Weekly Newsletter

September 7, 2023

Guess Which EV Market Loves

Chevys, Mustangs and Pickups?

Sign Up for Our Newsletter Here

Receive our insightful weekly newsletter and stay ahead of the competition.

Weekly Newsletter

September 7, 2023

Guess Which EV Market Loves

Chevys, Mustangs and Pickups?

Sign Up for Our Newsletter Here

Receive our insightful weekly newsletter and stay ahead of the competition.

Counterpoint Research’s recently publishedJuly updateof the5G SA Core Trackeris a culmination of an extensive study of the5GSA market. It provides details of all operators with 5G SA cores in commercial operation at the end of H1 2023, including market share by region, vendor, and the popular frequency bands for deployments. Apart from that, it touches upon the potential monetization opportunities for telecom operators across different domains and uses cases.

Last year, there was steady growth in the commercial deployment of5GStandalone (SA), with more than 20 operators moving to 5G standalone core. However, the pace slowed down in H1 2023 with the number of operators launching commercial 5G SA ranging in single digits. The primary reason for the slowdown in commercialdeploymentof 5G SA was the restraint arising from global macroeconomic factors and the lack of a clear picture of 5G monetization for operators. Although the pace of commercial deployment has slowed down in 2023,operatorsare working on monetization avenues, and are working on SA-specific use cases, including on-demand network slicing and FWA.

Most of the 5G SA commercial deployments have been in developed economies, and Counterpoint Research expects the next bulk ofnetworkrollouts will take place in emerging markets. This will drive the continuing transition from 5G NSA to 5G SA.

