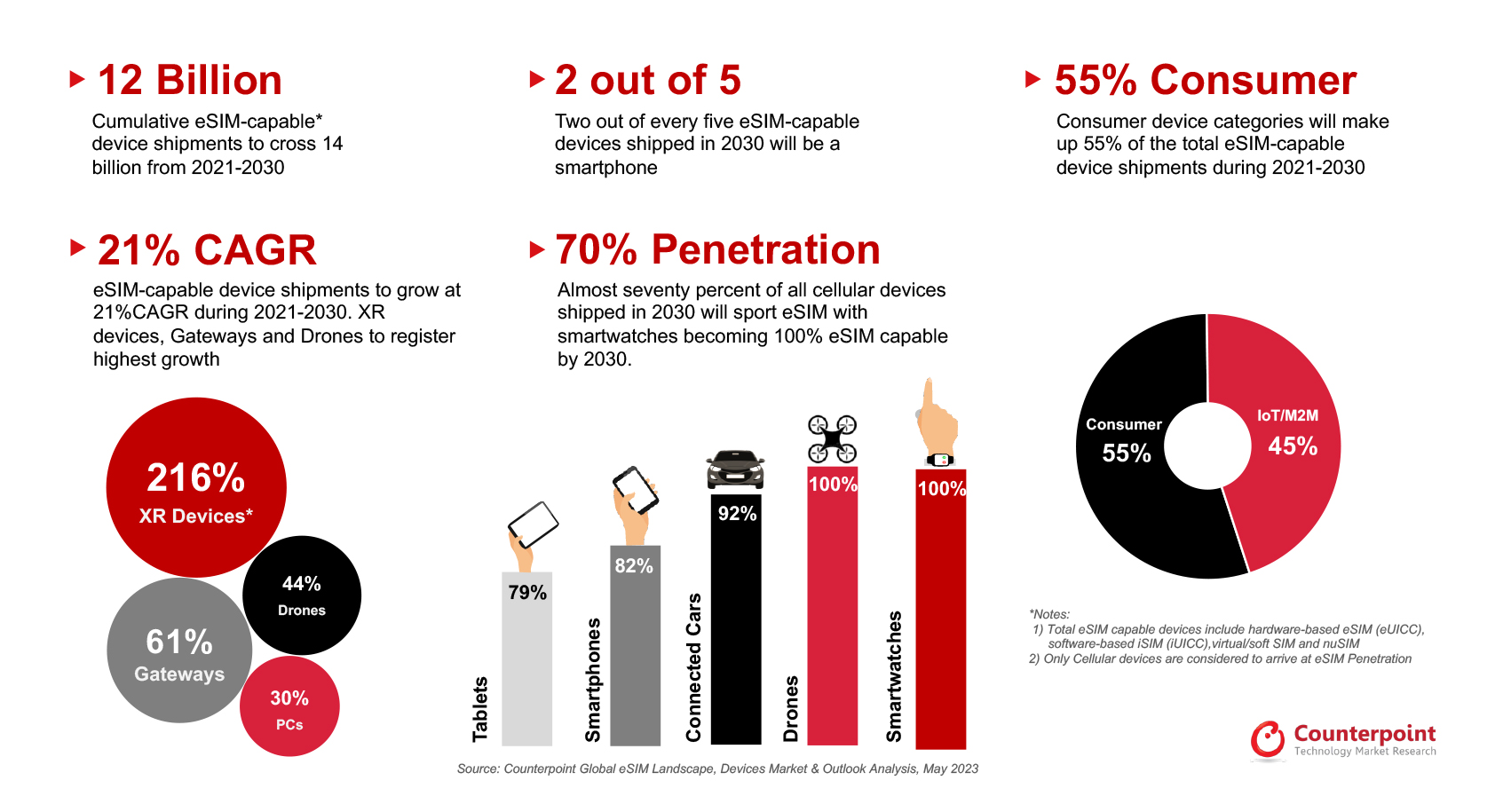

- More than 6 billion xSIM (eSIM + iSIM) devices will be shipped over the next 5 years.

