- The US feature phone market is more crowded and competitive now as OEMs enter agreements with carriers.

- Feature phone sales are forecast to reach 2.8 million in 2023 with stable sales continuing in the near term.

- New hardware configurations like eSIM or NFC can make devices more relevant for today’s consumers.

Feature phones have made a resurgence due to digital detox and Gen Z/millennials

Feature phones在USmarket have made a resurgence as创Z和千禧一代倡导数字detoxes due to the mental health concerns brought on by smartphones and social media. Hashtags like #bringbackfliphones on TikTok have garnered millions of views leading to the increased adoption of feature phones by younger consumers looking to adhere to movements like digital detoxing, minimalist lifestyles and unplugging. Given the relatively cheap price point of feature phones ($20-$50 with a prepaid carrier and $50-$100 unlocked), more people are trying out these devices and sharing their experiences on social media.

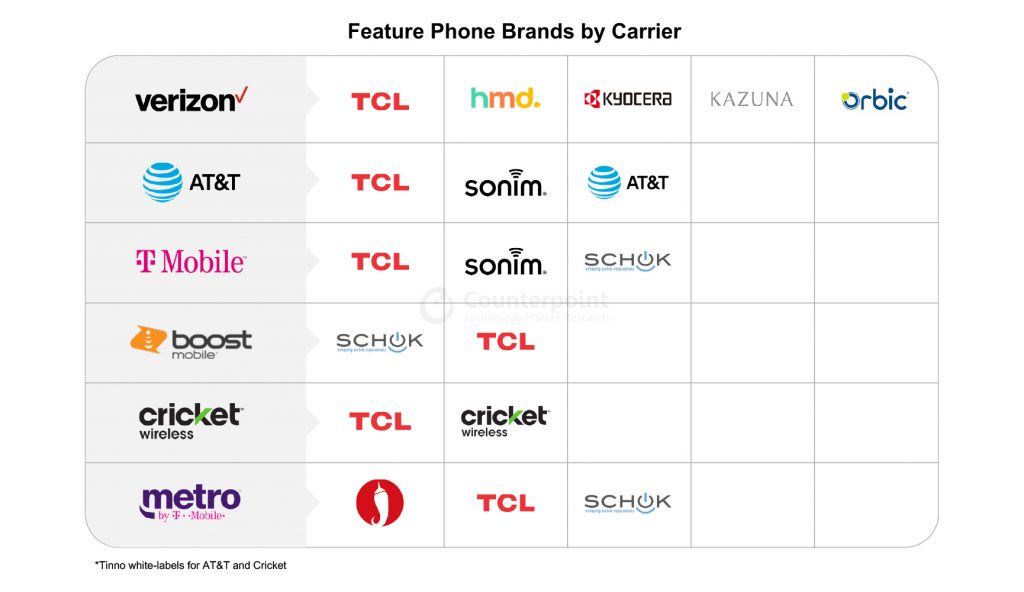

The market is more crowded now, TCL and HMD are leading but competition from Schok, Sonim, and white-label makers like Tinno are entering agreements with carriers

Smartphones were widely adopted almost instantly when they arrived. Due to this, the US feature phone market shrank significantly over the past 10 years. Currently, the feature phone market contributes to only a little more than a 2% share of overall handset sales in the US. Among the players catering to this segment of the market, TCL, which manufactures feature phones for majorcarriersin both branded and white-label capacities, leads the pack with a 43% share due to its strong presence on carrier channels. HMD ranks second with a 26% share, while other smaller players make up for the rest of the market.

