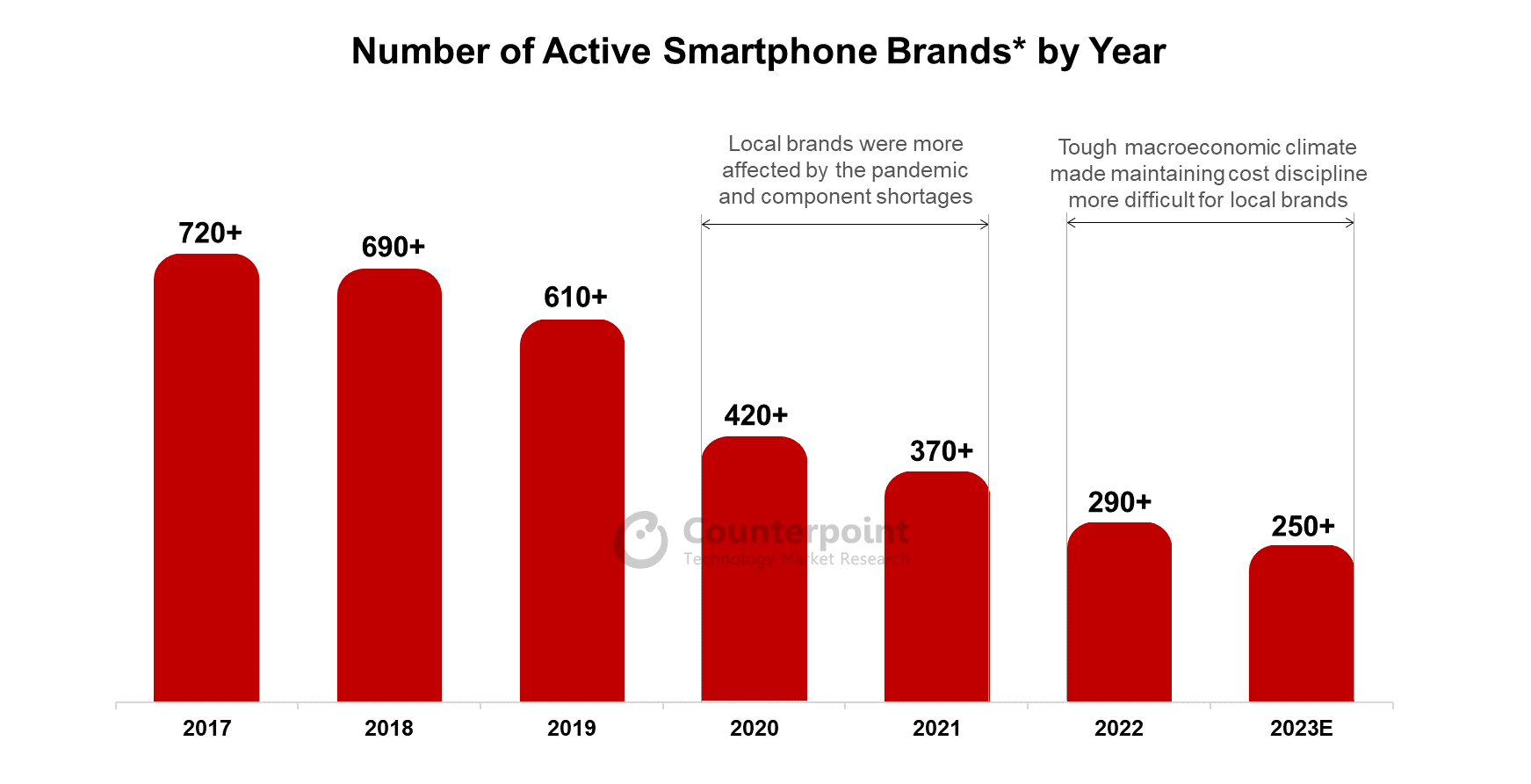

- The number of active brands is down to almost 250 in 2023 so far from over 700 in 2017.

- The decline in the number of active brands is almost entirely coming from local brands.

- A maturing user base, improving device quality, longer replacement cycles and a growing refurbished secondary market are some of the reasons for the declining number of active brands.

At itspeak in 2017, the global smartphone market saw more than 700 brands fiercely competing and contributing to the total annual sales of over1.5 billion units.Fast forward to2023and the number of active brands (that have recorded sell-through volumes) is down by a third to almost 250, according to Counterpoint’sGlobal Handset Model Sales Tracker, which has been tracking sales of these brands across more than 70 key countries.

A maturing user base, improving device quality,longer replacement cyclesand agrowing refurbished secondary market, along with economic headwinds, supply-chain bottlenecks, major technological transitions such as4G to 5G, and the growing scale and concentration of power in a handful of brands, have gradually whittled down the number of active brands and their volumes over the years. It has become difficult to remain profitable and feasible in this maturing marketplace. For example, major local smartphone brands, known as “local kings”, likeMicromax, Intex and Karbonn inIndia;InnJoo and Xtouch in theMiddle East and Africa;Meizu, Meitu,GioneeandCoolpadinChina;京瓷和东北C inJapan;andLGinSouth Korea, have exited over the last five years.