- 70% of all cellular devices shipped in 2030 will sport an eSIM.

- iSIM (iUICC) will grow fastest. It will become the preferred SIM form factor by 2030 for all cellular categories.

- 智能手机仍将是主要推动目前ry, more than 40% of all xSIM devices will be eSIM.

New Delhi, Seoul, Hong Kong, Beijing, London, Buenos Aires, San Diego –June 5, 2023

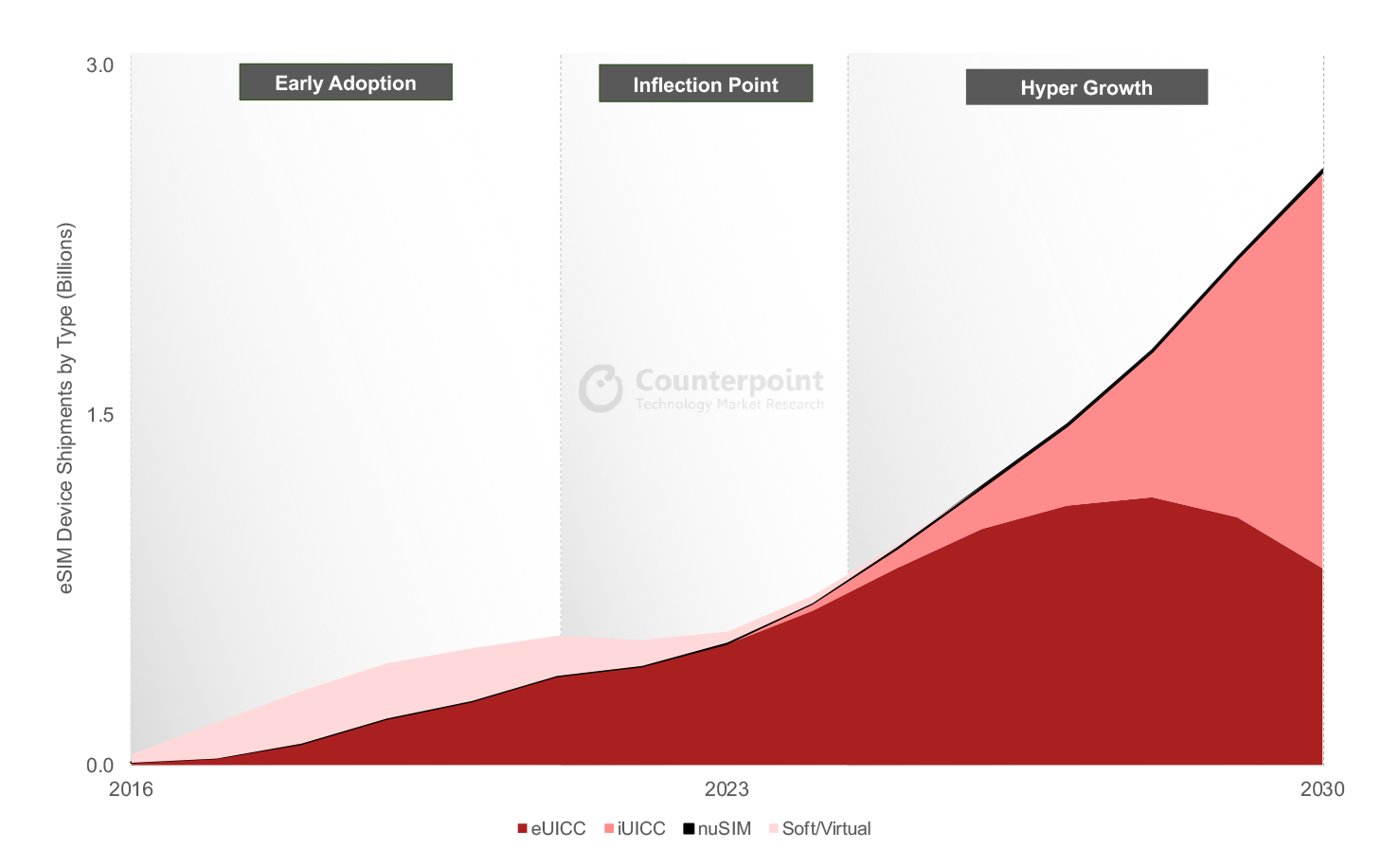

More than 6 billion xSIM-capable devices will be cumulatively shipped over the next five years, covering all form factors including hardware-based eSIM (eUICC), iSIM (iUICC), nuSIM and Soft SIM, according to Counterpoint’s latesteSIM Devices Market Outlookreport.

eSIM adoption has passed theinflectionpoint and is now entering a high-growth phase, driven by the rising adoption of eSIM in smartphones,connected vehiclesandcellular IoTapplications. The next phase of growth will be driven by greater awareness of eSIM among mobile network operators (MNOs) and device manufacturers, facilitated by the flexibility, cost efficiency, security, cost savings and above all, the key role eSIM is playing in the digital transformation of MNOs.

In 2022, eSIM-capable device shipments grew 11% YoY to reach 424 million units despite a 3% YoY fall in overall cellular-connected device shipments due to weaker demand forsmartphones. Globally, more than275 MNOssupport eSIM and provide connections to 30+ different eSIM-capable consumer device models on average. Furthermore, the number of cellular IoT modules and devices is continuously growing.

Commenting on the outlook for xSIM-capable device shipments,Research Vice President Neil Shah said,“The physical MFF2/WLCSP form-factor soldered eSIM chip has been the go-to standard for eSIM implementation alongside the other niche alternative implementations such as soft SIM and nuSIM. Over the next five years, hardware-based eSIM (eUICC) will remain the dominant eSIM form factor and will account for more than half of all shipments.”

