Tech giants showcased their most advanced solutions in AI and computing at the COMPUTEX 2023 show in Taipei in the first week of June. If NVIDIA CEO Jensen Huang’s keynote address focused on the company’s game-changing innovations around AI, Arm CEO Rene Haas’ keynote had compelling demonstrations showcasing Arm’s capabilities in AI. Qualcomm focused on on-device intelligence enhancement and Hybrid AI as the mainstream format ofAIin the future. With meaningful upgrades in computing capability, we expect to see the beginning of a new chapter in the coming years. In the following sections, we summarize the key takeaways from COMPUTEX 2023.

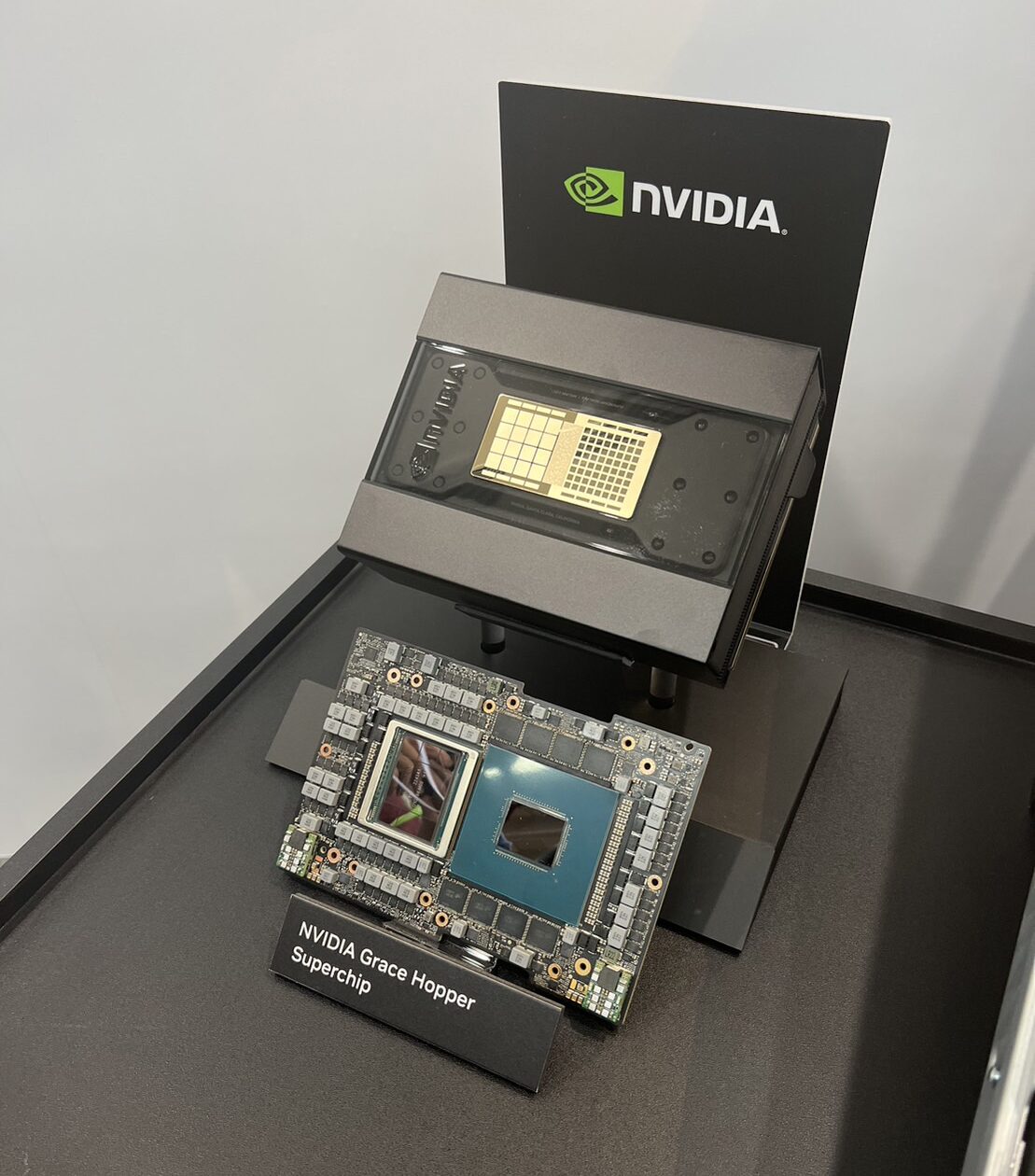

NVIDIA: Grace Hopper Superchip to boost AI revolution

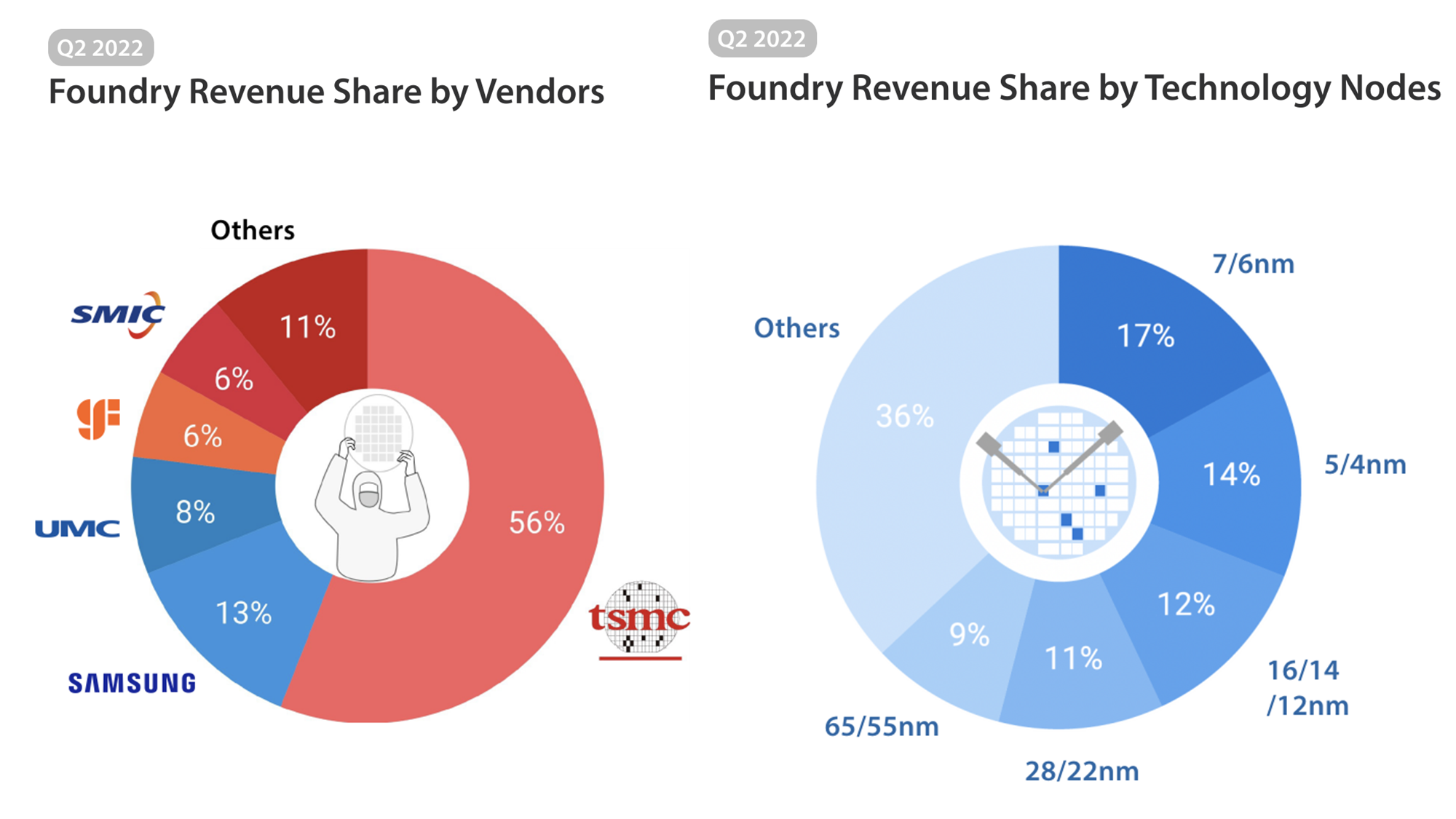

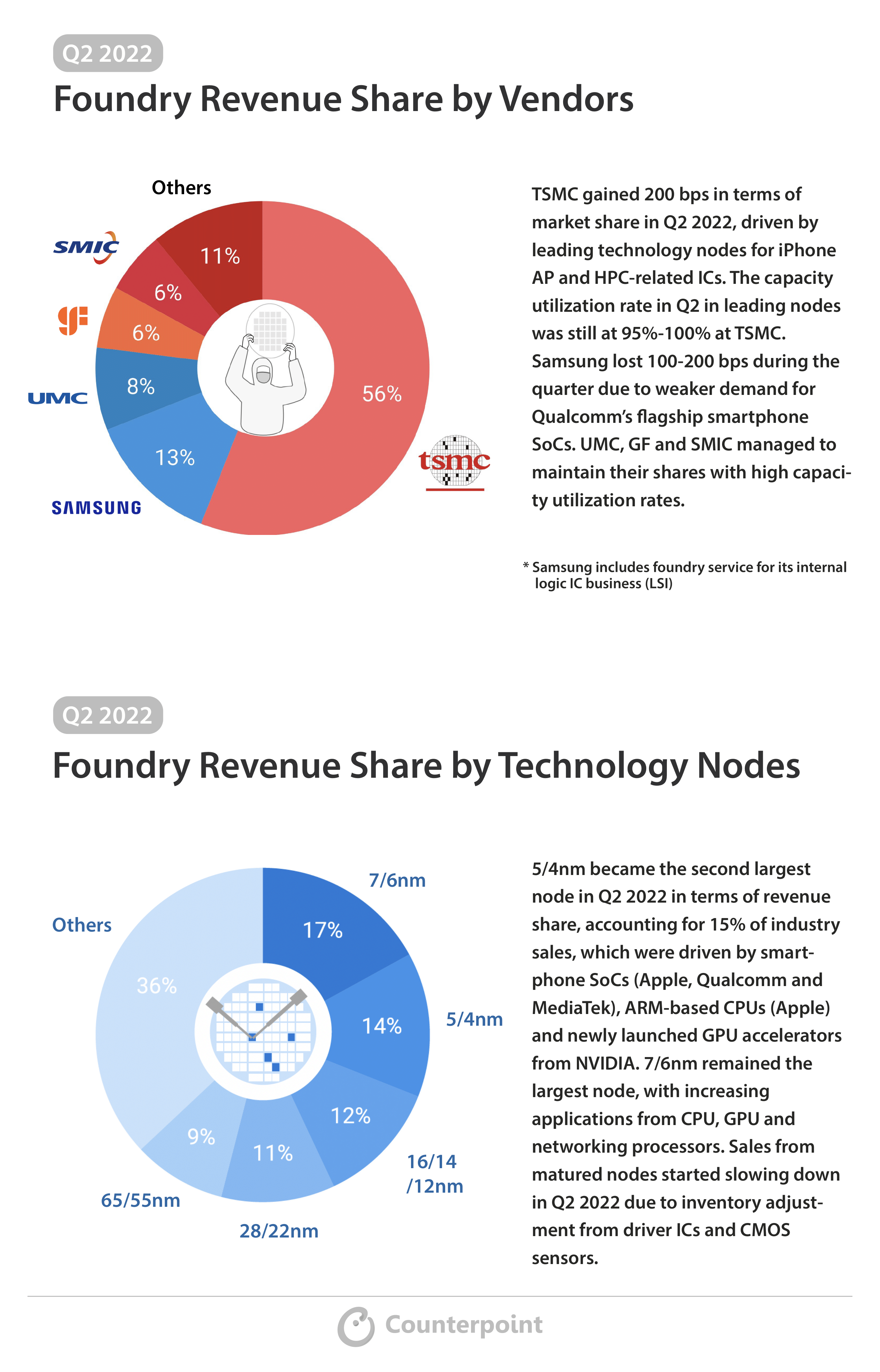

The world’s first-of-its-kind Grace Hopper Superchip, which is manufactured by the TSMC 4nm process node, is likely to level up NVIDIA’s determination on AI. In addition, more GPUs will be used for generative AI training and inference models, which willacceleratethe transformative technology in the near term, highlighted Mr. Huang.

Our Associate Director,Brady Wang,shared his ideas and insights at the influential event.

