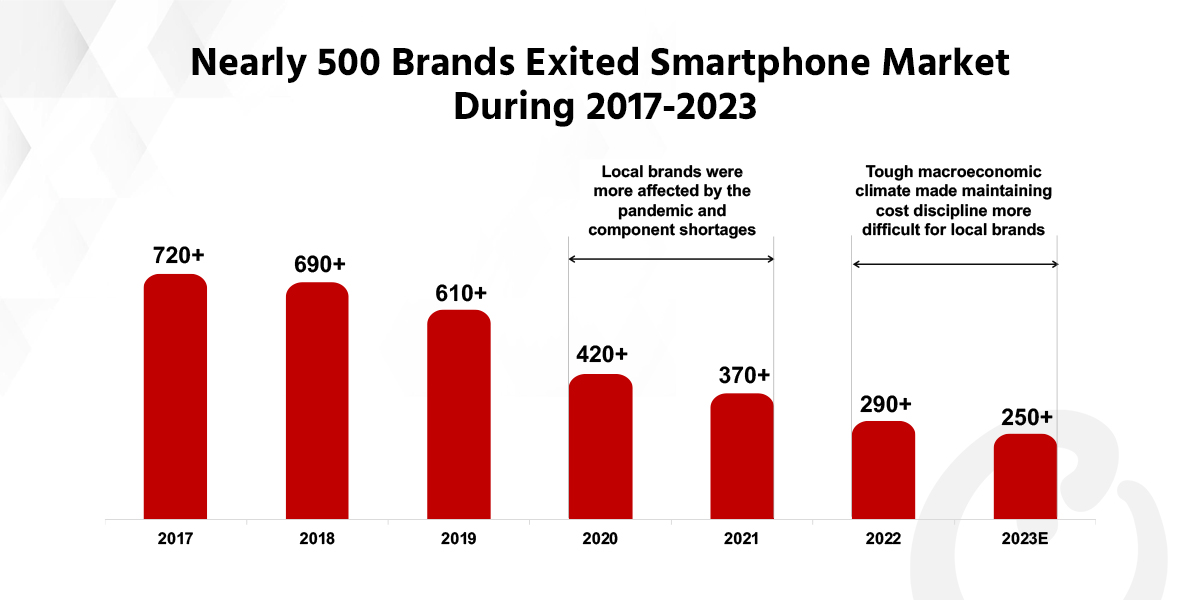

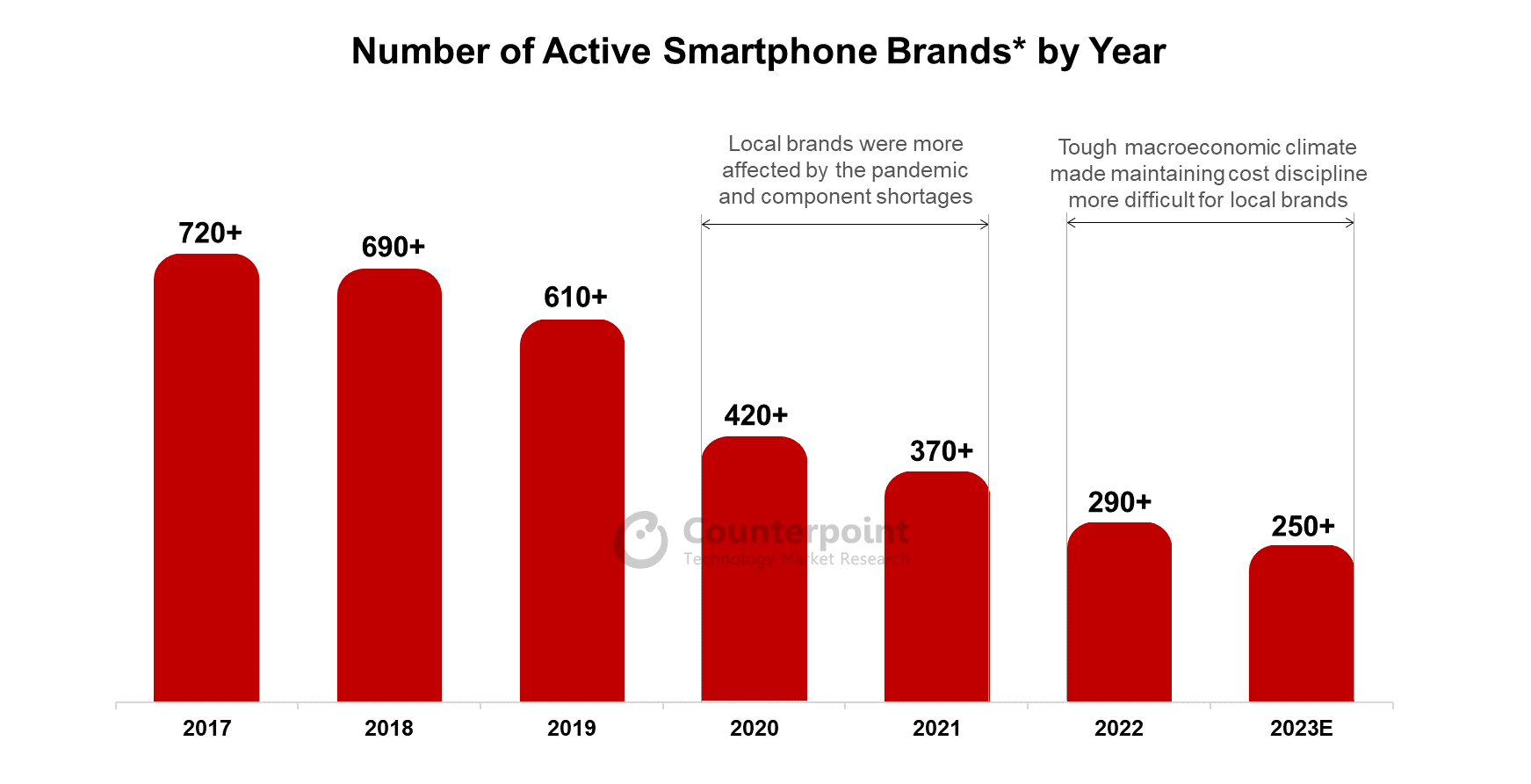

At itspeak in 2017, the global smartphone market saw more than 700 brands fiercely competing. Fast forward to2023and the number of active brands (that have recorded sell-through volumes) is down by two-thirds to almost 250, according to Counterpoint’sGlobal Handset Model Sales Tracker, which has been tracking sales of these brands across more than 70 key countries.

A maturing user base, improving device quality,longer replacement cycles, economic headwinds, supply-chain bottlenecks and major technological transitions such as4G to 5Ghave gradually whittled down the number of active brands and their volumes over the years. For example, local smartphone brands, once known as “local kings”, likeMicromaxinIndiaand Symphony in Bangladesh, have lost significant share or even exited over the last five years.

Decline of local brands

Strikingly, the decline in the number of active brands is coming largely from local brands, while the number of global brands has remained mostly consistent. Most local brands operate in lower price bands and in regions that have fragmented markets across wide geographies, likeAsia-Pacific,Latin Americaand Middle East & Africa.

Brands lag in R&D and marketing efforts

In a rapidly evolving smartphone industry, small brands have struggled to keep up with big brands across many fronts. While big brands have continued to invest in R&D,manufacturingand capacity building, small brands have been largely dependent onwhite-label devices. Furthermore, large promotional and marketing events and big-name brand ambassador tie-ups from sports and movies are commonplace for big brands, which most small brands don’t have the resources to do.

Evolving customer needs

Small brands capitalized on the market’s transition from 2G to 3G/4G, benefitting from strong entry-tier demand, particularly in Africa, Asia and Latin America. However, the needs of the average mobile phone consumer have been evolving since and the user base has matured. Therefore, there is now a greater demand for better specifications and design, brand value and ecosystem integration.

Unable to keep up with growing Tier-1 Chinese brands

The rise of Chinese brands likeXiaomi,OPPOandvivohas also accelerated the decline of small brands.Chinese brandshave been able to introduce significantly better smartphones at aggressive price points, providing customers better value for their money.

Small brands more affected by industry headwinds

From theCOVID-19 pandemic and component shortagesto theongoing global economic slowdown, multiple headwinds have affected smartphone brands across the board in the recent past. For big brands, it has been relatively easier to shore upprofitmargins in this market environment. But small brands have struggled to keep operations running.

展望未来,智能手机品牌的数量很快就会回来的l continue to decrease, and large global brands will be in the best position to adapt to all the macroeconomic headwinds and technological transitions in the market.

