Counterpoint Research Weekly Newsletter

Intel maintained #1 place in Q2 2023 amid memory market slow down, which dragged down major memory players performance such as Samsung, SK Hynix and Micron. In addition, Nvidia took over the second place from Samsung due to the revenue booming on its data center business supported by strong AI server demand. Nvidia expects to see another wave of revenue growth in the upcoming quarter which could make its revenue expand again. Qualcomm’s revenue was capped by looming handset revenue and thus ranked #4 in the quarter. Broadcom and AMD’s revenues were relative resilient amid demand uncertainty.![]()

Use the button below to download the high resolution PDF of the infographic:

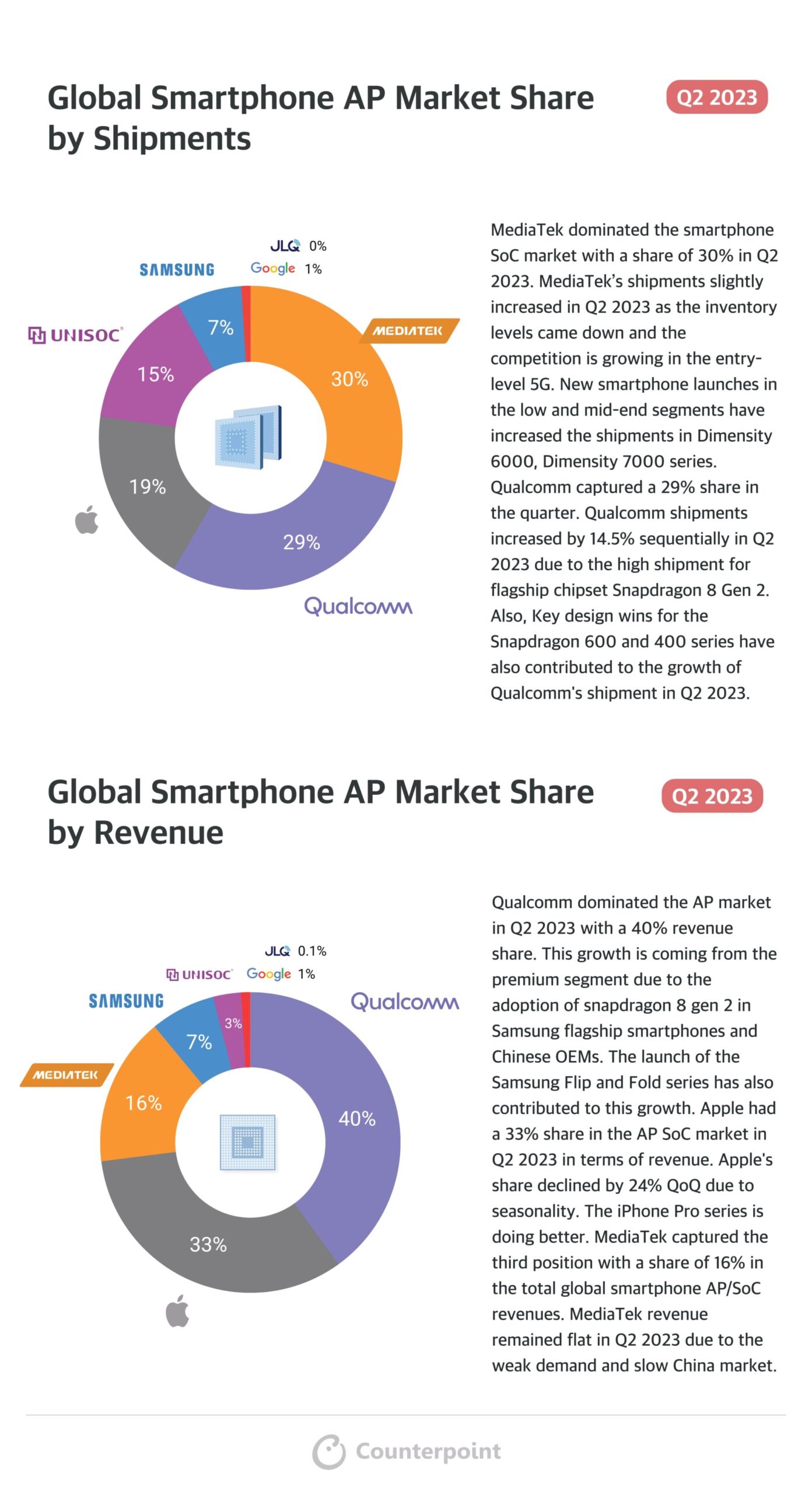

MediaTek dominated the smartphone SoC market with a share of 30% in Q2 2023. MediaTek’s shipments slightly increased in Q2 2023 as the inventory levels came down and the competition is growing in the entry level 5G. New smartphone launches in the low and mid-end segments have increased the shipments in Dimensity 6000, Dimensity 7000 series. Qualcomm captured a 29% share in the quarter. Qualcomm shipments increased by 14.5% sequentially in Q2 2023 due to the high shipment for flagship chipset Snapdragon 8 Gen 2. Also, Key design wins for the Snapdragon 600 and 400 series have also contributed to the growth of Qualcomm’s shipment in Q2 2023.