Additionally, carrier and OEM tie-ups play an important role in the dynamics. The big three US carriers – AT&T, Verizon and T-Mobile – are exploring different feature phone OEM options due to which the US feature phone market has grown more crowded lately, especially with carriers moving away from TCL devices and trying out smaller OEMs instead, like Tinno and FIH which have manufactured devices forAT&T’swhite-labeled feature phones. Sonim and Kyocera, which provide ruggedized devices, areVerizon’sfeature phone brands, while Schok and hot pepper areT-Mobile’s。 Feature phone sales are forecast to reach 2.8 million in 2023 with continued stable sales in the near term as niche demand drivers maintain sales

Feature phone sales are forecast to reach 2.8 million in 2023 with continued stable sales in the near term as niche demand drivers maintain sales

Feature phones still hold their place in the market and are likely to see consistent shipments, helped by their affordability and durability to suit specific use cases. Although the growth in numbers may not be huge, the demand from consumers looking for a feature phone as a digital detox mechanism will continue. Additionally, B2B sales may drive some demand as feature phones simplify costs for businesses. Furthermore, tourists and other consumers needing a cheap disposable feature phone will also continue to keep sales stable.

New hardware configurations like eSIM or NFC can make devices more relevant for modern consumers wishing to simplify their tech gadgets but still interact seamlessly in the digital world

There is a consumer base looking for devices that are minimalistic but also have features that are relevant to staying connected in today’s world. The design and specifications of feature phones have not changed much over the last few years. This is one of the factors that keep consumers from purchasing a feature phone. The addition of some new hardware configurations and features that are abreast with the current trends while still maintaining the simplicity of usage may open more gates for the growth of feature phones. NFC is one such feature. NFC can enable payments, home automation, quick pairing, and make public transport access more convenient for users. Similarly,eSIMs也可能成为一个伟大的硬件集成,因为它可能attract consumers to adopt a feature phone as a companion device that they can easily switch to from their main device in situations where they do not want to bring out their expensive smartphone. Adding these attributes would help make feature phones more relevant for day-to-day use.

See the full report below for more information:

US Feature Phone Trends and Outlook in the Age of Smartphones

The US feature phone market has seen a recent resurgence with Gen Z/Millennials advocating for digital detoxes due to mental health concerns. While TCL and HMD remain the dominant OEMs in the US, challenger brands are making the market more crowded. Feature phones will remain an important part of the US handset market for years to come as they continue to solve for niche needs that smartphones cannot address.