Key takeaways

A maturing smartphone user base, better R&D innovations by big brands, expansion of competing bigger brands and tough macroeconomic conditions have been the key drivers for this market consolidation trend. Therefore, small-scale or even incumbent brands looking to survive in this market need to invest in R&D to differentiate, be prudent with their target segments and marketing strategies, track the competition closely and identify gaps and opportunities to succeed.

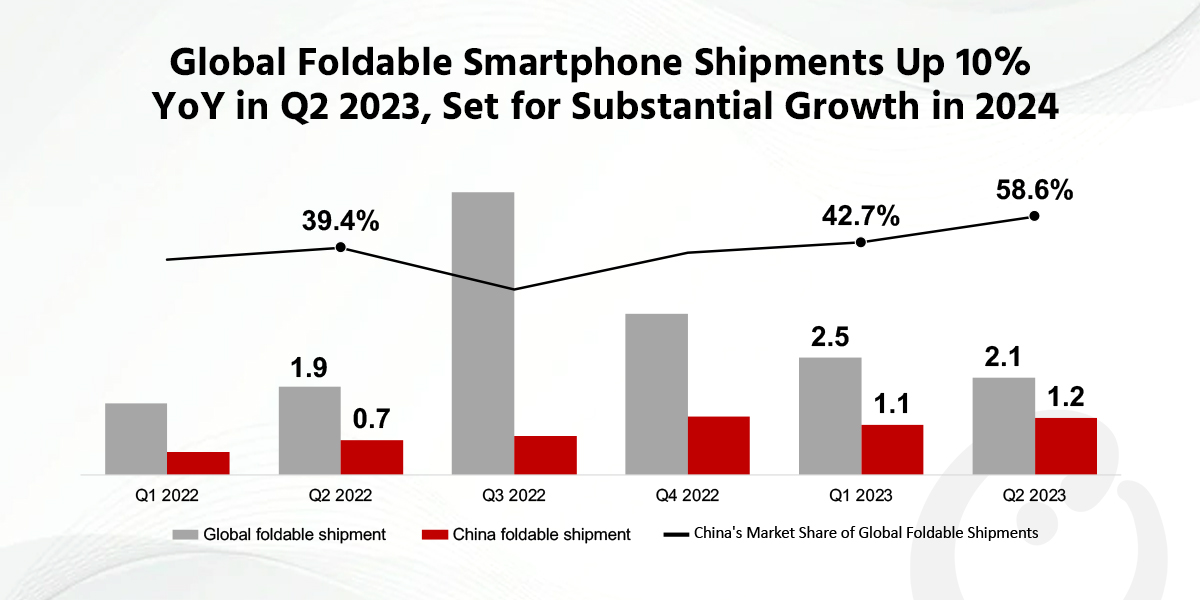

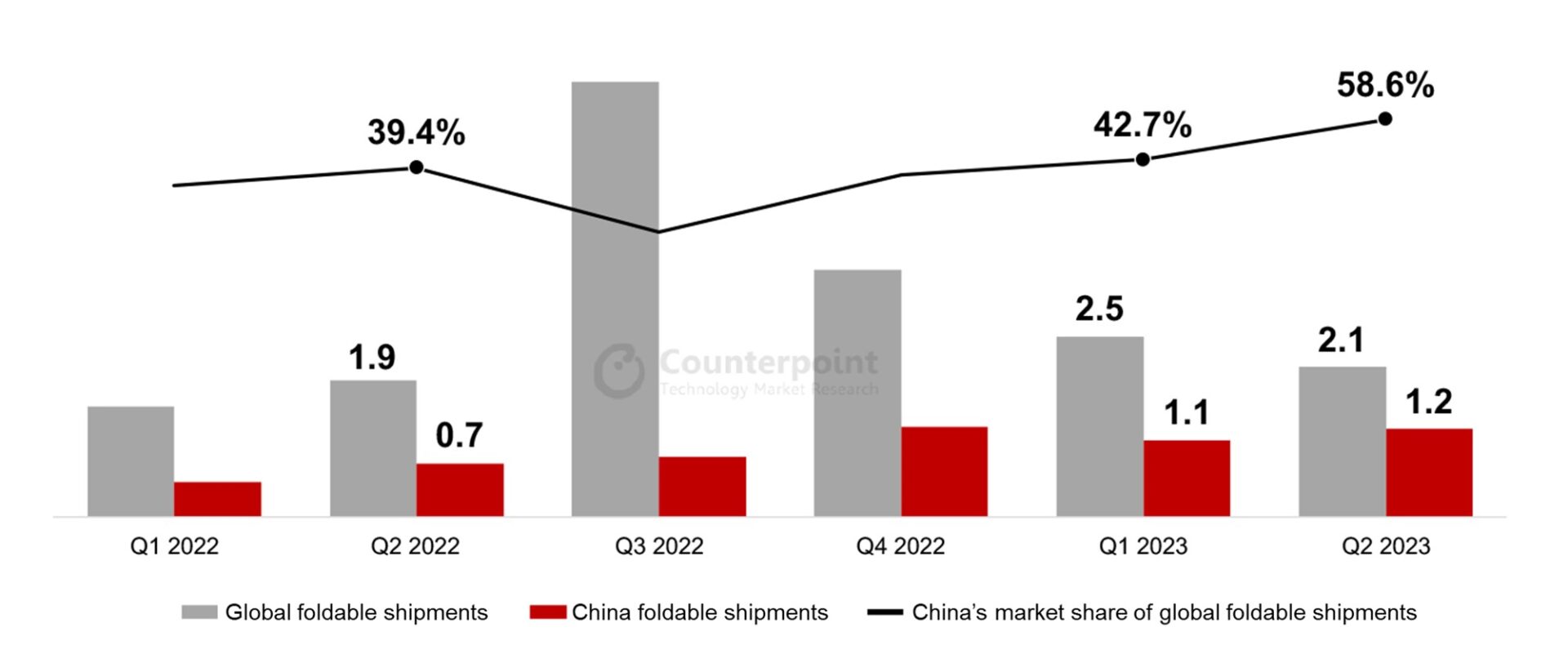

The global foldable smartphone market increased 10% YoY in Q2 2023 to reach 2.1 million units, according to Counterpoint Research’s most recentglobal foldable smartphone tracker.This growth is in stark contrast to that of the global smartphone market, which showed a 9% decline in shipments during the quarter to reach 268 million units. Due to the prolonged Russia-Ukraine war and the ongoing high global inflation, the smartphone market is expected to grow sideways. Nevertheless, the foldable smartphone sector continues to exhibit robust and sustained growth.

Global and ChinaFoldable Smartphone Shipments, Q1 2022-Q2 2023

The foldable smartphone landscape in the Chinese market presents a particularly intriguing scenario. During Q2 2023, shipments in the overall Chinese smartphone market slipped 4% YoY to reach 61.9 million units, hurt by the recent economic challenges faced by the country, which led to a reduction in consumer spending. However, the Chinese foldable smartphone market achieved notable success, surging 64% YoY to reach 1.2 million units. China now commands the largest share of the global foldable smartphone market, with a 58.6% share.