高通主导美联社市场在2023年第二季度40% revenue share. This growth is coming from the premium segment due to the adoption of snapdragon 8 gen 2 in Samsung flagship smartphones and Chinese OEMs. The launch of the Samsung Flip and Fold series has also contributed to this growth. Apple had a 33% share in the AP SoC market in Q2 2023 in terms of revenue. Apple’s share declined by 24% QoQ due to seasonality. The iPhone Pro series is doing better. MediaTek captured the third position with a share of 16% in the total global smartphone AP/SoC revenues. MediaTek revenue remained flat in Q2 2023 due to the weak demand and slow China market.

Use the button below to download the high resolution PDF of the infographic:

TSMC maintained its leadership in the foundry market with a stable 59% market share in Q2 2023. In contrast, Samsung Foundry’s market share dipped by nearly 1% to 11%, primarily due to ongoing smartphone inventory adjustments and the loss of smartphone AP SoC orders from a US client. On the other hand, UMC saw an increase in market share, driven by the continued strength of DDICs and automotive applications in Q2 2023.

In Q2 2023, the 5/4nm segment continued to dominate the market, holding a significant 21% market share. This strength was driven by robust demand, particularly in the field of AI, with key customers like Nvidia and Broadcom fueling this momentum. In contrast, the 7/6nm segment experienced weakness due to a slower-than-expected recovery in the smartphone market. On the other hand, the 28/22nm segment remained robust, as demand for primary applications, including DDIC and automotive-related applications, remained strong throughout Q2 2023.

Use the button below to download the high resolution PDF of the infographic:

Published Date: 16th August 2023

Overview:This insightful report covers key trends in Smart Home Security Cameras, Cellular IoT Connections, AI-driven transformations, revenue dynamics, and emerging technologies. It offers concise, valuable insights for informed decision-making across diverse industries.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Table of contents:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Published Date: 8th August 2023

Overview:This comprehensive analysis covers global EV trends, connected car sales, regional market dynamics, key players, emerging technologies, pricing strategies, and market growth. It also provides concise, insightful automotive trends for informed decision-making.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Table of contents:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Published Date: 24th July 2023

Overview:This is a comprehensive analysis of the latest developments in the wearables industry covering product reviews, market trends, and regional insights. It also includes the Sony WH-CH720N headphones, Apple’s Vision Pro, Meta’s Quest 3, smartwatch markets in China and India, MediaTek’s expansion, AR/VR value chain in China, Apple’s device ecosystem, and wearable innovations at MWC Barcelona 2023.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Table of contents:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Published Date: 24th July 2023

Overview:This is a comprehensive analysis of the industry, encompassing topics like international policies affecting self-reliance plans, regulatory acts in the US, earnings of major players, semiconductor manufacturing in India, emerging technologies in the market, and key events shaping the industry’s future. It provides valuable insights for stakeholders seeking a concise overview of the semiconductor landscape.

[one_half padding=”0 20px 0 0″]

![]()

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Exhaustive table of contents below:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Note: The report comprises of carefully selected aggregated insights published by our analysts during Q2 2023. The data presented herein corresponds to the Q1 2023.

Published Date: 12th July 2023

Overview:This report provides a comprehensive analysis of the global smartphone market, covering various topics and regions gathered throughout Q2. It includes insights into consumer preferences, market trends, and key players. The report offers a broad perspective on the industry, exploring topics such as foldable smartphones, market strategies, display technologies, reviews of smartphone models and much more. This report serves as a valuable resource for industry stakeholders seeking a concise overview of the global smartphone market.

[one_half padding=”0 20px 0 0″]

[/one_half]

[one_half_last padding=”0 0 0 30 px”]

[/one_half_last]

Exhaustive table of contents below:

[one_half]

[/one_half]

[one_half_last]

[/one_half_last]

Note: The report comprises of carefully selected aggregated insights published by our analysts during Q2 2023. The data presented herein corresponds to the Q1 2023.

Published Date: May 11, 2023

This page shows thequarterly revenue sharefor the top players in the global semiconductor foundry market from Q3 2021 to Q1 2023.

