- u-blox’s total revenue grew 44% YoY in 2022 to reach $654 million.

- The company shipped more than 100 million chipsets and modules in 2022.

- u-blox’s revenue is expected to grow more than 15% YoY in 2023.

Last year saw u-blox’s 25th anniversary, and the company marked the occasion in style, registering a record-breaking revenue of $654 million in 2022, an increase of 44.3% from 2021. Despitesupply chainchallenges, u-blox managed to fulfill customer demands with a diversified supplier base. The company experienced strong growth across all segments and regions.

Highlights for 2022

- u-blox’s operating profit increased 258% YoY in 2022 to reach $138 million, demonstrating improved operational efficiency.

- The mass adoption of high precession technology inindustrial automation, deliveryrobots, autonomous construction and agricultural equipment helped its industrial segment to grow 52% YoY and capture 63% of the company’s total revenue.

- Theautomotivesegment also grew 54% YoY due to the increased demand for navigation and infotainment applications, driven by the shift towardselectric vehicles. The segment contributed 28% to the total revenue.

- The consumer segment grew 34% YoY and captured 9% of the total revenue.

- Among regions, the revenue from APAC increased 59% YoY propelled by high demand for various applications such as infotainment, navigation, telematics and healthcare, particularly in Japan, Australia and New Zealand. In EMEA, the revenue grew by 43% driven by the strong performance of infotainment, navigation, industrial automation andasset-tracking应用程序。Similarly, the revenue in the Americas grew 48% YoY fueled by the robust growth of infotainment, navigation, telematics and healthcare applications.

- In 2022, modules and GNSS chips contributed 79% and 20% of the total revenue respectively. The company shipped more than 100 million modules and chips combined in 2022.

GNSS modules

u-blox is maintaining its leadership position in theGNSSmodule market due to its superior quality and high precision. In 2022, u-blox’s GNSS module shipments grew by 28% YoY, contributing more than half of the total module revenue. These modules are widely used in automotive and industrial applications. To further enhance its positioning solutions, it has formed partnerships with GMV to provide end-to-end safe positioning solutions for autonomous vehicles. Additionally, u-blox has secured multiple design wins, including with NXP semiconductor, NVIDIA and Li-Auto, for its ZED-F9K GNSS module for automotive applications.

Wi-Fi/BT modules

In 2022, u-blox’s Wi-Fi/BT module segment experienced a 17% YoY growth, generating a revenue of nearly $57 million. The widespread adoption ofWi-Fi 6in healthcare and industrial applications has played a significant role in the segment’s growth. Besides, u-blox’s partnership with AWS has created two innovative modules that are pre-provisioned for secure communication with AWS via Wi-Fi and cellular IoT, simplifying access to cloud services for customers. This collaboration with AWS is expected to drive the adoption of u-blox’s high-quality modules targeted at the industrial segment, increasing the company’s market share and revenue growth potential.

