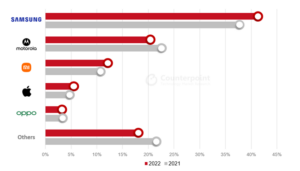

- Entry of Chinese brands stirring up regional market.

- Samsung remains regional leader with 36.9% share, followed by Motorola with 21.4% share.

- Apple’s growth mainly sustained by the iPhone 11.

- One in four smartphones shipped in the region is a 5G smartphone.

Buenos Aires, San Diego, Denver, New Delhi, Hong Kong, Seoul, London, Beijing – August 24, 2023

Smartphoneshipments in Latin America (LATAM) dropped 15.6% YoY but climbed 2.4% QoQ in Q2 2023, according to the latest data fromCounterpoint Research’s Market Monitorservice. The decline was due to the negative impacts of the regional economic crises and weak global smartphone shipments.

Commenting on the market dynamics,Principal Analyst Tina Lusaid, “LATAM’s economic growth in 2023 is actually slightly higher than forecast. However, this recovery has not yet inspired an increase in the rate of smartphone replacement. Lowconsumerdemand continued to affect the region during the quarter. Although most countries in the region are seeing declininginflation, consumer confidence is yet to bounce back, as political turmoil continues to constrain the general economy.”

Research Analyst Andres Silva added,“Seasonal factors such as Mother’s Day and Father’s Day promotions helped the market grow slightly QoQ in Q2 2023, although the market declined YoY. The entry of manyChinesebrands at once is stirring up the market as they aim for growth, pushing other brands to become more aggressive. However, the YoY decline affected all the top sixcountriesin the region.”

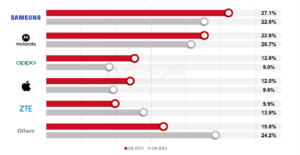

Top Smartphone OEMs’ Market Share in Latin America, Q2 2022 vs Q2 2023

Note: Figures may not add up to 100% due to rounding

Commenting on the ASP performance in the region,陆说: “There is a slight premiumization trend going on in the region. Compared to last year, LATAM’s total smartphoneASPonly grew around 4%. This has been a consistent trend. Inflation has some influence on it. However, established brands such as Samsung are pushing to increase the ASP in the region with5Gmodels.”

Market Summary

- Samsungwas once again the absolute leader in the LATAM market in Q2 2023. However, itsshipmentsand market share declined YoY with weakened performance in most of the countries in the region.

- Samsung has been very aggressive in offering extra discounts during the promotions. But not enough as its shipments were hurt by the Brazilian market and the entry ofChinesebrands.

- Since Samsung is focusing more on premium models now, the availability of its models in the lower price bands is becoming restricted. Thus, its overall value dropped -2% YoY.

- Motorola’s shipments decreased YoY but its market share increased slightly. It increased the number of models in the entry-segment E series. It also increased its brand awareness with the launch of theMotorolaEdge 40 Pro in May with an aggressive advertising campaign.

- Xiaomi lost share slightly during the quarter but remained stable due to the launch of the Redmi Note 12 during the first week of April. This increased its Q2 2023 shipments and sales.Xiaomialso increased its Poco brand shipments in the open channels in the region.

- Xiaomi recovered slightly from its position in Mexico. The participation of the grey market in the southern part of the LATAM region continued to grow.

- Apple’sshipments and market share both grew YoY in Q2 2023, mainly sustained by the iPhone 11. The4Gsmartphones are still driving Apple’s volume in the region.

- OPPOcontinued to be a strong fifth player in the region and ranked third in Mexico. Its volume increased by more than 70% in Q2 2023, while its share more than doubled YoY. Despite the growth, its shipments dropped QoQ.

- HONOR did not make it to the list, but its growth in LATAM has been notable.HONORwas the brand with the most aggressive growth during the quarter. However, it still needs to build on its branding.

- “Others”, mainly composed of regional brands, continued to decrease YoY. This category was most affected by the entry of low-price-band Chinese brands.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Tina Lu

Andres Silva

Peter Richardson

Follow Counterpoint Research

press@www.arena-ruc.com

Source: Counterpoint Research Q4 2022 Market Monitor

Source: Counterpoint Research Q4 2022 Market Monitor