“The first wave of mainstream iSIM adoption will be seen across IoT applications driven by leading IoT chipset and module players such as Quectel, Telit, Sequans and Sony Semi (Altair) in partnership with leading xUICC players likeKigen,G + DandThales. Other key stakeholders driving the adoption of iSIMs would include Qualcomm, IDEMIA, Truphone, Redtea Mobile, Oasis SmartSIM, Apple, Samsung and Nokia. Beyond 2028, iSIM is projected to take over as the dominant SIM form factor, with the shipments of iSIM-capable devices poised to climb to a cumulative 4 billion units by 2030.”

eSIM Has Reached an Inflection Point, Set to Enter a Period of Hyper-Growth

Source:Global eSIM Landscape – Market Outlook and Forecast

Commenting on eSIM adoption across different device categories,Senior Analyst Ankit Malhotrasaid, “Smartphones have been key in driving primary eSIM awareness among consumers and MNOs, and will continue to be the dominant eSIM-capable device category. Cellular connectivity in smartwatches is growing steadily which is also helping increase the penetration of eSIM-supported smartwatches. The adoption of entitlement servers by MNOs worldwide is a testament to the growing number of smartwatches and other companion devices powered by eSIM. Other cellular-capable consumer devices such as laptops and tablets will also see rapid eSIM adoption in the coming years.”

“The number of IoT/M2M devices equipped with eSIM is poised to grow faster than consumer device categories due to the natural cost, space and remote device management benefits that eSIM offers. The new eSIM IoT specifications SGP.31 by GSMA will accelerate eSIM adoption in the IoT segments potentially eradicating complexities of the existing eSIM Remote Service Provisioning (RSP) platform SM-DP/SM-SR for M2M/IoT segments.”

eSIM Devices Forecast and Analysis

Emerging device categories such as XR, drones and cellular gateways/FWA CPEs will be the fastest-growing categories. 5G-connected drones are another category that will benefit from eSIM technology and drive adoption across several use cases like last-mile delivery, disaster management, search and rescue, education, construction and agriculture. Regulation of beyond-visual-range drones in regions such as Europe will increase the adoption of eSIMs as well.

