Apple Takes 62% of Premium Market in Q1 2022

- Apple reached its highest first quarter share in the premium segment since Q1 2017.

- Galaxy S22 Ultra was the best-selling Android smartphone in the premium market.

- Premium smartphone market revenues remains resilient even as sales decline.

- Ultra-premium (US$1000 and above) was the fastest growing price segment globally.

Beijing, London, San Diego, Buenos Aires, New Delhi, Seoul, Hong Kong –June 23, 2022

The global premium (US$400 and above wholesale ASP) smartphone market sales volume declined 8% YoY during the quarter, but it still performed better than the overall smartphone market, which declined by 10%, according to Counterpoint Research’sMarket Pulse Service.这是eighth consecutive quarter in which the premium market has outperformed overall smartphone market growth.

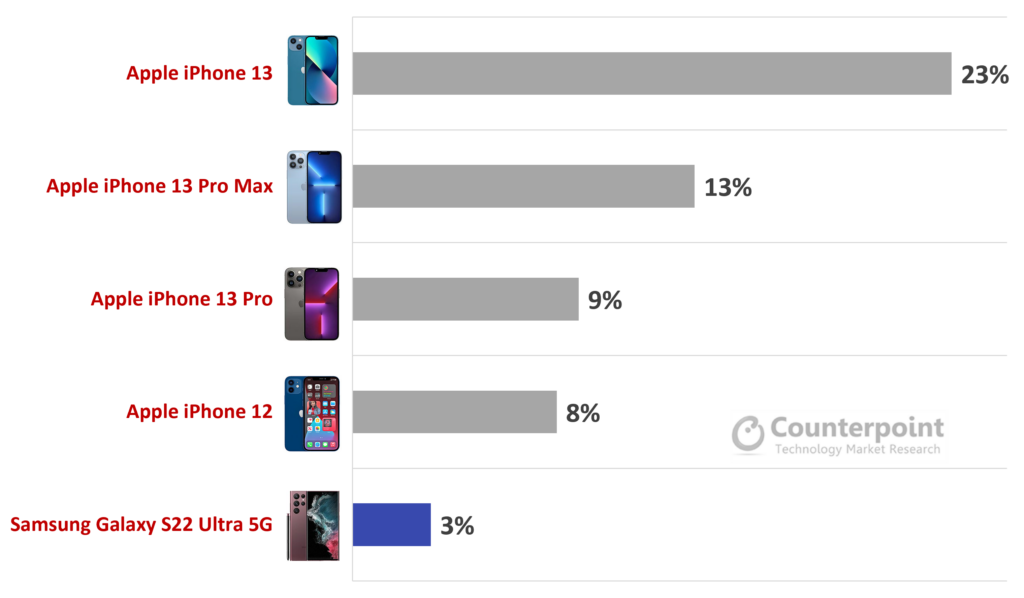

Applecontinued to lead the premium market, exceeding 60% share for the second consecutive quarter. This was driven by the iPhone 13 series. The iPhone 13 has been the best-sellingmodelglobally each month since October 2021. This was also the highest first quarter share for Apple in the premium segment since Q1 2017.

Global Premium (US$400 and above) Smartphone Sales Volume Share, Q1 2021 vs Q1 2022

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-Through Volume) Tracker

Samsung’s share declined in the segment. This was mainly because of a delayed launch of the Galaxy S22 series as compared to the S21 series launch in 2021. However, the S22 series is performing well overall. TheGalaxy S22 Ultrahas been a hit combining the best of the S series and the Note series. It was the best-selling androidsmartphonein the premium segment in Q1 2022.

Global Premium (US$400 and above) Smartphone Sales Share by Top Models, Q1 2022

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-Through Volume) Tracker

OPPO was the third largest brand in the premium segment. OPPO was followed by Xiaomi and Vivo. The sales contribution of the China market within the premium segment for Xiaomi, OPPO, and Vivo has reduced since 2021.

Foldable年代也慢慢获得牵引力,占主导地位的年代amsung. The sales volume for foldables grew 184% YoY in the premium segment, albeit from a small base, capturing 3% of the total sales volume in the premium segment. More smartphone manufacturers are entering the foldables market segment, and as prices come down, foldables are likely to become more mainstream.

Although sales volume in the premium segment declined YoY it grew in importance, with almost three in 10 smartphones sold coming from the premium segment; its highest-ever first quarter share. And sales value grew slightly (+0.5% YoY) due to an increase in the Average Selling Price (ASP). The premium segment alone accounted for almost two thirds of global smartphone value during the quarter, reaching the highest first-quarter value contribution as well. This also shows the strategic importance of having a presence in the premium segment.

Global Premium (US$400 and above) Share of Total Smartphone Market by Volume & Value, Q1 2017- Q1 2022

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-Through) Tracker

This revenue resilience was driven by a 164% YoY sales volume growth in the ultra-premium (US$>1000) price band, which became the largest contributor to the premium market, both in terms of sales volume as well as value. It was the fastest-growing price segment globally as well as in China, Western Europe, and North America.

The volume growth in the ultra-premium segment was driven by Apple and Samsung. The iPhone 13 Pro Max and the iPhone 13 Pro together captured over two-thirds of sales volume within the ultra-premium price segment. This was driven by strong volume growth in the US,China, and Western Europe. InChina, the sales in the >US$1000 price segment grew 176% YoY in Q1 2022. The segment alone captured over one-fifth of China’s smartphone market value during the quarter. Apple emerged as the biggest winner from Huawei’s decline in the premium market. The premium market in China still holds potential, and will be driven by upgrades, especially by users from Huawei’s large installed base.

Global Premium (US$400 and above) Sales Volume Share by Price Band

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-through) Tracker

Going forward, we will continue to see smartphone manufacturers trying to gain share in the premium segment. Withglobal inflation rising, the entry-level and lower price band segments are likely to be harder hit. Only through a rise in sales in higher price bands, will manufacturers be able to offset some of the resulting revenue declines. While developed markets dominate the premium market sales, the segment is also becoming important in emerging markets likeIndiaandLATAM, as consumers continue to upgrade.

Note: The analysis is based on wholesale ASPs; OPPO includes OnePlus in Q1 2022.

Please reach out to[email protected]新闻评论和调查。

You can alsovisit our Data Section(updated quarterly) to view the smartphone market share forWorld,USA,China, andIndia.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Tarun Pathak

Varun Mishra

Follow Counterpoint Research