NVIDIA also introduced the Spectrum-X platform, a fusion of the Spectrum-4 switch and Bluefield-3 DPUs, which boasts a record 51Tb/sec Ethernet speed and is tailor-made forAI networks. Combined with BlueField-3 DPUs and NVIDIA LinkX optics, it forms an end-to-end 400GbE network optimized for AI clouds. This innovation not only fits NVIDIA’s target but also consumes a great amount of foundry capacity, especially TSMC.

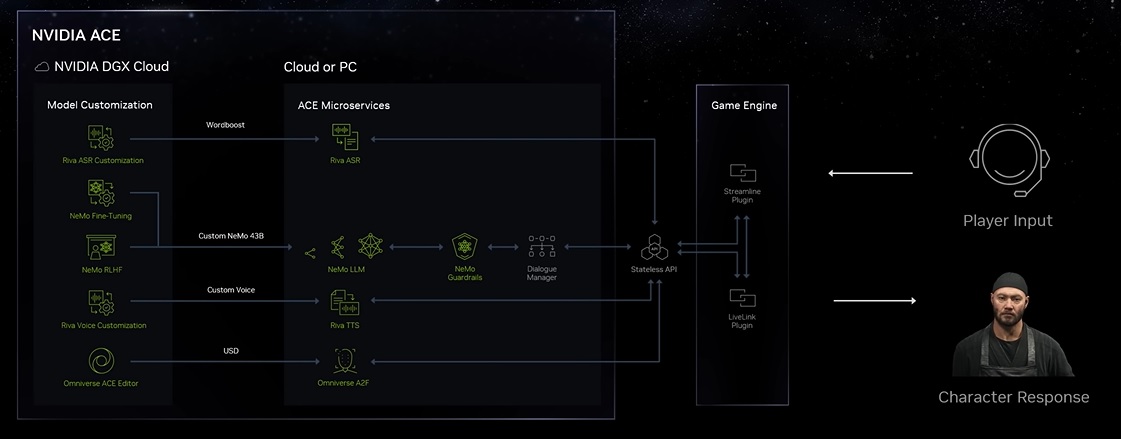

NVIDIA ACE Framework

NVIDIA: Avatar Cloud Engine (ACE) for Games

NVIDIA did not forget its loyal gamers. This time, it introduced the Avatar Cloud Engine (ACE) for Games, a groundbreaking custom AI model service. ACE empowers non-playable characters (NPCs) in games with AI-driven natural language interactions, revolutionizing the gaming experience. With ACE, gamers can enjoy more immersive and intelligent gameplay.

Notes from analyst Q&A with NVIDIA founder and CEO Jensen Huang

- If most of the workload involves training AI models, the data center operates as an AI factory. An optimal computer is capable of handling both training and inference tasks, although the selection of processors is contingent upon the specific inference type.

