- BEVs accounted for 80% of EV sales in the US in 2022.

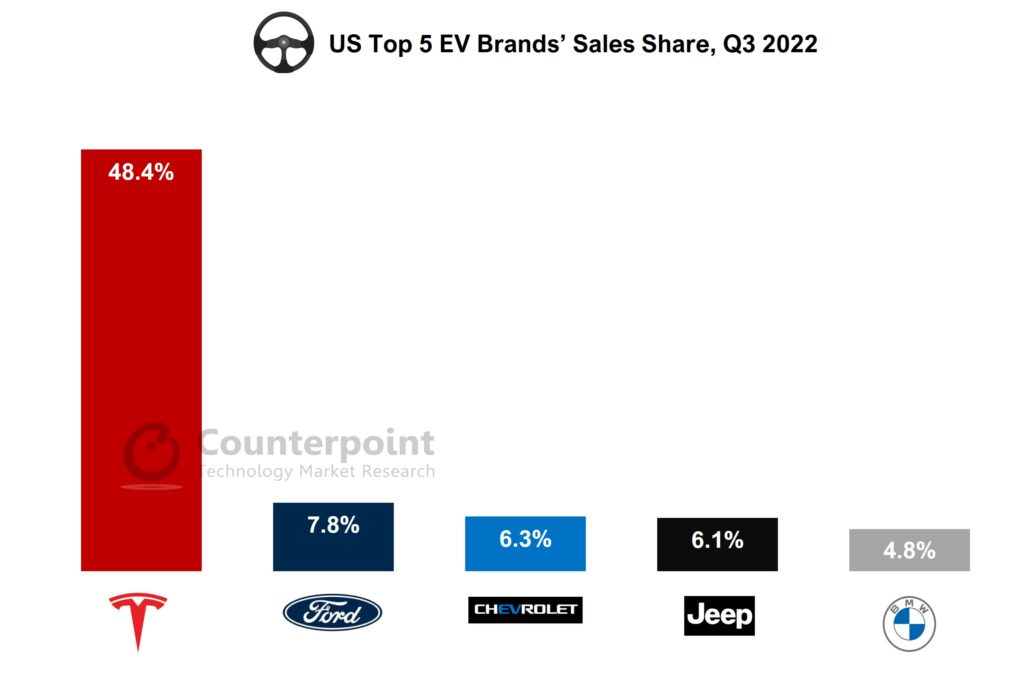

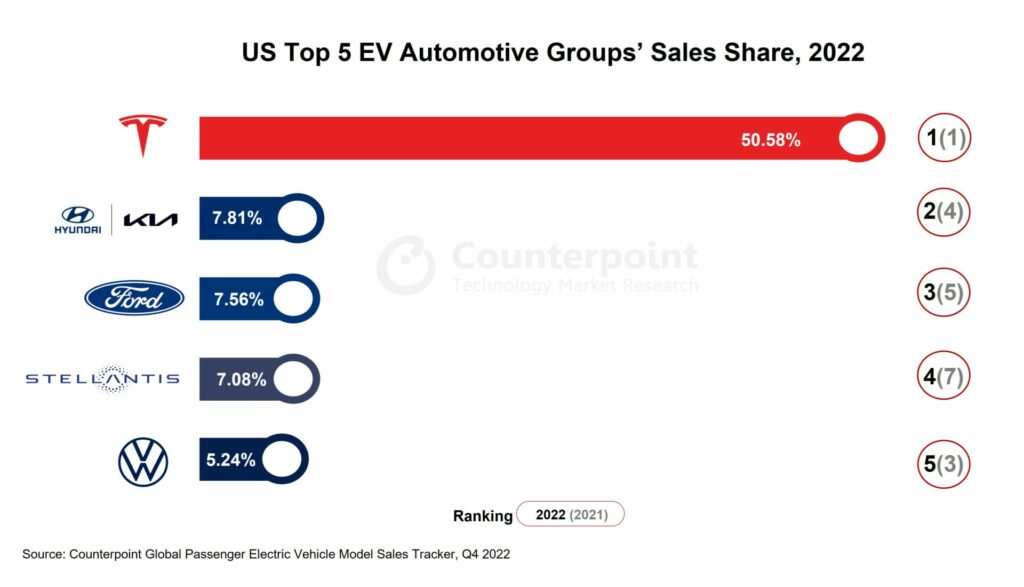

- In 2022, Tesla captured over 50% of the US EV market.

