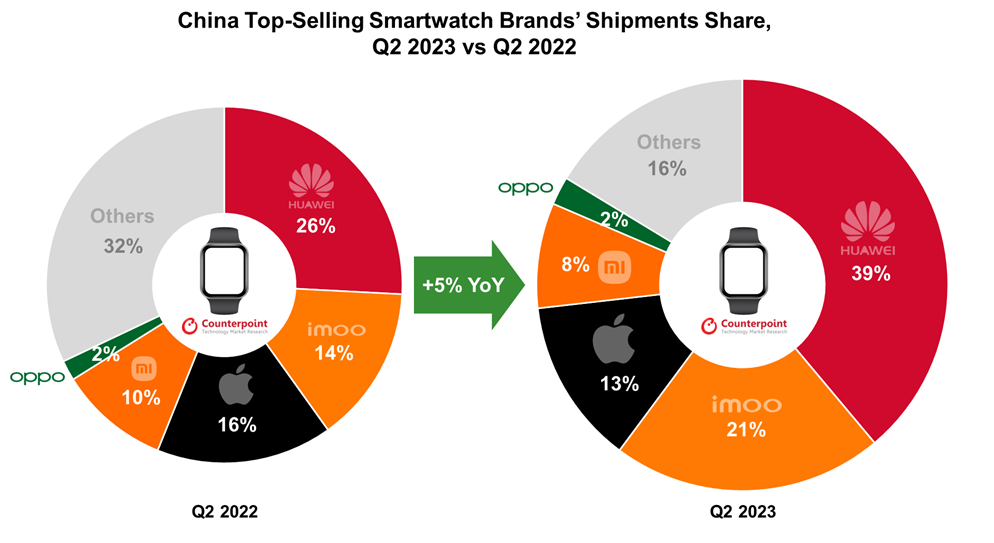

- China’s smartwatch shipments rose 5% YoY in Q2 2023 to mark the market’s gradual recovery.

- Huawei remained the best-selling brand with a 39% market share.

- imoo (BBK) surpassed Apple to rank second in market share.

