- Global ODM/IDH smartphone shipments fell 5% YoY in 2022 due toeconomic pressuresand weaker demand from China and Europe.

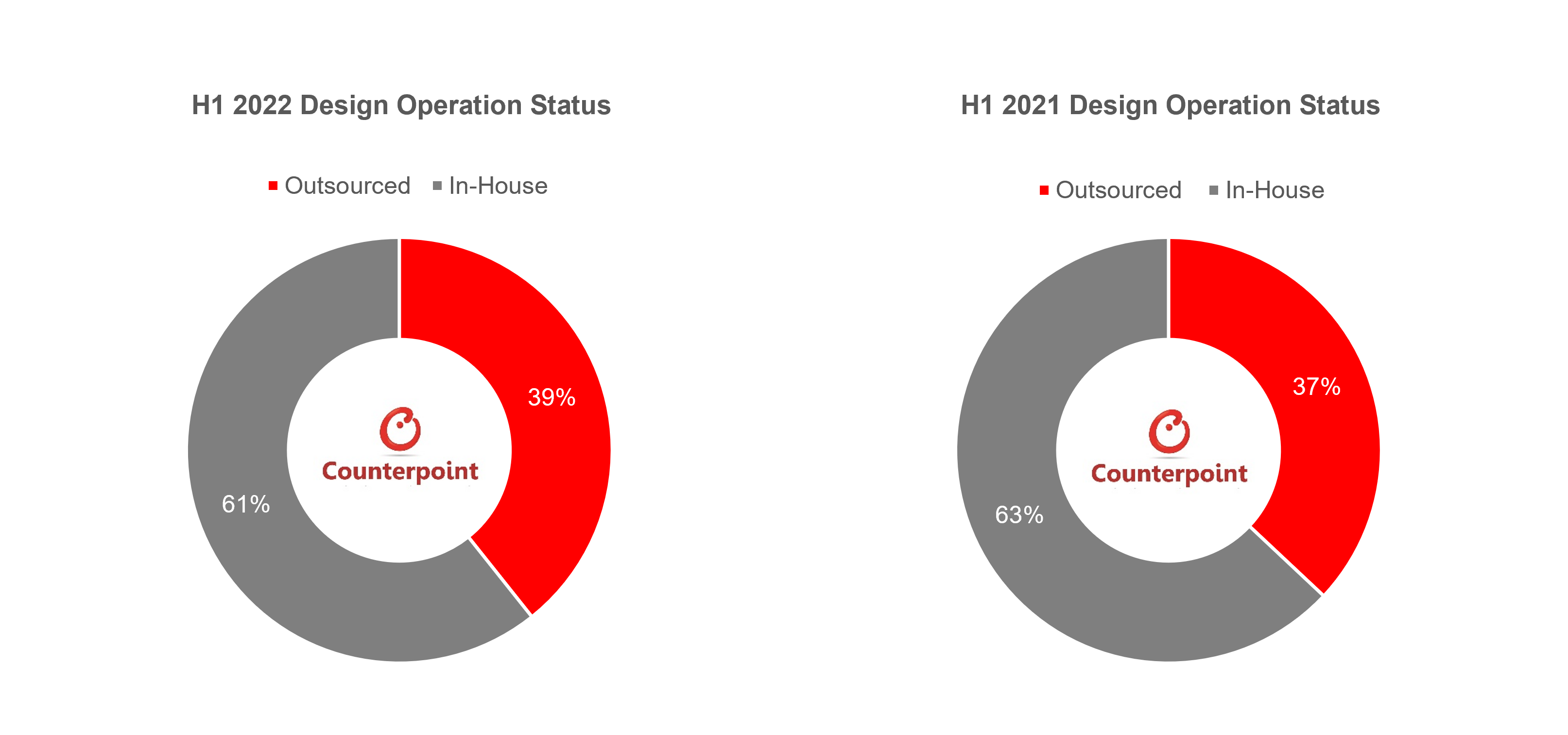