- EV sales are expected to exceed 1.9 million units in 2023.

New Delhi,London,San Diego, Buenos Aires, Hong Kong, Beijing, Seoul –April 4, 2023

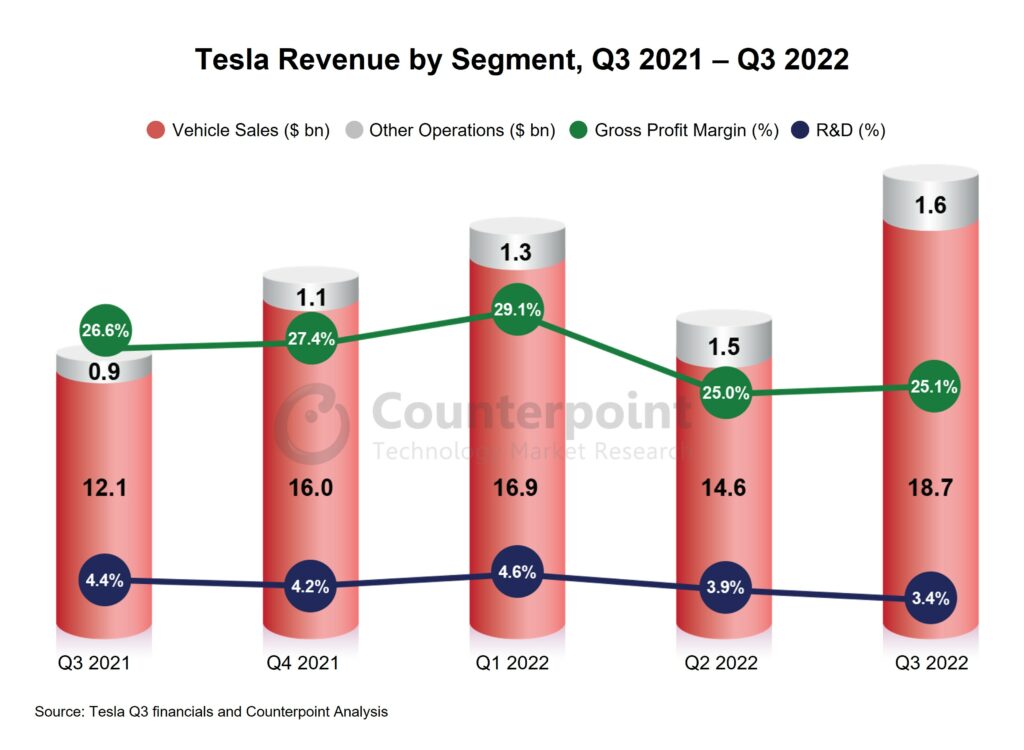

Passenger electric vehicle* (EV) sales** in the US grew 54.5% YoY in 2022, according to the latest research from Counterpoint’sGlobal Passenger Electric Vehicle Model Sales Tracker. Battery EV (BEV) sales grew by almost 70% YoY to account for more than 80% of allEV salesin 2022. Tesla remained the market leader in 2022 with more than 50% market share. Tesla sold more cars than the other17 automotive groupscombined.

Commenting on the market dynamics,Research AnalystAbhik Mukherjee说,“尽管乘用车总销量the US declined in 2022, EV sales increased to represent 7% of all US passenger vehicle sales.Teslais dominating the US EV market while other automotive giants likeFord,General Motors,Stellantis,VolkswagenandHyundaiare struggling to provide strong competition. But still, we are seeing new players likeLucidMotors,Karma,FiskerandVinfastentering the US EV space, underlining the market’s potential. Moreover, with the recentprice cutsby Tesla and all versions of Tesla’s Model Y becoming eligible for theEV tax credit subsidy, it is expected that Tesla will take an even higher market share.”