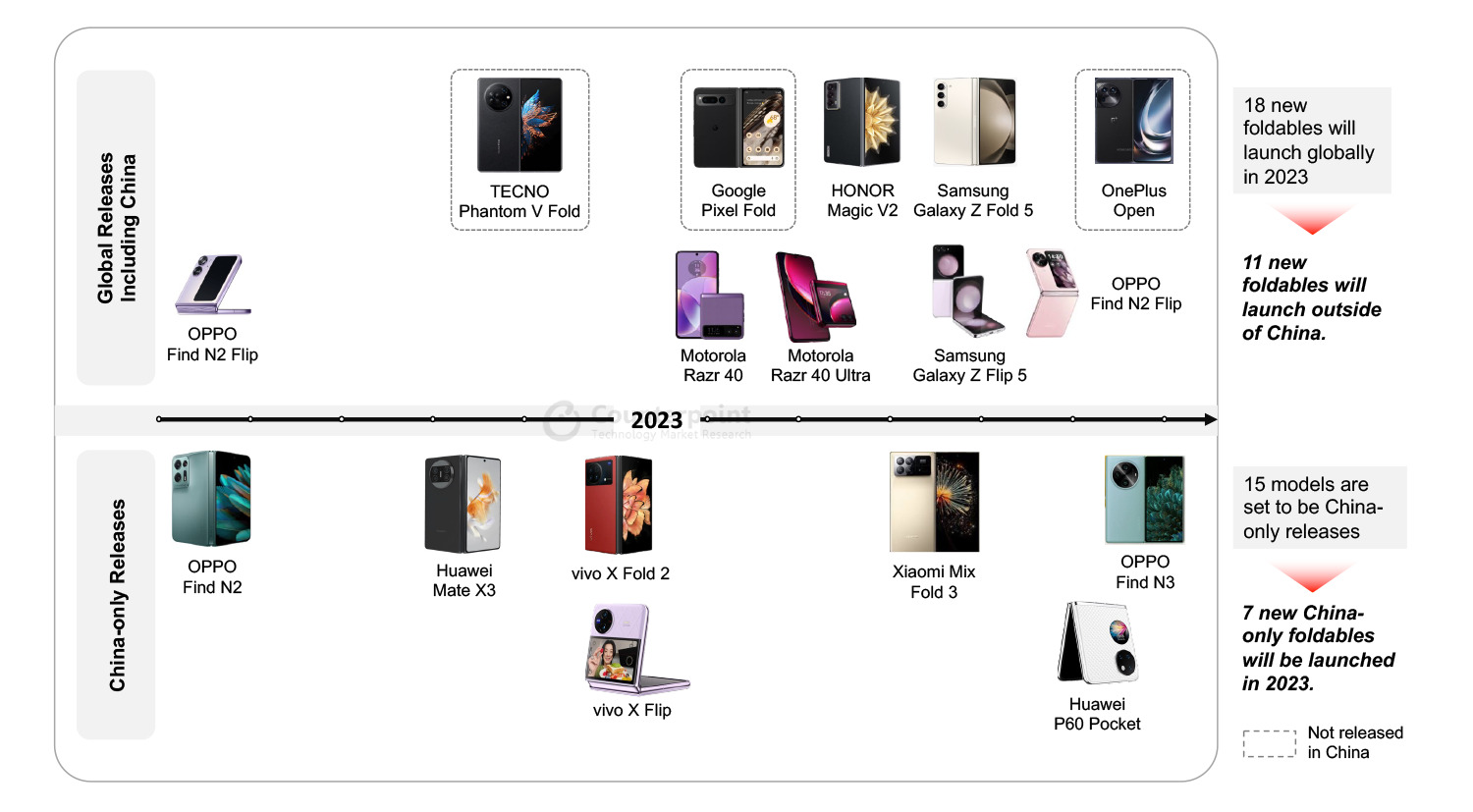

FoldableProduct Launch Status in 2023: Comparison of Global and Chinese Foldable Markets

The rapid growth of the Chinese foldable market is primarily attributed to the introduction of foldable products tailored for the Chinese market, coupled with a strong demand for these products among Chinese consumers. In Q2 2023, significant momentum is building for the continued growth of the foldable market. This surge was driven by the introduction of key products such as the Huawei Mate X3, vivo X Fold 2, and vivo X Flip, primarily targeting the Chinese foldable market. Additionally, the global (including China) launch of the Motorola Razr 40 and Razr 40 Ultra, further contributed to this growth trend. In Q2 2023, China saw the launch of five new foldable products tailored for its market, while the global market outside China only saw two foldable product launches during the same period.

Counterpoint Research Senior Analyst Jene Parksaid, “We believe that these frequent product launches (along with the marketing effects that accompany product launches) are changing Chinese consumers’ perception of foldable products. Consequently, Chinese consumers can access a variety of foldable products more easily and frequently than any other market in the world. The continuous release of various foldable products is recognized as one of the important reasons why the Chinese foldable market has continued to grow significantly compared to other markets.”

Global Foldable Smartphone Forecast,2023-2024

The global foldable smartphone market will undergo significant changes in H2 2023. Chinese manufacturers are expanding their presence internationally during this period, with notable releases including the HONOR Magic V2, OPPO Find N3 Flip, and the yet-to-be-named OnePlus foldable device. Notably, Samsung’s Galaxy Z Fold 5 and Galaxy Z Flip 5, considered to be some of the top-tier foldable offerings, were launched in August and are expected to capture a substantial market share in H2 2023.

Parkadded, “The global foldable smartphone market is set to see significant growth in the H2 2023, driven by the expansion of Chinese manufacturers. Although Samsung’s market share may dip due to increased competition, we believe that it will be a natural result. However, competition among manufacturers usually has the effect of increasing the size of the market for the product. We believe that the era of the mass foldable phone is expected to start in 2024, mainly led by Samsung and Huawei with their entry-level foldables. Entry-level foldables are expected to be priced around $600 to $700, making them more accessible to consumers.”

