新兴技术

任何企业都不能忽视科技的快速发展,新兴的技术将会影响商业领域中的每一个部分。

我们的详细报告可帮助您保持领先地位,当您知道如何减轻即将面临的威胁,如何通过从人工智能和增强现实到如5G等技术在内带来的新机遇。

近期研究

- Blog / PR

- /

- 9月 8, 2023

- /

- Team Counterpoint

- China’s EV market growth continued to slow, with Q2 2023 EV unit sales seeing a rise of only 37% YoY – lower than the global average

- Strong results from four of China’s big 5 EV makers were offset by a mix of tepid and disappointing results across a range of key manufacturers

- Chinese OEMs look prepped to expand globally, with share of global (ex-China) auto sales set to pass a significant 10% milestone in Q3 2023

- SAIC Group and BYD Auto account for the bulk of exports, with the latter well positioned for long-term growth as it enters Europe in earnest later this year

Beijing, Hong Kong, London, New Delhi, Boston, Seoul – September 8, 2023

According to Counterpoint Research’s latestChina Passenger Electric Vehicle Tracker, Q2 2023battery electric vehicle (BEV) unit sales in the country grew only 37% YoY, lower than theglobal average of 50%, highlighting a slowdown in domestic growth as the frail Chinese economy impacted demand in the world’s biggest EV market.

BYD Auto and Tesla continued to dominate unfazed, accounting for more than one-third of domestic unit sales. But the market also saw GAC Group establish itself as a solid number three on the back of strong demand for its line of compact Aion sedan and hatchbacks as it aggressively reduced prices in the midst of a price war.

“We’re also seeing strong numbers from several mid-sized domestic players that are having success across a broad range of vehicles – from sub-compact city cars through to long-range luxury cruisers. But many automakers are struggling as the market eases,” notes Ethan Qi, Associate Director. “China’s a big market but there’s also a lot of small carmakers, so any kind of slowdown and you’re probably going to see some consolidation as weaker companies inevitably exit.”

China Passenger EV* Unit Sales Share and YoY Growth by Auto Group

Many Chinese OEMs are looking externally for growth and are gaining a foothold in markets like Europe and Asia. “If you exclude China, by far the biggest market for EVs globally is Western Europe. It’s not China, but growth has started to accelerate this quarter,” says Qi. “Right now it’s all about MG, the SAIC-owned British badge that’s spearheading Chinese growth in the region with its compact cars and SUVs. It’s filling a vacuum in the affordable segment, where traditional names are struggling to supply consumers with EVs in that $20,000 – $40,000 sweet spot. This is where Chinese brands have a lot of depth.”

Chinese OEM Overseas EV Sales and Market Share

BYD Auto is enjoying success across a diverse group of markets mainly in Asia, but it is gearing up for Europe growth with new models to be shipped into the region later this year.

Ivan Lam, Senior Analyst, Manufacturing, notes, “BYD has all the classic advantages of a Chinese tech company including scale and proximity to the supply chain. What makes them stand out even more is their vertical integration right through to the battery. This helps them dominate at home. And as they expand production outside China, it will also make them a serious threat to global competitors.”

“我不会感到惊讶,如果他们能够抓住lot of share quickly because of the latent demand for affordable EVs in Europe. And a planned 2025 factory will only bolster their advantage over the long term,” muses Lam. “The maxim ‘If you can make it in China, you can make it anywhere’ really does apply here.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Follow Counterpoint Research

Monetizing 5G Will Be The Challenge for Incumbent Vendors in 2022

Monetizing 5G Will Be The Challenge for Incumbent Vendors in 2022

Open RAN: Again A Hot Topic At MWC in 2022

Global Server Market Tracker - Q3 2021

- Blog / PR

- /

- 9月 8, 2023

- /

- Whitepaper

- /

- 9月 7, 2023

- /

Overview:

我们很高兴与MySmarPricebringing you insights into the dynamic world of consumer electronics shopping during this time of year. India’s festive season brings about a remarkable shift in consumer behavior, with electronics taking center stage. Through this collaborative effort, we have harnessed the power of data and consumer sentiment, thanks to MySmartPrice’s unwavering support and access to their vast repository of insights. With a comprehensive survey featuring 12,499 respondents and enriched by the experiences of over 15 million monthly active shoppers, we have unearthed the driving forces behind consumers’ choices during this vibrant period. From the significance of discounts to the latest trends in smartphones, laptops, tablets, and home appliances, our research has illuminated the path for brands and businesses seeking to meet the evolving demands of festive shoppers. Together, we celebrate the spirit of the season and the economic vitality it brings to our nation, making this partnership a true reflection of the power of shared insights.