- In the foreseeable future, AI is poised to become the predominant force within the realm of NPCs in video games. These NPCs will possess a distinctive narrative and contextual background, effortlessly engaging with one another in a harmonious manner. Their movements will be fluid and their comprehension of instructions will be exceptional.

- AI revolutionizes the user experience onPCs, propelling the advancement of personalized recommender systems. Furthermore, even on compact smartphones, it taps into extensive personalized internet data. As a result, future interactions generate real-time, customized content, transitioning towards generative processing to accommodate the escalating demand for personalized information. This groundbreaking development signifies the dawning of a new era characterized by the proliferation of generated and augmented information, thereby departing from the previously dominant retrieval-centric paradigm.

- InfiniBand excels in high-performance computing, offering superior throughput for single computers and AI factories. It dominates in supercomputers and AI systems, while Ethernet is prevalent in cloud environments.

- China leads the way in cloud services, consumer internet and digital payments. It has swiftly advanced in electric and autonomous vehicles, showcasing local innovation through numerous GPU start-ups. This underscores China’s technological dominance and promising future growth.

- Omniverse streamlines computer setup with cloud integration and partnerships, enabling effortless information streaming through browser-based access. It optimizes factory design and simulation, minimizing work, errors and expenses.

Arm: Everything now is a computer; AI runs on Arm

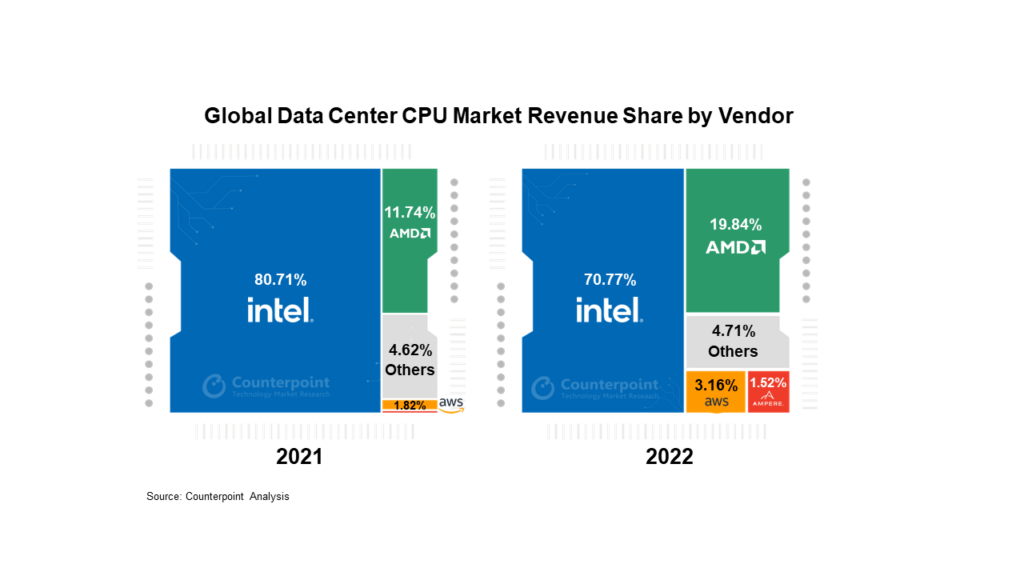

Citing the remarkable 260% increase in data center workloads from 2015 to 2021,ArmCEO Rene Haas emphasized the pivotal role of data centers, automotive technology and AI in driving the compute demand powered by ARM designs.