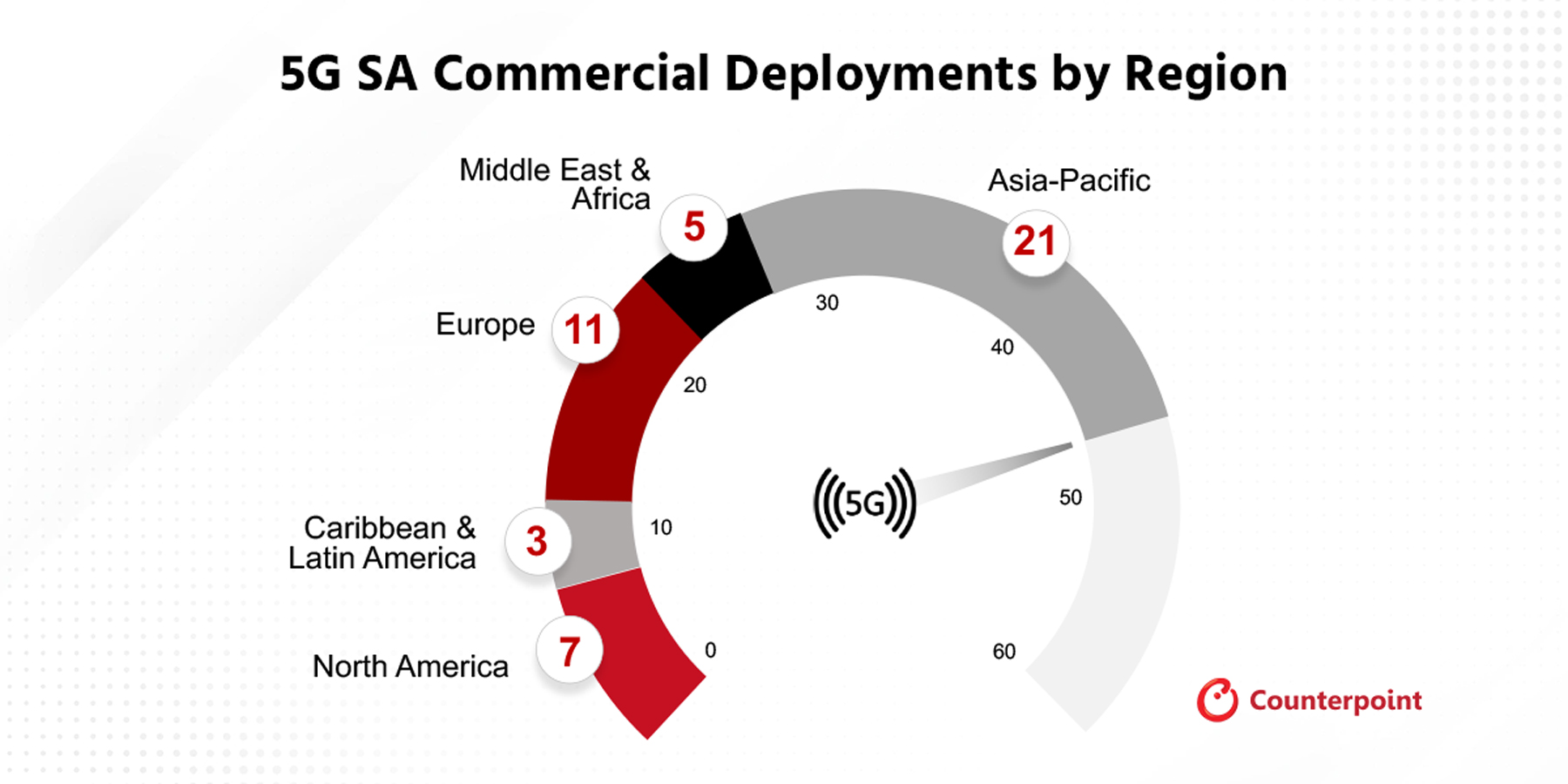

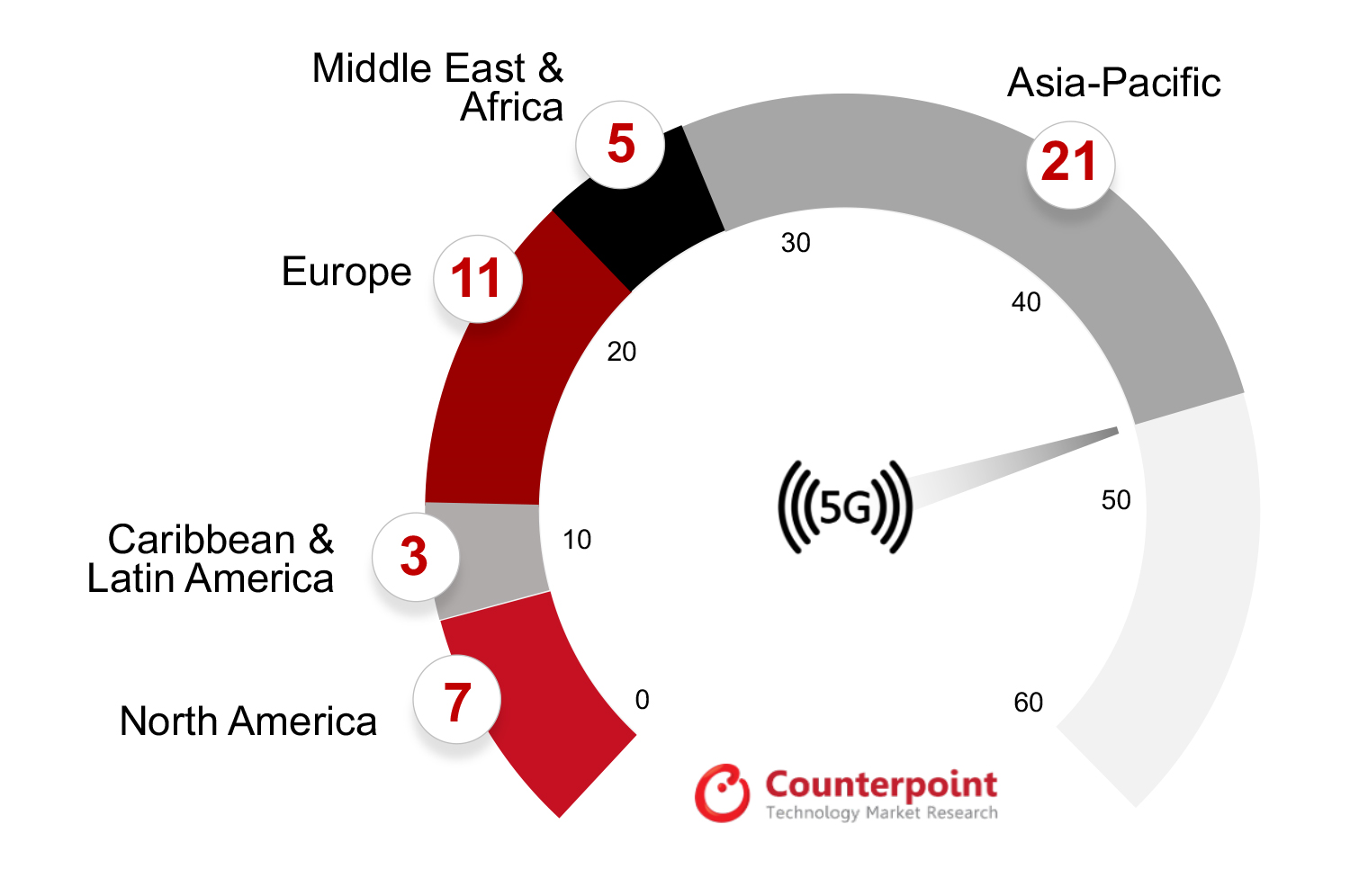

Exhibit 1: 5G SA Deployments by Region, H1 2023

As shown in Exhibit 1, the Asia-Pacific region led the segment, followed by Europe and North America, with the other regions – Middle East and Africa, and Latin America – lagging.

Key Points

重点讨论的报告包括:

Report Overview

Counterpoint Research’s5G SA Core Tracker, July 2023provides an overview of the 5G Standalone (SA) market, highlighting the key trends and drivers that are shaping the market, along with details of commercial launches by vendor, region, and frequency band. Additionally, the tracker provides details about the 5G SA vendor ecosystem split into two categories – public operator and private network markets.