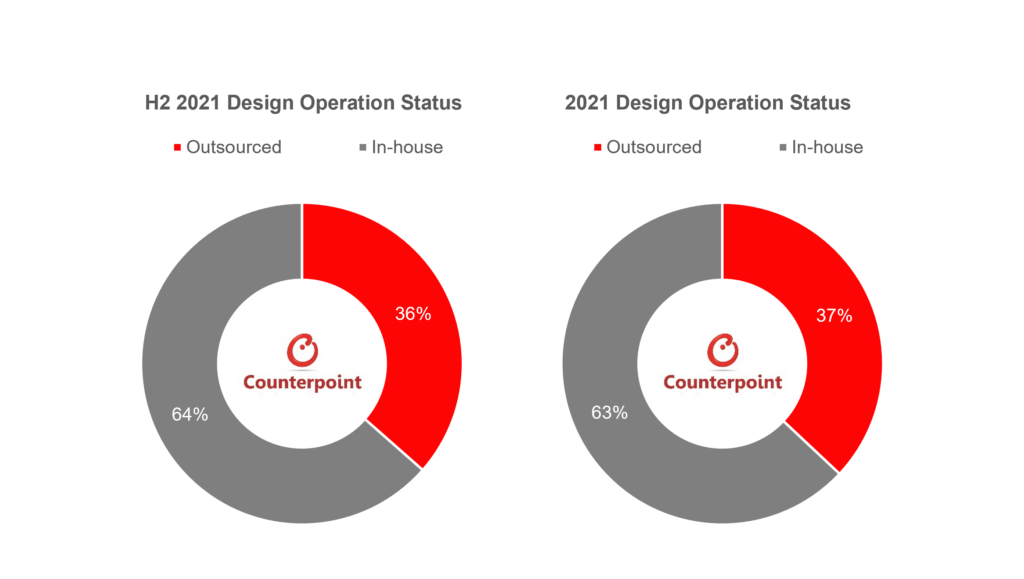

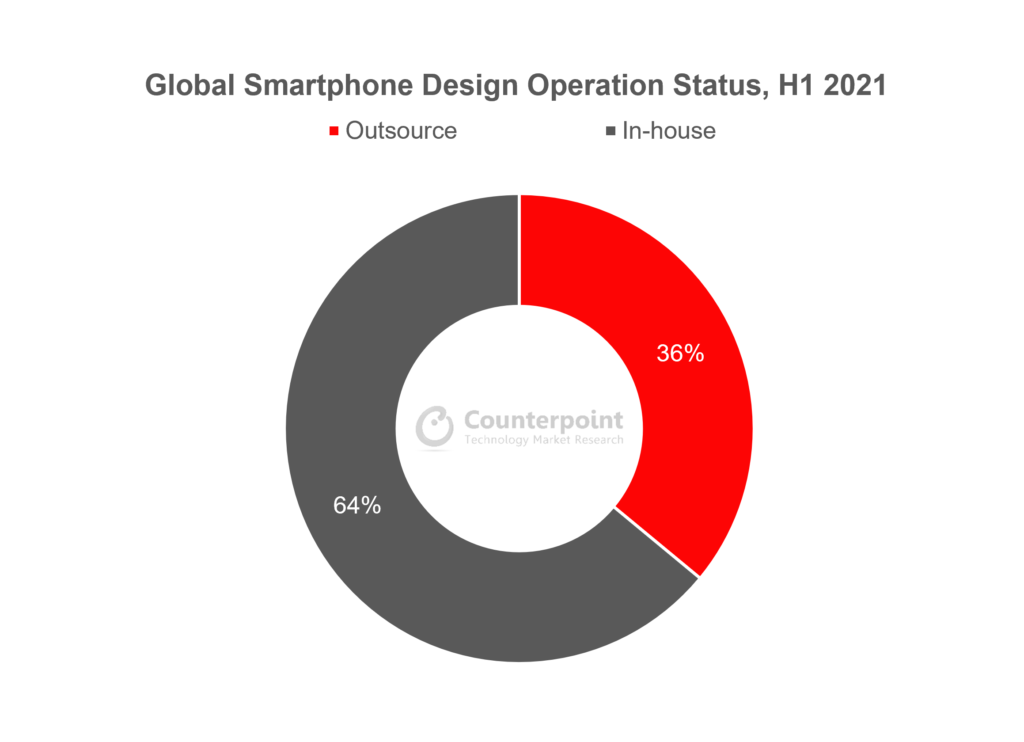

- 设计外包的比例继续运输ed to increase in 2022 compared to that in 2021.

