- The growing IoT ecosystem has brought forth its own set of challenges. One such challenge is permanent roaming.

- While many countries allow permanent roaming without significant constraints, some big countries have implemented limitations on this practice.

- There are multiple ways to circumvent the problem of permanent roaming. These includeeSIM, Multi-IMSI, aggregator platforms, and dynamic network selection algorithms.

The Internet of Things (IoT) has revolutionized the way we interact with the world around us. From smart homes to industrial automation,IoTdevices are playing a pivotal role in enhancing efficiency and convenience. However, the growing IoT ecosystem has brought forth its own set of challenges. One such challenge is permanent roaming, a phenomenon that has gained significance due to the global nature ofIoTdeployments. In this blog, we will delve into the concept of permanent roaming for IoT, discuss the challenges it poses, and explore potential solutions.

Understanding permanent roaming for IoT

永久漫游the context of IoT refers to the practice of utilizingcellularconnectivity across different geographical locations on a consistent basis. Unlike traditional mobile phones, which might roam temporarily when users travel, IoT devices often need to maintain connectivity across various regions for extended periods. This is a fundamental requirement for IoT devices used in logistics, remote monitoring,agricultureand other activities.

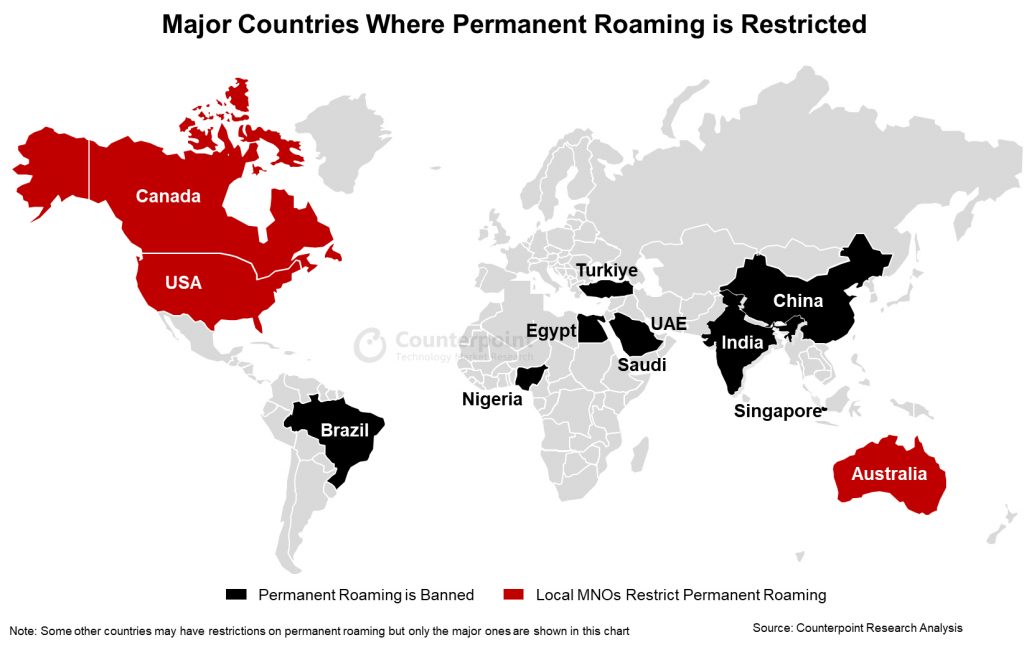

While many countries allow permanent roaming without significant constraints, some big countries have implemented limitations on this practice. The map below shows countries where permanent roaming is banned and those where local carriers have imposed restrictions.

Countries that prohibit permanent roaming includeIndia, China, Brazil, Saudi Arabia, Egypt, Nigeria, Turkiye (formerly Turkey), UAE and Singapore. Besides, mobile operators in the US, Canada and Australia have imposed restrictions on permanent roaming within theirnetworks, effectively imposing a ban on this practice in these countries. Remarkably, these 12 countries collectively cover more than 50% of the world’s population and account for well over three-quarters of the IoT market.

