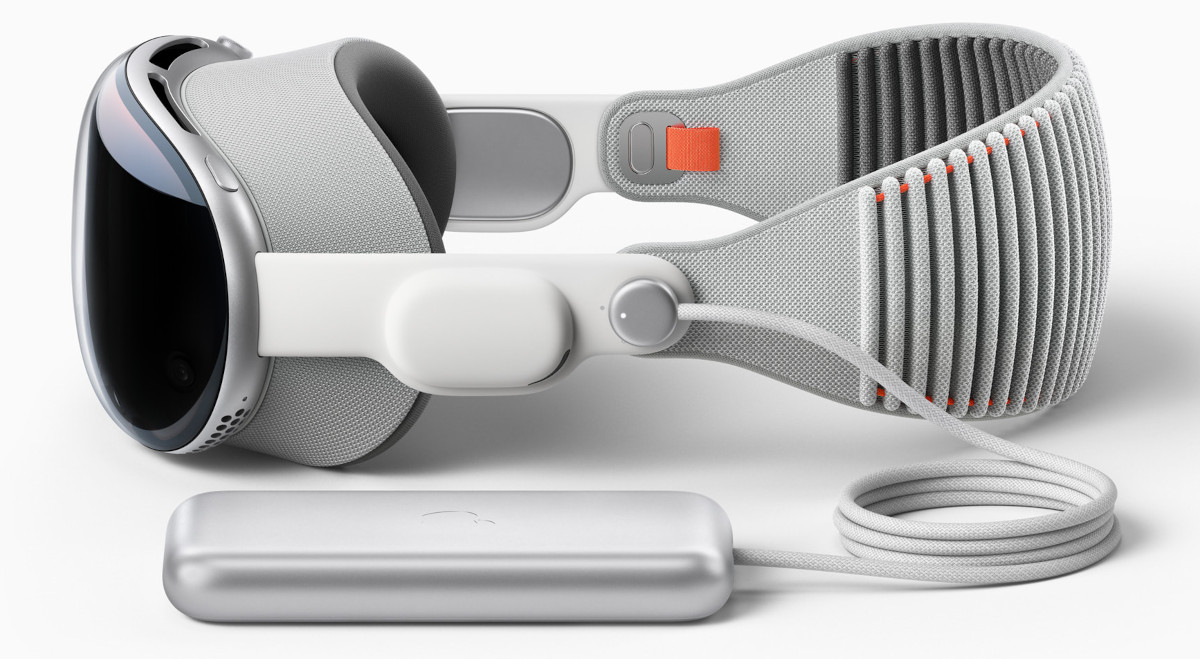

- Despite the Vision Pro’s steep $3,499 price point, Apple has still managed to create a “wow” factor. The device goes on sale early next year.

