- Indian brands showed the fastest YoY growth in 2022 and had a share of 24% in smart TV shipments.

- Smart TV contribution to overall TV shipments was over 90%, the highest ever.

- The average selling price (ASP) dropped by 8% YoY in 2022.

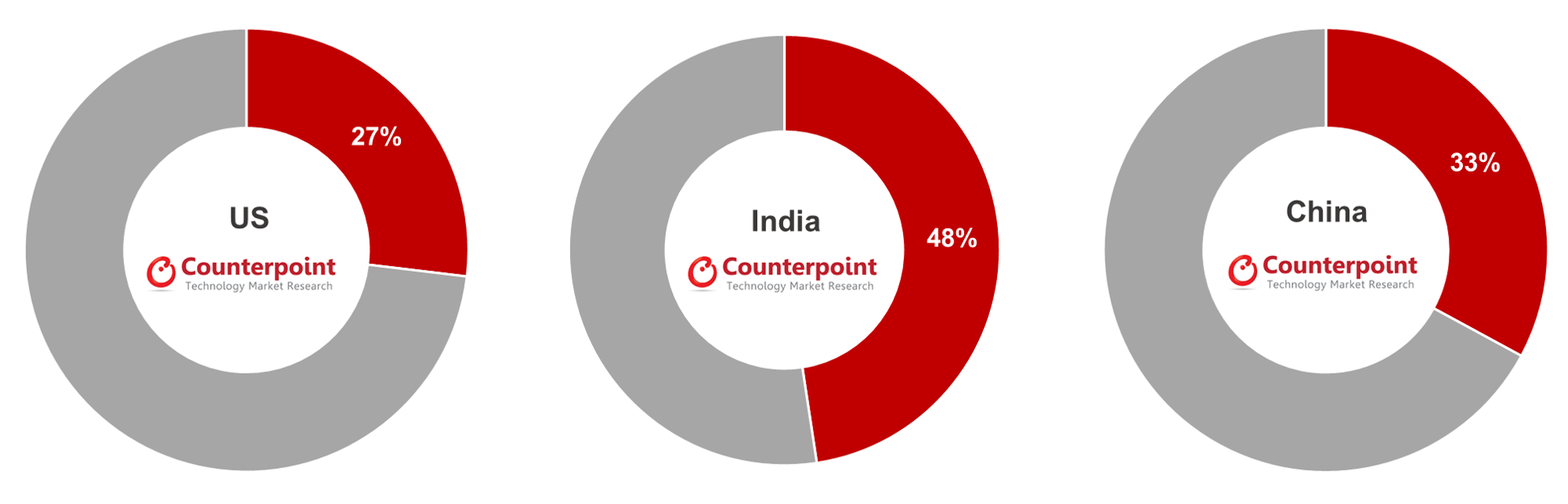

- Online channels contributed 33% of the overall shipments during the year.

- MediaTek chips captured around three-fifths of the total TV market.

- Non-smart TV shipments declined 24% YoY.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Taipei, Seoul – April 04, 2023