Challenges posed byrestrictions onpermanent roaming

IoT devices are typically deployed on a global scale, leading to a complex scenario where these devices are connected to multiple mobile network operators (MNOs) across different countries. Imagine an electric car company that markets its vehicles across various regions. In countries where permanent roaming is not allowed, the company must procure local connectivity. This situation presents a host of challenges that ripple through the operational landscape:

- Complex network management:Handling connections to multiple networks becomes really complex. Each network might have different prices, coverage areas and technical needs. The process of harmonizing such distinct facets is likely to be intricate and time-consuming.

- Dealing with many partners:The company needs to work with different network partners. This means making deals, managing money and ensuring good service quality across networks. Besides, multiple networks means multiple bills and contracts. All of these tasks together can become very complicated and hard to manage as this activity is not core to the business.

- Higher costs:Because of the rules against permanent roaming, the company has to pay more money to set up connections in each country. This extra cost can make things difficult and might affect how much the company can grow.

- Less flexibility:Without the ability to use permanent roaming, the devices might not work as well when they move between countries. This can be a problem for customers who expect a consistent experience.

- More planning needed:Since the company can’t rely on the same connection everywhere, it needs to plan ahead. This can slow things down and make expansion harder. There could be issues related to data sovereignty and compliance that may require additional planning.

Solutionsforpermanent roaming

There are multiple ways to circumvent the problems associated with permanent roaming. However, it is critical to select a managed service provider that has tie-ups with local MNOs/MVNOs. Alternatively, direct MNO relationships can be managed using aggregator connectivity management platforms.

eSIM (embedded SIM):eSIMtechnology is a game changer in the IoT landscape. It enables devices to have programmable SIM cards that can be remotely provisioned over the air. With eSIM, IoT devices can switch between different MNOs without requiring a physical SIM card replacement, thus simplifying the management of connectivity. UsingeSIM, it is possible to switch between a local profile and multiple roaming profiles every 90 days to avoid permanent roaming. Many managed service providers have this workaround to avoid permanent roaming. The new IoT eSIM specifications will further simplify the provisioning and orchestration of connectivity.

Multi-IMSI (International Mobile Subscriber Identity):Multi-IMSI solutions allow a single physical SIM card to have multiple IMSIs from different MNOs. This enables the device to seamlessly switch between networks while maintaining a single SIM card. By intelligently selecting the optimal IMSI based on factors like network quality and cost, Multi-IMSI solutions optimize connectivity and reduce operational complexities. However, the managed service provider needs to have a local presence or tie-ups.

Aggregator platforms:Aggregator connectivity management platforms (CMPs) act as intermediaries between IoT device owners and various MNOs. These platforms offer a unified interface for managing connectivity, provisioning,billing, and reporting across multiple networks. By consolidating these tasks, aggregator platforms simplify the management of permanent roaming for IoT devices. A new set of aggregator CMPs like IOTM and ConnectedYou is targeting enterprises instead of carriers to solve the problem of managing multiple networks.

Some of the aggregator platforms offer Dynamic Network Selection Algorithms. Smart algorithms can be implemented in IoT devices to dynamically select the most suitable network based on parameters such as signal strength, latency and cost.

Conclusion

With the IoT landscape continuing to expand globally, the challenges associated with permanent roaming are becoming more pronounced. However, with the advent of innovative solutions such aseSIM, Multi-IMSI, aggregator platforms, and dynamic network selection algorithms, these challenges can be effectively mitigated. These solutions not only simplify the management of connectivity but also enhance cost-effectiveness and operational efficiency for IoT deployments. The key is to find the right managed services partner, which has a platform that enables easy management of connectivity.