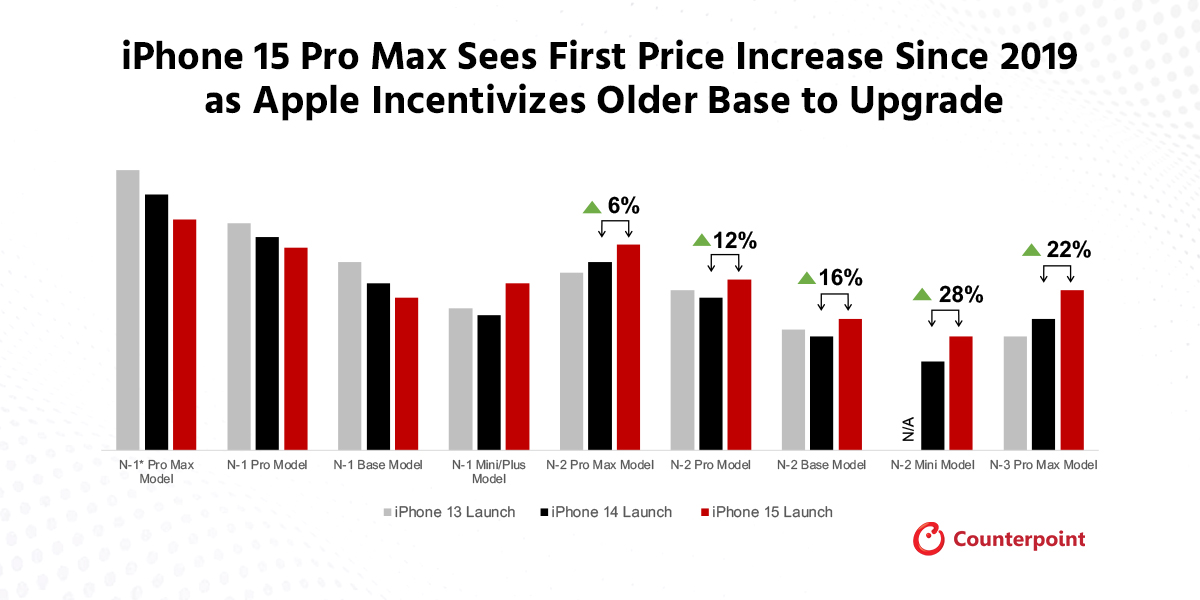

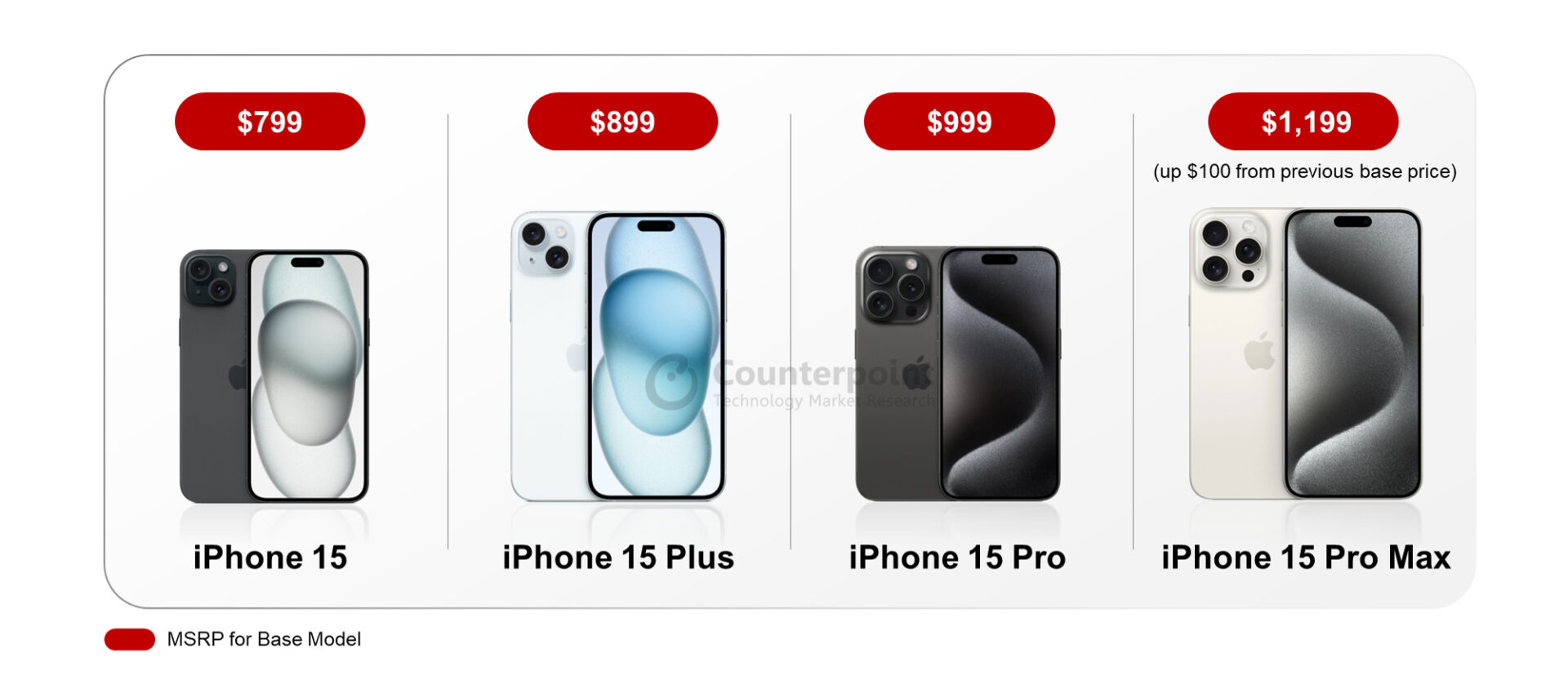

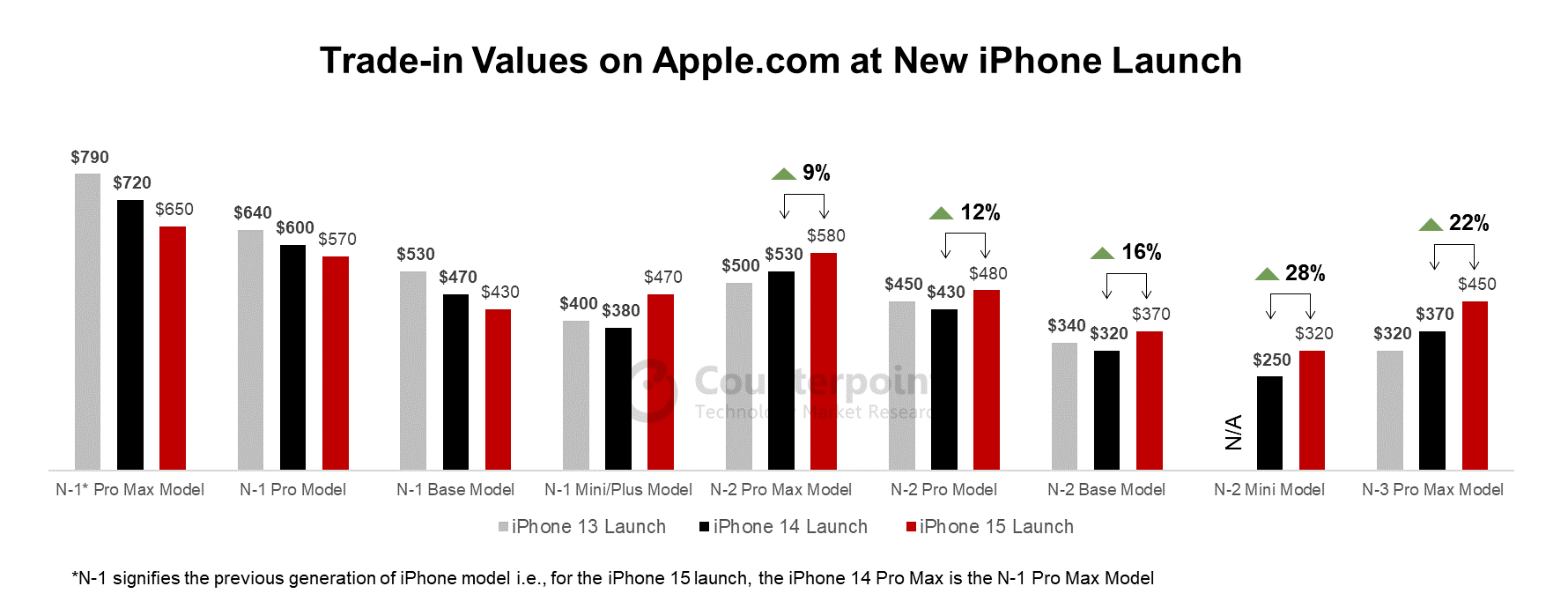

Apple has released its new iPhone 15 series, confirming the price increase for the Pro Max model by $100 in the US. This is the first time since the Pro series launched in 2019 that Apple has raised its prices. Apple’s carrier promotions have softened slightly compared to the iPhone 14 launch while trade-in values for N-1 devices (newest generation minus one, i.e. iPhone 14) have also decreased. Apple is offering better trade-in values for N-2 or N-3 devices compared to last year to help upgrade its older-generation base.

New pricing for Pro Max – Now at $1,199 for base model

The Pro Max price increase to $1,199 is mostly a result of an upgrade to a titanium chassis as well as a telephoto camera, which will allow for 5x optical zoom with a 120mm lens. The base model now also comes with 256GB of storage. This price increase may change consumer purchasing patterns and potentially have repercussions for Apple’s overall ASP as consumers may decide to purchase more affordable models this time around. It may be noted here that the 256GB iPhone 14 Pro Max also retailed for $1,199.