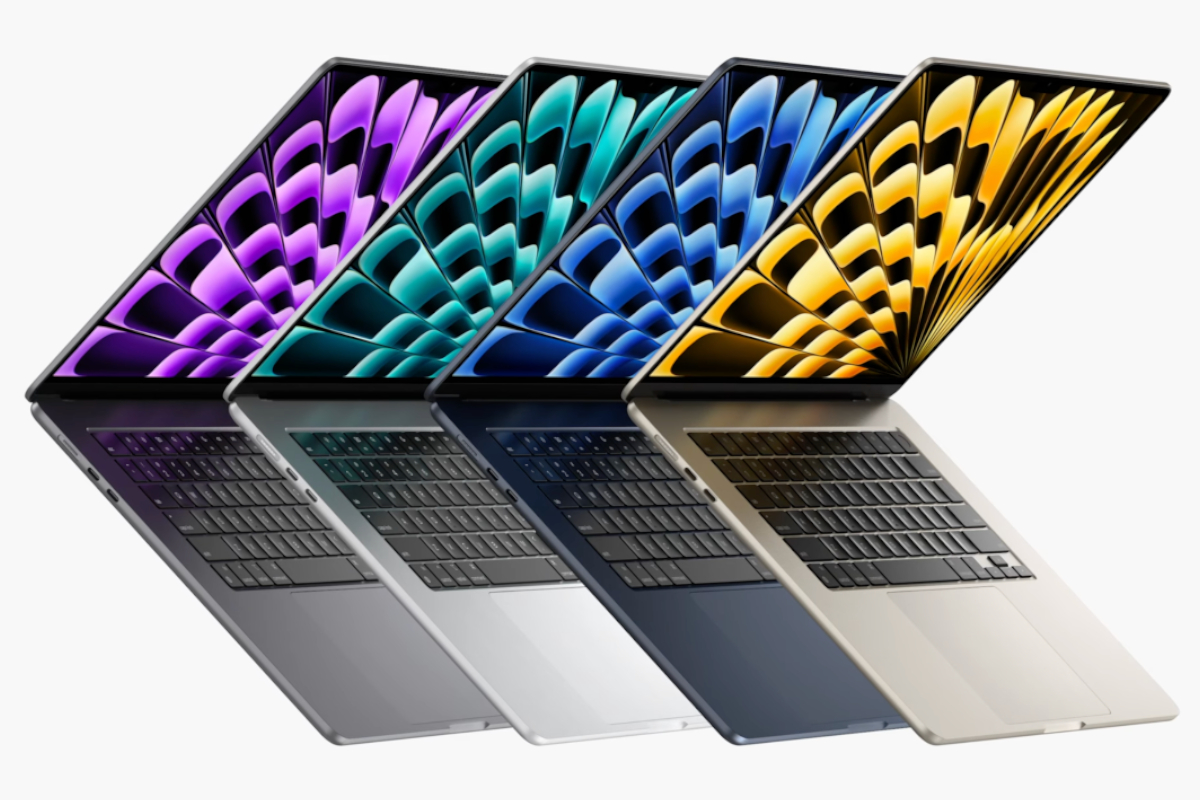

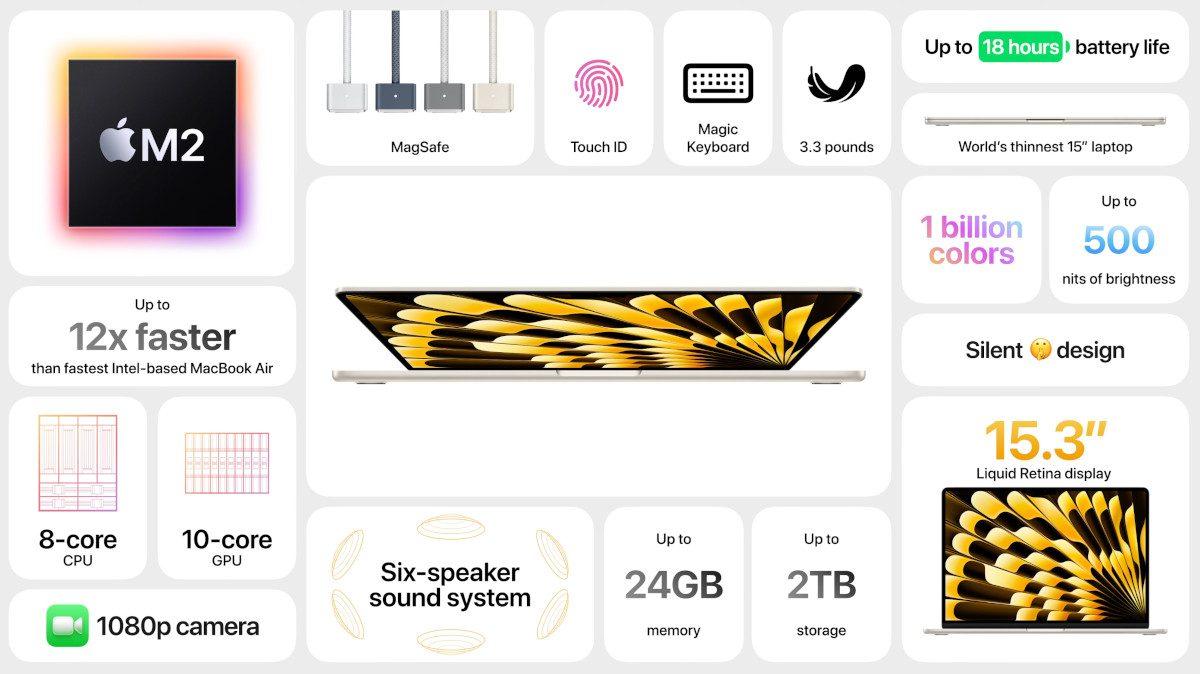

- The MacBook Air 15 with a thin and light profile but a bigger screen size could be an ideal option for content creators on the go.

- By bringing Apple Silicon to the Mac Pro, Apple has completed its transition from Intel, giving it more control over the hardware and software stack.

- Updates to iOS, iPadOS, macOS, and WatchOS bring minor improvements, but the personalization and interactive widgets show a more consistent approach to user experience across Apple products.

Applehosted its annual worldwide developer conference (WWDC 2023) at Apple Park, California, from June 5 to June 9, during which it announced exciting new hardware and software launches. These included fresh devices such as the newMacBook Air, Mac Studio Gen-2, and Mac Pro with M2 Ultra SoC, alongside the latest iOS 17, iPadOS 17, macOS Sonoma, tvOS 17, and WatchOS 10. However, the star of the show was Apple’s hotly anticipated mixed-reality headset, called the ‘Vision Pro’, which took our breath away.

Here is a quick recap of everything Apple announced at WWDC 2023.

Hardware announcements

Apple’s ‘Vision Pro’ mixed-reality headset is finally here

“One more thing…” – this has been synonymous with every major announcement that Apple has made over the past decade, and WWDC 2023 was no different. After months of leaks and rumors, Apple finally unveiled its “revolutionary” new product, the Vision Pro, along with itsmixed-realityplatform, the VisionOS. Apple has its sights on the next decade and beyond with the Vision Pro, which will be available for sale early next year.

cutti开拓空间计算的时代ng-edge Vision Pro is powered by an M2 processor along with a custom R1 co-processor for real-time processing. It features a micro-OLED display with 4K resolution per eye. It has 12 cameras, six microphones and five sensors to offer an immersive overall experience.

ALSO READ:Apple Thinking About the Next DecadeandBeyond with Vision Pro Announcement

Users can control the Vision Pro UI with their eyes, voice and hands. As the headset allows for video pass-through, you are not isolated, and you can still see and interact with the people around you. The cameras let you capture 3D photos so you can relive those moments later. You can also turn your laptop screen into a giant display, giving you an unlimited canvas, so you are no longer limited by a display. All your apps can be used anywhere, and you can even resize them. There are many amazing features that Apple demonstrated at WWDC and will continue to refine them ahead of the start of sales early next year. The Apple Vision Pro is priced at a whopping $3,499.

WATCH: Apple Vision Pro Mixed Reality Headset: Quick Look at Key Features

MacBook Air gets bigger, better and more powerful

Though WWDC is a software event, it was dominated by hardware announcements this year, starting with the Mac. The new MacBook Air 15 is incredibly thin at 11.5mm, with Apple claiming it to be the world’s thinnest 15-inch laptop. It weighs 3.3 pounds, and features two Type-C thunderbolt ports, MagSafe charging and a 3.5mm headphone jack. It comes with a 15.3-inch liquid retina display with thin bezels, 500 nits of peak brightness and one billion colors.

For video calls, the laptop includes a 1080p camera, three-array mics and six speakers so you can hear and be heard loud and clear. Under the hood is an M2 chip which Apple says is 12x faster than the Intel-based MacBook Air and is efficient enough to offer up to 18 hours of battery life. The new 15-inch MacBook Air starts at $1,299 ($1,199 for education) and will be available from the third week of June.

The 13-inch MacBook Air now starts at $1,099, making it cheaper than before by $100. Meanwhile, the 13-inch MacBook Air M1 retains its $999 price tag, giving users more choices when looking for a MacBook Air.