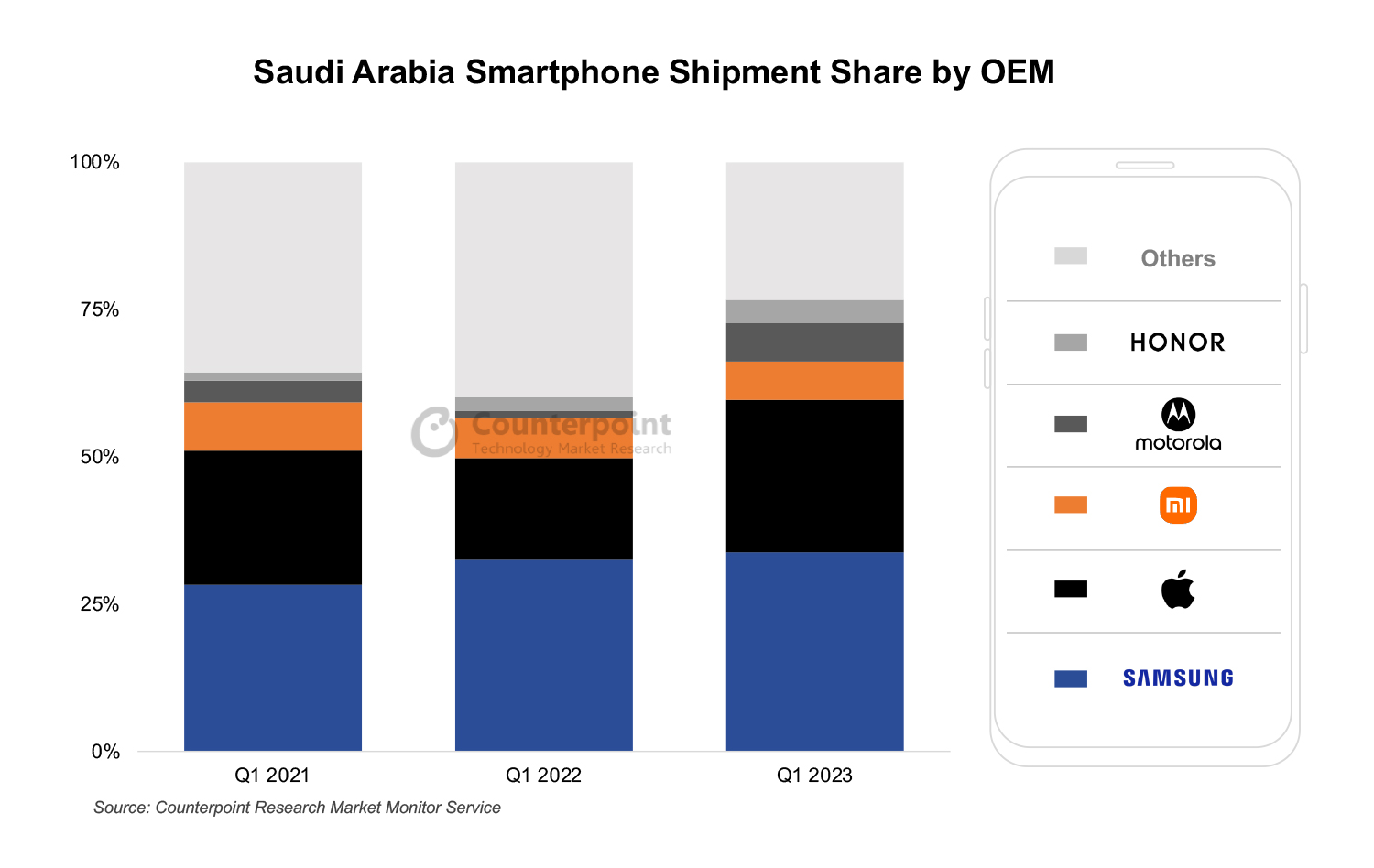

Saudi Arabia Smartphone Shipments by Top 5 OEMs for Q1 2021, Q1 2022, Q1 2023

Saudi Arabia Smartphone Shipments by Top 5 OEMs for Q1 2021, Q1 2022, Q1 2023