Table of Contents:

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

Related Reports:

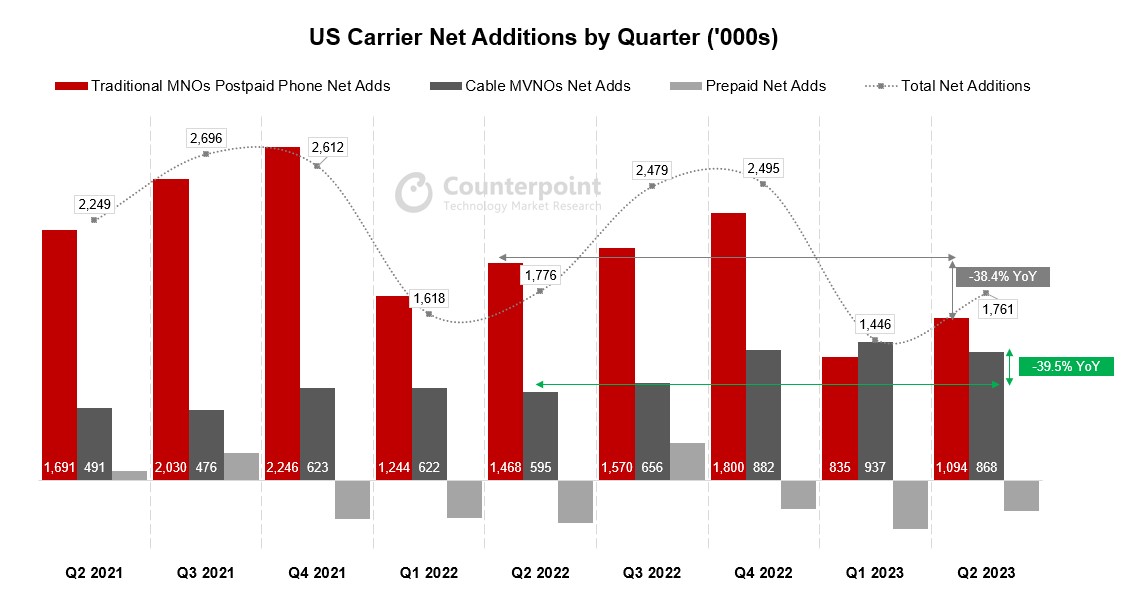

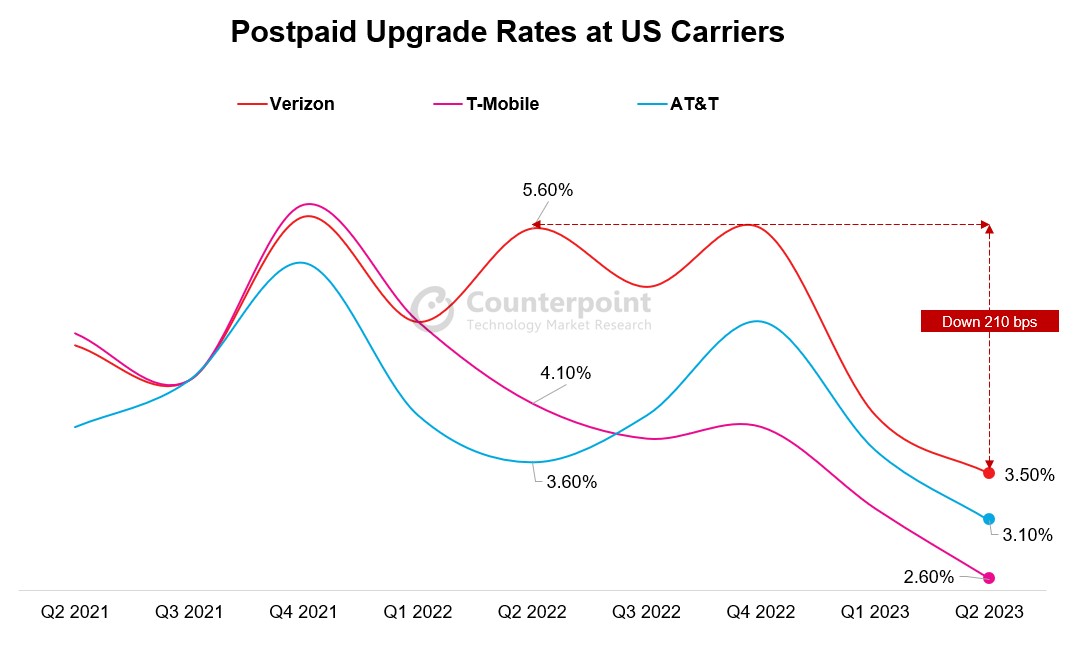

The Q2 2023 earnings season is in the books for the US carriers and several clear trends from the quarter have come into focus. While much of Verizon and AT&T’s earnings calls centered around “lead-sheathed cables”, creating a buzz in the media,the top trends of the quarter for US operators were the ongoing strength of Xfinity and Spectrum Mobile, prepaid to postpaid/cable migration, and record low upgrade rates at the postpaid carriers。Overall phone net additions for Q2 2023 were down slightly YoY with the prepaid market losing value-conscious consumers to Xfinity and Spectrum Mobile, and as Verizon, AT&T and T-Mobile migrated high-value prepaid customers onto their postpaid plans. Additionally, the prepaid market continues to face challenges brought on by recent acquisitions. Meanwhile, existing customers at the postpaid carriers held off on upgrading their devices as overall economic uncertainty resulted in customers holding off on unnecessary upgrades.

