- The Saudi Arabia smartphone market was among the few to record YoY growth in Q1 2023.

- Even as many economies struggled in 2022 amid macroeconomic and geopolitical pressures, Saudi Arabia was bolstered by its highest oil revenues in decades, all-time-low unemployment rates, all-time-high non-oil economic activity and strong private consumption.

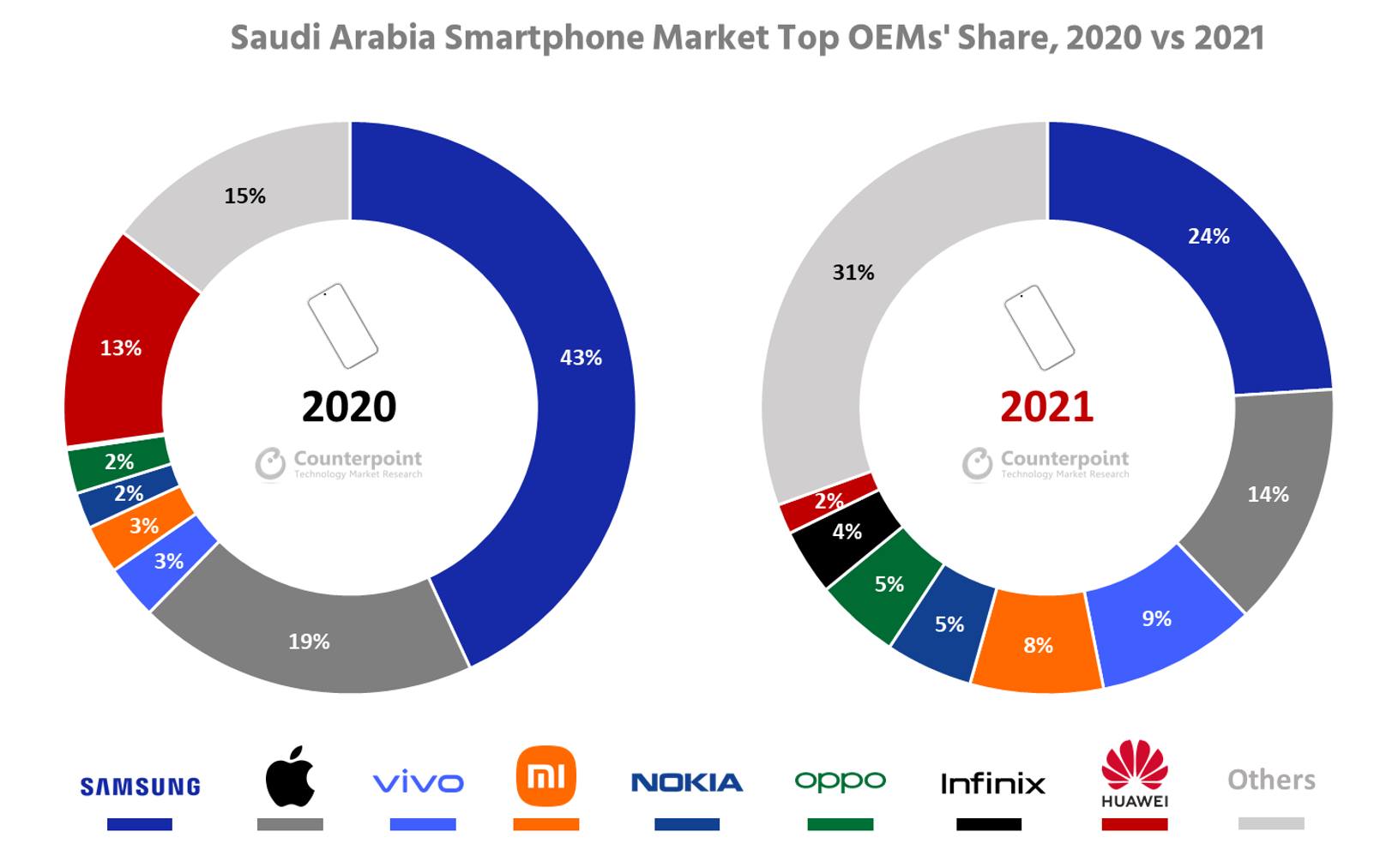

- Among OEMs, Samsung and Apple continued to take over half of the total smartphone shipments in Q1 2023, with Samsung taking the #1 spot.