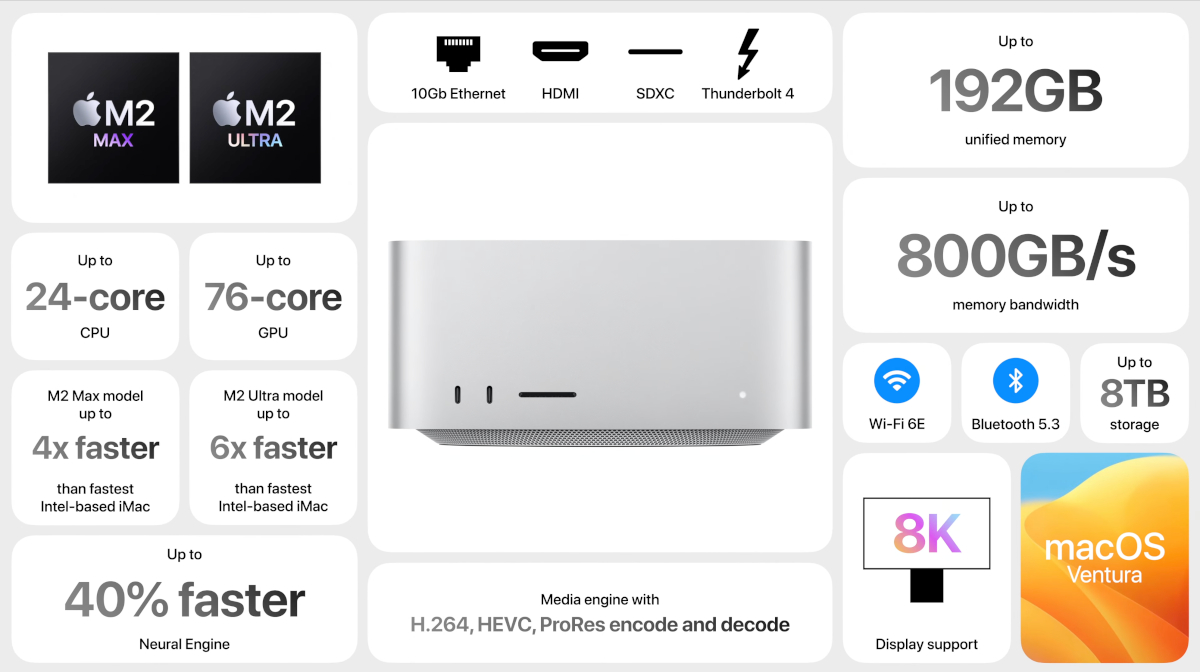

Mac Studio gets more powerful with M2 Ultra

The Mac Studio is loved by all types of creators, be it for editing photos, videos, podcasts or even presentations. It is now getting a big upgrade with the powerful M2 Max SoC, which Apple says is 25% faster than the previous M1 Max. Apple continued with the stats, saying video editors can now render videos 50% faster on Adobe After Effects.

Apple also announced the M2 Ultra SoC, which connects two M2 Max die together with ultra-fusion architecture to double the performance. It comes with a 24-core CPU to offer 20% faster CPU performance, and its 76-core GPU is 30% faster than M1 Ultra. There is also a 32-core Neural engine which is 40% faster than the previous generation. It supports 192GB of unified memory. Built on a 5nm process node, it has 134 billion transistors and 800GBs of memory bandwidth. The Mac Studio with M2 Ultra can support six pro display XDR monitors.