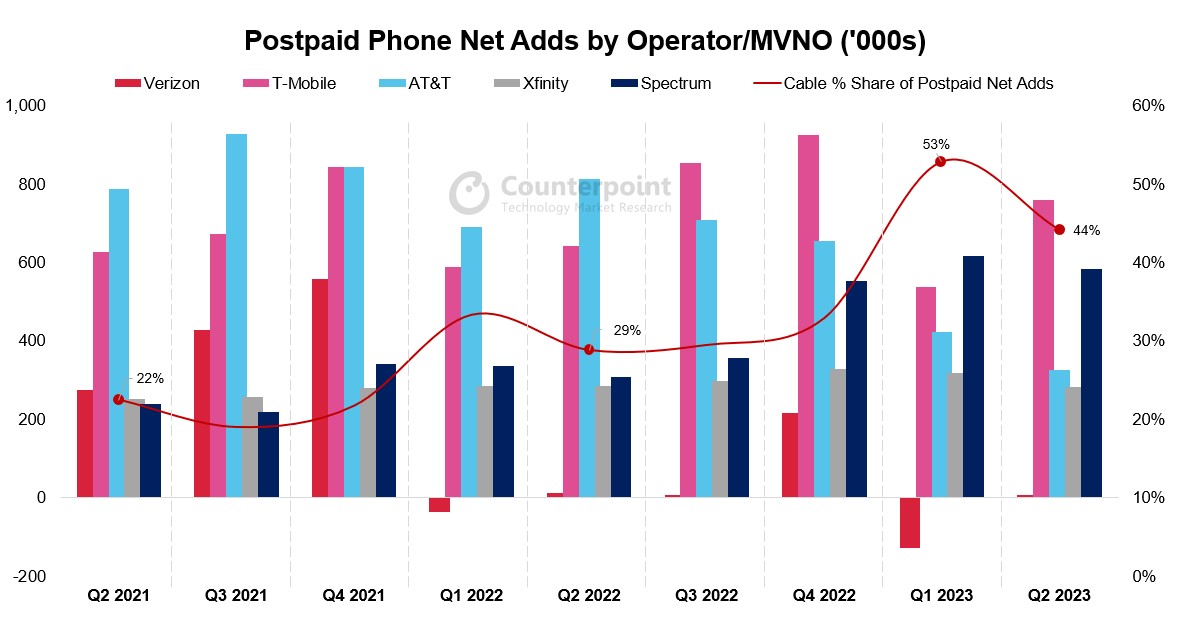

Cable Players Continue to Win Subscribers

While each of the postpaid carriers posted positive net phone additions in the quarter, their share of net additions was decisively lower than last year. Verizon continues to lag AT&T and T-Mobile by a significant margin in new customer acquisition, but AT&T and T-Mobile are losing steam as the cable players snag a higher share of net additions. In Q1 2023, Xfinity and Spectrum claimed 53% of total net phone additions. In Q2 2023, the figure dropped to 44% but grew significantly from the previous year’s 29% share.

The prepaid segment saw its third consecutive quarter of overall subscriber losses.The segment is seeing value-driven customers opt for competitively priced plans at Xfinity and Spectrum, while the postpaid carriers continue to migrate high-value prepaid customers onto postpaid plans. Verizon continues to see significant subscriber losses as it is still migrating the customers it obtained through the Tracfone acquisition onto its network and off AT&T and T-Mobile’s networks. Verizon has now lost about 1 million of the subscribers it gained from Tracfone. Similarly, Dish continues to see subscriber losses as it struggles to keep the Boost Mobile brand competitive with Metro and Cricket. Dish is also banking on strong performance from its new postpaid Boost Infinite services to keep the brand afloat, although delays in the launch of Boost Infinite and Dish’s slow network buildout have inspired skepticism.

Low Upgrade Rates in Postpaid

Device sales were minimal at the postpaid carriers through Q2 2023 as upgrade rates reached record lows and churn remained minimal. Consequently, equipment revenues were down significantly across the postpaid carriers. As our recent PR noted, smartphone shipments into the US were down 24% YoY, in large part driven by customers holding onto their devices for longer amid economic uncertainty, lower levels of innovation in the smartphone market, and ongoing improvements in device durability. Upgrade rates are likely to remain below last year’s levels through the end of the year and into 2024 constrained by macroeconomic headwinds, but upgrade rates should spike towards the end of Q3 2023 with the launch of the iPhone 15 and through the holiday shopping season in Q4 2023.