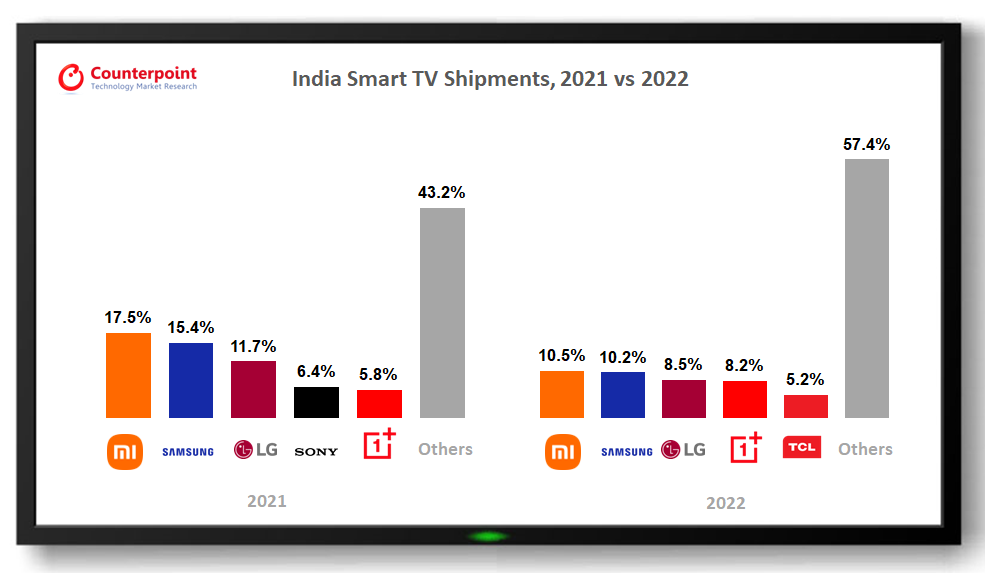

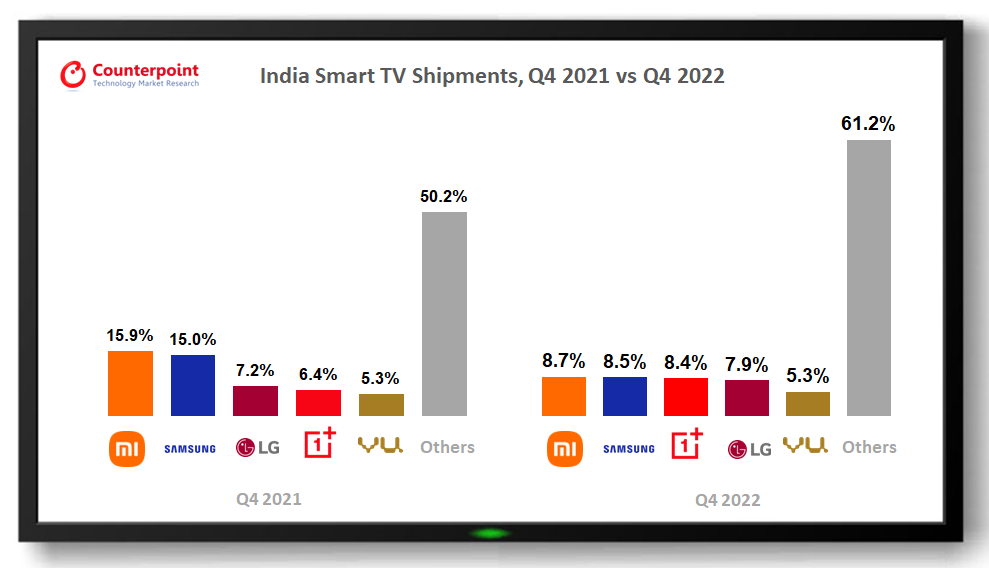

India’ssmart TVshipments grew 28% YoY in 2022, according to the latest research from Counterpoint’sIoT Service. The growth for the year was primarily driven by strong shipments during the festive season in the third quarter, multiple new launches, discounts and promotions, and the demand for bigger screen-size TVs in the lower price tier. For Q4 2022, the growth was almost flat at 2% YoY due to a slowdown in demand after the festive season.

Commenting on the market trends,Research Analyst Akash Jatwala说, “Consumers are preferring bigger screen sizes, especially 43”, due to which the smart TV shipments in this display size grew 29% YoY in 2022. This size has also started trickling down to the budget price range (INR 20,000-INR 30,000 or ~$243-$364). Dolby integration is another most sought-after feature and is available in lower-price TVs too. Dolby Audio support in the INR 10,000-INR 20,000 (~$121-$243) price band increased 37% YoY and was available in about 41% of the smart TVs shipped in 2022. On the operating system side, Google TV grew multifold and was available in 4% of the smart TVs shipped during the year. Many brands are launching TVs with Google TV in the mid-segment (INR 30,000 – INR 50,000). In terms of country of origin, Indian brands showed the fastest growth and had a share of 24% in smart TV shipments during the year, whereas global and Chinese brands had 40% and 36% shares respectively.”

看市场的增长,Senior Research Analyst Anshika Jain说, “OnePlus, Vu, and TCL were among the fastest-growing brands in the smart TV segment in 2022. Xiaomi led the overall smart TV market with an 11% share, followed by Samsung and LG. Smart TV shipments in the INR 20,000-INR 30,000 price band grew 40% YoY to reach a 29% share. The average selling price (ASP) declined 8% YoY to around INR 30,650.”