Number of Pages:18

- Key Takeaways

- Current Market Dynamics

- Feature Phone Volumes by Year

- Current Market Drivers

- Market Share by OEM

- Postpaid and Prepaid Market Share by OEM

- Specification Analysis

- Current Feature Phone Specifications and Market Innovations

- Feature Phone Outlook

- Market Forecast until 2027

- Future Trends and Specifications

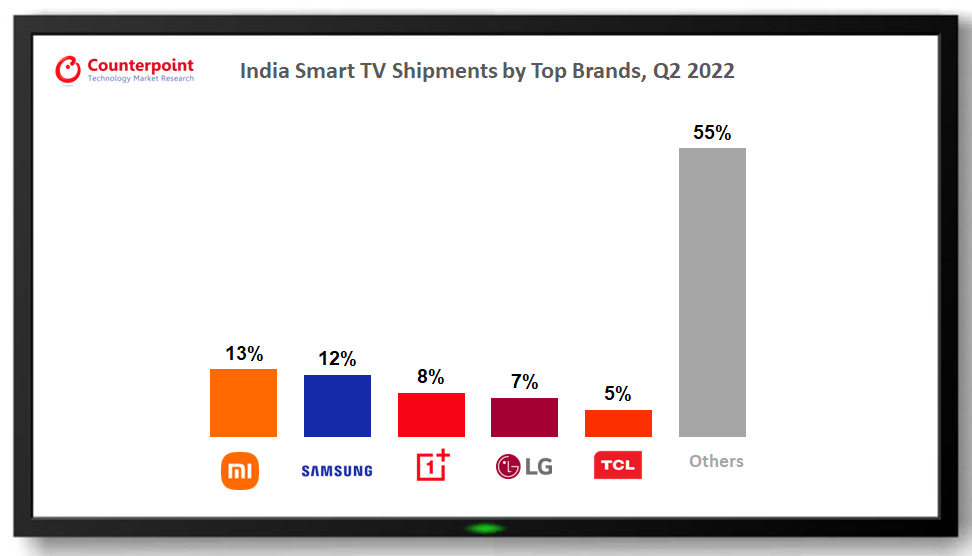

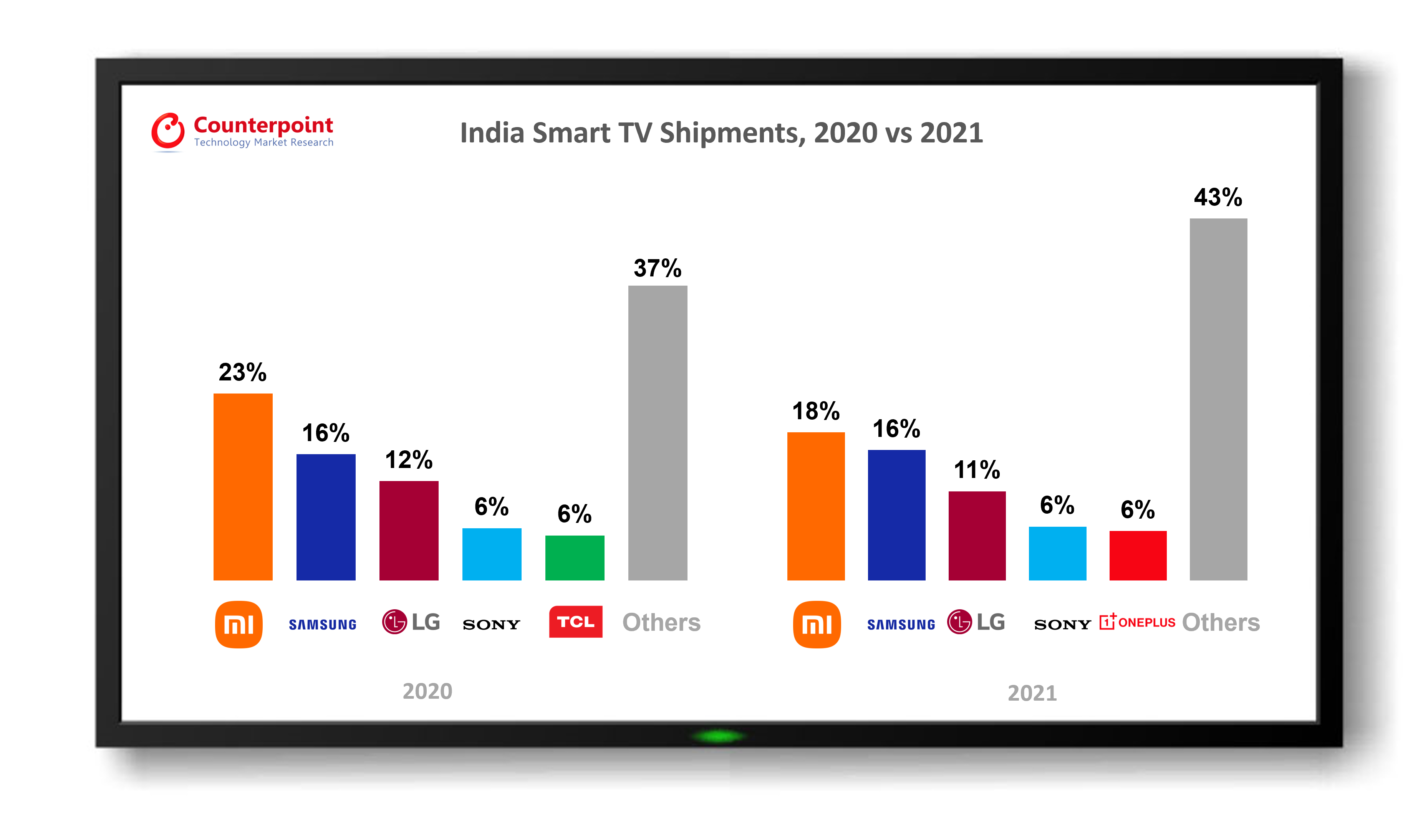

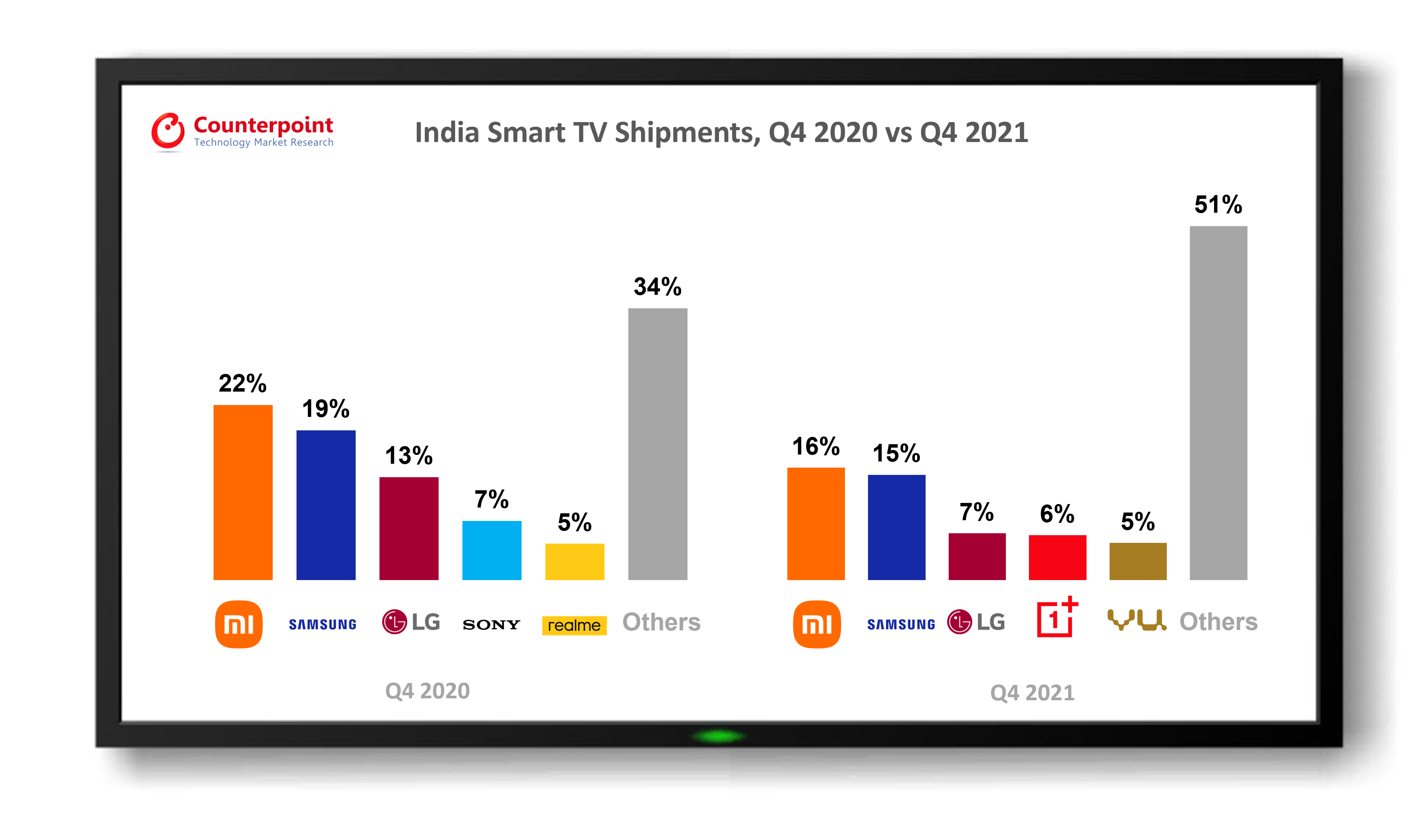

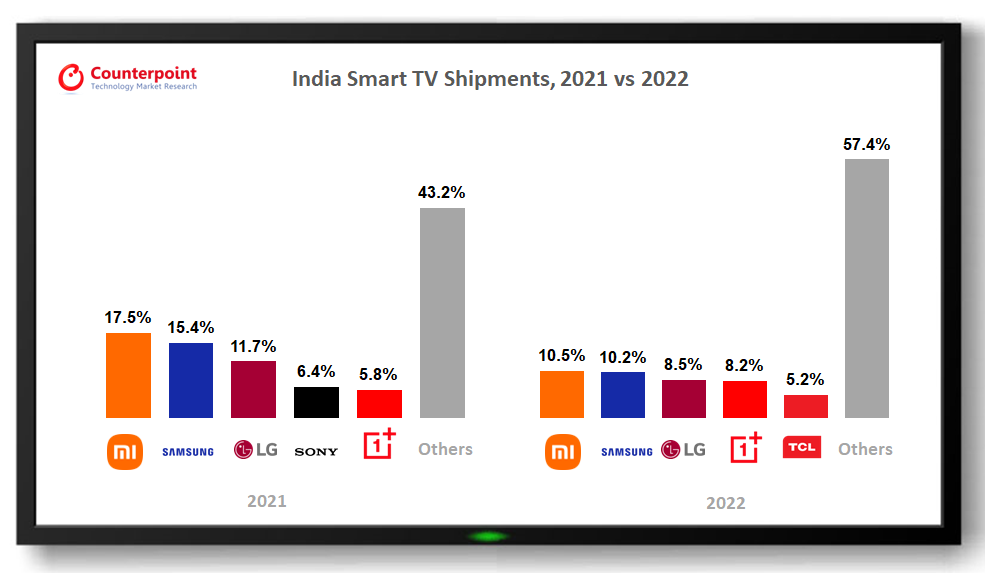