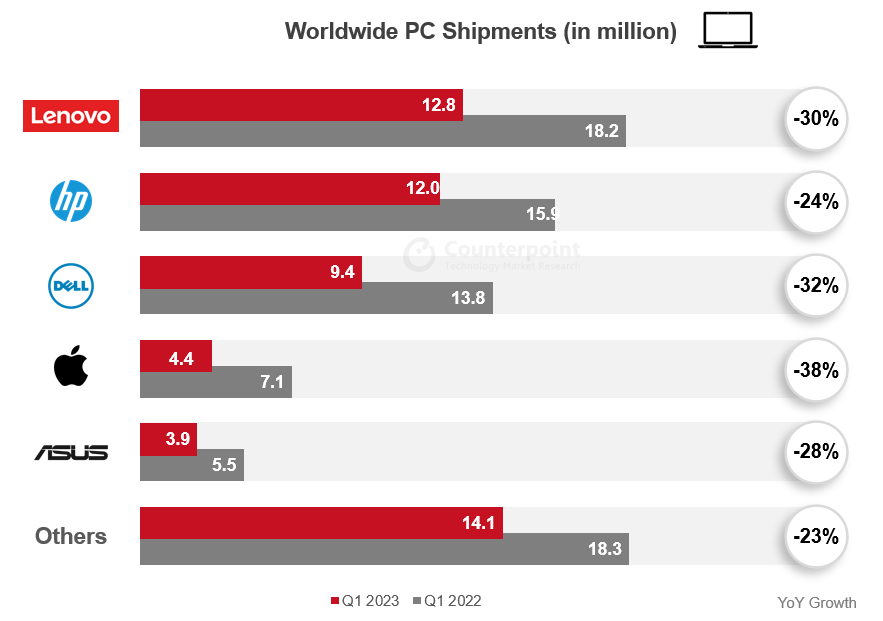

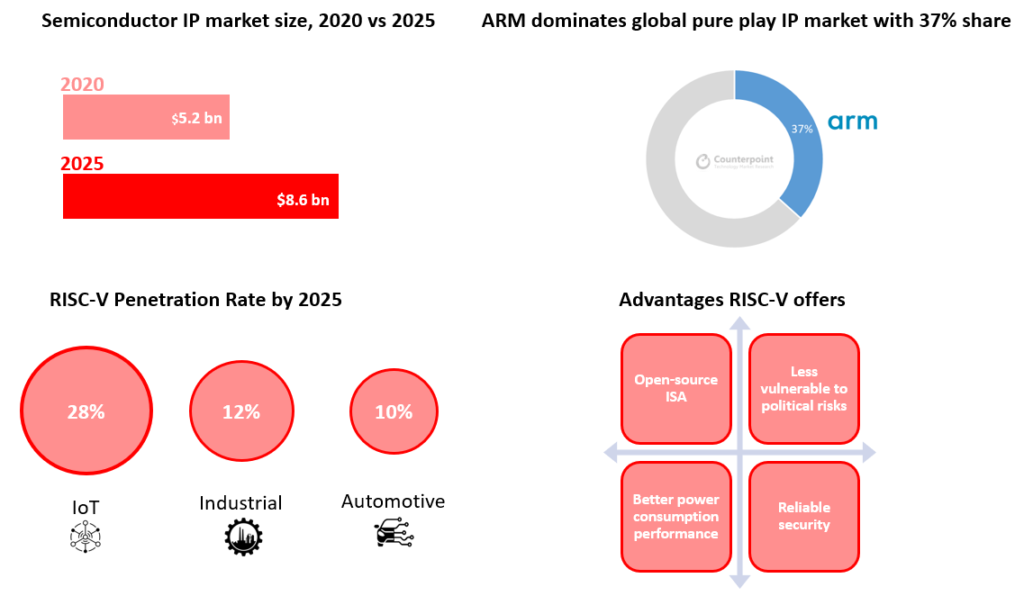

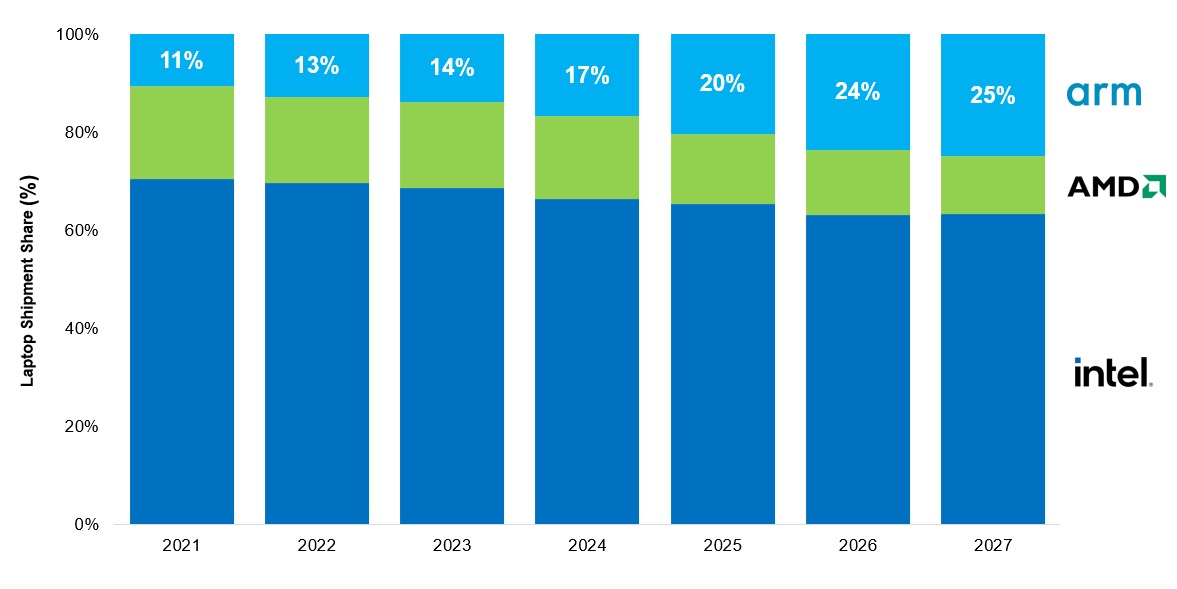

According to Counterpoint Research,Arm-based notebookswill gain over Intel and AMD, almost doubling their shipment share to 25% by 2027 from 14% today.

Laptop Shipment Share by CPU/SoC Type %

source: Counterpoint Research

AI emerged as a focal point during Haas’ keynote, where he captivated the audience with compelling demonstrations showcasing Arm’s capabilities. That said, Arm is poised to support an even broader range of applications in the future.

We also echo Arm’s view and believe that generative AI, digital twins and edge computing will emerge as top technology trends in 2023 and affect the whole tech industry.

Qualcomm: Focus on on-device intelligence enhancement, Hybrid AI

Qualcomm’s “AI” Hexagon processor offers 3-5 times better computing performance compared to existing CPU/GPU solutions. The company aims to expand the application of its Snapdragon 8cx Gen 3 processor to the laptop industry with thorough support from Microsoft.

For AI, Qualcomm believes there are limitations to the efficiency improvements of Edge AI or Cloud AI. However, leveraging Qualcomm’s connectivity solutions and combining edge AI with cloud AI can provide incremental benefits in terms of cost/energy savings, privacy and security enhancements, reliability, and latency. Therefore, the company guides that Hybrid AI (Edge AI + Cloud AI) will be the mainstream format of AI in the future.