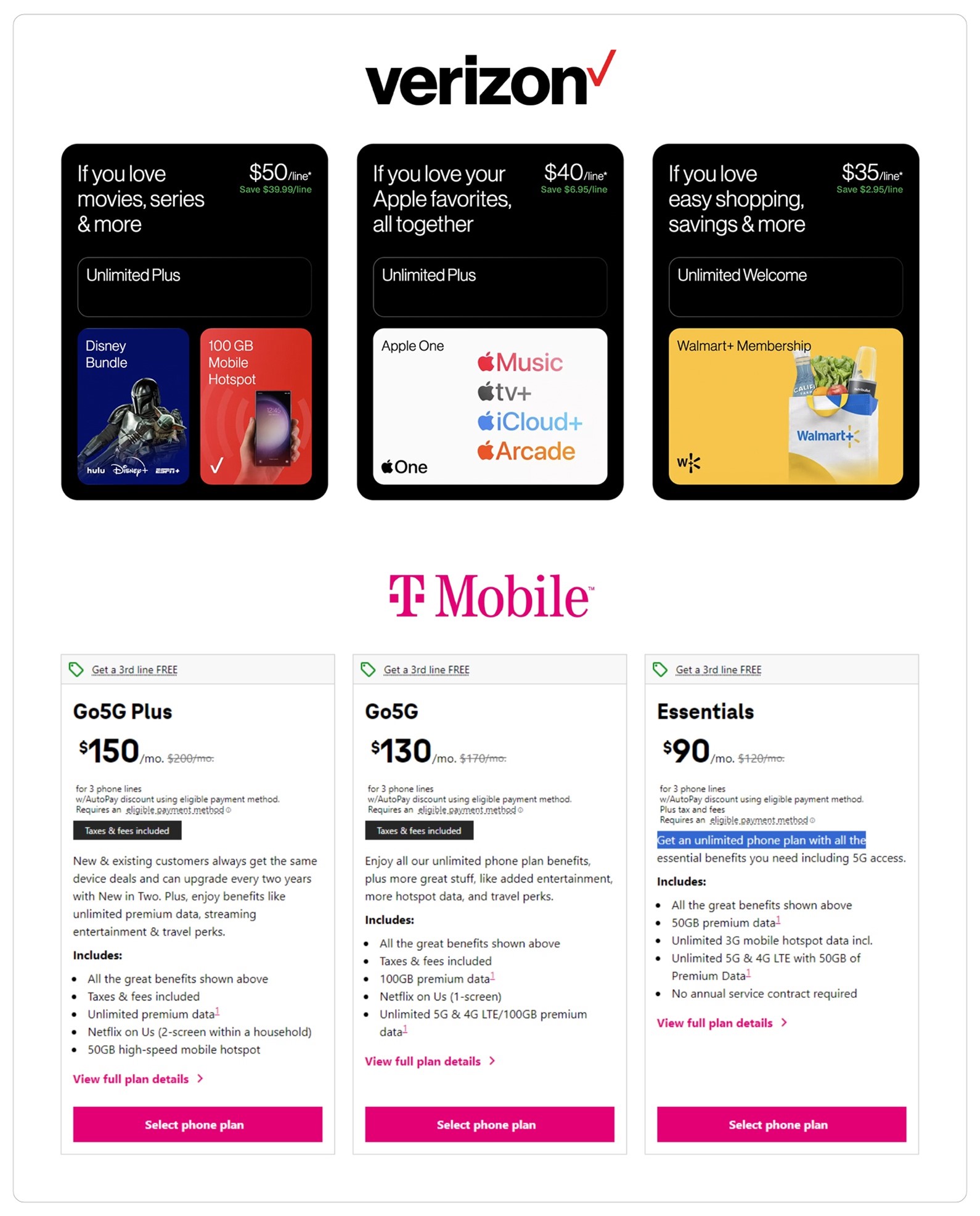

In Q2 2023, the carriers offered strong promotions for upgraders on flagship devices, keeping upgrade rates and device sales from falling further during the quarter. The carriers generally lose money on device sales and make up for it from service revenues. However, as the cable players snare a higher share of customer additions, the growth potential from subscriber growth and consequent service revenues is limited. To combat this situation, the carriers are looking to increase ARPU by offering higher value plans, but also by offering plans on discount to better compete with the cable players. We have also seen AT&T and Verizon increase prices on old plans to raise ARPU or encourage subscribers to adopt new service plans. Verizon and T-Mobile both restructured their service plans during Q2 2023, simplifying their menu of services and improving the value offered to customers. Meanwhile, AT&T stood pat with its slate of service plans but announced that later this year it would reduce its autopay discount to $5/month from $10/month, which will improve ARPU.

What to Expect in H2 2023

As 2023 marches on, we expect to see the carriers become even more competitive with their service promotions as the cable players continue to win in customer acquisition. Additionally, we see the carriers offering even more “bundling” opportunities, as they aggregate streaming services, internet service, and cellular service to improve their overall value offer. Meanwhile, prepaid will continue to struggle, as customers in this segment have been the worst hit by inflation. The second half of the year will see an uptick in device sales, as usual, with the launch of the Apple iPhone 15 in September and as the holiday shopping season sets in. However, we expect overall smartphone sales to remain down YoY.