- We expect the Saudi Arabia smartphone market to continue its growth momentum in 2023, with annual shipments likely to grow in low single digits.

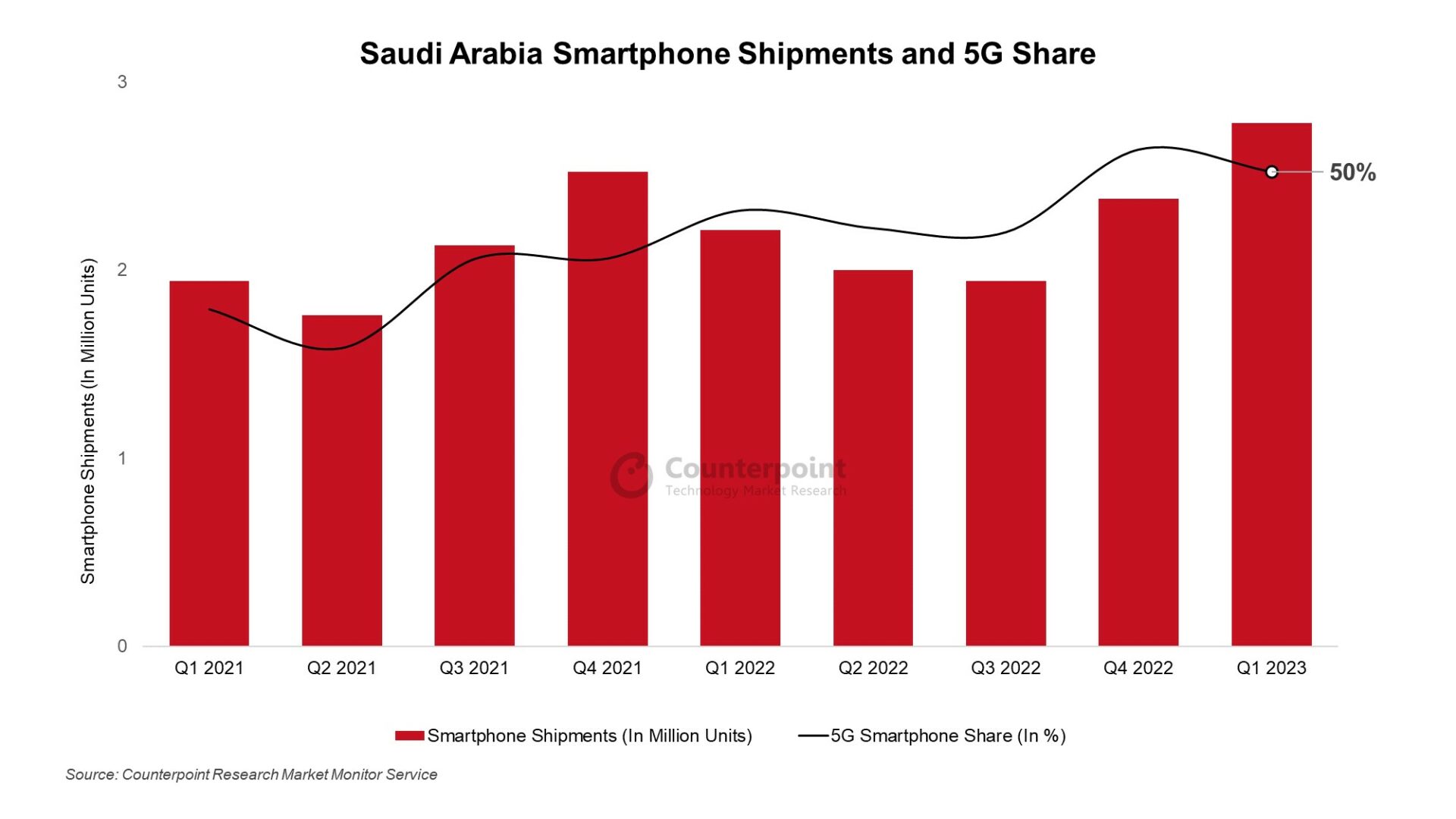

The Saudi Arabia smartphone market was among the few to record YoY growth in Q1 2023, with shipments growing 26% YoY largely due to strong macroeconomic fundamentals, accelerating digitalization, and growing device financing options. In QoQ terms, the shipments grew 17% as OEMs filled channels for the Easter and Ramadan sales season, towards the end of the quarter.

Growth drivers

As manyglobal economies struggled in 2022amid macroeconomic and geopolitical pressures, Saudi Arabia was among the few to buck the trend. Bolstered by its highest oil revenues in decades as global oil prices soared, Saudi Arabia was the fastest-growing economy in 2022, with all-time-low unemployment rates, all-time-high non-oil economic activity and strong private consumption. PoS (Point of Sale) transactions, e-commerce activity and digital payments have also been on the rise in Saudi Arabia, all pointing to growing digitalization and private consumption. Some of the market momentum at the end of 2022 was carried into Q1 2023, especially after the economic boost provided by the FIFA World Cup in Qatar and the year-end and holiday season of Q4 2022.

Saudi Arabia Smartphone Shipments and 5G Share – Q1 2021 to Q1 2023

While the feature phone to smartphone migration has slowed down in Saudi Arabia, a growing digital economy and an aspirational customer have become key growth drivers. Commercial and private 5G use is also increasing in the country, pushing 5G smartphone sales. 5G technologies are a key part of Saudi Arabia’s digitalization and growth push under the Vision 2030 plan. The country has partnered with major 5G infrastructure players likeHuaweiandEricsson, and5G networksare now available in most major cities, covering around 80% of the country’s population. Saudi Arabia has also been hailed as a 5G pioneer in the region in terms of coverage, speed and consistency. 5G smartphone share remained above half of total smartphone shipments for the second consecutivequarterin Q1 2023 and is likely to grow further in 2023.