![]()

| Global Semiconductor Foundry Revenue Share (%) |

Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

| TSMC | 55% | 53% | 54% | 56% | 59% | 59% | 59% |

| Samsung Foundry* | 15% | 16% | 15% | 13% | 12% | 13% | 13% |

| GlobalFoundries | 6% | 6% | 6% | 6% | 6% | 6% | 7% |

| UMC | 7% | 7% | 7% | 8% | 7% | 7% | 6% |

| SMIC | 5% | 5% | 6% | 6% | 6% | 5% | 5% |

| Others | 12% | 12% | 12% | 11% | 10% | 10% | 10% |

(*)Samsung includes foundry service for its internal logic IC business

This page provides a view on the global foundries revenue share from 2021 till 2023. Here are some highlights from Q1 2023:

DOWNLOAD:

(Use the buttons below to download the complete chart)![]()

![]()

Read our foundry quarterly report for Q1 2023here.

For detailed insights on the data, please reach out to us atsales(at)www.arena-ruc.com. If you are a member of the press, please contact us atpress(at)www.arena-ruc.comfor any media enquiries.

Related Posts:

New Delhi, Beijing, Jakarta, London, Boston, Toronto, Taipei, Seoul – May 09, 2023

Invest India, the National Investment Promotion and Facilitation Agency, India Semiconductor Mission (ISM), and Counterpoint Research, recently hosted a series of webinars with key industry speakers to discuss the opportunities in India for establishing a semiconductor manufacturing base and in becoming a key destination for supply chain diversification.

The webinar covered four central topics, namely thesemiconductormarket across sectors and applications; government programs and incentives for foreign manufacturers; talent availability and initiatives for re-skilling; and the current infrastructural capabilities and support for semiconductor manufacturing.

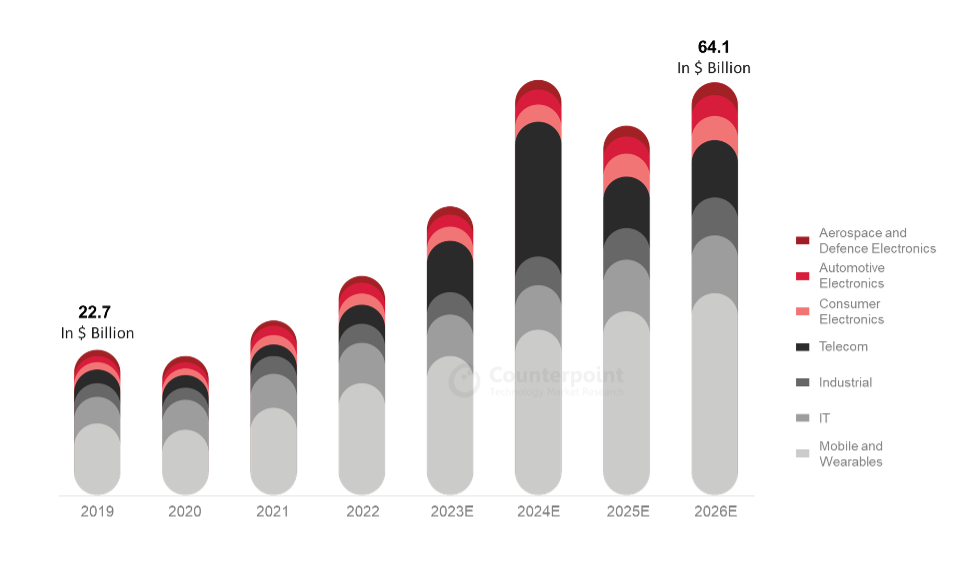

With India’ssemiconductormarket expected to balloon to $64 billion by 2026, the country presents a considerable opportunity for global semiconductor manufacturing. India’s semiconductor market was valued at $22.7 billion in 2019, according to a joint report by Counterpoint Research and the India Electronics & Semiconductor Association (IESA). The 2026 forecast is set to be driven by both domestic and export markets with significant demand from theconsumer electronics, telecom, IT hardware and industrial sectors. India’s ‘telecom stack’ and industrial applications are expected to account for two-thirds of the total.

India Semiconductor Market Size by Application

Meanwhile, components leveraging mature technology nodes (28nm and higher) are expected to see significant short-term opportunities as they support India’s growingautomotiveand industrial sectors.

“In the short term, there is a huge opportunity being driven by domestic demand across applications like sensors, logic chips and analog devices,” said Tarun Pathak, Research Director at Counterpoint.

He also said “Local sourcing is already happening in a significant way. It accounted for around 10% of the overallmarketin 2022.”

At the global level, the Government of India has committed to being a reliable partner in thesemiconductorsupply chain, introducing various incentives and programs that facilitate foreign investments across a broad array of sectors.

Mr. Amitesh Kumar Sinha, CEO of ISM and Joint Secretary, Ministry of Electronics and Information Technology, said, “India is committed to becoming a reliable partner in global supply chains and we are working towards that by framing long-term policies, keeping the next 25 years in mind.”

Mr. Sinha further added, “More than 70% of the project costs forsemiconductormanufacturing are incentivized by the Central and State Governments in India of which 50% is funded by the Central Government on an upfront basis while the rest is covered by the State Governments.”

