- Ericsson and Nokia’s Q2 2023 results are in line with their revised expectations.

- The telecom gear manufacturers are convinced that a few short-term hurdles can be managed to drive growth.

- The mobile network segment, the largest contributor to both firms’ revenues, witnessed some slowdown in Q2 2023 due to decreased demand from capex-saturated regions.

Nordic telecom giants Ericsson and Nokia announced their Q2 2023 results last week, which were in line with their revised expectations despite lower revenues. The overall market condition remains challenging due to macro uncertainty, but the telecom gear manufacturers are convinced that a few short-term hurdles can be managed to drive growth both in the short term and long term.

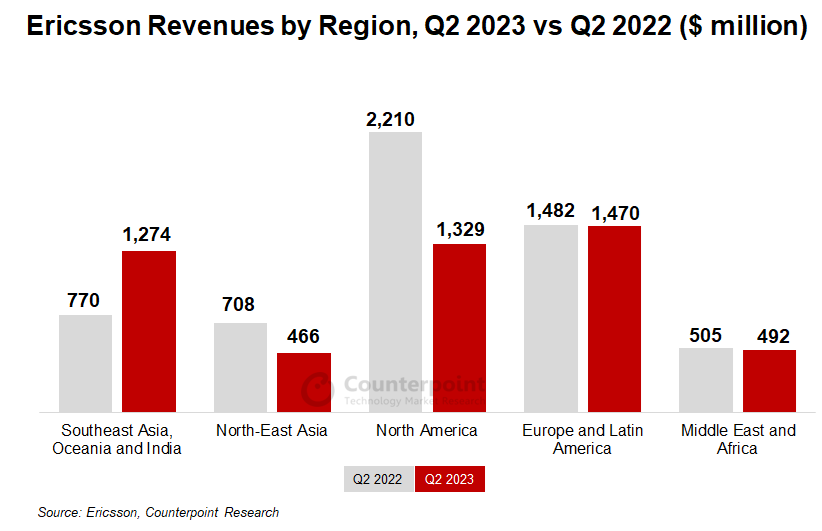

Fast5G电在新兴国家,如印度嗨ghlights for both the vendors as revenue growth in these regions was able to offset the sales decline in North America and North-East Asia where operators slowed down their network expenditures after several quarters of high investment.

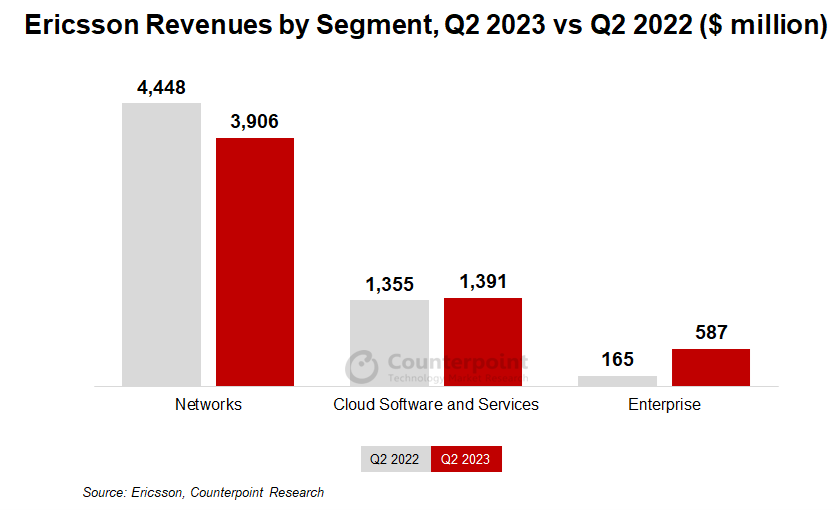

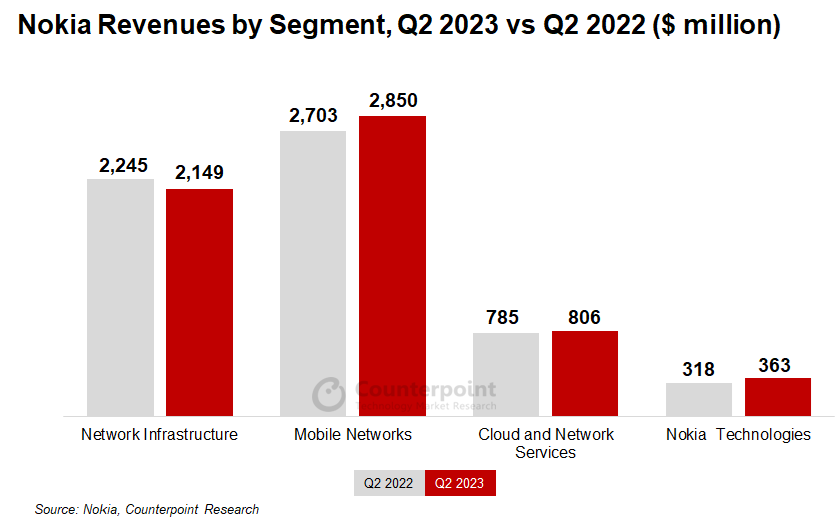

Swedish giant Ericsson generated net sales of $5.9 billion for the quarter, reporting a 9% YoY decline in organic sales. Ericsson’s Finnish counterpart Nokia generated $6.2 billion in revenue for the quarter, which was flat YoY on a constant currency basis.

Mobile network segment

This segment is based on the core competence of these organizations and is also the largest contributor to both firms’ revenues. It witnessed some slowdown for the two companies in Q2 2023 on the back of decreased demand from capex-saturated regions. Operators in these regions continue to be selective in spending and are depleting their inventories that have been running high after the 2021-2022 boom.

- Revenue from Ericsson’s Networks division stood at $3.9 billion. It doubled for emerging markets like India and Southeast Asia but plummeted for regions like North America. India is now Ericsson’s second-biggest market. During the quarter, the company also marked the shipping of 10 million 5G-ready radios.

- Revenue from Nokia’s Mobile Networks division stood at $2.85 billion, a slight growth YoY. The increase in revenue due to faster 5G rollouts in India and Europe was able to offset the decline in North America.

Gross margin was impacted for both operators as the sales mix changed drastically. Adapting to changing demand and expecting a recovery in the North American region, both manufacturing firms are looking forward to an improved gross margin by the end of this year.

Cloud software services

Telecom service providers too have been hit by cloud disruption as network evolution has witnessed operators migrating to the cloud. The two Nordic vendors have been at the forefront in assisting operators in transitioning to cloud-native operations, which helps in future-proofing and improving network performance and efficiency.

- Ericsson’s revenues from its Cloud and Software Services division stood at $1.39 billion, a marginal increase over the previous year. The sales, for a change, were driven by 5G in the North American region. Ericsson currently leads the global market for5G Standalone Core deploymentswith a majority of operators choosing the Swedish company for their cloud-native 5G SA Core. Ericsson’s managed services, however, took a hit.

- Nokia registered $806 million in net sales for its Cloud and Network Services division. Unlike its Swedish counterpart, Nokia’s growth came from the Europe and Middle-East and Africa (MEA) regions, while it faced a decline in the North American region. Nokia too has been actively helping operators worldwide to deploy 5G Standalone Core (just behind Ericsson in the number of deployments), which alongside Enterprise Solutions helped boost its revenues in this segment, marginally offset by declines in the Cloud Services and Business Applications.

Ericsson’s enterprise segment, network APIs and IPR licensing

- Last year, Ericsson acquired Vonage, which contributed revenues of nearly $390 million during the quarter, a 12% increase YoY. The company strongly believes that the enterprise segment will continue to grow as it redefines how the capabilities of 5G networks are utilized and paid for by the customers.

- Ericsson will also continue to digitize the ecosystem for CSPs by maintaining its investments to build the Global Network Platform (network Application Program Interfaces or APIs). With time, a variety of global network APIs will complement the existing communication APIs like video, voice and SMS to help CSPs better monetize their 5G networks, accelerate 5G network rollout and improve network capex.

- The company also signed a5GIPR licensing agreement during this quarter to help validate its IPR portfolio strength.

Nokia’s diverse portfolio – Networks infrastructure and enterprise

- 尽管面临一些短期的挑战和宏观oeconomic uncertainty, which resulted in a YoY revenue decline, Nokia’s Network Infrastructure segment generated $2.15 billion in revenues and continued to gain market share across the globe.

- The IP networks grew in Europe with increasing sales to enterprise customers.

- The optical networks unit registered a double-digit growth driven by increasing broadband penetration in India.

- The fixed networks unit witnessed a decline on the back of slowing FWA deployments in North America.

- Nokia’s revenue from its enterprise customers grew by almost 30% YoY. The company added 90 new enterprise customers this quarter. Its private wireless business reached more than 635 customers.

- Nokia also signed a long-term patent license agreement with Apple. Multi-year revenue recognition might start in January 2024.

- Nokia also struck an important deal with Red Hat this quarter, where the latter will serve as the primary reference platform to develop, test and deliver core network applications in an attempt to rebalance Nokia’s portfolio.

Analyst outlook

网络设备厂商和软件提供商re looking to transform obstacles into opportunities. Both Ericsson and Nokia are expecting their business performance to improve towards Q4 2023 and to continue improving in the coming years. Inventory correction by operators has been the prime reason for the revenue decline this quarter. But network sales have been able to weather the slowdown as operators need to increase the capacity of their networks.

Counterpoint Research believes that 5G investment has not yet peaked. Over the next few years, the industry will witness the advent of5G Advancedstarting with 3GPP Release 18, operators transitioning to 5G SA, an increase in the number of monetizable 5G use cases,FWA going global, and increased 5G investments in mid-band andmmWavebands. The entire mobile industry is bullish about private networks, which present a significant opportunity for operators and vendors alike. Amid the growing geopolitical turbulence, with the West hardening its stand on the “rip and replace” of Chinese networking equipment, Nokia and Ericsson might even see other markets opening up for them. Reducing internal costs and streamlining internal operations remains a challenge for both suppliers. The two should benefit from growing confidence in the enterprise segment. Nokia expects to leverage its leadership in the network infrastructure business and attain market leadership in the fixed-broadband space with its wide variety of ONTs, OLTs and FWA CPEs.

相关的帖子:

- NVIDIA and Softbank Developing AI-Based 5G MEC Telco Network

- CNBC-TV18: The 5G Opportunity Featuring Neil Shah

- AI/ML Key in Enhancing 5G Network Efficiency, Reducing Complexity

- 5G Rollout Accelerates in India

- 5G Advanced – Stakeholder Collaboration Essential To Maximise ROI For Operators

- Ericsson-Aeris Deal Reflects Broader IoT Market Trends