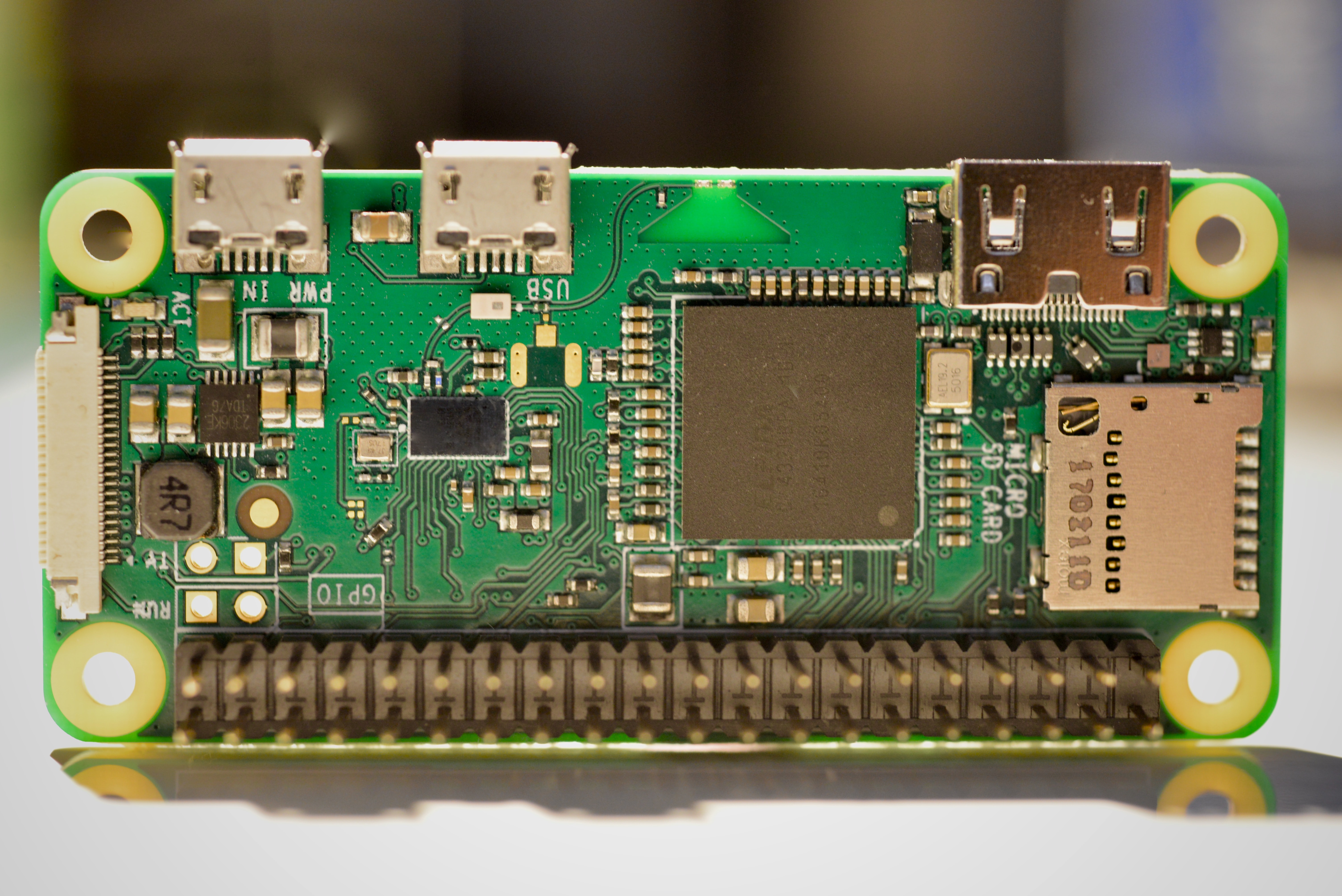

Apple Silicon comes to Mac Pro, completing the transition from Intel

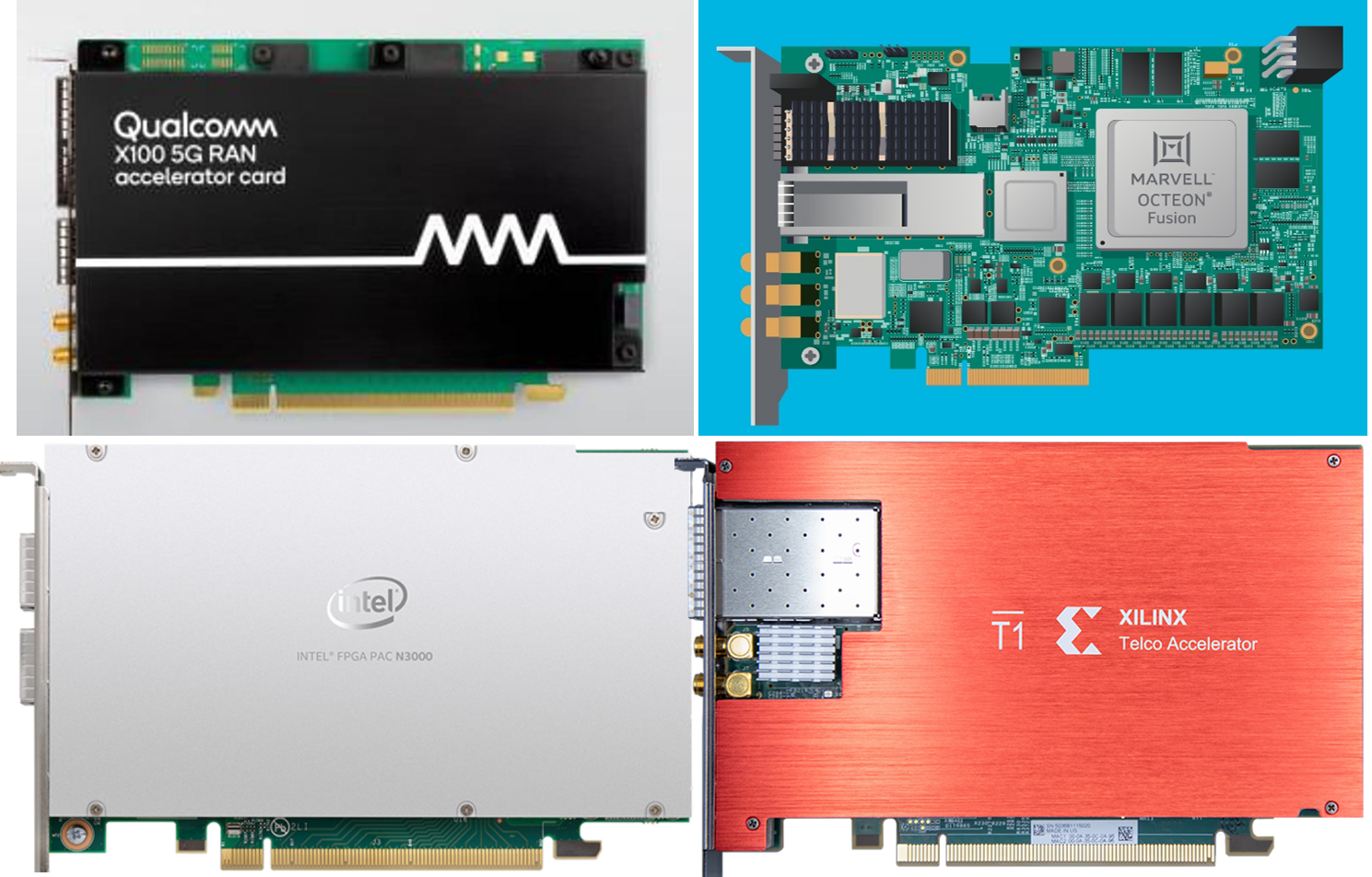

For those heavy and demanding workflows of film editors and sound engineers, Apple is bringing itsApple Siliconwith PCI expansion to the Mac Pro. This also completes the transition fromIntelto Apple Silicon. Powered by M2 Ultra SoC, the Mac Pro comes with eight thunderbolt ports – two on the front and six at the back. There are six PCI expansion slots too, allowing users to customize their Mac by adding audio/video IO, networking and storage.

The Mac Studio will start at $1,999 with M2 Max SoC, whereas the Mac Pro will start at $6,999. They will be available from the third week of June.

