5G mmWave: Ecosystem & Economics Becoming Attractive (Part 1)

Read the part 2 of 5G mmWave: Ecosystem, Economics Becoming Attractivehere.

Change is in the air.COVID-19has wrought massive changes on how people work, learn and interact. New technology can enable the accelerated changes caused by the pandemic to become a positive transformation with benefits accruing in many directions.

While5G是一个关键解锁这种潜在的反式的一部分吗formation, concerns have been raised about the role of mmWave and whether the time is right to roll-out the highest frequencies within the 5G family. We believe that mmWave will be a cornerstone to the success of 5G – though not without challenges.

5G is a Spectrum Game

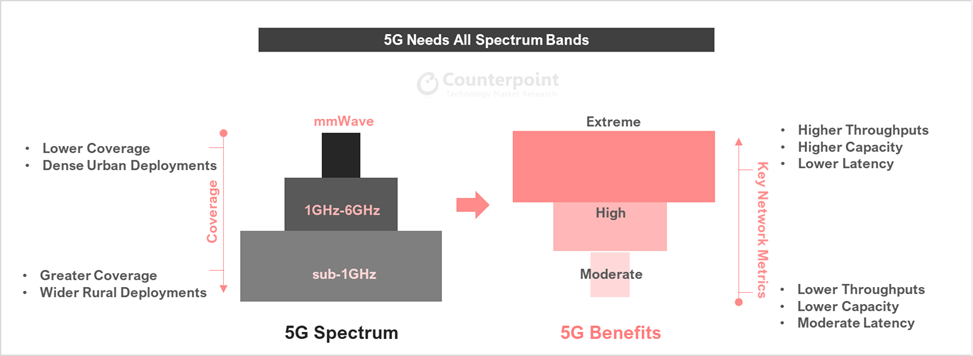

The success of 5G is a function of the combinations of spectrum used. The promise of building robust, scalable, high-speed, low-latency, and high-capacity networks is based on how astutely communications service providers (CSPs) can leverage one of their most valuable assets, the radio spectrum. This holds true for 5G and will apply equally to future networks such as6G.

The benefits of 5G compound through the adoption of different elements. Adding 5G NR to an existing network in a Non-Standalone (NSA) architecture gets CSPs out of the starting blocks. But moving to a standalone (SA) core network, faster backhaul and network densification enable more of the 5G promise to be realized. The key driver, however, will be the use of a higher-order spectrum (6GHz-110GHz) coupled with advanced modulation, channel coding, beamforming, antenna diversity, and other techniques.

5G mmWave Value Proposition is Unmatched

As 5G expands to use a wider range of frequencies in combination, it enables greater value. For example, 5G in a limited slice of the sub-6GHz spectrum provides good coverage and faster speeds, but it will not offer gigabit level throughputs, higher capacity, or sub-10ms latencies. However, combine that sub-6 GHz spectrum with a much larger tranche of mmWave spectrum and a variety of deployment scenarios become possible, such as mixing catering to high peak traffic loads in dense urban areas, while meeting broader coverage needs. This enables greater efficiencies throughout the network. Even a 5G standalone with mmWave layer can be better than a 5G standalone sub-6GHz network in certain use-cases, although a combination of them both is usually even better.

Applications enabled by 5G will include 5G Fixed Wireless Access (FWA),Cloud Gamingleveraging 5GMEC(Multi-Access Edge Computing) technology to 5G NRNetwork Sliced Private Networks,XRapplications, and more.

5G is defined by its three primary dimensions: throughput, capacity in terms of a number of connected devices, and latency). mmWave spectrum plays a key role in enabling all three. Put simply, if these are the 5G cake, mmWave is the icing on the top.

5G mmWave Cost Economics. Outlook is Impressive Across the Value Chain.