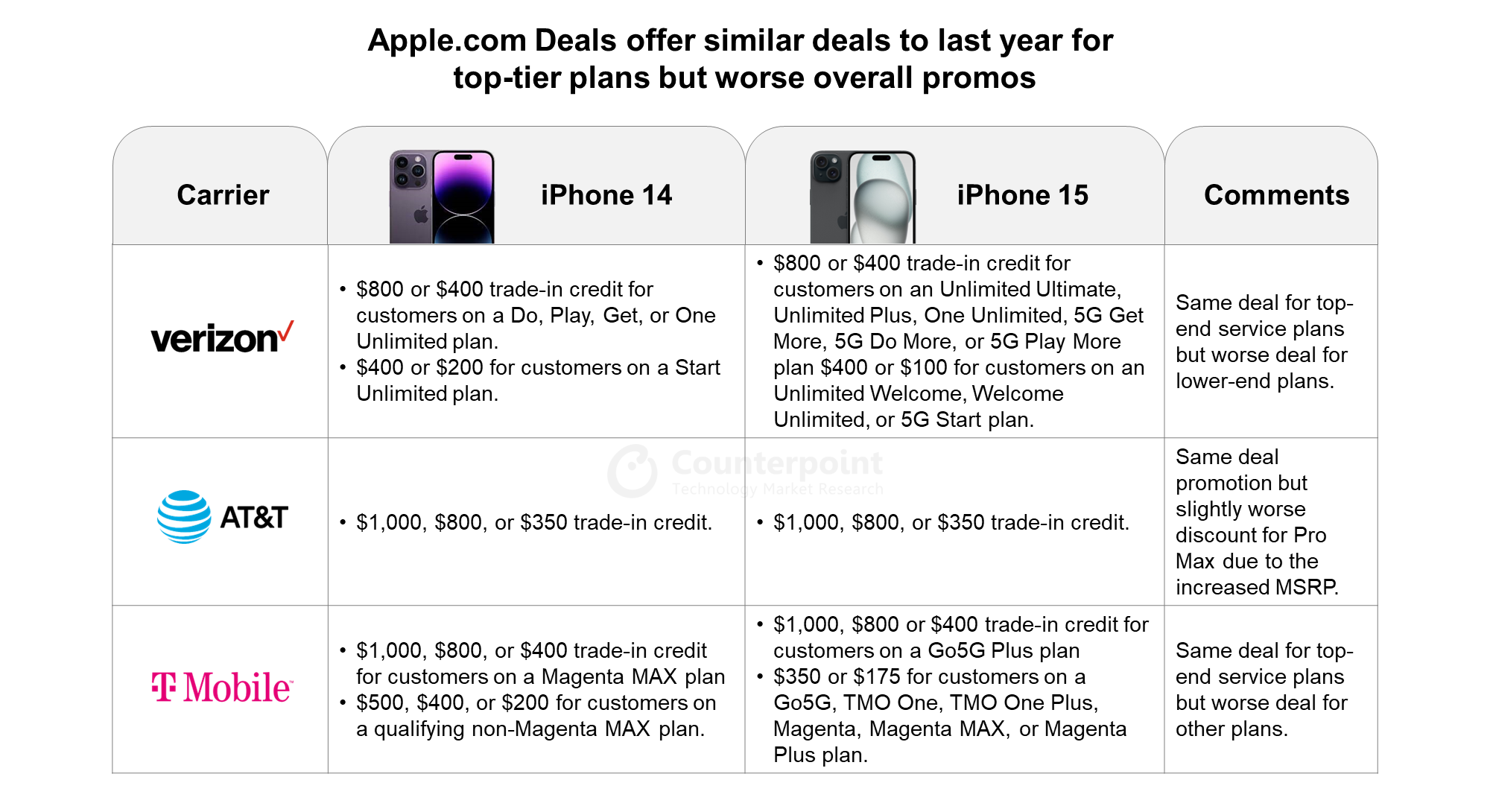

US promotions decrease slightly

US carriers Verizon, T-Mobile and AT&T generally have the same top-line promotions for the highest tiered plans on Apple’s website as last year’s iPhone 14 launch. This means that both AT&T and T-Mobile will offer up to $1,000 off on devices with a qualifying trade-in and eligible plan. Verizon remains the outlier, offering a discount of only $800. However, Verizon and T-Mobile’s lower-tiered plans have seen a decrease in value. This means that iPhone 15 promotions are slightly worse compared to last year, especially with the higher price of the iPhone 15 Pro Max.

与此同时当运营商看到嘘orically low upgrade rates and smartphone purchases are being delayed as consumers continue to face economic uncertainty. Nevertheless, we believe the iPhone 15 has the potential to be another big upgrade cycle for Apple, especially for the iPhone 11 and iPhone 12 owners as they look to upgrade their three- to four-year-old devices.

Trade-in Values Have Decreased for N-1 Models, But Apple is Pushing its Older Base to Upgrade

Although the discounts offered have largely remained the same, the pure trade-in values of N-1 devices have fallen, again. When the iPhone 13 series launched, customers could get a maximum of $790 in trade-in value for their old iPhone 12 Pro Max. This trade-in value dropped to $720 for the iPhone 13 Pro Max when the iPhone 14 series released last year. This year’s iPhone 15 launch saw trade-in values drop to $650 for the iPhone 14 Pro Max as the highest-value trade-in device.

Compared to the years before, Apple is putting a stronger focus on offering better trade-in values for its N-2 and N-3 models such as the iPhone 13 series and iPhone 12 series. Trade-in values for N-2 models have increased 9%-28% YoY for this year’s launch. This also shows that Apple wants to incentivize customers to upgrade their older models to the latest iPhone 15 while signaling to the iPhone 14 users to hold off for now. In fact, these trade-in values could potentially be more attractive to customers than carrier deals, especially if they are not on the highest tiered plans available. This might lead to more customers purchasing an unlocked device directly from Apple rather than opting for a carrier promotion offered by Apple.

At the launch of theiPhone 15andWatch 9series this week, Apple mentioned that it was on track to release theApple Vision Pro, which it announced in June this year, in early 2024. It has also included some features in the new iPhone and Apple Watch that are consistent with its Vision Pro development:

In our analysis of theApple Vision Pro, we highlight that it is the most complex consumer electronics product ever made. And it is already causing a shift in approach by its rivals.

Nevertheless, we still believe that Apple is using the Vision Pro essentially as an insurance policy. The majority of Apple’s revenue and profit is derived from the iPhone product line, and related products and accessories – Watch, for example, would not exist without iPhone.

Therefore, iPhone is the core of Apple’s almost $2.75-trillion market cap (at the time of writing). Apple is bound to do anything in its power to defend the iPhone’s market position.

For a long time, people have speculated that the product most likely to replace the smartphone as their primary interface with digital life will be some sort of augmented reality device. So far, the eXtended Reality (XR) market has been disappointing – generating a few 10s of millions of unit sales but not a huge amount of consistent usage, apart from some niche enterprise use cases. Furthermore, the technical challenge of making true augmented reality glasses has proven to be beyond the capabilities of even the most technically gifted companies.

Apple is therefore not immediately threatened by the slowly developing XR industry. But would it be wise for it to sit on the sidelines and watch while potential competitors work on what might, one day, be a product that can truly compete with its iPhone revenue stream? Of course not, and it hasn’t.

For Apple, the worst possible outcome would be if the XR segment took off strongly and it did not have a product in the game. Even if Apple spends a few billion dollars developing its XR products and the market still doesn’t take off, it would be costly but scarcely make a dent in its ample cash reserves.

So, Apple has made the logical choice and invested in creating the Apple Vision Pro. Along the way, it has amassed an impressively large patent portfolio that it can use to defend its position.

If, ultimately, the XR market does take off, Apple will be in a prime position to exploit the opportunity. However, if it continues to behave as an interesting niche market, then Apple has cemented its place by having a product that will be used to measure all others.

Subscribing clients can read ourfull analysis of the Apple Vision Prothat also includes sales projection scenarios.

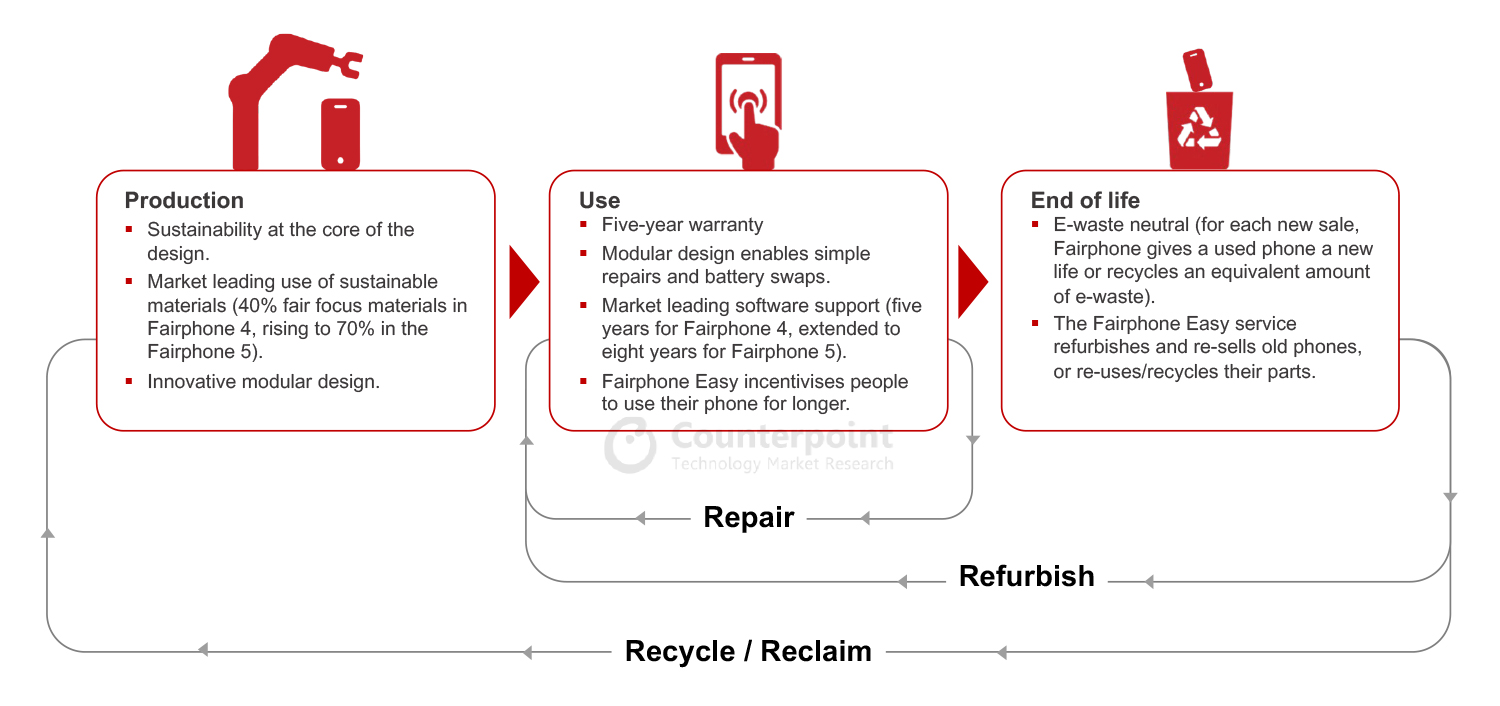

Today, on Thursday 14thSeptember 2023, sales began of the most environmentally friendly smartphone ever made: the Fairphone 5. To mark the occasion, Counterpoint Research has just published aprofile reporton Fairphone, which looks into Fairphone’s performance as a sustainability pioneer over the last year, and assesses its future prospects. Here are some of the highlights.