Software announcements

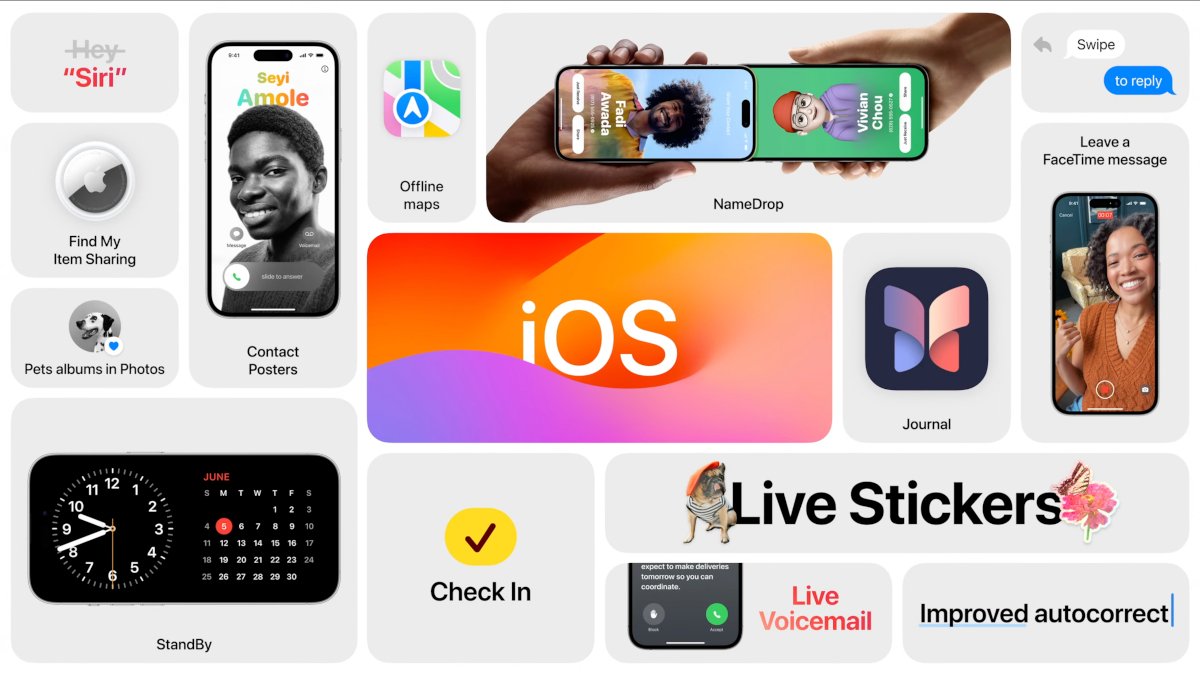

iOS 17 gets more personalized and intuitive

With the iOS 17, Apple is bringing new experiences, better communication and sharing to iPhone users. For Apple ecosystem users, Phone, iMessage and FaceTime are the three essential apps for everyday communication. The Phone app now comes with personalized contact posters where you can either have a photo or emoji. Apple also supports the vertical layout for Japanese text. And it is not just for calling, this new visual identity is also a part of the contact card for a more consistent experience.

The next feature is Live Voicemail, where you can see the transcription of the recipient. If you think it is important, you can answer right away. The feature is like Bixby text calls on Samsung smartphones. Apple is also bringing voicemails to FaceTime. When you call someone on FaceTime and they are not available, you can leave a video voicemail instead.

Messages now have search filters. So next time you start a search, include additional words to incorporate filters. This will help you find exactly what you are looking for. Now, there are times when you are in a meeting or traveling and there is a whole bunch of conversation that you missed. There is a new catch-up arrow on the top right which will let you quickly jump to the first message you haven’t seen.

Other key messaging features of the iOS 17 include:

- Swipe on the bubble for quick in-line replies

- Audio message transcription

- In-line location within the conversation

- Check-in to keep in touch with your loved ones

- Besides location, you can also share battery level and cellular service status

All the information shared with your family and friends is also end-to-end encrypted.

Next, Apple is also bringing a better Stickers experience. All the recently used stickers and memoji are now available in a brand-new drawer. You can even peel and stick emoji stickers in the conversation, and even rotate and resize them. These stickers are available systemwide, so you can use them with any app.

Apple is also changing the way we share contact details with someone new. A new feature called NameDrop lets you bring your phones closer and share phone numbers and other contact details with the person. The feature can be used with an iPhone and Apple Watch too. But that’s not all, you can now AirDrop content over the internet too.

还有一个新的圣andby mode. It can be activated by turning the iPhone in landscape mode while charging. It will turn your phone into a desk clock displaying the time, date, weather and alarm information at a glance. You can add widgets and even customize the screen with different clock styles to fit your needs.

Apple had made the assistant hot word even simpler, so instead of “Hey Siri”, now you can just say “Siri” followed by the command. And you can now use back-to-back commands like a conversation, without having to call “Siri” again and again. Lastly, Apple Maps can now be used offline by selecting an area and downloading offline maps. This can be very helpful when there is no cellular network.