The Semicon India Program, which has an outlay of about $10 billion, funds 50% of thesemiconductormanufacturing project costs with 2.5% of the budget earmarked for R&D, skill development and training.

Apart from market sizing and fiscal support, the fourth area addressed during the webinar was the existing infrastructural capabilities and the availability of a skilled workforce, materials supply and other parts of the local supply chain.

India’s own fabrication unit, Semiconductor Laboratory (SCL), provided an end-to-end case study emphasizing India’s supply chain’s robustness across utilities, materials and talent.

Dr. Manish Hooda, Head of Technology Development at SCL said, “SCL has been an end-to-end manufacturer for 30 years, providing products for space and railway applications. For the last 15 years, SCL has received uninterrupted power supply and stable, continuous flow of ultra-pure quality water, which highlights India’s readiness to support high-volume manufacturing of semiconductors.”

An edited version of the webinar recording can be foundhere.

Contacts:

Nupur Yadav

Rohan Thomas Abraham– Sector Lead, ESDM – Invest India

媒体联系人

Follow Counterpoint on LinkedIn and Twitter

About Counterpoint Research

Counterpoint Technology Market Research is a global research firm specializing in TMT. It services major technology and financial firms with data, monthly reports, and detailed analyses of key technology markets.

About Invest India

Invest India is the national investment promotion and facilitation agency of India. The agency’s team of domain and functional experts provide sector- and state-specific inputs, and hand-holding support to investors through the entire investment cycle, from pre-investment analysis and decision making to after care and grievance redressal. Additionally, all facilitation support to investors under the “Make in India” program is provided free of cost by Invest India.

Website:https://www.investindia.gov.in/

About India Semiconductor Mission (ISM)

India Semiconductor Mission (ISM) is a specialized and independent business division within the Government of India’s Digital India Corporation. The organization aims to build a vibrant semiconductor and display ecosystem in India to facilitate the country’s emergence as a global hub for electronics manufacturing and design. Led by global experts in the semiconductor and display ecosystem, ISM’s mission is to serve as a focal point for the comprehensive, coherent, efficient and smooth deployment of the Program for Development of Semiconductor and Display Ecosystem, in consultation with government ministries/departments/agencies, industry players and academia.

Website:https://ism.gov.in/

New Delhi,London,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul – April 24, 2023