Automotive and smart mobility are huge growth areas as well. Connected cars are one of the largest and most obvious use cases for eSIMs. Consistent connectivity experience for mobility applications is becoming paramount, particularly for safety use cases such as eCall and the future rise of autonomous driving.

The comprehensive and in-depth report ‘Global eSIM Landscape’ is nowavailable. Please contact Counterpoint Research to gain access to the report.

Clickhereto read abouteSIM Enablement,eSIM ProvisioningandeSIM Orchestration.

Background

市场研究是一个世界人口对位技术l research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Ankit Malhotra

Neil Shah

Counterpoint Research

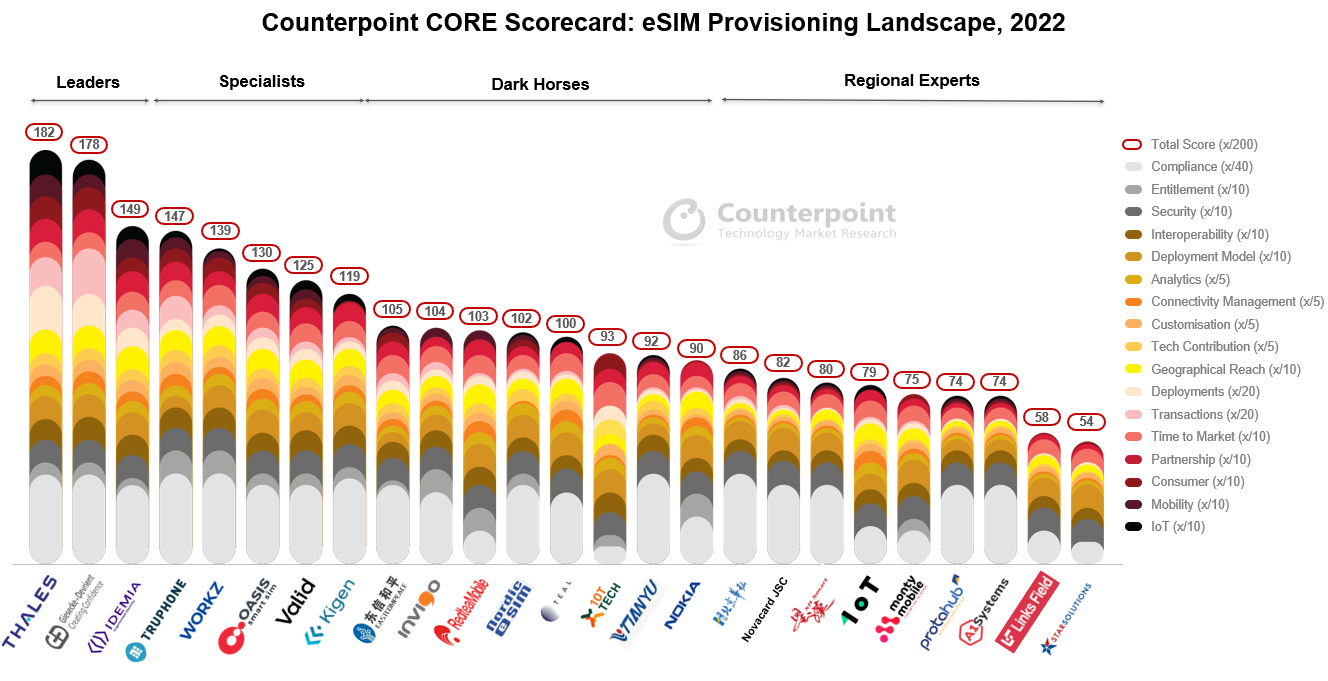

Source:eSIM CORE (Competitive, Ranking and Evaluation) Scorecard and Analysis, March 2023

Source:eSIM CORE (Competitive, Ranking and Evaluation) Scorecard and Analysis, March 2023