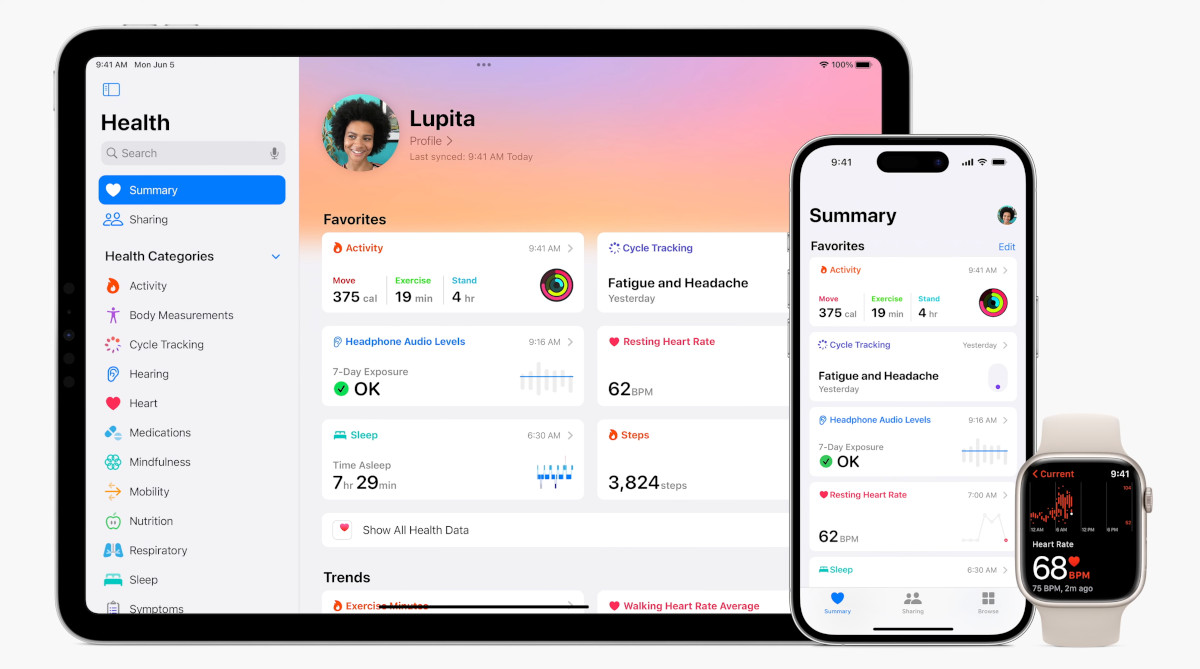

iPadOS gets more personalized with a lock screen and interactive home widgets

With the new iPadOS 17, Apple is adding interactive widgets through which you can carry out tasks without having to open the app. For instance, you can turn the lights on and off from the Home widget, or even play/pause music from the Apple Music widget.

Just like on the iPhone, you will now be able to customize the lock screen as well. From photos to astronomy to a kaleidoscope, there are a lot of options to choose from. On the left, you can also add multiple widgets to get more information at a glance on the lock screen.

The iPad is also getting Live Activities, allowing users to keep track of food with Uber Eats, travel plans with Flighty, live scores from the sports app, and more, all from the lock screen.

Taking full advantage of the large screen canvas, the Health app can show rich details of health-related activities like heart rate, steps, and more at a glance in one place.

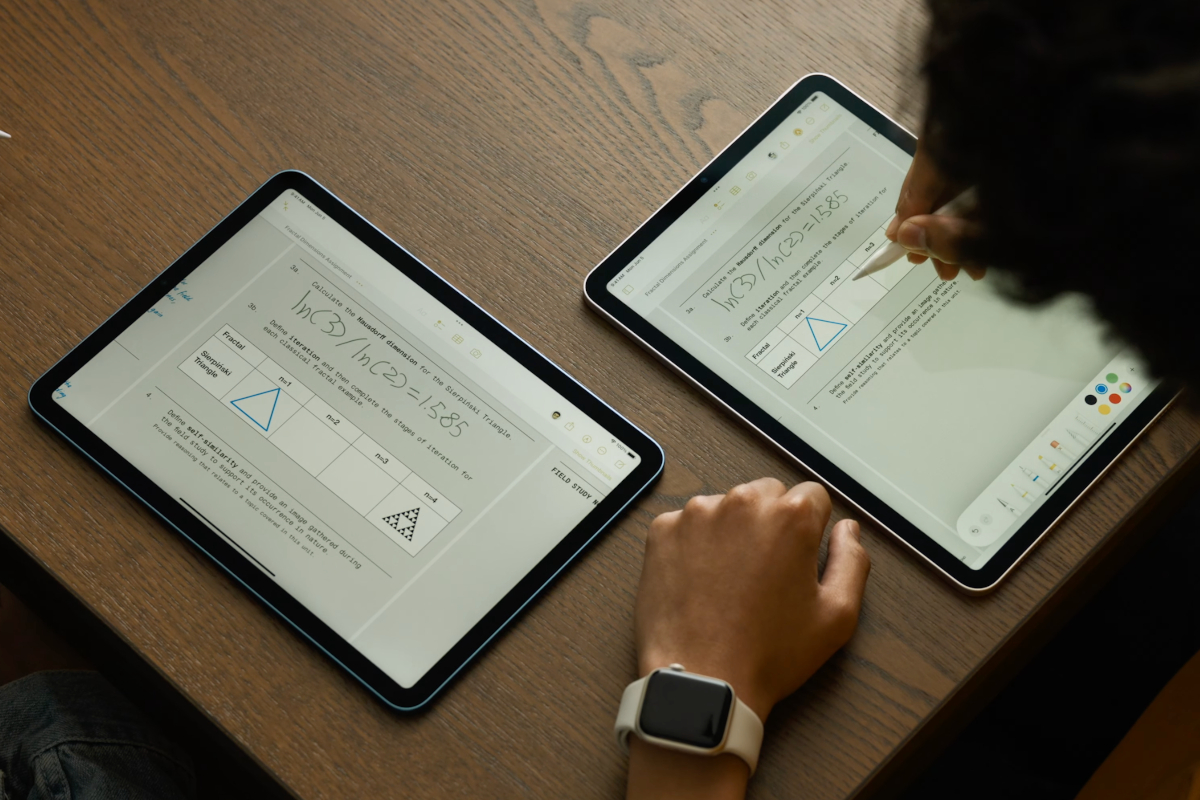

The iPadOS 17 can identify the fills in a PDF and add relevant details using autofill, like name, address, phone number and email. You can even add a signature to the document using Apple Pencil. Apple has also added a collaboration feature which can be helpful when working together. You can see each other’s updates in real time as you scribble.