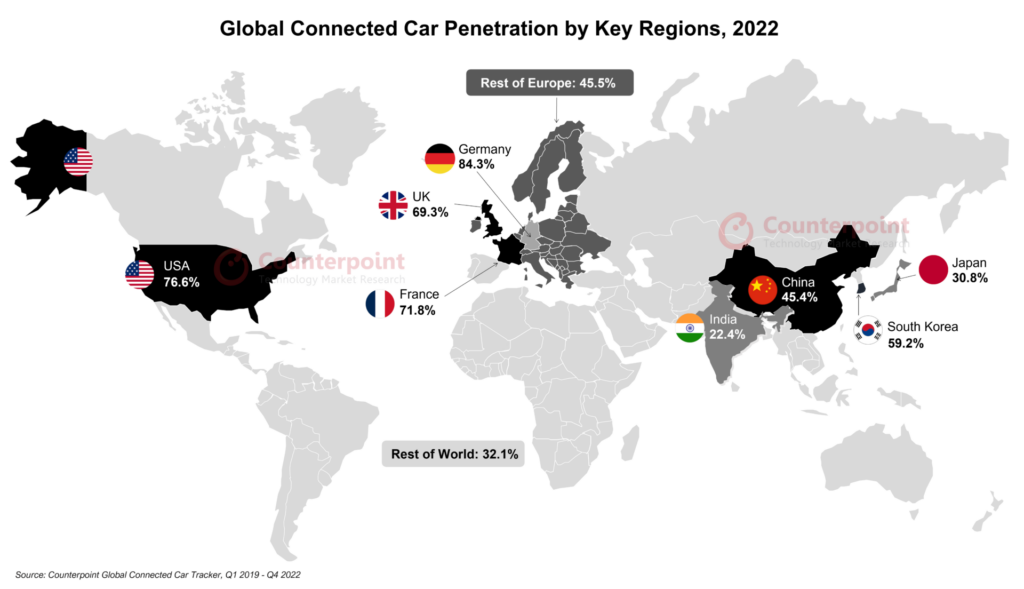

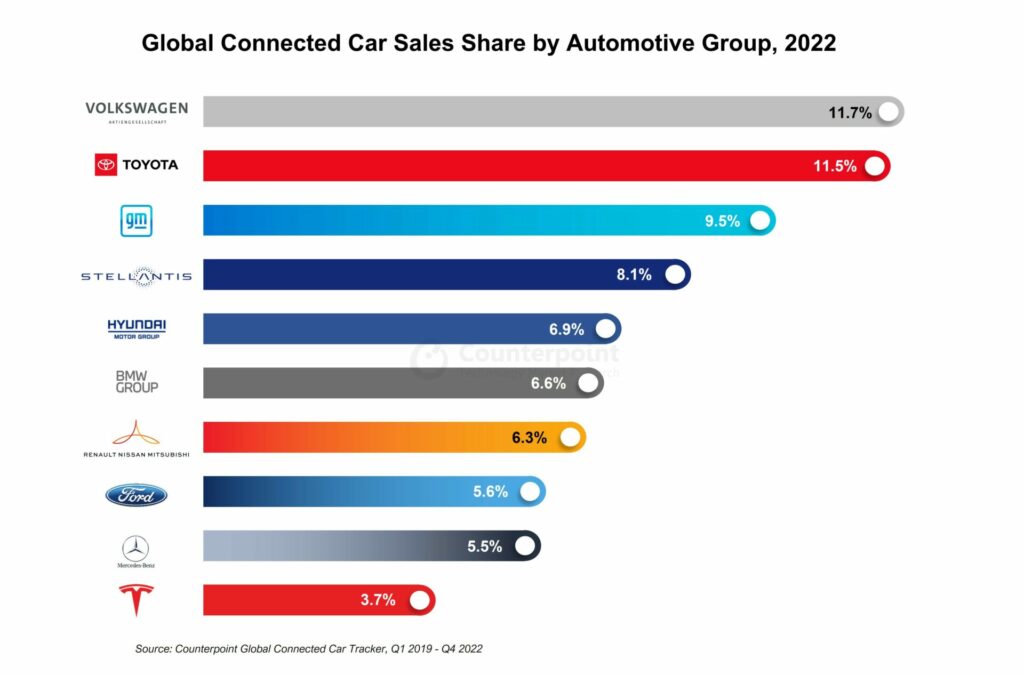

Global connected car sales* grew 12% YoY in 2022 with the share of connected cars in the overall car sales exceeding 50%, according to the latest research from Counterpoint’sSmart Automotive Service. TheUSremained the strongest market for connected cars followed by China andEurope. These three markets accounted for nearly 80% of the total connected car sales globally in 2022. Despite having a relatively small share of connected car sales, Japan experienced the highest growth in connected car penetration.

Commenting on the market dynamics,Research AnalystAbhilash Guptasaid, “The penetration of connectivity in cars improved during 2022 after struggling in 2020 and 2021. In 2022, new facelift versions of older models like the Honda Civic, Toyota Corolla, Ford Escape and Chevrolet Equinox were introduced with upgraded 4G connectivity and new features. Some prominent features include remote lock/unlock, remote engine start/stop, climate control, vehicle status, location tracking, geofencing, emergency assistance, in-cabin music, video streaming, and over-the-air updates. Next-generation vehicles are being introduced with various connected and autonomous features that require high-speed internet access available through 5G. However, as of now, 5G remains a niche, available only in premium cars like the Ford F-150 Lightning, Cadillac LYRIQ, Mercedes-Benz EQS, Audi e-tron GT, BMW iX and GWM Haval HG.”

Gupta added, “With consumers’ focus shifting to connectivity in the car, non-connected car shipments are steadily declining. The top five automotive groups accounted for nearly half of the connected cars sold in 2022. Volkswagen Group led the charts in terms of connected car sales volume, closely followed by Toyota Group. Tesla broke into the top 10 for the first time.”

Commenting on the market outlook,Senior AnalystSoumen Mandalsaid, “The shift towards digitization in cars is increasing at a rapid pace and is visible in the consistent rise of connected car penetration globally. Currently, 4G dominates the connected car market with almost95%share. But as the automotive market is transitioning towards electrification, software-defined vehicles and autonomy, the need for seamless and faster in-vehicle connectivity will be fulfilled through 5G. By2030, more than 90% of connected cars sold will have embedded 5G connectivity. Connected car sales are expected to grow at a CAGR of 13% between 2022 and 2030.”

*Sales here refer to wholesale figures, i.e. deliveries out of factories by respective brands, and consider only passenger cars with embedded connectivity.

全面、深入的全球连接Car Tracker,Q1 2019-Q4 2022’ and ‘Global Connected Car Forecast, 2019-2030F’ are now available for purchase atreport.www.arena-ruc.com.