Conclusion

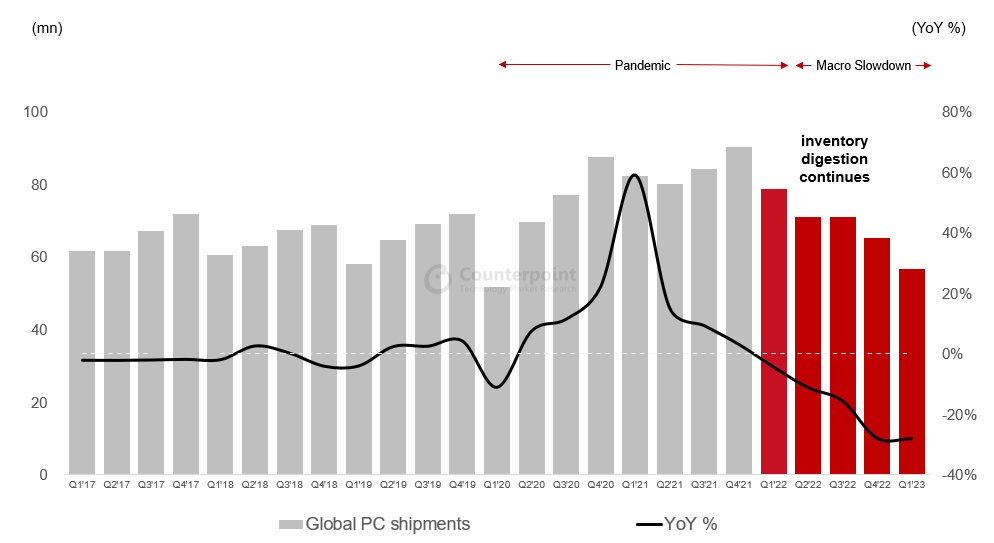

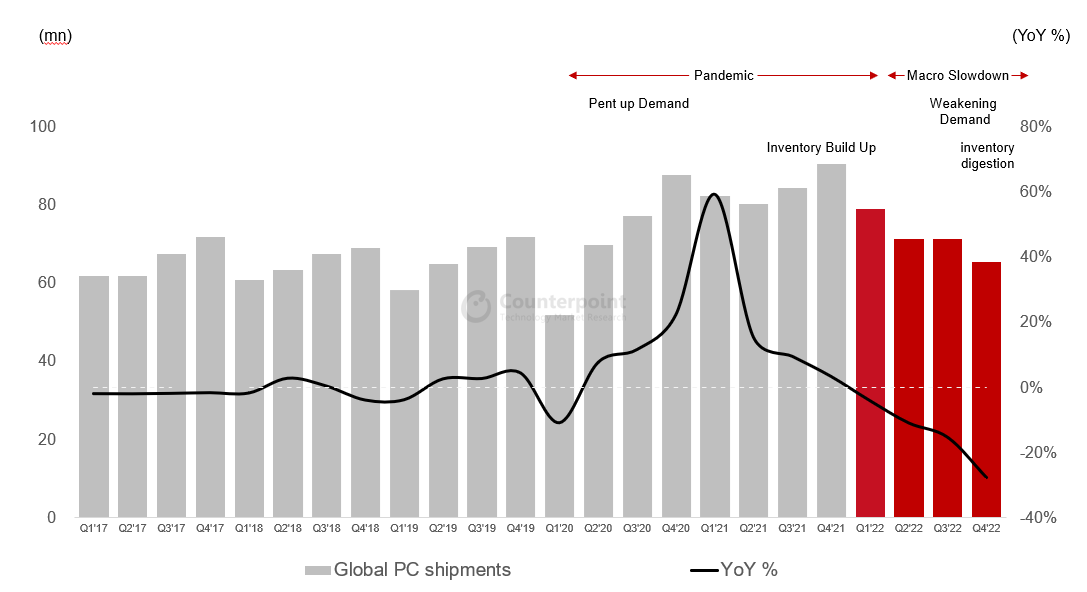

With the COVID-19 pandemic loosening its grip,COMPUTEXwas back in its on-site mode this year in Taipei with solid and eye-catching AI solutions. We are stepping into a newcomputingera, with generative AI set to transform our lives. Not only server vendors and data center hyper-scalers, but mobile and PC vendors are also working together to facilitate technology improvements with AI support.

Counterpoint’s analysts continue to work closely with the tech product market to monitor all changes and trends.