Cellular IoT modules

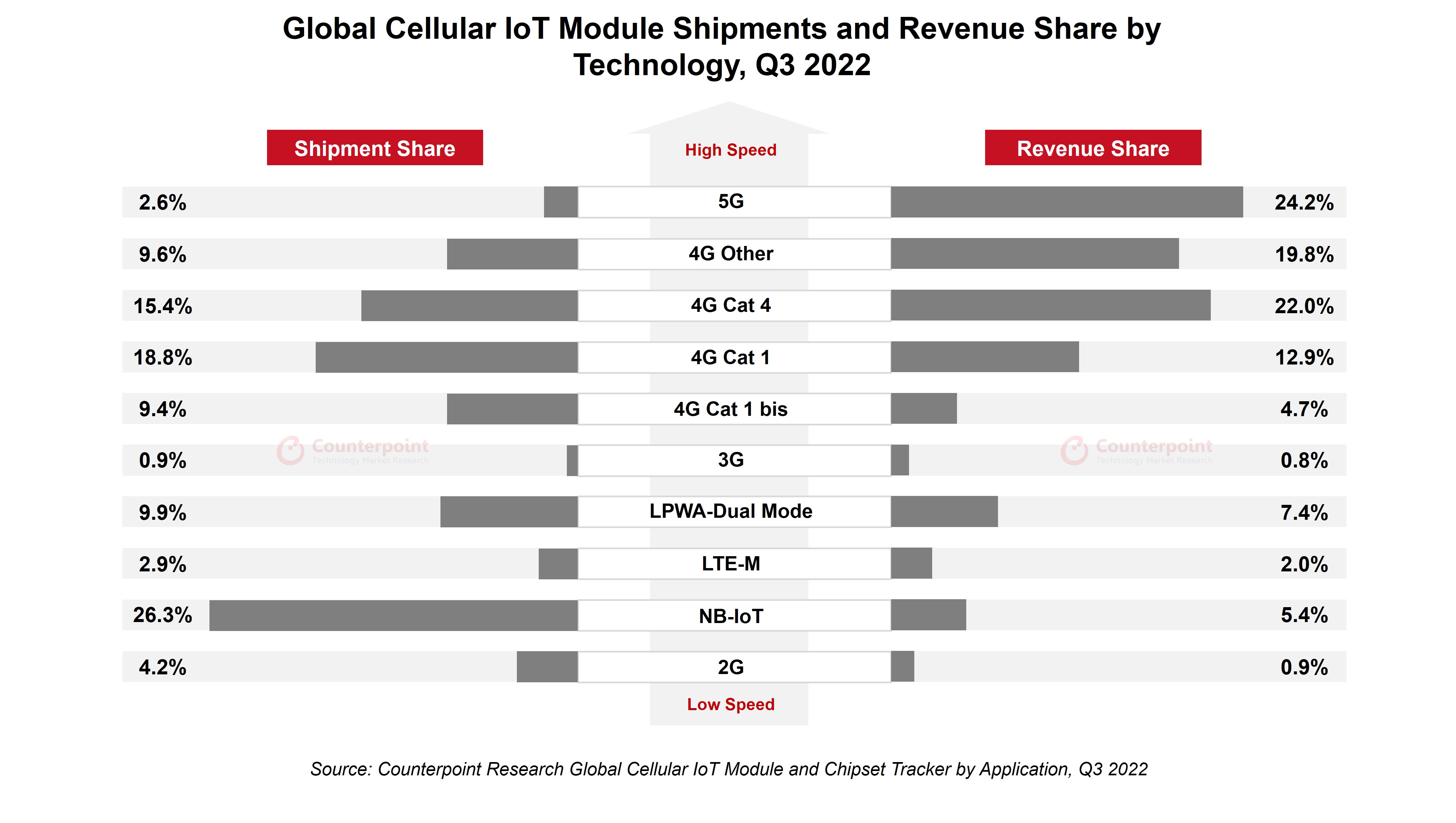

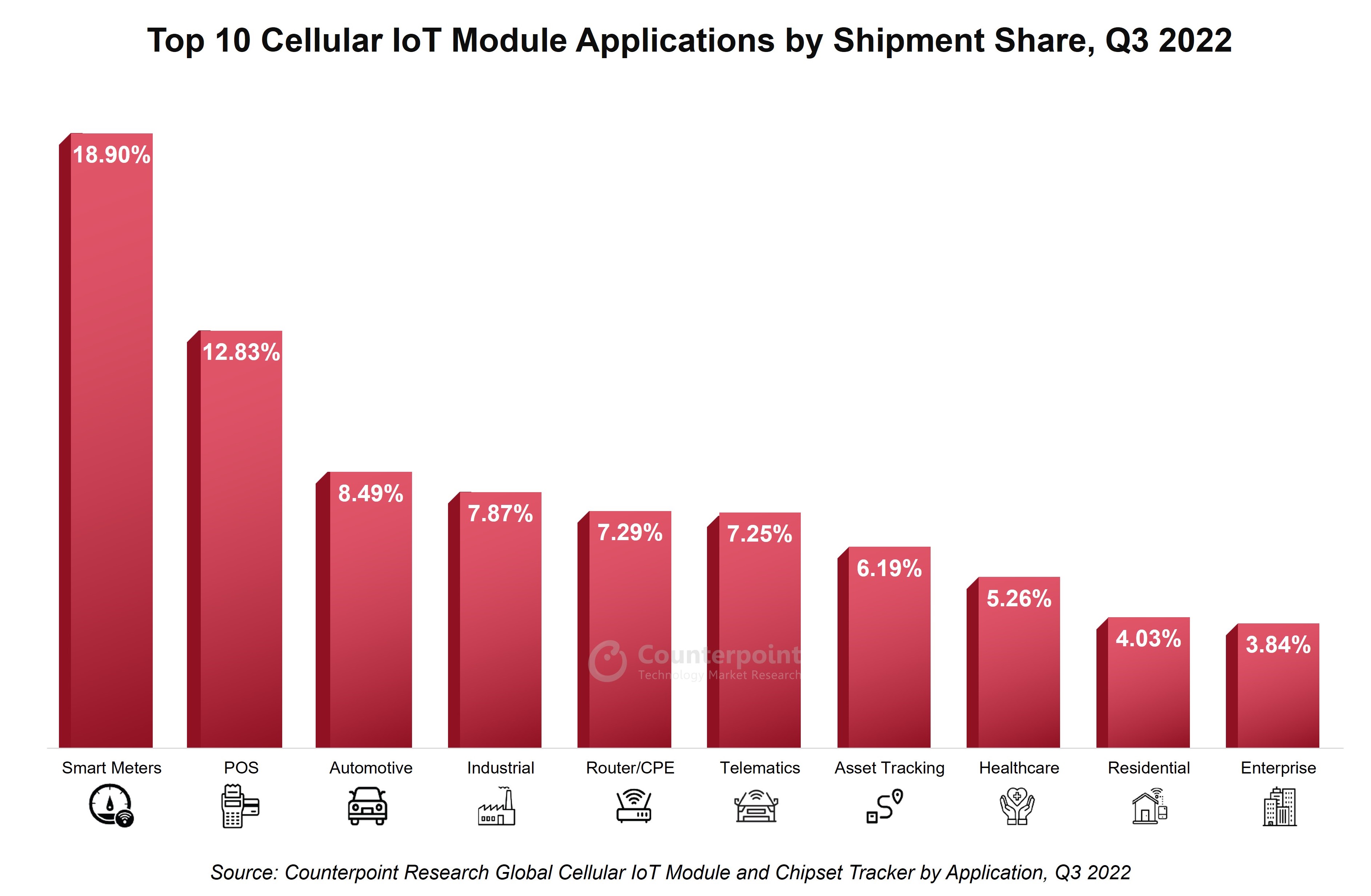

According to Counterpoint Research’sCellular IoT Module Tracker Service, u-blox’s cellular IoT module segment grew by 37% YoY in 2022, reaching $176 million. The launch of new products in the first half of the year played a crucial role in this growth, with its smallest 4G Cat 1 modules shipping one million units within two months of launching. Its UBX-R5 LPWA chipsets are also gaining traction among customers. In the cellular LPWA chipsets market, u-blox is competing with major players such asQualcomm, Sony and Sequans. Sony’s latest 5G LPWA chipset may create further competition for u-blox.

GNSS chips

u-blox shipped nearly 54 million GNSS chips in 2022, which contributed $131 million in revenue. The u-blox 8 series chipsets continue to be the top-selling chipset, while the new M10 chipsets are ramping up production at a rate of one million per month. Nofence is leveraging u-blox GNSS chipsets to develop GNSS-enabled livestock collars for regenerative farming.

Outlook

The company’s future strategy is to continue to lead with innovative solutions that combine chipsets and modules with services while considering socio-economic and eco-friendly factors. The ongoing adoption of electric and autonomous vehicles will be a major growth opportunity for u-blox. With