Feel free to reach us at press@www.arena-ruc.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Counterpoint Research

Related posts

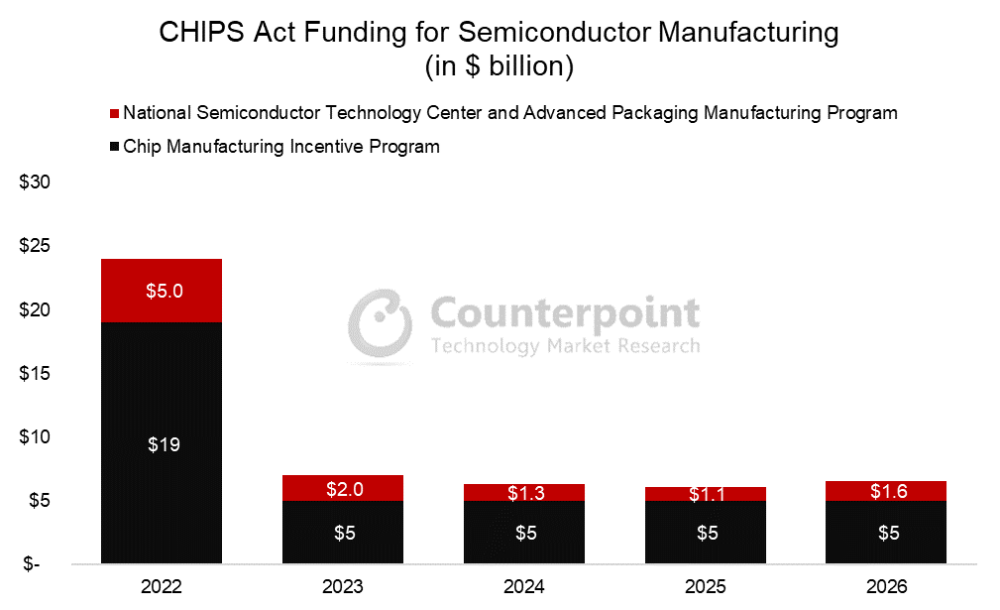

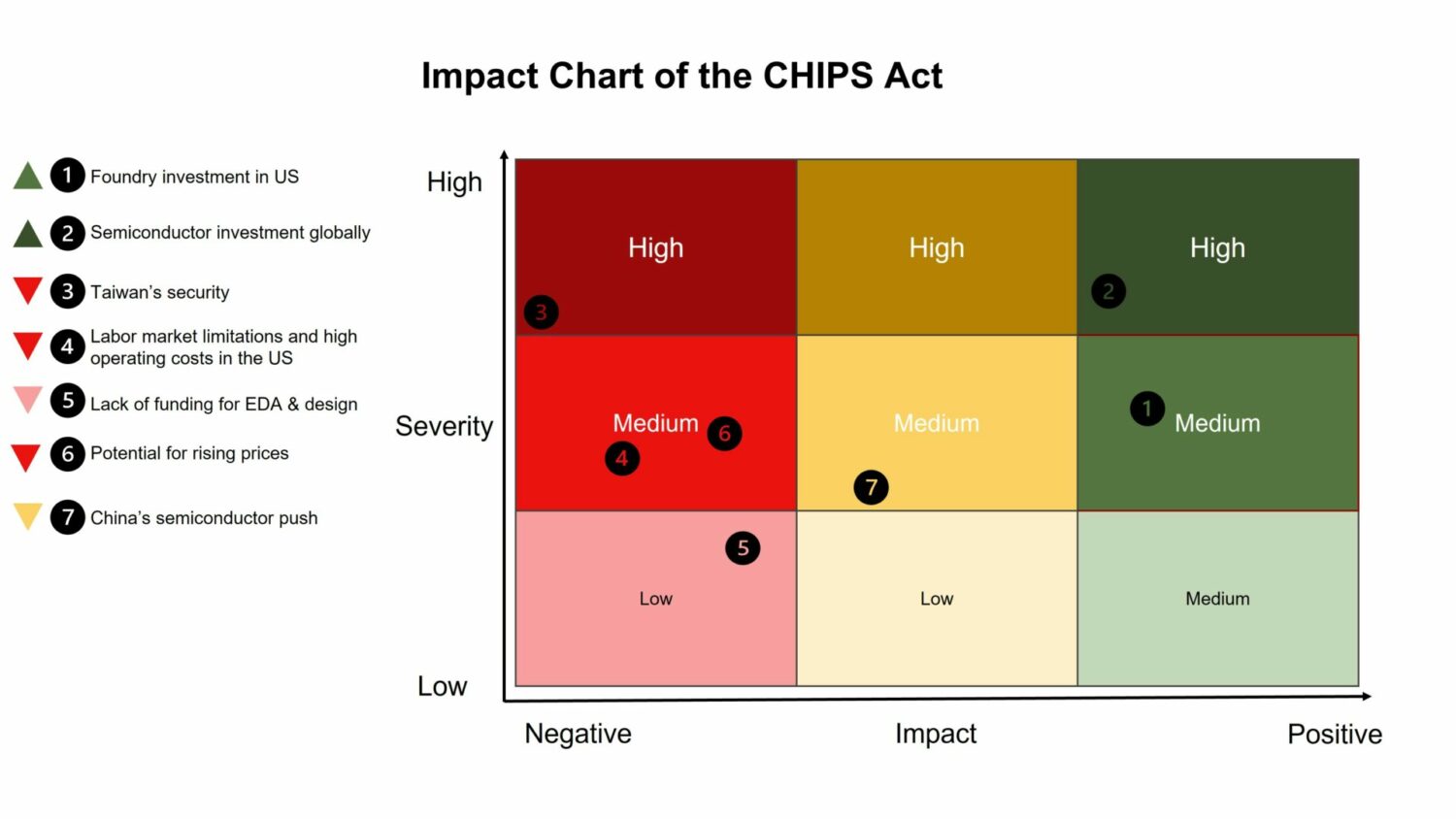

Last August, the US Congress passed the CHIPS Act, the largest piece of industrial policy signed into law in the US in a generation. The legislation includes over $52 billion in subsidies for semiconductor manufacturing. Over the past two decades, the share of semiconductors manufactured in the US has steadily fallen while advanced semiconductor manufacturing has become increasingly concentrated in just a handful of cities, primarily in Taiwan and South Korea.

The outbreak of COVID-19 wreaked havoc on supply chains as factories shuttered, while the fallout of an unexpected winter storm in Texas further disrupted semiconductor manufacturing. Compounded by an explosion of demand as companies, schools and government offices pivoted to work from home, the chip shortage set in, shaving a percentage off of GDP growth according to the White House. In summary, the events of the past few years have made abundantly clear the foundational role that semiconductors play in today’s economy, and the costs that accompany constrained supply.

All this triggered the finalization and passage of the CHIPS Act. The US government was convinced that the country’s supply of semiconductors, which power everything from washing machines, smartphones and cars to supercomputers and hypersonic missiles, faced an unacceptable bottleneck at a pivotal moment. The US is almost entirely dependent on Taiwan for the production of advanced chips even as cross-strait tensions reach new highs and US-China relations new lows. Indeed, concerns over a potential conflict in the South China Sea as well as between North Korea and South Korea, not to mention acts of God, impacting chip supplies convinced the US government about boosting the country’s semiconductor manufacturing. But with higher labor costs and plenty of red tape,semiconductor manufacturersneeded added incentives to make the transition worthwhile. The CHIPS Act has done just that, sparking a wave of private investment.