Competitive landscape

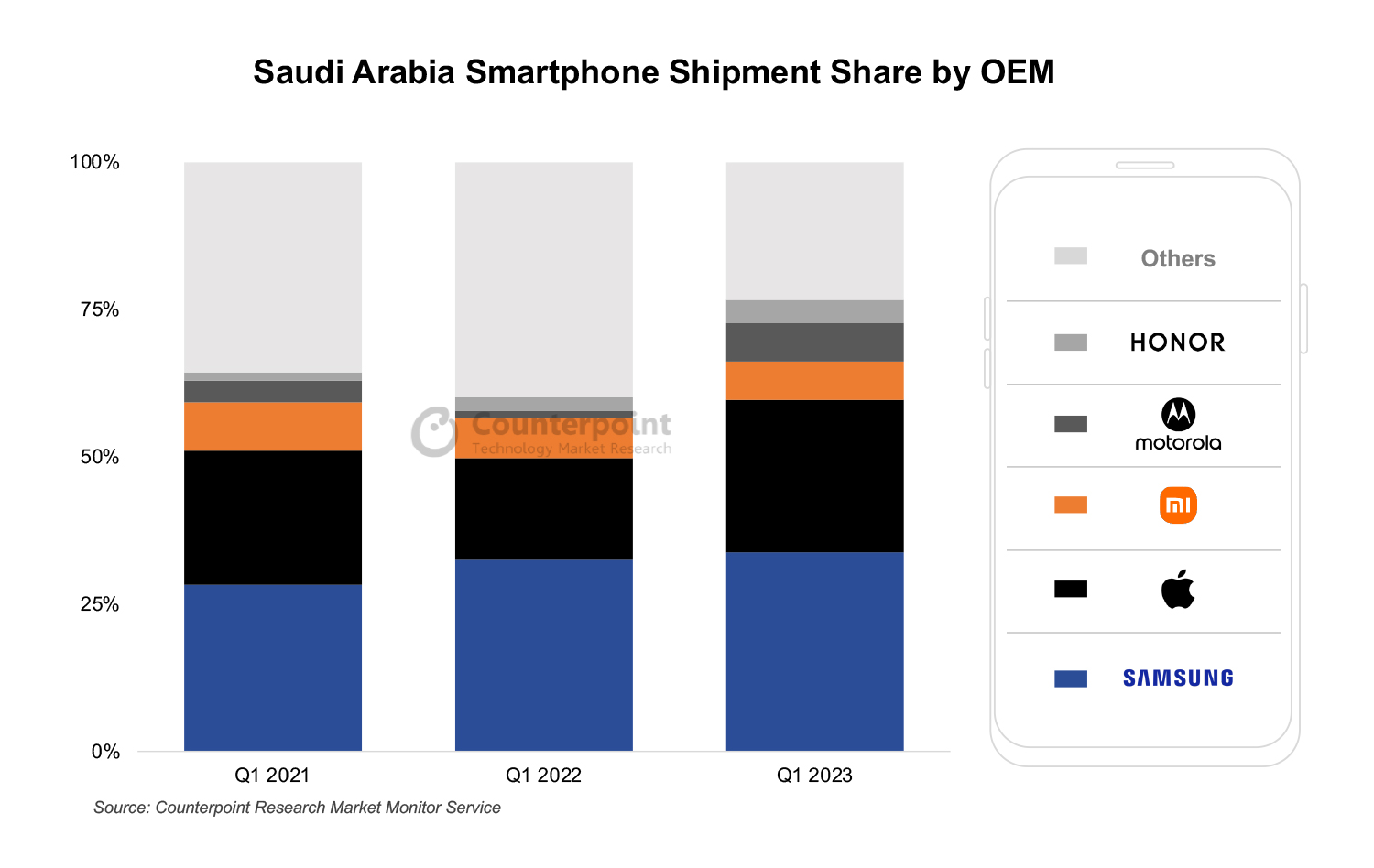

Saudi Arabia Smartphone Shipments by Top 5 OEMs for Q1 2021, Q1 2022, Q1 2023

Saudi Arabia Smartphone Shipments by Top 5 OEMs for Q1 2021, Q1 2022, Q1 2023

Among OEMs, Samsung and Apple continued to take over half of the total smartphone shipments in Q1 2023, with Samsung taking the #1 spot. Xiaomi and Motorola were distant third, with HONOR rounding out the top five for Q1 2023.

Samsunggrew YoY as its supply normalized in the region. The brand’s 5G models have been leading growth, especially the new affordable 5G M-series and A-series iterations. The Galaxy M53 was the best-selling Android device in the country in Q1. Samsung’s newest flagshipGalaxy S23series was shipped slightly earlier than theS22 series in 2022to meet the pre-order demand triggered by aggressive marketing and promotions in the country, with most channels and offline stores participating.

Apple’ssmartphone shipments nearly doubled YoY led by the popularity of itsiPhone 14 series, especially thePro versions, and as older models became affordable and available. Apple reached its highest-ever Q1 shipment share in Saudi Arabia in 2023. The brand has greatly benefitted from therise of financing options, like the ‘Buy Now, Pay Later’ model, in Saudi Arabia, making its devices accessible to a greater demographic. Besides, a rising mean wage and stable exchange rates increased the average Saudi Arabian consumer’s purchasing power in 2022. iPhones took four of the top five spots in the bestseller list for Q1 2023, with the iPhone 14 Pro coming out on top.

WhileXiaomi’sshipments grew YoY in Q1, it lost share marginally, as Motorola and HONOR gained share driven by new launches. Xiaomi has been able to maintain share largely due to its broad portfolio across price bands, innovative marketing strategies, and a strong presence across both offline and online channels.

Motorolahas been gaining share, led by its offerings in the $150-$249 price band, particularly its G series, which accounted for nearly three-quarters of its total sales in Q1. Motorola has benefitted from improved product availability, especially for new launches, and strong brand pull, especially for middle-income customers looking for upgrades to their lower-segment devices.