Jain added, “Smart TV contribution to overall shipments reached its highest ever of 90% during the year. It is expected to go up further due to more launches in the sub-INR 20,000 price range and non-smart-TV-to-smart-TV migration. Non-smart TV shipments declined 24% YoY in 2022. Online channels increased their contribution to the total shipments to 33% during the year.”

Source: India Smart TV Shipments Model Tracker, Q4 2022

Source: India Smart TV Shipments Model Tracker, Q4 2022

Notes: Xiaomi’s share includes Redmi’s share

Market summary for 2022

- Xiaomicontinued to lead India’s smart TV market in 2022 with an 11% share. The Mi TV 5A series and Redmi Smart TV series, especially the 32” model, were among the volume drivers for the brand. Xiaomi has updated its PatchWall with some new features and enhancements, such as content search across multiple OTT platforms, Live TV with more channels, and better recommendation with IMDB integration.

- Samsungtook the second spot. In 2022, Samsung launched new models in its T4000 series in 32” and 43” sizes. Apart from this, it also launched new QLED models in the >INR 50,000 price range. During the year, Samsung had promotional events like Big TV Days and Big TV Festival where it offered discounts and smartphones with selected models, with EMIs starting at a lower cost.

- LGtook the third spot in the smart TV market in 2022. During the year, LG launched new models in the 32” segment, its volume driver. Besides, it also launched premium QNED TVs in India. During the sales events, LG offered no-cost EMIs on selected models, one-year complimentary product insurance, and cashback.

- OnePluswas one of the fastest-growing brands in 2022, growing 80% YoY and ranking fourth. OnePlus captured the second position in the

- TCLranked fifth during the year and was among the fastest-growing brands in 2022. During the year, TCL launched many new models, including QLED TVs, across different price segments. Some of the prominent series were the C635, P635 and P735.

- Sonywas among the preferred brands in the premium segment. During the year, Sony launched new budget models W820K and W830K. The brand also launched new versions of its OLED series. Most of the launches during the year came with Google TV. Sony ranked third in the premium segment (>INR 50,000).

- 96% of the market is being driven by LED TVs, while many brands such as TCL, VU, Sansui, Hisense, Thomson, Blaupunkt and Kodak have started launching newer QLED TV models in the >INR 30,000 price range and >50” screen size.

- More than 99% of the TVs are assembled locally, with some high-end TVs being imported.

- MediaTek chips had around a three-fifths share of the total TV market during the year.

- Smart TVs are coming with newer features, such as integrated soundbars from leading players, video call facility, higher refresh rate for immersive gaming experience, and free Live TV channels.

Source: India Smart TV Shipments Model Tracker, Q4 2022

Source: India Smart TV Shipments Model Tracker, Q4 2022

Notes: Xiaomi’s share includes Redmi’s share

Market summary for Q4 2022

- Smart TV shipments saw flattish growth of 2% YoY owing to the slowdown after the festive season.

- Xiaomiled the market with a 9% share, followed by Samsung and OnePlus at 9% and 8% respectively.

- Global brands (excluding Indian and Chinese) led the market with a 39% share, followed by Chinese brands at 32% and Indian brands at 29%.

- Smaller-screen TVs of 32” constituted most of the volume (47%), as they were available in the sub-INR 15,000 price segment.

- OnePlus,TCL, andVUwere among the fastest-growing brands in the sub-INR 30,000 price range due to the availability of newer models, and their popularity among customers.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Anshika Jain