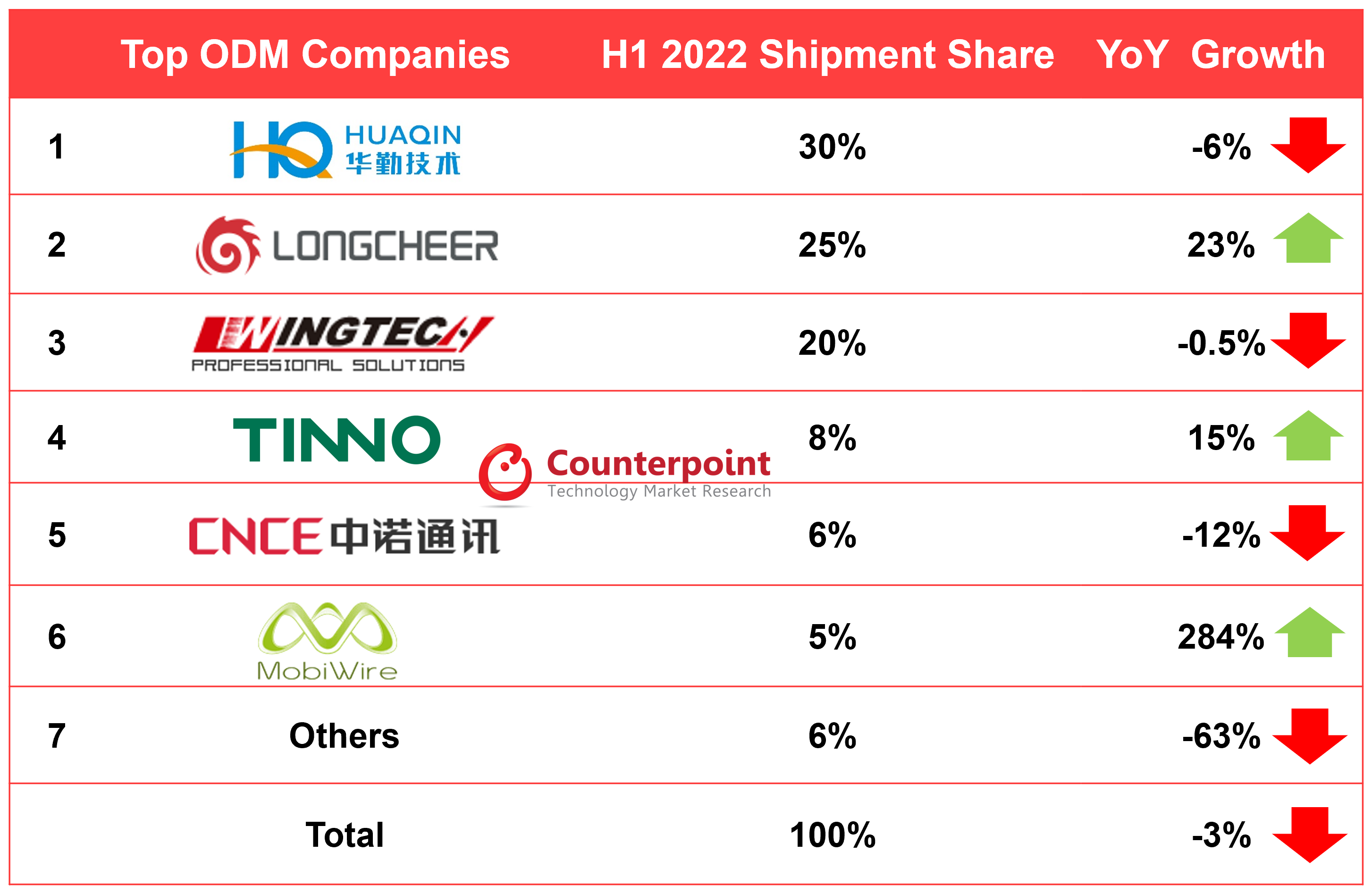

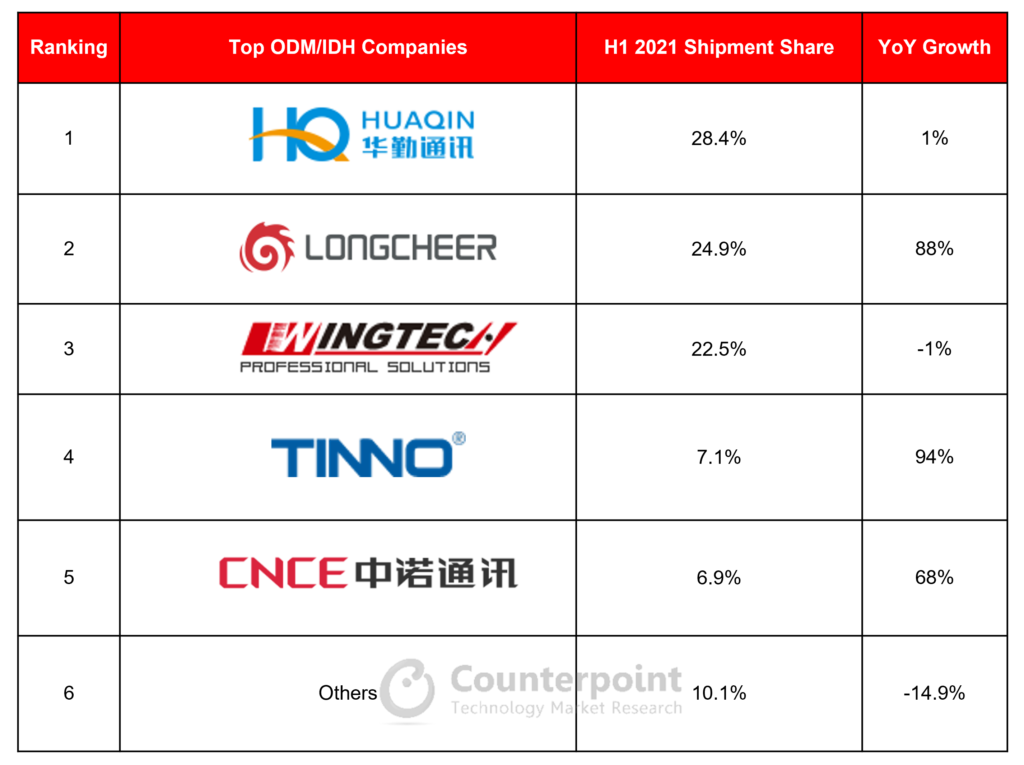

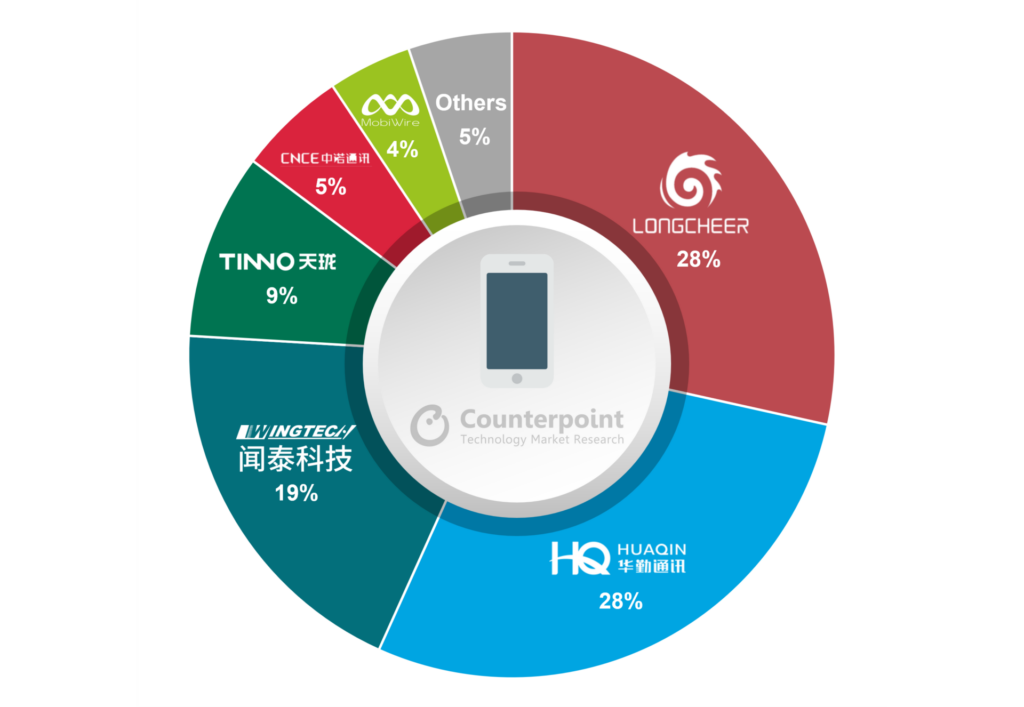

- Longcheer, Huaqin, and Wingtech retained their dominance in the global ODM/IDH smartphone market, accounting for 76% share in 2022, compared with 70% in 2021.