Fairphone is the pioneer of smartphone circularity

Fairphone is undoubtably the most sustainable smartphone company in the world, and is a pioneer ofsmartphone circularity. Through all three stages of the smartphone circular economy – production, use and end of life – Fairphone has developed initiatives that increase the sourcing and use of sustainable materials, maximise the lifespan of its devices and minimise e-waste, while maintaining ethical business practises.

在生产方面,可持续发展是core of the design, with market leading use of sustainable materials and an innovative modular design. The latter is key to Fairphone’s party piece: the ability for the user to do simple repairs and battery swaps, by themselves at home with some basic tools. This extends the life of the device, helped by a five-year warranty and market leading software support (five years for Fairphone 4, extended to eight years for Fairphone 5). All in all, Fairphone incentivises people to use their phone for longer. And finally, when it comes to the end of a device’s life, Fairphone refurbishes and re-sells old phones, or re-uses/recycles their parts. In addition, Fairphone ise-waste neutral, where for each phone sold, a used phone is given a new life or an equivalent amount of e-waste is recycled).

Circularity summary for Fairphone

Others are taking sustainability seriously, and are catching up

With these initiatives, Fairphone sets the benchmark against whichother manufacturersshould be compared. In an ideal world, all smartphones would be made the Fairphone way, and indeed, one of Fairphone’s goals is to motivate and encourageother smartphone OEMsto adopt more sustainable business models.

But this is easier said than done. It is one thing to create a sustainable smartphone when you are producing two models at any one time and selling 116,000 of them a year. It is entirely another thing to replicate that when you have hundreds of models in your portfolio and sell hundreds of millions of phones a year.

Nevertheless, consumers are becoming increasingly aware and concerned about their environmental impact, so sustainability amongst smartphone OEMs will become more and more important. By blazing the sustainability trail and showing others what can be achieved, Fairphone can influence larger players, such as Samsung and Apple but especially most Chinese OEMs who are sustainability laggards, to up their game and move the industry in a fairer direction.

Of course, as others improve, Fairphone’s USP may diminish. Fairphone could end up being the architect of its own downfall.

The full report is availablehere.

Given the absence of most major smartphone OEMs from IFA 2023, HONOR grabbed most of the headlines. And it didn’t disappoint, launching two products that were sure to get people talking: one a masterpiece of engineering, and the other, a masterpiece of thinking outside the box.

First, we have the Magic V2, HONOR’s latest foldable smartphone that comes only six months after its Magic Vs was launched internationally at MWC 2023. But as we learned from HONOR executives, why wait when such a leap in technology has been achieved? This was quite a poignant statement in an era when most smartphone vendors launch new devices annually, usually without any major upgrades to shout about.

荣誉当然有大声抗议with the Magic V2, as the hardware is simply staggering. HONOR has managed to produce a smartphone so thin that it seems to defy physics: at 4.7mm thick when unfolded and 9.9mm thick when folded, the V2 is only slightly thicker than a standard smartphone even when folded. For comparison, the Samsung Galaxy Z Fold5 measures 13.4mm thick when folded, and the Galaxy S23 Ultra is 8.9mm thick. Similarly, at 231g, the HONOR Magic V2 actually weighs less than the iPhone 14 Pro Max or the Samsung Galaxy S23 Ultra, and significantly less than Samsung and Google’s foldables respectively. Overall, it’s the closest to a standard candybar smartphone than any other foldable on the market. And since the dimensions of the front screen are similar to a normal phone, not tall and thin like the Samsung Galaxy Z Fold5, it’s easy to forget it’s a foldable!

But a foldable it is, and the hinge is superbly slick. It occasionally fails to hold itself in an upright position, but it feels solid and leaves no gap at all. The internal screen is beautiful with a 2K resolution, a super-smooth adaptive 120Hz refresh rate, and the crease is hardly noticeable. It feels very premium indeed. The camera is yet to be tested, but the 50MP main, a 50MP ultrawide, and a 20MP 2.5x telephoto lenses, plus AI Falcon Capture, on-paper at least, put it ahead of the Galaxy Z Fold5 and even the Google Pixel Fold. Of course, the latter has Pixel Fold benefits from Google’s image processing technology, but the Magic V2 looks like it will be a very capable snapper.

There are a few downsides. First, the Magic V2 has no IP rating, compared to the Galaxy Z Fold5 IPX8 rating. And secondly is the question of software. Previous HONOR foldables have featured polished software in the way they handle apps and images on the internal screen, but scaling and optimisation are areas for improvement. Time will tell if HONOR has improved with the V2, but I suspect things may still lag the Samsung experience.

However, HONOR has still produced what I think is the best book-type foldable smartphone the industry has seen so far. Sadly, it may not be coming to international markets until next year, which does leave me wondering why HONOR decided to “launch” it now. If the tech is ready (and it’s already available in China), then why not launch it now and get the jump on Samsung? Leaving it until next year gives Samsung a few extra months to try to catch up.

HONOR’s other major announcement at IFA, and the one that attracted most of the headlines was its concept outward folding smartphone, the HONOR V Purse. The device features interchangeable straps and chains that allow it to be carried like a purse or a handbag and uses its outward-facing display to show wallpapers designed to mimic different purse styles.

Little else is known about the device, including whether it will actually be put into production, and to be honest, I don’t think it will be taken very seriously. The personalization possibilities are fun, but I can’t really picture anyone using it with the strap as a “clutch bag” and whacking it on every surface. Also, having such an expensive device clearly on display is asking for trouble.

Even so, it’s a nice example of creative thinking from HONOR, and a welcome attempt to differentiate in a segment where devices are already all looking the same.

英特尔维护# 1在2023年第二季度在记忆arket slow down, which dragged down major memory players performance such as Samsung, SK Hynix and Micron. In addition, Nvidia took over the second place from Samsung due to the revenue booming on its data center business supported by strong AI server demand. Nvidia expects to see another wave of revenue growth in the upcoming quarter which could make its revenue expand again. Qualcomm’s revenue was capped by looming handset revenue and thus ranked #4 in the quarter. Broadcom and AMD’s revenues were relative resilient amid demand uncertainty.![]()

Use the button below to download the high resolution PDF of the infographic:

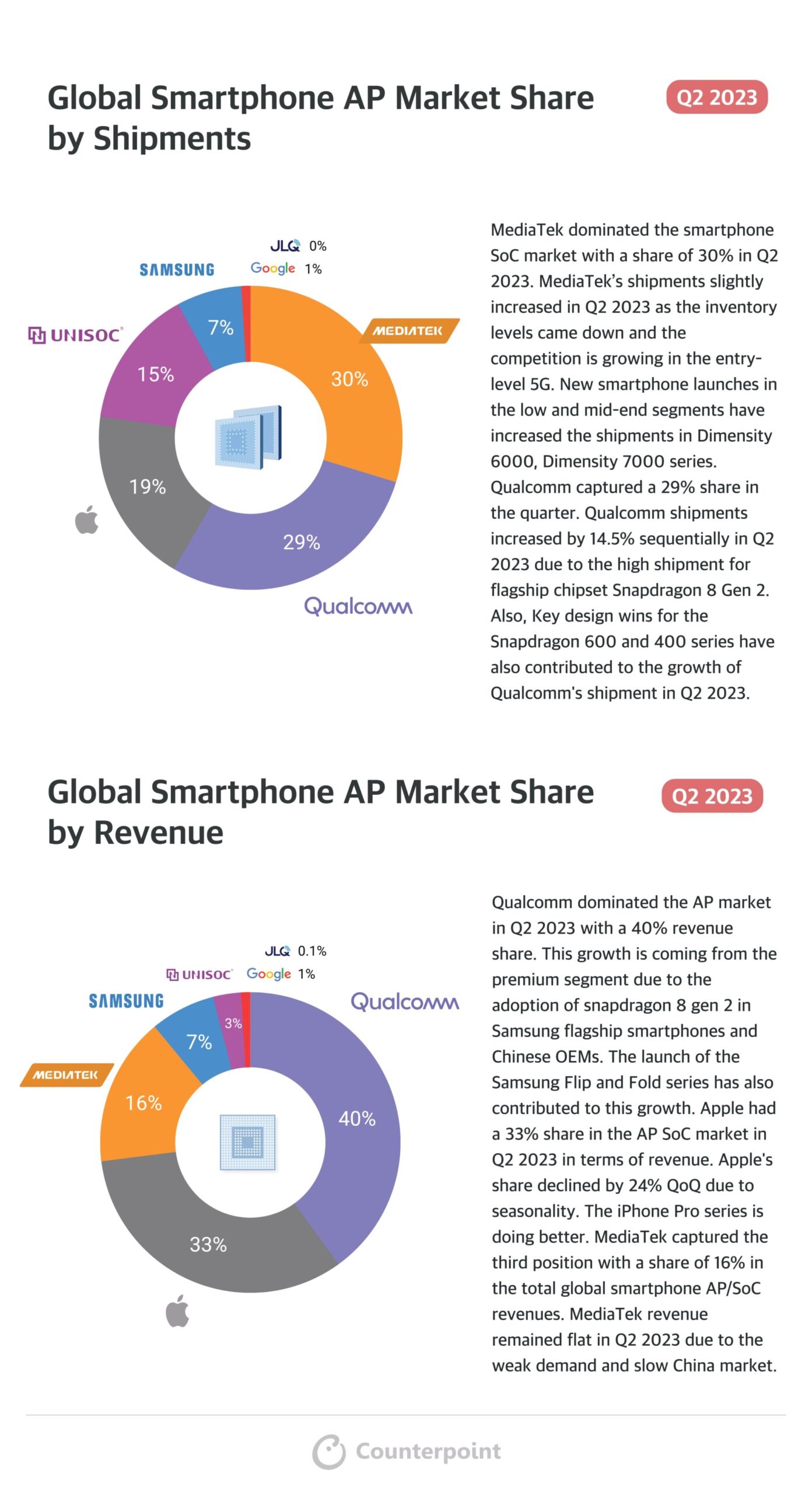

MediaTek dominated the smartphone SoC market with a share of 30% in Q2 2023. MediaTek’s shipments slightly increased in Q2 2023 as the inventory levels came down and the competition is growing in the entry level 5G. New smartphone launches in the low and mid-end segments have increased the shipments in Dimensity 6000, Dimensity 7000 series. Qualcomm captured a 29% share in the quarter. Qualcomm shipments increased by 14.5% sequentially in Q2 2023 due to the high shipment for flagship chipset Snapdragon 8 Gen 2. Also, Key design wins for the Snapdragon 600 and 400 series have also contributed to the growth of Qualcomm’s shipment in Q2 2023.

高通主导美联社market in Q2 2023 with a 40% revenue share. This growth is coming from the premium segment due to the adoption of snapdragon 8 gen 2 in Samsung flagship smartphones and Chinese OEMs. The launch of the Samsung Flip and Fold series has also contributed to this growth. Apple had a 33% share in the AP SoC market in Q2 2023 in terms of revenue. Apple’s share declined by 24% QoQ due to seasonality. The iPhone Pro series is doing better. MediaTek captured the third position with a share of 16% in the total global smartphone AP/SoC revenues. MediaTek revenue remained flat in Q2 2023 due to the weak demand and slow China market.

Use the button below to download the high resolution PDF of the infographic:

TSMC maintained its leadership in the foundry market with a stable 59% market share in Q2 2023. In contrast, Samsung Foundry’s market share dipped by nearly 1% to 11%, primarily due to ongoing smartphone inventory adjustments and the loss of smartphone AP SoC orders from a US client. On the other hand, UMC saw an increase in market share, driven by the continued strength of DDICs and automotive applications in Q2 2023.

In Q2 2023, the 5/4nm segment continued to dominate the market, holding a significant 21% market share. This strength was driven by robust demand, particularly in the field of AI, with key customers like Nvidia and Broadcom fueling this momentum. In contrast, the 7/6nm segment experienced weakness due to a slower-than-expected recovery in the smartphone market. On the other hand, the 28/22nm segment remained robust, as demand for primary applications, including DDIC and automotive-related applications, remained strong throughout Q2 2023.

Use the button below to download the high resolution PDF of the infographic:

Published Date: September 7, 2023

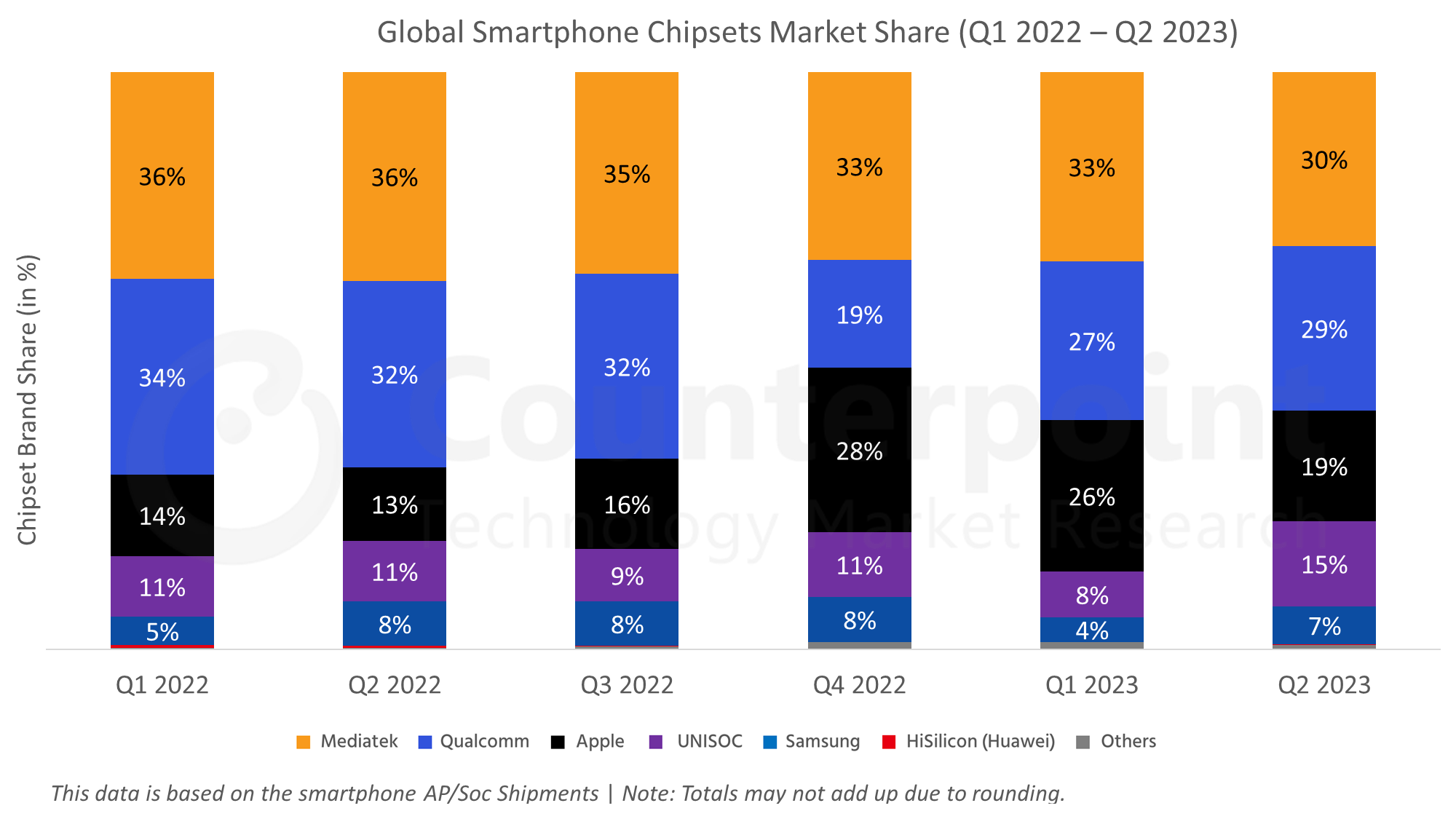

A repository of quarterly data for the global smartphone AP marketbased onsmartphone AP/SoC shipmentnumbers.