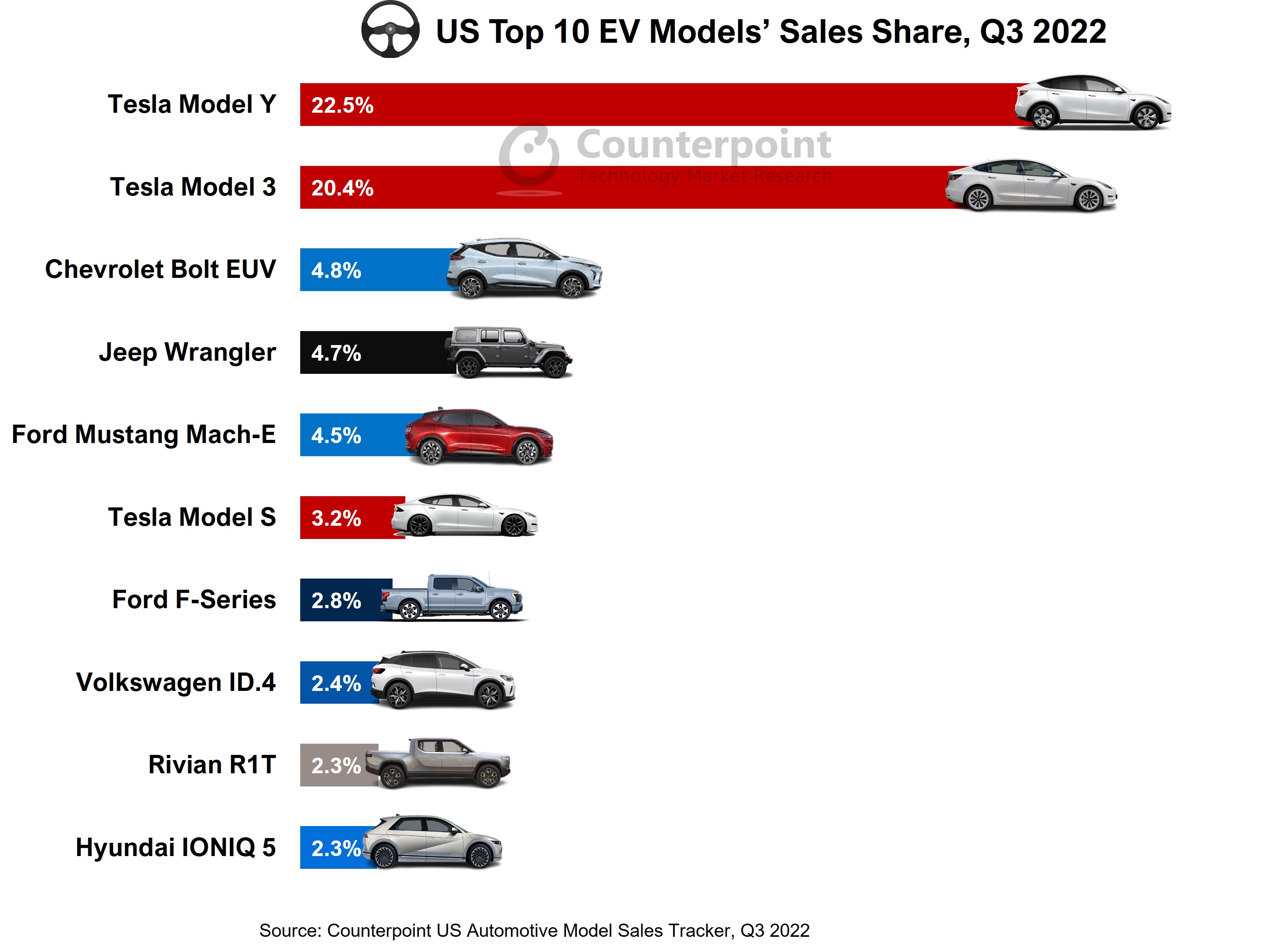

The top10 best-sellingEV models accounted for69%of total EV sales in the US. All four Tesla models were present in the top-10 bestseller list for 2022. Hyundai’s IONIQ 5 and Kia’s EV6 made a significant impact, entering the list within a year of their US launch.