Beijing, New Delhi, Hong Kong, Taipei, Seoul,San Diego, Buenos Aires, London– March, 2023

Smartphone shipments from Original Design Manufacturers/Independent Design Houses (ODMs/IDHs) declined 5% YoY in 2022, according to Counterpoint Research’s latest Global Smartphone ODM Tracker and Report.

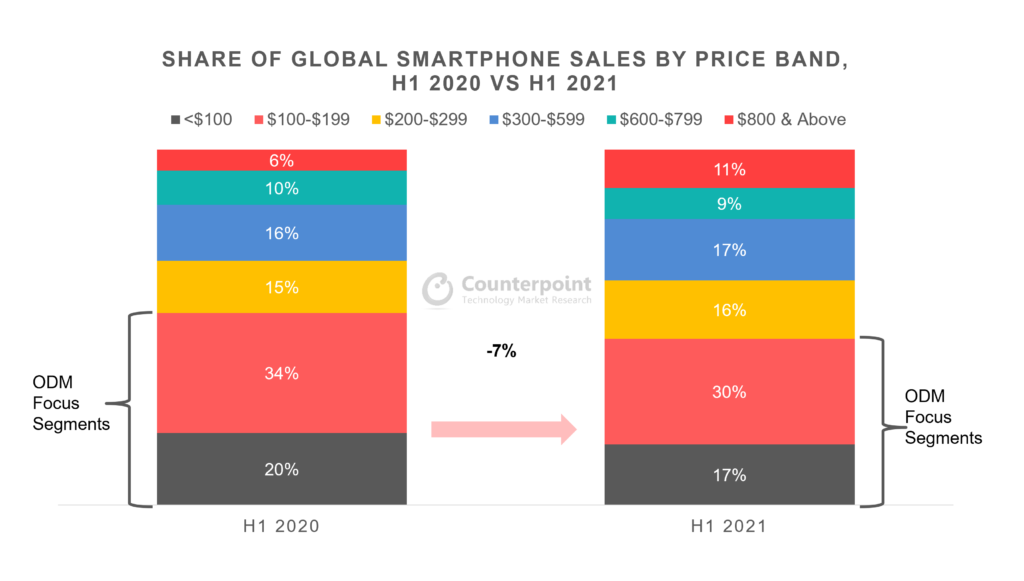

Senior Research Analyst Shenghao Baisaid, “The YoY decline in ODM/IDH companies’ shipments in 2022 was driven by weak performance fromOPPO Group,Transsion Group,Lenovo GroupandHONOR. Thesesmartphone OEMswere hurt by economic headwinds during the year and the negative effects were passed directly to their ODM partners.”

Baiadded, “However, the contribution of ODMs toward smartphone shipments has been increasing. For instance, the proportion of ODM shipments in vivo rose rapidly in 2022 after the brand kicked off its cooperation with Huaqin and Longcheer.”