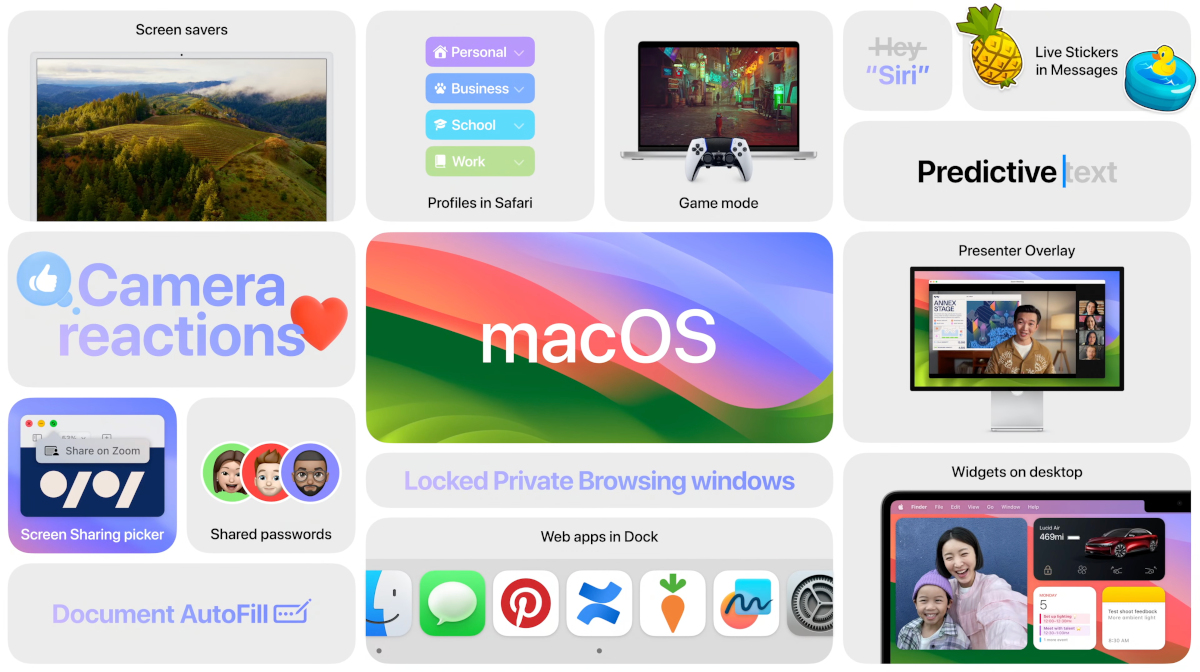

macOS Sonoma gets a new Gaming Mode and more

A lot of key features from iOS 17 and iPadOS 17 such as widgets, messaging and the “Siri” hot word are coming to macOS Sonoma. With the new update, Apple is bringing new screensavers, widgets that you can now move around that canvas and out from the notification center.

Apple is finally getting serious about gaming on the macOS and bringing “Game Mode” with the new OS update. It will prioritize CPU and GPU to optimize the gaming experience on Mac. Apple says it has also worked on reducing the audio latency when using AirPods, and input latency when using PlayStation or Xbox controller by doubling the Bluetooth sampling rate.

But what’s even more impressive is the “Game Porting Toolkit” where developers can quickly evaluate if their game can run well on Mac. The process earlier used to take months, but now with the toolkit, it can be completed in days, thus bringing down the development time.

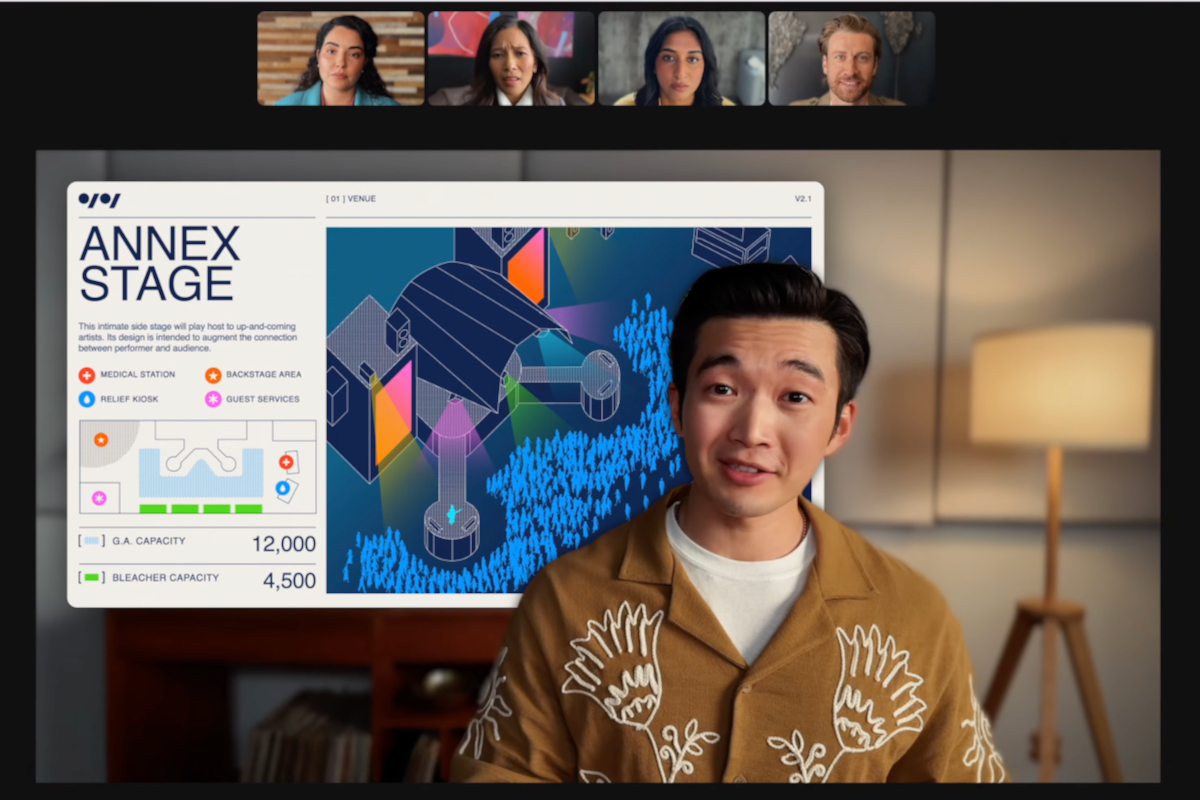

Another big feature is coming to help users when they are presenting remotely. Using the Apple Silicon and Neural Engine, you will get a new overlay option when doing remote presentations. It can be a small bubble showing your face or a large overlay where you can remain prominent in front of your presentation. But that’s not all, you can even add emoji reactions to your video stream, adding more fun to your video presentation.