Feature phones have made a resurgence due to digital detox and Gen Z/millennials

Feature phonesin theUSmarket have made a resurgence asGen Z and millennials are advocating for digital detoxes due to the mental health concerns brought on by smartphones and social media. Hashtags like #bringbackfliphones on TikTok have garnered millions of views leading to the increased adoption of feature phones by younger consumers looking to adhere to movements like digital detoxing, minimalist lifestyles and unplugging. Given the relatively cheap price point of feature phones ($20-$50 with a prepaid carrier and $50-$100 unlocked), more people are trying out these devices and sharing their experiences on social media.

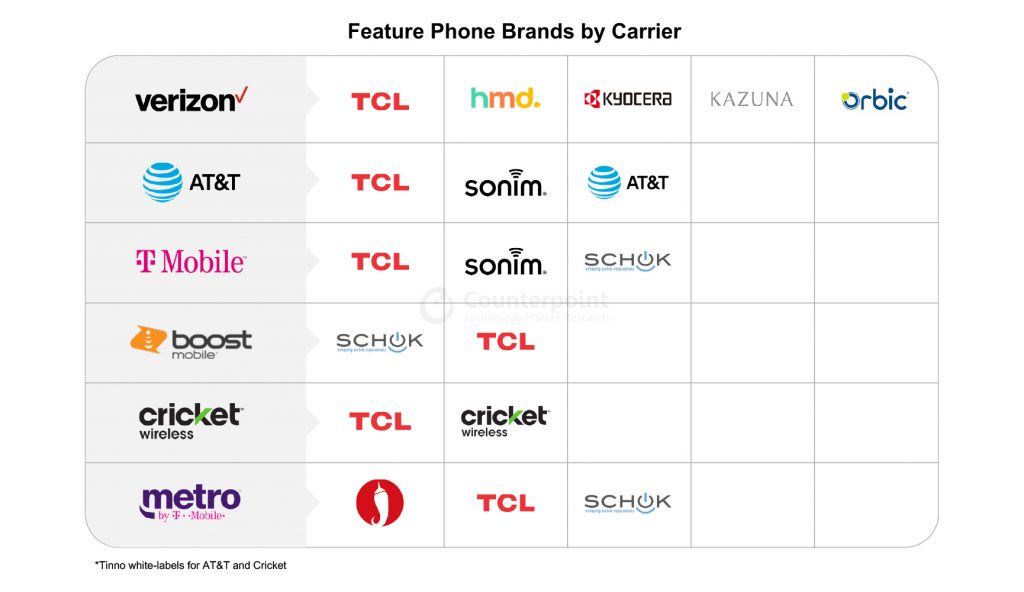

The market is more crowded now, TCL and HMD are leading but competition from Schok, Sonim, and white-label makers like Tinno are entering agreements with carriers

Smartphones were widely adopted almost instantly when they arrived. Due to this, the US feature phone market shrank significantly over the past 10 years. Currently, the feature phone market contributes to only a little more than a 2% share of overall handset sales in the US. Among the players catering to this segment of the market, TCL, which manufactures feature phones for majorcarriersin both branded and white-label capacities, leads the pack with a 43% share due to its strong presence on carrier channels. HMD ranks second with a 26% share, while other smaller players make up for the rest of the market.

Additionally, carrier and OEM tie-ups play an important role in the dynamics. The big three US carriers – AT&T, Verizon and T-Mobile – are exploring different feature phone OEM options due to which the US feature phone market has grown more crowded lately, especially with carriers moving away from TCL devices and trying out smaller OEMs instead, like Tinno and FIH which have manufactured devices forAT&T’swhite-labeled feature phones. Sonim and Kyocera, which provide ruggedized devices, areVerizon’sfeature phone brands, while Schok and hot pepper areT-Mobile’s。 Feature phone sales are forecast to reach 2.8 million in 2023 with continued stable sales in the near term as niche demand drivers maintain sales

Feature phone sales are forecast to reach 2.8 million in 2023 with continued stable sales in the near term as niche demand drivers maintain sales

功能手机仍在标记t and are likely to see consistent shipments, helped by their affordability and durability to suit specific use cases. Although the growth in numbers may not be huge, the demand from consumers looking for a feature phone as a digital detox mechanism will continue. Additionally, B2B sales may drive some demand as feature phones simplify costs for businesses. Furthermore, tourists and other consumers needing a cheap disposable feature phone will also continue to keep sales stable.

New hardware configurations like eSIM or NFC can make devices more relevant for modern consumers wishing to simplify their tech gadgets but still interact seamlessly in the digital world

There is a consumer base looking for devices that are minimalistic but also have features that are relevant to staying connected in today’s world. The design and specifications of feature phones have not changed much over the last few years. This is one of the factors that keep consumers from purchasing a feature phone. The addition of some new hardware configurations and features that are abreast with the current trends while still maintaining the simplicity of usage may open more gates for the growth of feature phones. NFC is one such feature. NFC can enable payments, home automation, quick pairing, and make public transport access more convenient for users. Similarly,eSIMsmay also be a great hardware integration as it may attract consumers to adopt a feature phone as a companion device that they can easily switch to from their main device in situations where they do not want to bring out their expensive smartphone. Adding these attributes would help make feature phones more relevant for day-to-day use.