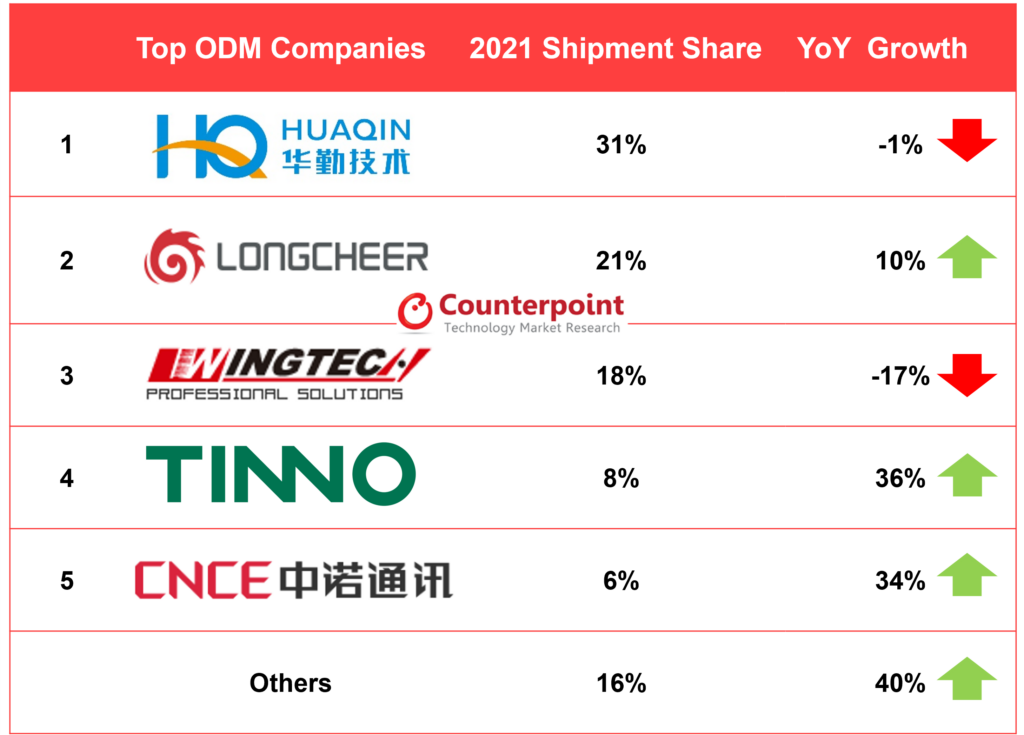

Longcheer, HuaqinandWingtechcontinued to dominate the competitive landscape of the global smartphone ODM/IDH industry in 2022. The companies, also known as the ‘Big Three’, accounted for 76% of the global ODM/IDH smartphone market in 2022 compared with 70% in 2021.

Global Smartphone ODM/IDH Vendors Shipment Share, 2022

Source: Counterpoint Research’s Global Smartphone ODM/IDH Tracker, 2022

Commenting on the performance of the leading ODMs,Senior Research Analyst Ivan Lamsaid, “Longcheer’s shipments surged in 2022 due to strong orders fromXiaomiandSamsung, helping the company rank first in terms of shipment share. Meanwhile, Huaqin managed to remain one of the leaders among ODMs due to its diversified client portfolio and an increase in orders fromvivo, the top smartphone OEM inChina. In contrast, Wingtech saw only a modest YoY increase in shipments, as it continues to view smartphone ODMs as only one component of its overall ODM business.”

Lamfurther added, “In Tier 2, Tinno’s shipments continued to grow steadlity after the spin-off of the WIKO brand, due to successful marketing with major carriers in the US, Japan and Africa. Its partnerships with Lenovo and Transsion also contributed to an increase in shipments. MobiWire experienced a significant rise in shipments after winning Transsion’s projects. Additionally, its recent collaboration with TCL is expected to serve as an alternative revenue source as TCL shifts its focus to the below $300 segment.”

“The leading ODM players are actively expanding their ODM and EMS services to other smart device categories, with Huaqin ranking first in shipments in broader smart devices categories. To enrich their portfolios, ODMs are actively exploring sectors such as components, semiconductors, automotive and XR products. They are trying to put more helmsmen in place to ensure their company sails more steadily in the face of global headwinds,”Lamsaid.

China’s manufacturing sector has been recovering after COVID-19 restrictions in the country were lifted. China’s capacity is expected to return to normal by 2023. Meanwhile, the global electronic industry’s manufacturing diversification continues to grow.

Commenting on these trends,Baisaid, “Smartphone OEMs are investing heavily in India. Meanwhile, EMS companies are expanding their assembly lines toIndia,Southeast Asia,LATAMand other regions.India’s local manufacturingwill be able to fulfill the domestic demand and will also be sufficient for exports.”

Counterpoint Research’s market-leadingGlobal Smartphone ODM Tracker and Reportis available for subscribing clients.

Feel free to contact us at press@www.arena-ruc.com for questions regarding our in-depth research and insights.

You can alsovisit our Data Section(updated quarterly) to view the smartphone market share forWorld,USA,ChinaandIndia.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Ivan Lam

Shenghao Bai

![]()

shenghao.bai@www.arena-ruc.com

Alicia Gong

Counterpoint Research