Since the CHIPS Act was passed, investments worth over $200 billion have been announced for manufacturing capacity in the US, with new foundries underway from TSMC, Intel, Samsung, Micron and Texas Instruments. But while the CHIPS Act has lit the flame under private companies to act, some of the legislation’s provisions and shortcomings could lead to its undoing. These projects are faced with red tape and regulations that will cause them to linger before coming on line. Besides, while funding has been made available for workforce education and job training, the scale of the need for new employees and the lack of the required workers and skills will likely pain semiconductor firms for years to come. One solution would be to raise the number of visas available for skilled workers from abroad. Another would be to provide targeted assistance to students pursuing degrees in related fields. Finally, the Act itself fails to address the reason why semiconductor manufacturing left the US in the first place – American labor costs and regulations make production in the US more expensive than elsewhere. Once the funding runs dry, how will American semiconductor manufacturing remain competitive? Additional burdens on employers to guarantee union wages and provide child care certainly won’t make these projects anymore cost-competitive.

虽然有缺陷,但芯片的行为是一个主要的圣one to creating secure, resilient supply chains that will insulate the country from many outside shocks. This is a step in the right direction, but more must be done if the country wants to win the semiconductor manufacturing marathon and avoid fizzling out after the starting sprint.

虽然有缺陷,但芯片的行为是一个主要的圣one to creating secure, resilient supply chains that will insulate the country from many outside shocks. This is a step in the right direction, but more must be done if the country wants to win the semiconductor manufacturing marathon and avoid fizzling out after the starting sprint.

For more information about the CHIPS Act, a detailed report on the legislation can be foundhere.

Additional Reading:

US Chips Act Takes New Form Before August Recess, Leaves Some Unhappy

UMC Q1 2023 Earnings: Weak Cyclical Recovery But 28nm Remains Resilient

Global Smartphone AP (Application Processor) Shipments Market Share: Q3 2021 to Q4 2022

Will Japan Curbs Hit China Semiconductor Self-reliance Plans?

Joining the US-led effort to restrict chipmaking equipment exports to China, Japan has put in place restrictions that are more draconian than that of the US and where the Japanese state has effectively taken control of the country’ssemiconductorcapital equipment market.

Micron: A display of weakness

(This is a version of a blog that first appeared on Radio Free Mobile. All views expressed are Richard’s own.)