See the full report below for more information:

The US feature phone market has seen a recent resurgence with Gen Z/Millennials advocating for digital detoxes due to mental health concerns. While TCL and HMD remain the dominant OEMs in the US, challenger brands are making the market more crowded. Feature phones will remain an important part of the US handset market for years to come as they continue to solve for niche needs that smartphones cannot address.

Number of Pages:18

[one_half padding=”0 15px 0 0″]

[/one_half]

[one_half_last padding=”0 0px 0 0″]

[/one_half_last]

最近的兴趣激增生成AI高lights the critical role that AI will play in future wireless systems. With the transition to 5G, wireless systems have become increasingly complex and more challenging to manage, forcing the wireless industry to think beyond traditional rules-based design methods.

5GAdvanced will expand the role of wireless AI across 5G networks introducing new, innovative AI applications that will enhance the design and operation of networks and devices over the next three to five years. Indeed, wireless AI is set to become a key pillar of5G Advancedand will play a critical role in the end-to-end (E2E) design and optimization ofwirelesssystems. In the case of 6G, wireless AI will become native and all-pervasive, operating autonomously between devices and networks and across all protocols and network layers.

E2E Systems Optimization

AIhas already been used in smartphones and other devices for several years and is now increasingly being used in the network. However, AI is currently implemented independently, i.e. either on the device or in thenetwork。As a result, E2E systems performance optimization across devices and network has not been fully realized yet. One of the reasons for this is that on-device AI training has not been possible until recently.

On-device AI will play a key role in improving the E2E optimization of 5G networks, bringing important benefits foroperatorsand users, as well as overcoming key challenges. Firstly, on-device AI enables processing to be distributed over millions of devices thus harnessing the aggregated computational power of all these devices. Secondly, it enablesAImodel learning to be customized to a particular user’s personalized data. Finally, this personalized data stays local on the device and is not shared with thecloud。这提高了可靠性和减轻数据vereignty concerns. On-device AI will not be limited to just smartphones but will be implemented across all kinds of devices from consumer devices to sensors and a plethora of industrial equipment.

New AI-nativeprocessorsare being developed to implement on-device AI and other AI-based applications. A good example isQualcomm’snew Snapdragon X75 5G modem-RF chip, which has a dedicated hardware tensor accelerator. Using Qualcomm’s own AI implementation, this Gen 2 AI processor boosts the X75’s AI performance more than 2.5 times compared to the previous Gen 1 design.