Download the report using the form below

- /

- 9月 7, 2023

- /

Counterpoint is attending the Apple event on 12thSeptember, 2023

Our Research Vice President Neil Shah and Research Director Jeff Fieldhack will be attending the Apple event on 12th September 2023. In case you are planning to be there, you can schedule a meeting with them to discuss the latest trends in the technology, media and telecommunications sector and understand how our leadingresearchandservicescan help your business.

Learn more about the Apple eventhere.

Click here(or send us an email at contact@www.arena-ruc.com) to schedule a meeting with Neil and/or Jeff.

- Data

- /

- 9月 7, 2023

- /

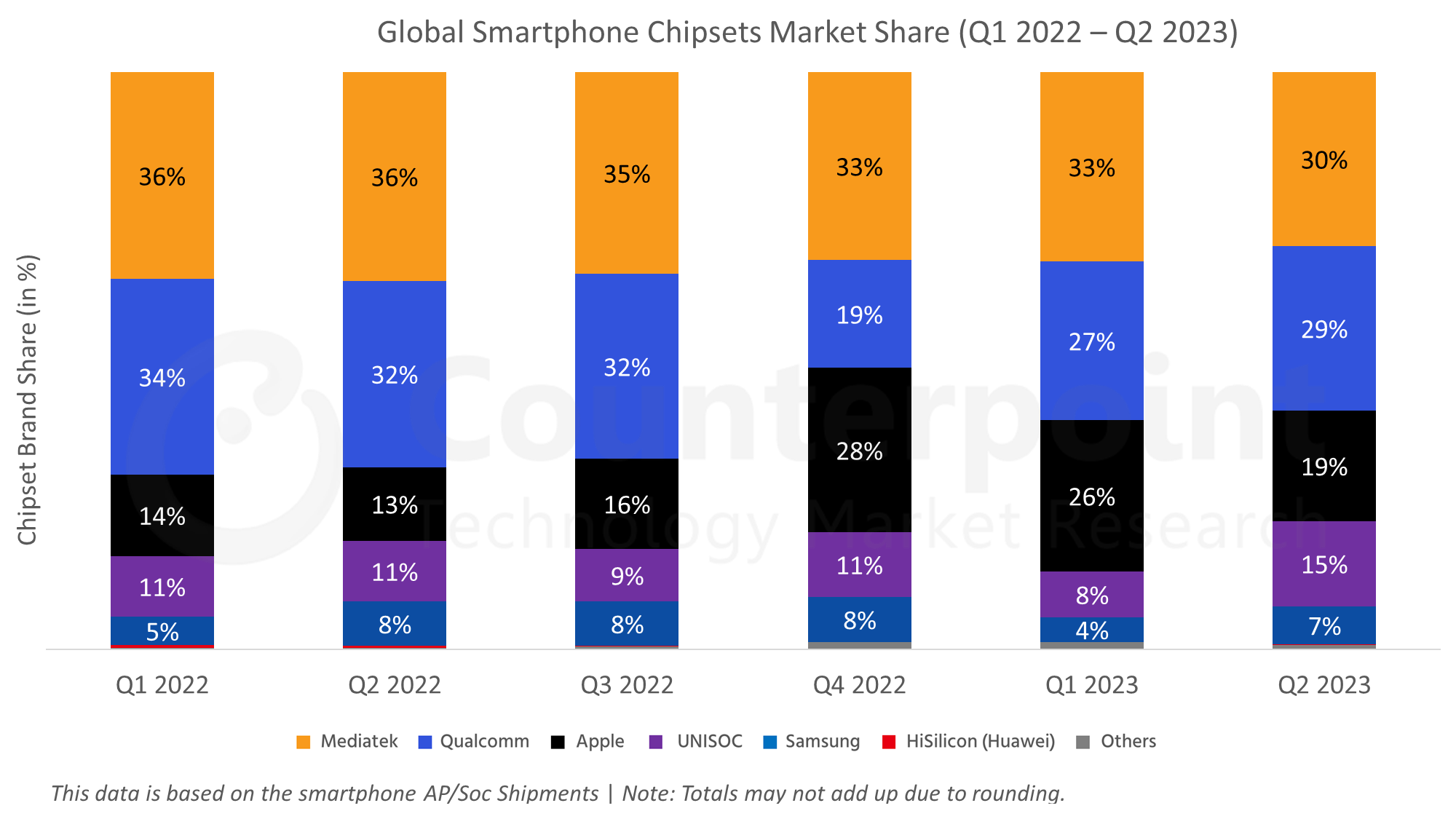

Global Smartphone AP (Application Processor) Shipments Market Share: Q1 2022 to Q2 2023

Published Date: September 7, 2023

A repository of quarterly data for the global smartphone AP marketbased onsmartphone AP/SoC shipmentnumbers.

This data is based on the smartphone AP/SoC shipments

This data is based on the smartphone AP/SoC shipments

Note: Totals may not add up due to rounding

| Global Smartphone Chipset Market Share (Q1 2022 – Q2 2023) | ||||||

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

| Mediatek | 36% | 36% | 35% | 33% | 33% | 30% |

| Qualcomm | 34% | 32% | 32% | 19% | 27% | 29% |

| Apple | 14% | 13% | 16% | 28% | 26% | 19% |

| UNISOC | 11% | 11% | 9% | 11% | 8% | 15% |

| Samsung | 5% | 8% | 8% | 8% | 4% | 7% |

| HiSilicon (Huawei) |

1% | 0% | 0% | 0% | 0% | 0% |

| Others | 0% | 0% | 1% | 1% | 1% | 1% |

Source:Global Smartphone AP-SoC Shipments & Forecast Tracker by Model – Q2 2023

DOWNLOAD:

(Use the buttons below to download the complete chart)![]()

![]()

Highlights:

Apple’s sales declined in Q2 2023 due to seasonality. Its Pro series did better.

MediaTek’s shipments increased slightly in Q2 2023 with reduced inventory levels and growing competition in the entry-level 5G smartphone market. New smartphone launches in the low-to-mid-end segments increased the shipments of Dimensity 6000 and Dimensity 7000 series. The Dimensity 9200 Plus was added to the premium tier.

Qualcomm’s shipments increased in Q2 2023 due to the Snapdragon 8 Gen 2’s adoption in Samsung’s flagship smartphones and by Chinese OEMs. The launch of Samsung’s Flip and Fold series also contributed to this growth. Qualcomm refreshed the Snapdragon 7 Gen 1, Snapdragon 6 Gen 1 and Snapdragon 4 Gen 1 series to gain some share back. However, the premium segment’s growth remained in focus.

Samsung’s shipments increased in Q2 2023. The Exynos 1330 and 1380’s launch added volumes to the low and mid-high segments.

UNISOC’s shipments grew in Q2 2023 after a weak Q1. It gained some share in the $100-$150 LTE segment. In H2 2023, as entry-level 5G smartphones pick up in regions like LATAM, SEA, MEA and Europe, UNISOC will gain some share.

For a more detailed smartphone AP-SoC shipments & forecast tracker, click below:

Global Smartphone AP-SOC Shipment & Forecast Tracker by Model – Q2 2023

This report tracks the smartphone AP/SoC Shipments by Model for all the vendors. The scope of this report is from the AP/SoC shipments from all the key vendors like Apple, Qualcomm, MediaTek, Huawei, Samsung, UNISOC and JLQ. We have covered all the main models starting fromQ1 2020 to Q2 2023. We have also included aone-quarter forecast for Q3E 2023. This report will help you to understand the AP/SoC Market from the shipment perspective. Furthermore, we have also covered key specs for these AP/SoC covering market view by:

- Network(4G/5G AP/SoC)

- Foundry Details(like TSMC, Samsung. etc.)

- Process node(5nm, 6nm, 8nm, etc.)

- Manufacturing Process(FinFET, N7, N5, etc.)

- CPU Cores Architecture and CPU Cores Count

- Modem(External/Internal)

- Modem Name

- Secure Element Presence

- Security Chip

- AI Accelerator

For detailed insights on the data, please reach out to us atsales(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

Related Posts:

Related Posts

我们在新兴技术领域的意见领袖

Neil Shah

Vice President

Peter Richardson

Vice President

Jeff Fieldhack

Resesarch Director

Gareth Owen

Associate Director

Tina Lu

Senior Analyst

Parv Sharma

Senior Analyst

Soumen Mandal

Senior Analyst