With every generation, the biggest question CSPs look at is the returns on the investments for new generation network infrastructure CAPEX, cost of spectrum, and the OPEX to maintain and run the network. 2G, 3G, 4G ROI was largely dependent on the availability of mobile devices that drove a massive wave of personal transformation from real-time communication to rich content consumption to on-the-go commerce and more. The integration of broad-spectrum 5G and adjacent technologiesAI, IoT, Cloud, Edge Computing,Blockchain, etc) will unlock new ARPU opportunities enabling new waves of enterprise and social transformation not previously possible.

With every generation, the biggest question CSPs look at is the returns on the investments for new generation network infrastructure CAPEX, cost of spectrum, and the OPEX to maintain and run the network. 2G, 3G, 4G ROI was largely dependent on the availability of mobile devices that drove a massive wave of personal transformation from real-time communication to rich content consumption to on-the-go commerce and more. The integration of broad-spectrum 5G and adjacent technologiesAI, IoT, Cloud, Edge Computing,Blockchain, etc) will unlock new ARPU opportunities enabling new waves of enterprise and social transformation not previously possible.

These new waves will enable CSPs to recoup the investment in mmWave spectrum, 5G SA core networks, and adjacent technologies.

An interesting recent study highlights the ability of mmWave 5G in different scenarios including dense urban areas, indoor deployments, and FWA toreduce the overall Total Cost of Ownership (TCO) significantlywhich can help accelerate the ROI for operators eventually.These were scenarios where more connected users, consuming more dataon the mmWave only or mmWave + 3.5GHz network vs a 3.5GHz only network. This was tested in China and Europe with both showing promising savings for the operators when the mmWave spectrum is deployed.

Further, with the rise of Open RAN networks (see here) and clever approaches to working with the telecoms supply chain, the CAPEX for deploying a 5G NR mmWave network deployment can be cut significantly, boosting the TCO. For example:

Further, with the rise of Open RAN networks (see here) and clever approaches to working with the telecoms supply chain, the CAPEX for deploying a 5G NR mmWave network deployment can be cut significantly, boosting the TCO. For example:

Japan’s fast-growing CSPRakutenis disrupting the market by building out a highly cost-effective 5G in mmWave (28GHz) network. It is deploying almost 8000 sites using AirSPAN mmWave distributed Radio Unit (dRU) small cell, utilizing the Qualcomm 5G RAN platform (FSM100xx) for a complete Modem-RF system-level solution for small cells, combined with a vDU in a holistic solution. Rakuten is claimingthe 5G mmWave network infrastructure implementation is 60% cheaper than traditional systemsworking directly with vendors.

Indevices, according to our BoM Cost Analysis, the delta between a mmWave and a sub-6GHz only smartphone is narrowing fast. For example:

- The flagship Samsung Galaxy Note 20 UltrammWave variant costs a mere 10% morethan the sub-6 GHz variant in terms of total component costs (see here).

- For becoming the most popular and best-selling 5G phone this year, iPhone 12, the cost deltabetween the mmWave version and sub-6GHz isquite lowerthan expected, which gave Apple to add other important components such as OLED, UWB across the lineup from iPhone 12 to iPhone 12 Pro series. (see here).

- With respect to 5G CPE, our research shows 5G FWA is a significant opportunity with more than a billion 5G FWA CPEs likely to be sold over this decade (see here). The cost between a mmWave CPE vs sub-6GHz only CPE hasnarrowed significantly,offering a great opportunity for CSPs to roll-out 5G NR mmWave networks without worrying about the mmWave-based device costs to impact user adoption.

5G mmWave Ecosystem & Economics no Longer a Bottleneck

While there remain challenges in migrating to 5G, there are promising economic indicators in the analysis of costs and potential benefits. Leading components vendors are already on their third generation of application processors and modems, infrastructure vendors are innovating to enable CSPs to rapidly enhance coverage. And handset vendors are rapidly bringing down the cost of 5G-capable smartphones.

Cost-benefit analyses are pointing to multiple ways in which CSPs can achieve lower TCO and greater ROI when deploying mmWave. As the standards mature, we expect more and more use cases will become possible and this will encourage many organizations to participate. We expect that by early- to mid-2022 we will see an inflection point for mmWave-based networks and devices that will help propagate the transformation is only just beginning.