Decline of local brands

Strikingly, the decline in the number of active brands is almost entirely coming from local brands. The number of global brands has remained consistent at over 30. Most local brands operate in regions that have fragmented markets across wide geographies, likeAsia-Pacific,Latin Americaand Middle East and Africa. Such brands focus on customers looking for affordable devices.

Over the past few years, local brands’ sales volumes have seen steep declines. Nearly 90% of local brands have sold ≤100,000 units in 2023 so far, showing a lack of scale and brand pull. Some brands have shut down completely or shifted their focus tofeature phonesor other categories such aswearablesorIoT. In H1 2023, the total sales contribution of local brands was down by over 80% from 2017 levels. Global brands, on the other hand, saw a decline of only 13%.Lava, Micromax and BLU are the major brands that saw steep sales declines.

Source:Counterpoint Research Global Monthly Handset Sales Tracker

Brands lag in R&D and marketing efforts

In a rapidly evolving smartphone industry, small brands have struggled to keep up with big brands across many fronts. While big brands have continued to invest in R&D,manufacturingand capacity building, small brands have been largely dependent onODMsand white-label devices for distribution. Further, large promotional and marketing events and big-name brand ambassador tie-ups from sports and movies are commonplace for big brands. However, most small brands lack the resources for such marketing or channel partnerships and for R&D and product differentiation. This has been accelerating their decline, a sign of a maturing market.

Smartphone ASPs have increased with evolving customer needs

Small brands capitalized on the market’s transition from 2G to 3G/4G, benefitting from strong entry-tier demand, particularly in Africa, India and Latin America. Some of these brands, like Micromax in India or Evercoss inIndonesiaor Vestel inTurkey,也一直在顶级品牌during this transition, earning them the title of ‘local kings’.

However, the needs of the average mobile phone consumer have also been evolving since and the user base has matured. Furthermore, the industry has been transitioning to 5G, which is a major technology transition. Therefore, now there is a greater demand for better specifications, design, brand value, ecosystem integration and device longevity. Average smartphone use has also gone up over the past decade, withcustomers spending over four hours a day now, according to Counterpoint’sConsumer Lens研究。与日益增长的客户需求和用例s, the smartphoneASPis also increasing. It is up by ~50% in 2023 so far when compared to 2017. Many small brands have failed to scale to higher price bands largely due to a lack of adequate investments in capacity and R&D innovations to stand out in the market.

Unable to keep up with growing Tier-1 Chinese brands

The rise of Chinese brands likeXiaomi,OPPOandvivohas also accelerated the decline of small brands.Chinese brandshave been able to introduce significantly better smartphones at aggressive price points, providing customers better value for their money. Their unparalleled access to the Chinese manufacturing ecosystem, vertical integration and global scale have helped them outcompete small brands. Furthermore, a strong portfolio spread across multiple price tiers, expansion to multiple markets, prudent channel strategies (like fore-commerce) and innovative marketing strategies have helped these brands remain competitive and grow rapidly.

Small brands more affected by industry headwinds

From theCOVID-19 pandemic and component shortagesamid trade wars to theongoing global economic slowdown, multiple headwinds have affected smartphone brands across the board in the recent past. For big brands likeSamsungandApple, it has been relatively easier to shore upprofitmargins tohelp cushion their lossesin this market environment. But small brands have struggled to keep operations running.

Rising costs coupled with a maturing customer looking for a better device experience have severely hit many small brands’ revenues and profits. Consequently,2020recorded the biggest drop in the number of active smartphone brands.

The second-largest drop was recorded in2022, following the onset of the ongoing global economic downturn and rising inflation, according to Counterpoint’sMacroeconomic Index. Small brands have mostly been operating in the sub-$200 price segments, where demand has been most affected by the changes in the customer’s disposable income, which declined across markets in 2022 as inflation rose. Furthermore, the rise of the secondary refurbished smartphone market directly hit new smartphone sales in this highly price-sensitive segment.

Further consolidation likely, some brands may carve a niche

The number of smartphone brands will continue to decrease, and large global brands will be in the best position to adapt to all the macroeconomic headwinds and technological transitions in the market. However, small brands that focus on specific use cases, unique design orientations or customer segments, like Sonim, DORO andFairphone, may be able to survive by offering their niche devices at a premium. This includes brands offering ruggedized smartphones, devices for the elderly and children,highly circular devicesand devices focusing on digital minimalism, among others.

Key takeaways

A maturing smartphone user base, better R&D innovations, expansion of competing bigger brands, tough macroeconomic conditions, limited focus on the low-end segment, and the secondary refurbished smartphone market have been the key drivers for this market consolidation trend. Therefore, small-scale or even incumbent brands looking to survive in this market need to invest in R&D to differentiate, be prudent with their target segments and marketing strategies, track the competition closely and identify gaps and opportunities to succeed.