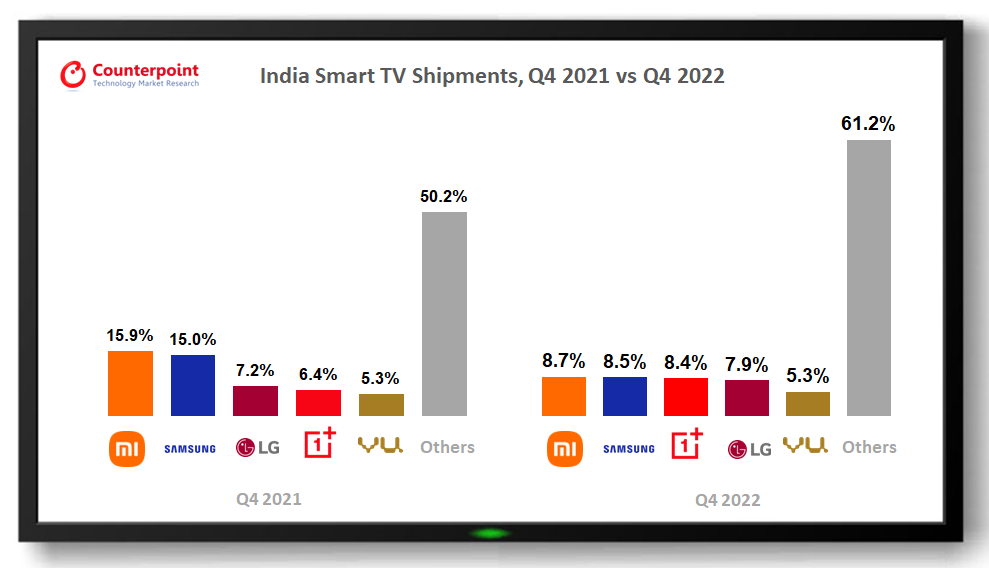

来源:英蒂a Smart TV Shipments Model Tracker, Q4 2022

来源:英蒂a Smart TV Shipments Model Tracker, Q4 2022 来源:英蒂a Smart TV Shipments Model Tracker, Q4 2022

来源:英蒂a Smart TV Shipments Model Tracker, Q4 2022