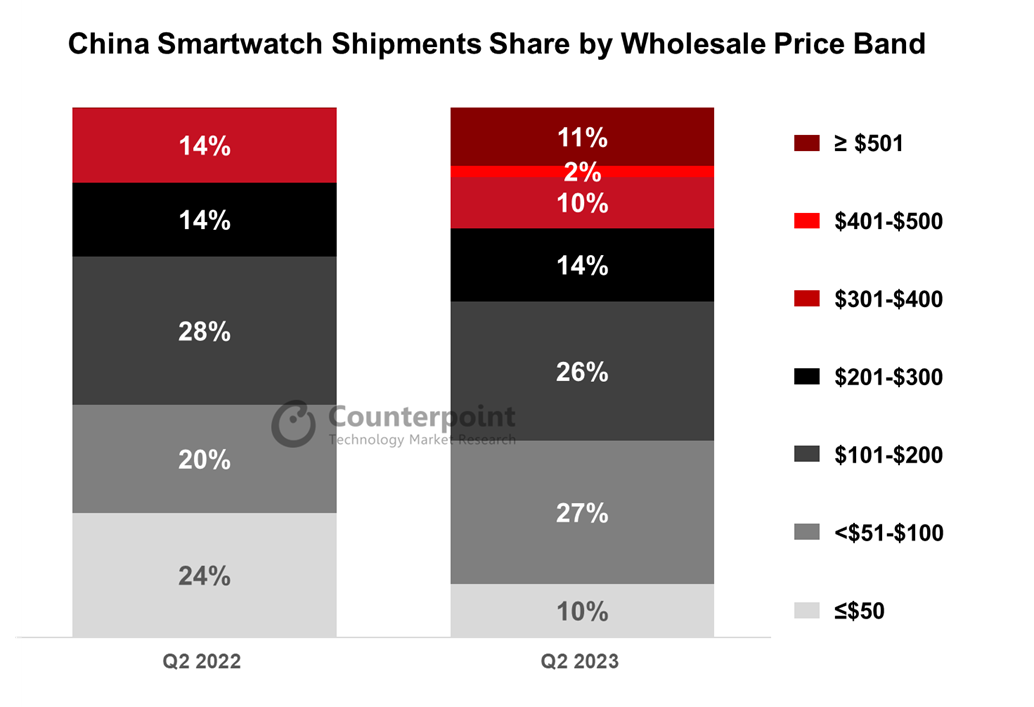

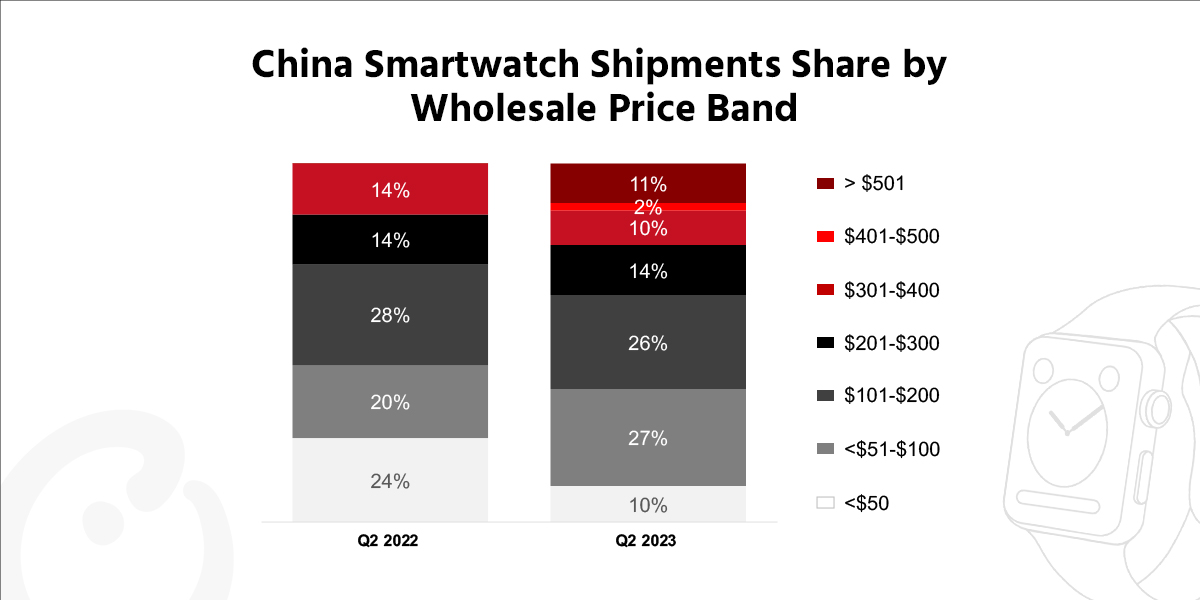

- The≥$500 price band’s share increased significantly, while the ≤$50 price band’s share decreased significantly.

Beijing, New Delhi, Seoul, Hong Kong, London, Buenos Aires, San Diego – August 30, 2023

Marking a gradual recovery in Q2 2023, China’s smartwatch shipments increased 5% YoY, according to Counterpoint Research’s latestGlobal Smartwatch Model Tracker.

Senior Analyst Shenghao Baisaid, “The YoY rise in Q2 came on a low base of the same period last year. At the same time, the holiday travel in Q2 and the 618 e-commerce festival also boosted consumer demand for smartwatches. The market has recovered slightly better than we had predicted.”