HONORwas among the fastest-growing brands in Q1, with its shipments more than doubling YoY. HONOR’s growth is largely due to focused expansion efforts, aggressive launch campaigns and an attractive mid-tier to high-end portfolio. HONOR has also benefitted from utilizing Huawei’s earlier distribution and channel relationships. The HONOR 70 and the X series were the top volume drivers for the OEM in Saudi Arabia for Q1 2023.

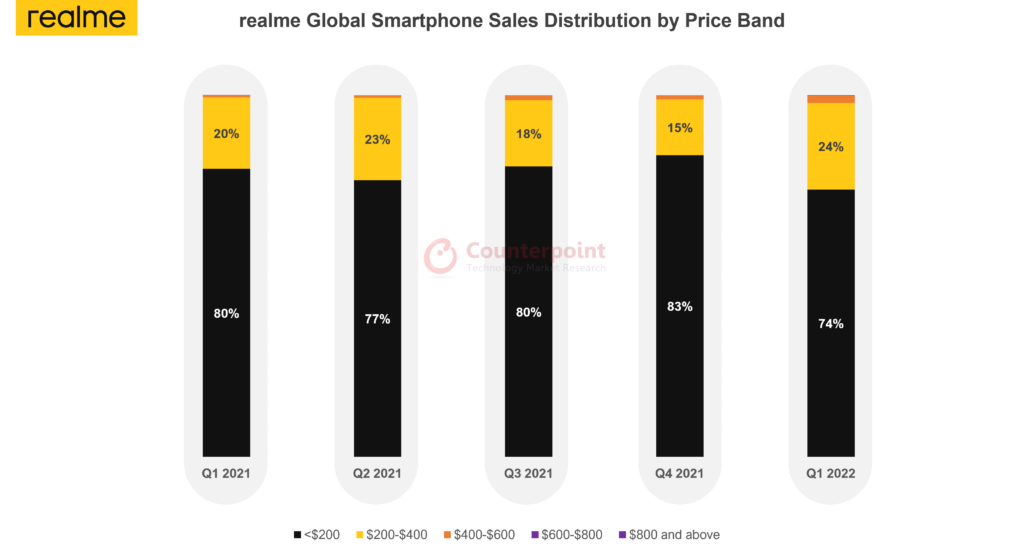

所有价格带我的智能手机销量同比增长n Q1 2023 but declined QoQ largely due to seasonality. All price bands except thepremiumband (≥$600) lost share YoY as consumers moved up the price bands. But thepremium乐队第一季度增长最快的乐队,由美联社ple and Samsung. Apple captured around 85% of the total premium smartphone sales in Q1. The mid-tier ($100-$249) remained the largest price band in Saudi Arabia, capturing nearly half of the total smartphone sales in Q1, with Samsung and Xiaomi taking the top spots in the price band. Thelower (<$100) segmentgrew YoY but, like other non-premium segments, lost sales share during the same period, as customers continued to buy higher-ASP devices with improving affordability and rising aspirations.

Market outlook

We expect the ASP of smartphones sold in Saudi Arabia to continue to rise in 2023, as wage rates improve, financing options become more accessible, and customers move towards better devices. Currently, Apple and Samsung remain best equipped to capture more share of the aspirational Saudi Arabia smartphone market, but the quest for the #3 spot continues. While Xiaomi remains comfortably in the #3 spot, other Android OEMs have been mounting pressure with bolder promotions and marketing activities and aggressive launch strategies. Motorola, HONOR and Transsion Group brands Infinix and TECNO are likely candidates outside the top three to capture market growth.

Going forward, we expect the Saudi Arabia smartphone market to continue its growth momentum, with annual shipments likely to grow in low single digits in 2023. Increasing 5G use, ramping up of digitalization, greater access to financing options and growing aspirations of customers are expected to drive growth.

Note:

- ASP & Priceband Analysis done using Wholesale Prices

- Xiaomi includes Redmi, Pocophone, Black Shark