Akash Jatwala

Counterpoint Research

press(at)www.arena-ruc.com

In July this year,

In July this year,

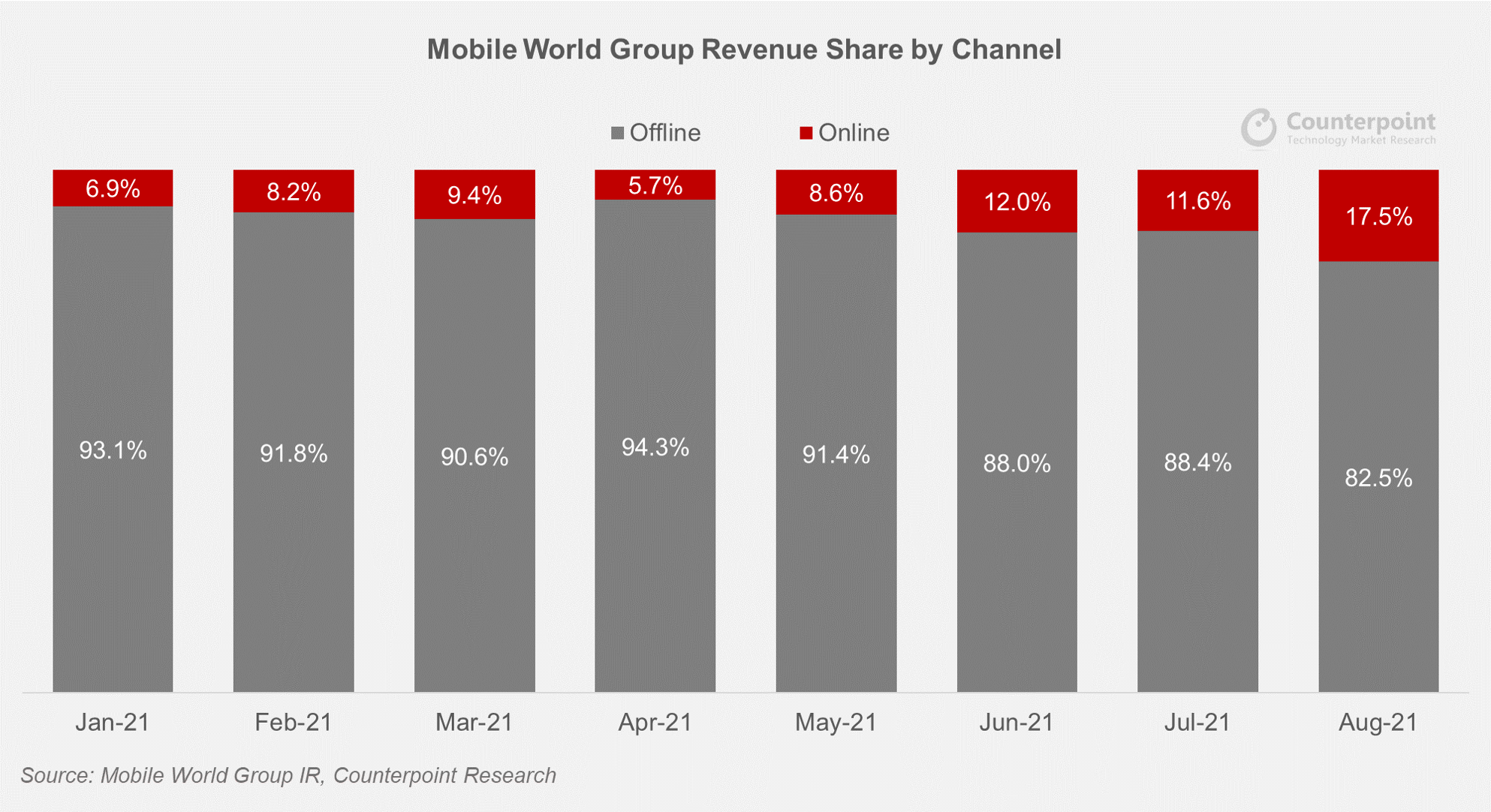

The report predicts that this trend of increasing online share will slow down for some time, and this year will be similar to the previous year or slightly lower. Senior Analyst Sujeong Lim said, “After the rapid growth in 2020, we expect 2021 to see some easing after the COVID-19 vaccination. However, it is expected to grow slightly every year from 2022 onwards, supported by growth in emerging markets and the middle-aged population becoming more accustomed to IT devices and internet use.”

The report predicts that this trend of increasing online share will slow down for some time, and this year will be similar to the previous year or slightly lower. Senior Analyst Sujeong Lim said, “After the rapid growth in 2020, we expect 2021 to see some easing after the COVID-19 vaccination. However, it is expected to grow slightly every year from 2022 onwards, supported by growth in emerging markets and the middle-aged population becoming more accustomed to IT devices and internet use.”