This data is based on the smartphone AP/SoC shipments

This data is based on the smartphone AP/SoC shipments

Note: Totals may not add up due to rounding

| Global Smartphone Chipset Market Share (Q1 2022 – Q2 2023) | ||||||

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

| Mediatek | 36% | 36% | 35% | 33% | 33% | 30% |

| Qualcomm | 34% | 32% | 32% | 19% | 27% | 29% |

| Apple | 14% | 13% | 16% | 28% | 26% | 19% |

| UNISOC | 11% | 11% | 9% | 11% | 8% | 15% |

| Samsung | 5% | 8% | 8% | 8% | 4% | 7% |

| HiSilicon (Huawei) |

1% | 0% | 0% | 0% | 0% | 0% |

| Others | 0% | 0% | 1% | 1% | 1% | 1% |

Source:Global Smartphone AP-SoC Shipments & Forecast Tracker by Model – Q2 2023

DOWNLOAD:

(Use the buttons below to download the complete chart)![]()

![]()

Highlights:

Apple’s sales declined in Q2 2023 due to seasonality. Its Pro series did better.

MediaTek’s shipments increased slightly in Q2 2023 with reduced inventory levels and growing competition in the entry-level 5G smartphone market. New smartphone launches in the low-to-mid-end segments increased the shipments of Dimensity 6000 and Dimensity 7000 series. The Dimensity 9200 Plus was added to the premium tier.

Qualcomm’s shipments increased in Q2 2023 due to the Snapdragon 8 Gen 2’s adoption in Samsung’s flagship smartphones and by Chinese OEMs. The launch of Samsung’s Flip and Fold series also contributed to this growth. Qualcomm refreshed the Snapdragon 7 Gen 1, Snapdragon 6 Gen 1 and Snapdragon 4 Gen 1 series to gain some share back. However, the premium segment’s growth remained in focus.

Samsung’s shipments increased in Q2 2023. The Exynos 1330 and 1380’s launch added volumes to the low and mid-high segments.

UNISOC’s shipments grew in Q2 2023 after a weak Q1. It gained some share in the $100-$150 LTE segment. In H2 2023, as entry-level 5G smartphones pick up in regions like LATAM, SEA, MEA and Europe, UNISOC will gain some share.

For a more detailed smartphone AP-SoC shipments & forecast tracker, click below:

This report tracks the smartphone AP/SoC Shipments by Model for all the vendors. The scope of this report is from the AP/SoC shipments from all the key vendors like Apple, Qualcomm, MediaTek, Huawei, Samsung, UNISOC and JLQ. We have covered all the main models starting fromQ1 2020 to Q2 2023. We have also included aone-quarter forecast for Q3E 2023. This report will help you to understand the AP/SoC Market from the shipment perspective. Furthermore, we have also covered key specs for these AP/SoC covering market view by:

For detailed insights on the data, please reach out to us atsales(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

相关的帖子:

Mexicois the second most important smartphone market in Latin America. The country has the second-highest population in the region and hosts an extremely competitive ecosystem. Mexico’s geographical size and lack of import barriers make it an extremely attractivesmartphonemarket.

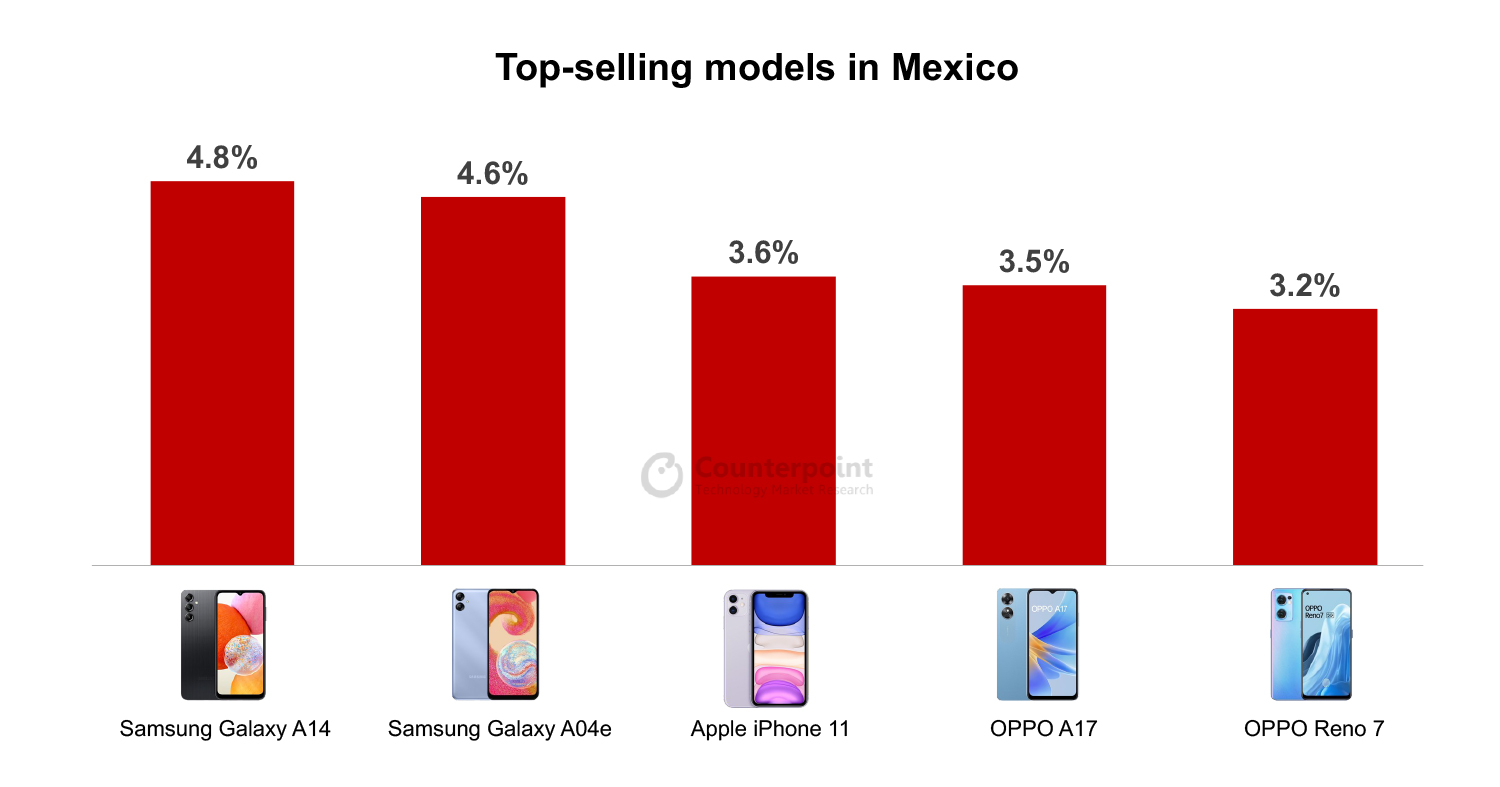

The top-selling models accounted for 35% of Mexico’s total smartphonemarket在2023年第二季度。前10名名单几乎看起来像Samsung’s performance for the quarter as the brand dominated the top-selling chart in Mexico in Q2 2023. Five of the 10 best-selling models were fromSamsung. According to Counterpoint’s Market Pulse Report, Samsung’s share in Q2 2023 was slightly more than 30%.

OPPO and Motorola both had two models in the Q2 2023 top-selling list. Motorola, which has always been a strong player in theMexicanmarket, launched a few new models during the quarter that helped the brand increase its market share. OPPO, a relatively new entrant in theLATAMmarket, managed to retain its third position in market share with two of its models in the top-selling list.

60% of the models in the top 10 list were priced below $150. This price band accounts for 52% of the overallsmartphonemarket in Mexico. However, premiumization is infiltrating the Mexican market, and the number of models in the >$150 band is increasing in the top-selling list. This trend is accelerating slowly but will surely lead to a higher overall smartphone ASP.

Apple’s four-year-oldiPhone11 has been part of the Mexican bestseller list for a few quarters now. It was the third best-selling model in the Mexican market in Q2 2023. The iPhone 11, which is a 4G model, was the most expensive model on the list. The massive sales of this model reflect the strength of Apple’s branding.

The 4G version of OPPO’s Reno 7 was another model in the bestsellers list priced more than $150. This is quite an achievement for the brand, which arrived in the region just three years ago.OPPOis still building its branding in the Mexican market. The Reno 7 has been in the Mexican top-selling chart since December 2022.

It is noteworthy that only two models in the chart are 5G phones – the Samsung Galaxy A34 and the Samsung Galaxy A54 5G. The latter one is also the most expensive Samsung model in the top-selling list. Meanwhile, Telcel has been pushing its subscriber base to replace their phone with a 5G one. Mexican consumers are still not ready for5Gtechnology. They would rather get more specs than access the technology.