a strong order book in place, u-blox is forecasting a substantial YoY revenue increase of 6% to 16% for 2023. The average analyst estimate for the 2023 revenue is $724 million, representing an 11% increase. Considering the high demand and interest for its products in the automotive, industrial and asset-tracking segments, it is probable that u-blox’s revenue will be near the higher end of the projected range.

相关的帖子

- Despite China’s Failure to Recover in Q3 2022, Global Cellular IoT Module Market Experiences Growth

- AI, Digital Twins, Real-time Compute Emerge as Top Technology Trends for 2023

- Data Center CPU Market: AMD Surpasses Intel in Share Growth

- Sensing, Power Solutions Drive onsemi’s Record Revenue in 2022

- Arm Laptops to Remain Resilient Amid Global PC Market Weakness

- Fragmentation, Consolidation Mark Changing IoT Landscape

- Outsourced Manufacturing Captures More Than Half of Global Cellular IoT Module Shipments in H1 2022

- iSIM-based Cellular Device Shipments to Cross 7 Billion Units During 2021-2030

- Technology Trends Driving Future XR Market Growth

- MediaTek Targets Diverse Technology Verticals With 4 New Chipsets

- Global Passenger Electric Vehicle Market Share, Q1 2021 – Q4 2022

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Telit’s Acquisitions to Reshape Global IoT Module Market

- 5G AIoT Unlocking New Era of IoT