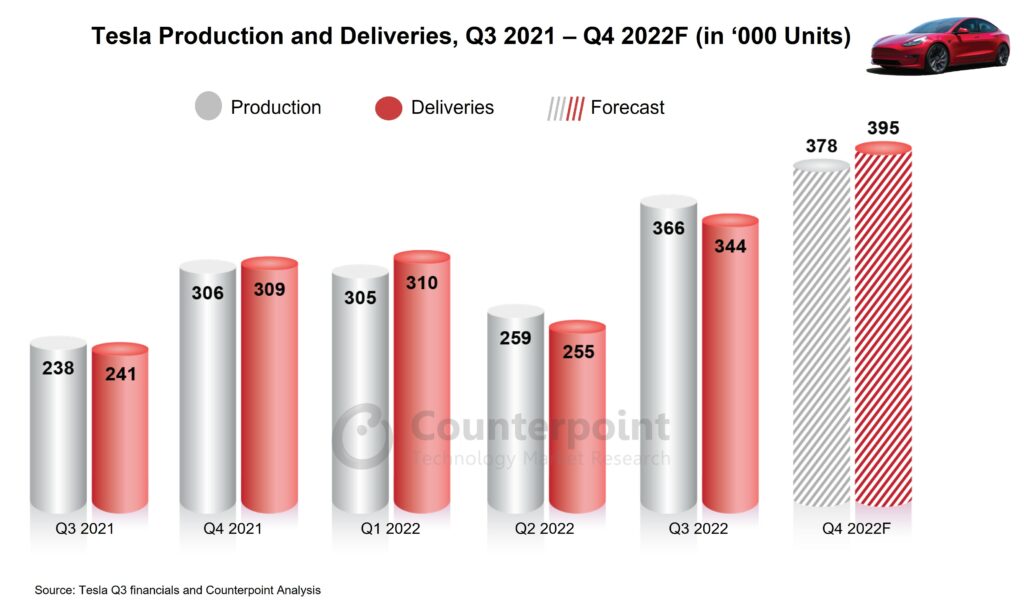

Discussing the market outlook,Research DirectorJeff Fieldhacksaid, “High interest rates due to macroeconomic pressures during 2022 negatively affected vehicle sales in the US. In2023, EV sales are expected to reach over1.9 million unitsbut only if economic headwinds do not severely impact the market, like in 2022. With automotive OEMs and battery manufacturers joining hands to set up battery manufacturing plants across the US, the battery supply chain is expected to become smoother and component costs will moderate, making the potential US EV market greater than10 million per year by 2030.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Abhik Mukherjee

Abhilash Gupta

Soumen Mandal

Jeff Fieldhack

Peter Richardson

Counterpoint Research

相关的帖子

- Global Passenger Electric Vehicle Market Share, Q1 2021 – Q4 2022

- Electric Vehicles Gain Ground in Southeast Asia; Thailand Dominates Volumes

- One in Four Cars Sold in China in 2022 Was an EV With BYD Powering Country’s Outperformance

- Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground

- Global Electric Vehicle Sales Crossed 10 Million in 2022; Q4 Sales up 53% YoY

- AI Voice Assistants to Push Success of Autonomous Driving, Software-defined Vehicle

- Thailand Leads Southeast Asia EV Market With 60% Share

- China EV Charging Points Soar 56% YoY in 2021; 42% CAGR Seen for 2022-2026

- One in Two Cars Sold Will Have Electric Powertrain by 2030

- ADAS Penetration Crosses 70% in US in H1 2022, Level 2 Share at 46.5%

- LiDAR Now High on Automotive Industry Radar