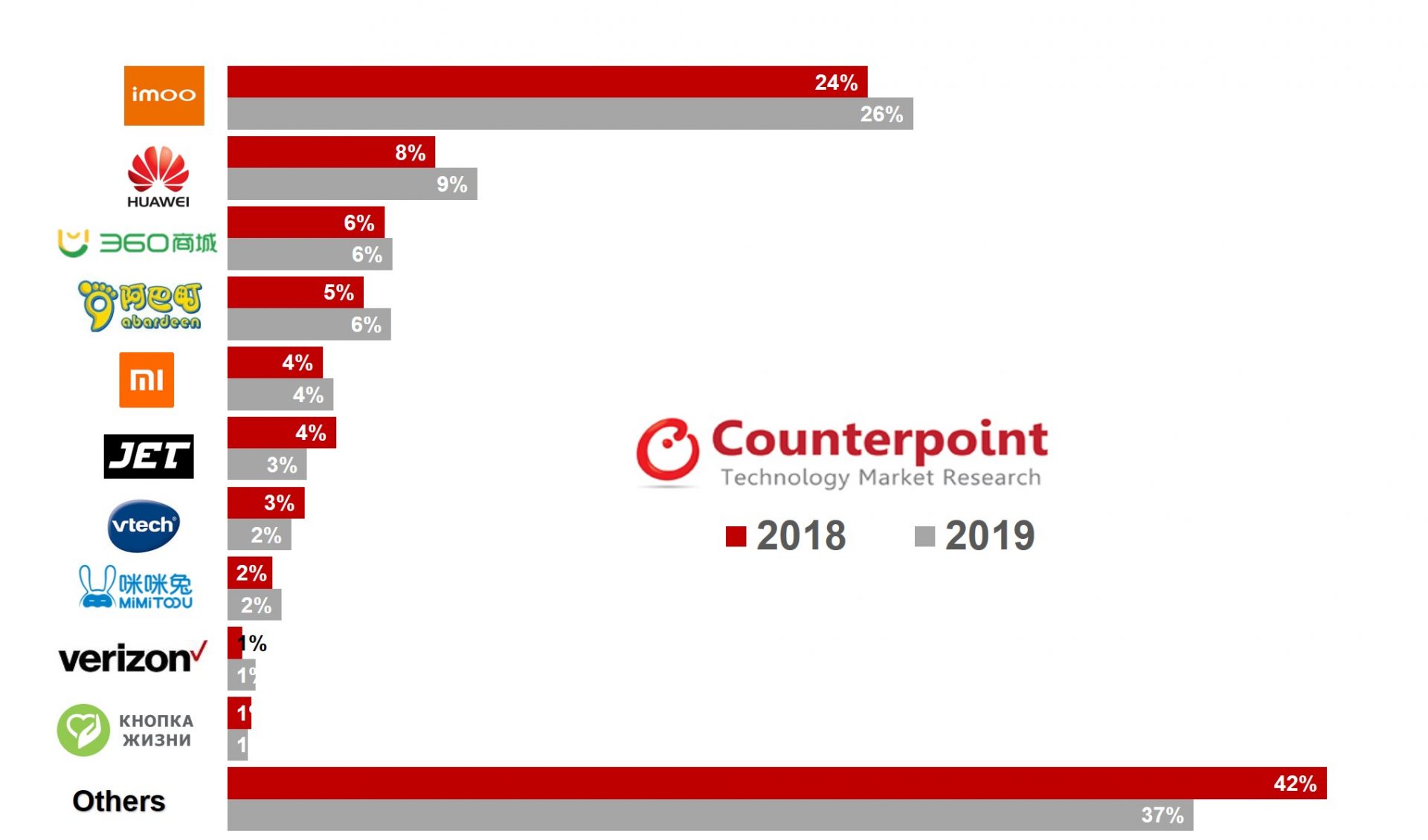

Source: Counterpoint’s Global Smartwatch Model Tracker

Note: Figures may not add up to 100% due to rounding

Market summary

Huaweirecorded a 58% YoY growth, maintaining its good reputation among consumers. The newly launched Huawei Watch 4 and Huawei Watch 4 Pro series models were popular with consumers, while old models such as the Huawei Watch GT 3 series still sold well. Another newly launched model, the Huawei Watch Ultimate, contributed to the brand’s performance in the ultra-premium segment.

imoo(BBK) benefited from the demand in the first full back-to-school quarter after the pandemic lockdown was lifted in China. Its multiple offline retail stores also contributed to the brand’s growth.

Applerecorded a 15% YoY decrease in Q2 2023. Although the Apple Watch Series 8 was the best-selling model family in China during the quarter, its shipments decreased 25% compared to that of its predecessor Apple Watch Series 7 in Q2 2022. With new product launches expected in Q3 2023, Apple is likely to increase its market share in the quarter.

Xiaomi同比减少15%,但增长记录7% QoQ. The brand still took the biggest share in the ≤$50 segment. Waning consumer interest in entry-level products contributed to the decline in Xiaomi’s market share.

OPPOachieved a 28% YoY increase in Q2 2023. Promotions during the 618 e-commerce festival helped the OPPO Watch 3 and OPPO Watch 3 Pro’s sales.

Source: Counterpoint’s Global Smartwatch Model Tracker

Note: The price refers to the wholesale price

In terms of wholesale price bands, the ≤$50 band’s share significantly dropped compared to the same period last year. This price band’s share has been recording YoY drops in the past several quarters. On the other hand, the ≥$500 segment’s share rose significantly to 11% from almost negligible in Q2 2022.

Research Analyst Alicia Gongsaid, “The entry-level products with simple features are not as popular with consumers as they once were. A growing number of consumers are gravitating toward smarter devices with more health monitoring, sports tracking and guidance functions. Since the Apple Watch Ultra’s release last year, the share of premium segments has been growing. The promotions during the 618 e-commerce festival also contributed to these segments’ growth.”

Background

市场研究是一个世界人口对位技术l research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Use the button below to download the high resolution PDF of the infographic:

Use the button below to download the high resolution PDF of the infographic: