- The global TWS market recorded shipments of about 300 million units in 2021. This figure is expected to continuously increase till 2025.

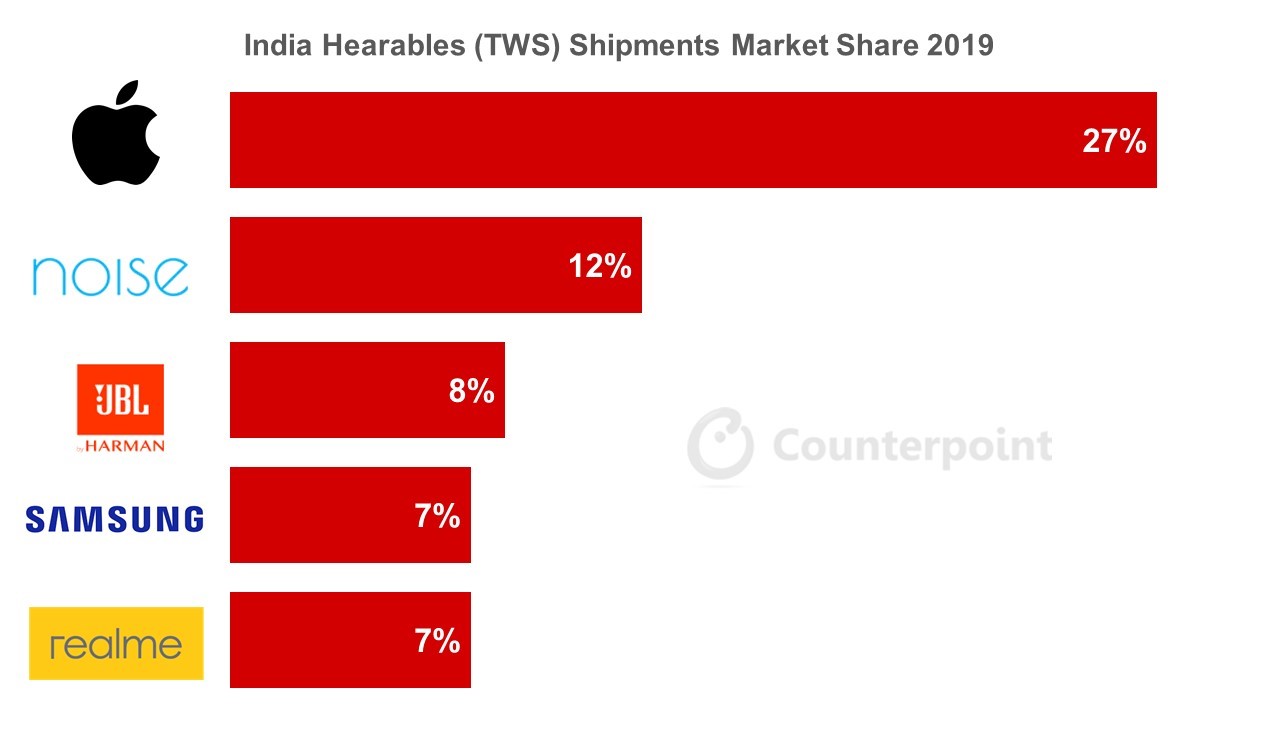

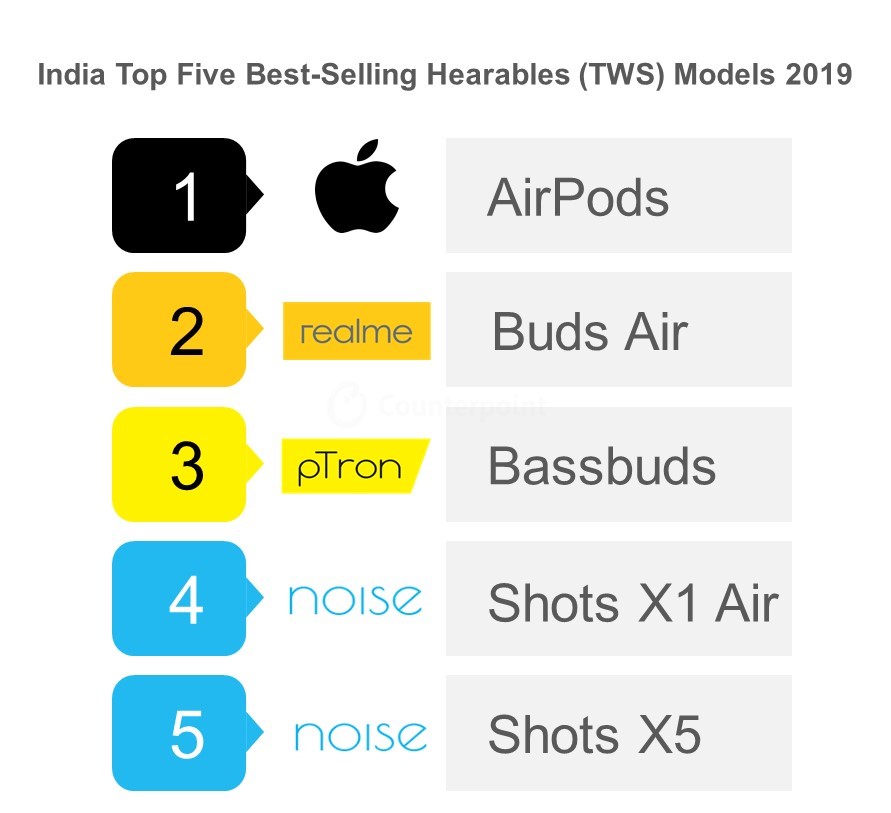

- Sales in the <$100 segment have increased steadily with the firm growth of emerging local companies such as Skullcandy in the US and boAt in India.

- 另一方面,销售在> 150段,which can be described as premium product sales, have stagnated.

- Leading TWS brands like Apple, Samsung, Sony, Sennheiser and B&O, which mainly focus on the >$150 segment, are trying to expand market share by differentiating their products.

Global TWS Market Shipments (Forecast)

Source: Counterpoint TWS Hearables Market Tracker

TWS Market Share by Price Band

Source: Counterpoint TWS Hearables Market Tracker

Sales in the sub-$100 segment have increased steadily with the firm growth of emerging local companies such as Skullcandy in the US and boAt in India. On the other hand, sales in the >$150 segment, which can be described as premium product sales, have stagnated. Leading TWS brands like Apple, Samsung, Sony, Sennheiser and B&O, which mainly focus on the >$150 segment, are trying to expand their market share by differentiating products from the low-to-mid-priced ones. Currently, they are strengthening existing functions in such products or adopting new ones.

Samsung and Apple are differentiating their products with enhanced ANC, where users can enjoy the music with reduced fatigue and increased immersion. Samsung has showcased its new Intelligent ANC (IANC) with the Galaxy Buds 2 Pro. Unlike the existing ANC, it can effectively remove external noise by analyzing surrounding sound. Apple is equipped with “adaptive transparency” to minimize the intensity of loud noises with its computational algorithms. The two companies did not increase the size of the earbuds while increasing play time. The Galaxy Buds 2 Pro reduced its weight, but it effectively removed external noise with the enhanced ANC function.

Sony introduced a new concept with its LinkBuds, which were released earlier this year. LinkBuds are ring-type driver units that reduce greatly the weight of the product and the fatigue associated with it, making them suitable for daily use. Moreover, users can talk to others without removing the earbuds by using “speak-to-chat”. As music play stops automatically when a conversation is detected, users do not need to press the stop button to talk to others, justifying LinkBuds’ catchphrase “Keep every world on”.

With the TWS market competition intensifying, leading companies are enhancing existing functions or introducing new functions to differentiate their products. In this trend, battery performance is also becoming more important. The battery size should be reduced to accommodate more sensors. At the same time, the battery power needs to be strengthened to implement various functions and maintain play time. It is this conflict that will make the energy density of a TWS more important. It will eventually lead to increased interest in small-size batteries in the TWS market.

Releated Posts

- India TWS Shipments Increase 168% YoY in Q2 2022; Local Brands Capture Record Share at 81%

- India TWS Shipments Double YoY in Q3 2022; Indian Brands Capture Record 79% Share

- Low-end Models Drive Rebound of Global TWS Shipments in Q2 2022

- Brand and features beat price in TWS market

- Global TWS Shipments Grow 24% YoY to Reach 300 Million in 2021

- Infographic: 2021 | Hearables (TWS)

The expected launch today of Samsung’s new and improved Galaxy Buds Plus at the UNPACKED 2020 event should bring longer battery life, faster charging, and improved sound quality to the vendor’s next earbud iteration, although noise cancellation will likely be unavailable.

The expected launch today of Samsung’s new and improved Galaxy Buds Plus at the UNPACKED 2020 event should bring longer battery life, faster charging, and improved sound quality to the vendor’s next earbud iteration, although noise cancellation will likely be unavailable.