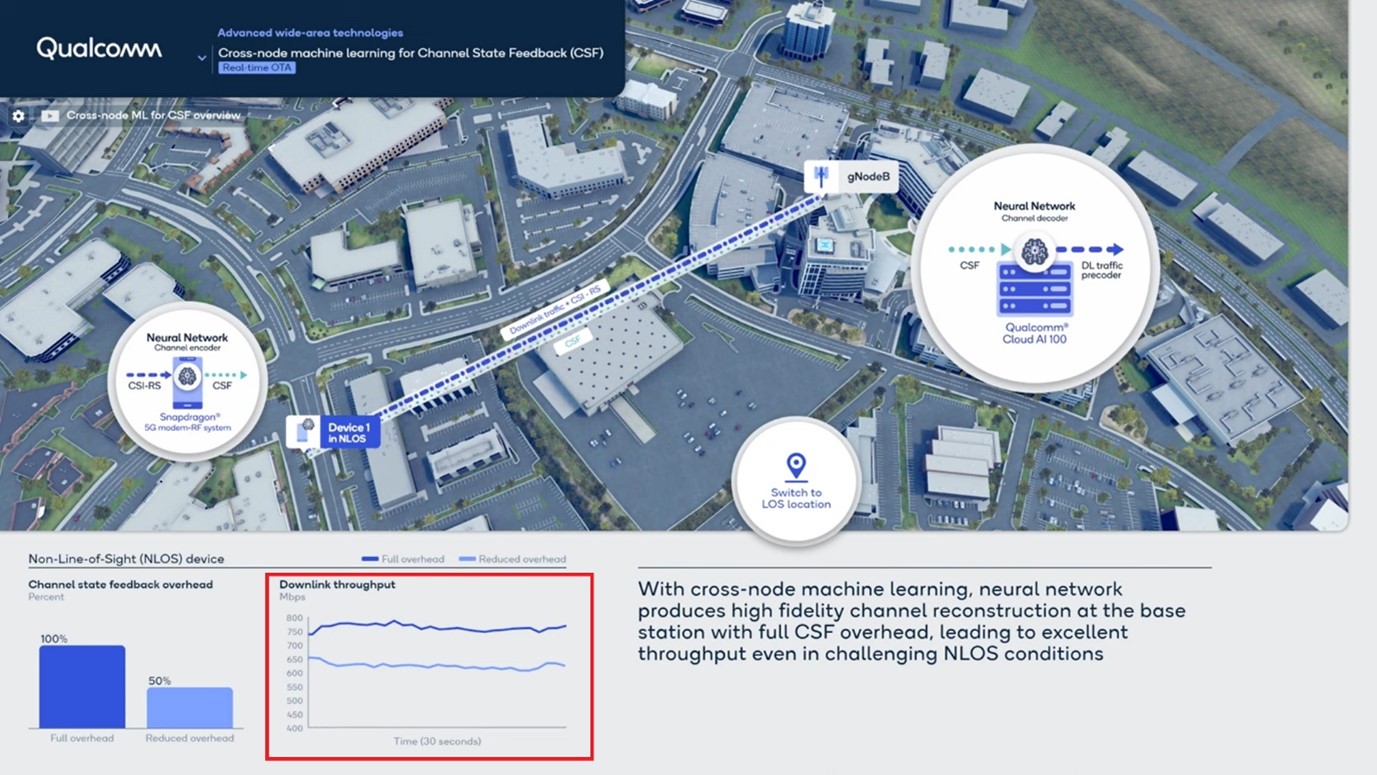

While on-device AI will play a key role in improving the E2E performance of5G networks, overall systems optimization is limited when AI is implemented independently. To enable true E2E performance optimization, AI training and inference needs to be done on a systems-wide basis, i.e. collaboratively across both the network and the devices. Making this a reality in wireless system design requires not only AI know-how but also deep wireless domain knowledge. This so-called cross-node AI is a key focus of 5G Advanced with a number of use cases being defined in 3GPP’s Release 18 specification and further use cases expected to be added in later releases.

Wireless AI: 5G Advanced Release 18 Use Cases

3GPP’s Release 18 is the starting point for more extensive use of wireless AI expected in6G。Three use cases have been prioritized for study in this release:

Channel State Feedback:

CSI is used to determine the propagation characteristics of the communication link between a base station and a user device and describes how this propagation is affected by the local radio environment. Accurate CSI data is essential to provide reliable communications. With traditional model-based CSI, the user device compresses the downlink CSI data and feeds the compressed data back to the base station. Despite this compression, the signalling overhead can still be significant, particularly in the case of massive MIMO radios, reducing the device’s uplink capacity and adversely affecting its battery life.

An alternative approach is to use AI to track the various parameters of the communications link. In contrast to model-based CSI, a data driven air interface can dynamically learn from its environment to improve performance and efficiency. AI-based channel estimation thus overcomes many of the limitations of model-based CSI feedback techniques resulting in higher accuracy and hence an improved link performance. The is particularly effective at the edges of a cell.

Implementing ML-based CSI feedback, however, can be challenging in a system with multiple vendors. To overcome this, Qualcomm has developed a sequential training technique which avoids the need to share data across vendors. With this approach, the user device is firstly trained using its own data. Then, the same data is used to train the network. This eliminates the need to share proprietary, neural network models across vendors.Qualcomm has successfully demonstrated sequential training on massive MIMO radios at its 3.5GHz test network in San Diego (Exhibit 1)。

Exhibit 1: Realizing system capacity gain even in challenging non-LOS communication

AI-based Millimetre Wave Beam Management:

The second use case involves the use of ML to improve beam prediction on millimetre wave radios. Rather than continuously measuring all beams, ML is used to intelligently select the most appropriate beams to be measured – as and when needed. A ML algorithm is then used to predict future beams by interpolating between the beams selected – i.e. without the need to measure the beams all the time. This is done at both the device and the base station. As with CSI feedback, this improves network throughput and reduces power consumption.

Precise Positioning:

The third use case involves the use of ML to enable precise positioning.Qualcomm has demonstrated the use of multi-cell roundtrip (RTT) and angle-of-arrival (AoA)-based positioning in an outdoor network in San Diego.The vendor also demonstrated howML-based positioning with RF finger printing can be used to overcome challenging non-line of sight channel conditions in indoor industrial private networks.

An AI-Native 6G Air Interface

6G will need to deliver a significant leap in performance and spectrum efficiency compared to 5G if it is to deliver even faster data rates and more capacity while enabling new 6G use cases. To do this, the 6G air interface will need to accommodate higher-order Giga MIMO radios capable of operating in the upper mid-band spectrum (7-16GHz), support wider bandwidths in new sub-THz 6G bands (100GHz+) as well as on existing 5G bands. In addition, 6G will need to accommodate a far broader range of devices and services plus support continuous innovation in air interface design.

To meet these requirements, the 6G air interface must be designed to be AI native from the outset, i.e. 6G will largely move away from the traditional, model-driven approach of designing communications networks and transition toward a data-driven design, in which ML is integrated across all protocols and layers with distributed learning and inference implemented across devices and networks.

This will be a truly disruptive change to the way communication systems have been designed in the past but will offer many benefits. For example, through self-learning, an AI-native air interface design will be able to support continuous performance improvements, where both sides of the air interface — the network and device — can dynamically adapt to their surroundings and optimize operations based on local conditions.

5G Advanced wireless AI/ML will be the foundation for much moreAIinnovation in 6G and will result in many new network capabilities. For instance, the ability of the 6G AI native air interface to refine existing communication protocols and learn new protocols coupled with the ability to offer E2E network optimization will result in wireless networks that can be dynamically customized to suit specific deployment scenarios, radio environments and use cases. This will a boon for operators, enabling them to automatically adapt their networks to target a range of applications, including various niche and vertical-specific markets.