Apple has been focusing on user privacy-related features and in the new macOS Sonoma, it is taking a step further with the Safari browser. The new features allow you to lock browser windows, block trackers and more. The new macOS also gains the ability to help you share your passwords and passkeys with your family. Lastly, there is also web app support, allowing you to quickly access your favorite sites.

watchOS 10 adds widgets for quick access and more

The watchOS 10 now allows you quick access to widgets in a smart stack by just rotating the crown from any watch face. Users can also add a widget that can hold their favorite complications like quick access to a stopwatch, music, or timer. Apps like World Clock get a new update with dynamic background colors reflecting the time of the day in that particular time zone.

When you wear theApple Watchand work out, the live activity will also be shown as a widget on the iPhone lock screen. Apple is also updating the Compass and Maps apps with a safety feature to help users that go hiking. The compass will generate two waypoints, with one of them being a cellular waypoint.

In case you move to an area with no cellular network, the newly generated waypoint will indicate the place you were in the reception area. We think it is a great addition as you can track back to the area where you had reception and make a phone call or send a text message to your family and friends.

There are many other features and improvements, apart from the ones mentioned here, that are coming to Apple Watch with the watchOS 10 update.

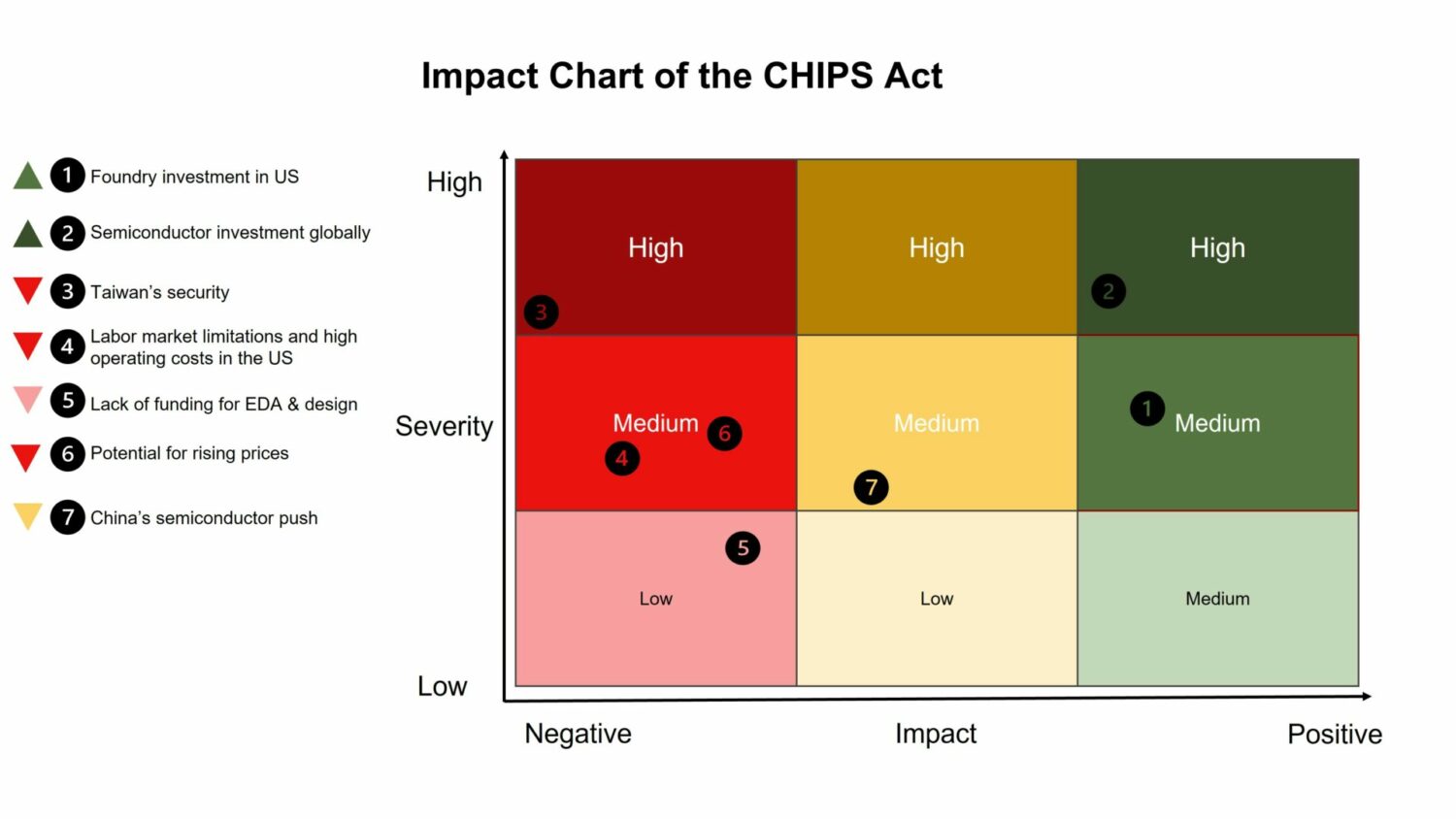

虽然有缺陷,但芯片的行为是一个主要的圣one to creating secure, resilient supply chains that will insulate the country from many outside shocks. This is a step in the right direction, but more must be done if the country wants to win the semiconductor manufacturing marathon and avoid fizzling out after the starting sprint.

虽然有缺陷,但芯片的行为是一个主要的圣one to creating secure, resilient supply chains that will insulate the country from many outside shocks. This is a step in the right direction, but more must be done if the country wants to win the semiconductor manufacturing marathon and avoid fizzling out after the starting sprint.