Our Research DirectorTarun Pathakwill be speaking at the 2023 Global Semiconductor Industry Strategy Summit on Friday, April 7th, 2023. His session details are below:

Topic:Looking at the global smartphone market from the perspective of AP/SOC technology evolution

When:Friday, April 7th, 2022 | 16:10-16:30 (GMT+8)

Location:Regency Art Hotel, Macau, China

About the event:

JW Insights will hold the 2023 Global Semiconductor Industry Strategy Summit (2023 GSISS) in Macau, China from April 7th to 8th, 2023. We will invite representatives from world-renowned research and consulting firms, industry associations, leading enterprises, and investment companies to participate.

为期两天的活动将全面升级and extension of the “Jiwei Semiconductor Analyst Conference” and “Dialog with Automotive Electronics Industry Experts” organized by JW Insights. The 2023 GSISS aims to analyze the future trend and co-competition relationship of the semiconductor industry from a global perspective and invite analysts, industry organizations, leading companies, and VCs to discuss future industry development trends, opportunities, and challenges in depth from multiple perspectives, such as technological trends, market dynamics, industry chain changes, and regional competition and cooperation, providing a communication platform from a global perspective for China’s companies and foreign enterprises’ strategic deployment, business and investment decision-making for investment firms.

During the summit, JW Insights will jointly establish an industry exchange organization with world-renowned consulting firms and industry associations, form a regular industry exchange mechanism, and jointly discuss opportunities and challenges for semiconductor industry development.

Clickherefor more information about the event.

Click below(or send us an email at contact@www.arena-ruc.com) to schedule a meeting with him.

![]()

You can schedule a meeting with him to discuss the latest trends in the technology, media and telecommunications sector and understand how our leadingresearchandservicescan help your business.

To get live 2023 GSISS updates you can follow us on Twitter

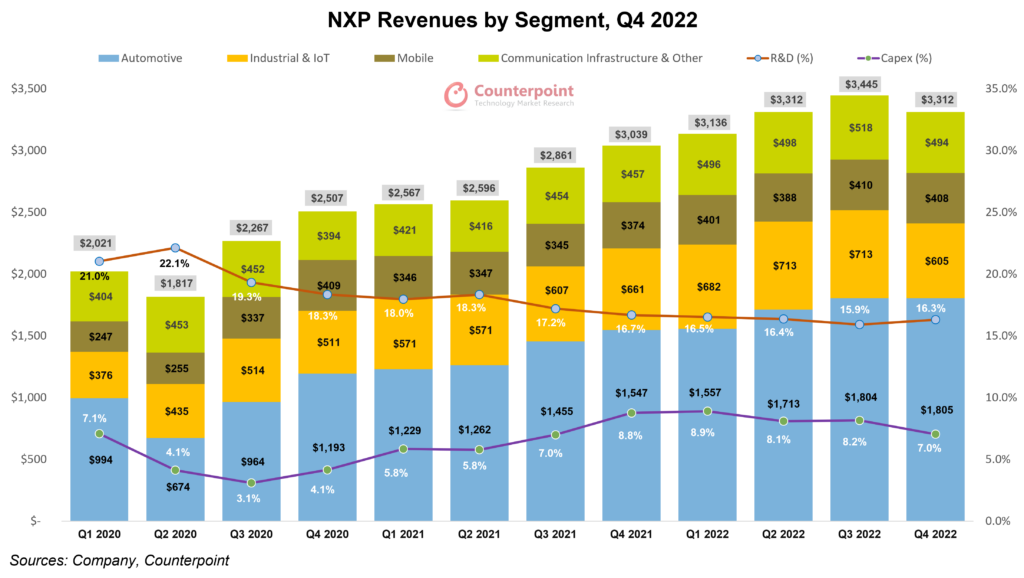

NXPSemiconductors reported record revenues of $13.21 billion in 2022, a yearly growth of 19.4% on account of increased revenues in all end markets, unprecedented design wins across the entire portfolio and higher pricing (due to input cost inflation).Automotiveand coreIoTmarkets witnessed robust demand throughout 2022, outstripping the company’s supply capabilities.Consumer IoTand mobile markets experienced softening demand environment in the latter half of the year. In Q4 2022, NXP delivered revenues of $3.31 billion, up 9% YoY and down 4% QoQ. The Q4 revenues were $12 million better than the midpoint of the guidance with all markets performing in line or better than expected except the communication and infrastructure segment. The full-year non-GAAP gross profit was $7.64 billion with non-GAAP gross margin standing at 57.9%, an increase of 180 basis points YoY due to higher internal factory utilization and follow-through on higher revenues.

Input cost inflation due to supply chainconstraintsled to higher pricing for NXP solutions in 2022, a trend that will continue this year as well. Dynamicmacrotrends continue to pose an uncertain general demand environment and a potential rebound in theChinesemarket could significantly improve end markets’ revenues, which is why managing internal and channel inventory is an important topic for the company. Overall, NXP is prepared for market uncertainties and will continue to execute diligently on its accelerated growth drivers and be disciplined with its operating expenses while protecting long-term R&D investments.