- LG led the global TCU market in 2021, followed by Continental and Harman.

- US, China and Germany were the top three geographies in the global TCU market.

- 5G is still a niche segment, capturing less than 1% of global TCU volumes.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul – April 7, 2022

Global telematics control unit (TCU) shipments grew 13% YoY in 2021, according to the latest research from Counterpoint’sGlobal Telematics Control Unit Tracker. This growth came despite the COVID-19 outbreak andsupply chainshortages, and was driven by the rising penetration of connected cars and the consumer preference for digital features. Moreover, favourable government policies such as eCall mandates are also helping this market to grow. The global ASP (average selling price) of TCUs increased slightly in 2021 due to the rising cost of 4G chipsets. We expect the supply situation to remain constrained through much of 2022.

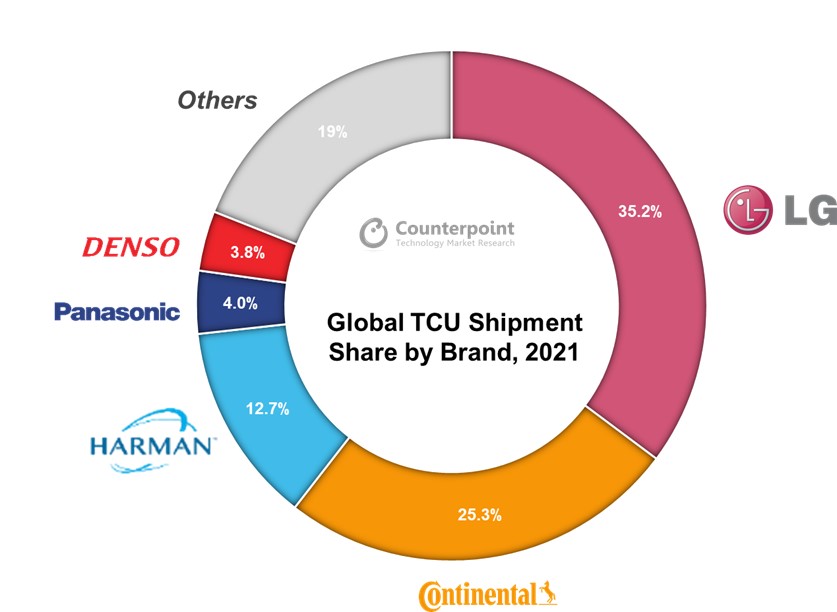

Commenting on the market dynamics,SeniorResearch AnalystSoumen Mandalsaid, “LG leads the global TCU market, followed by Continental and Harman. These top three players account for nearly three-quarters of the market.

LG’s TCU shipments grew 19% YoY in 2021. Its close relationships with GM and Volkswagen in the Chinese andUSmarkets are helping LG maintain its leadership position. LG is leading across all major regions except Europe.

Continental,the second-largest TCU player, has a good hold on the European market, especially Germany, France and UK. However, it lost around 2% market share in 2021 compared to 2020. Continental launched 5G TCUs in early 2022 to target 5G opportunities in the automotive sector. We expect this to help Continental regain share in the coming quarters.

Harman,第三大的球员,主要集中在luxury car market. It is already offering 5G TCUs with leading premium brands. Harman’s expertise in the automotive industry and its strong distribution channels via Samsung will likely help it to win more deals and improve its position.

Among other brands, Denso and Visteon made big improvements in the TCU brand ranking list for 2021. The partnerships between Denso and Toyota, and Visteon and Ford are proving beneficial for these brands.”

With technology transitions, 2G and 3G are unable to meet the data demands of cars. And with especially 3G being phased out, 4G and 5G are becoming the only viable options. Currently, more than 90% ofconnected carsare using 4G TCUs. However, 4G is reaching maturity. We have already seen a few 5Gchipsets,NADmodules and TCU launches in 2021. We expect more cars will be equipped with 5G connectivity this year. Moreover, increasing penetration of autonomous vehicles and C-V2X deployment will help in 5G adoption as well.

Looking at connectivity trends,Research AnalystMohit Sharmasaid, “As we move to higher levels ofautonomy, the amount of data generated byADASsensors will surpass 400MB/s. To process all this data, high processing power will be required. In addition, more sophisticated AI algorithms will be required along with large volumes of data storage. The industry has to shift to 5G for cloud computing. 5G will provide more than 30 times faster data speeds and promises to reduce latency by 10 times.”

Autonomous vehicles, connected cars andelectrificationare the main trends shaping the future of mobility. Connectivity will be the backbone of these systems. OEMs are enhancing existing connectivity services like infotainment and OTA software updates while adding newer services like custom entertainment packages and insurance. Automakers are pushing connected services to diversify their revenue streams and more closely understand the overall customer behaviour to improve their car’s performance and services.

On future perspective,Associate DirectorBrady Wangsaid, “Global TCU shipments are expected to grow at a CAGR of 15% during 2020-2025. In terms of value, the TCU market will grow more than twofold to reach $7 billion by 2025. The rising penetration of higher-priced 5G TCUs is one of the major reasons for this huge growth. In terms of shipments, 5G will be the fastest (206%) growing technology during the forecast period.”

For detailed research, refer to the following reports available for subscribing clients and also for individual subscription:

- Global Telematics Control Unit Tracker, Q1 2019-Q4 2021

- Global Telematics Control Unit Forecast, 2019-2025F

Counterpoint tracks and forecasts on a quarterly basis 10+ TCU brands’ shipments, revenues and ASP performance across 4 cellular technologies and 10 major geographies.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Soumen Mandal

Brady Wang

Mohit Sharma

Counterpoint Research

press(at)www.arena-ruc.com

Related Reports:

- Smart Mobility Intelligence Tracker, February 2022 Edition

- Global Connected Car Tracker, Q1 2019 – Q4 2021

- Global Connected Car Forecast, Q1 2019 – 2026F

- Global Automotive NAD Module and Chipset Tracker, Q1 2018 – Q4 2021

- Global Automotive NAD Module and Chipset Forecast by Technology, 2018 – 2025

- Global Automotive NAD Module Market Analysis, Q3 2021

- Indian Automotive Electronics Market to Triple by 2027

- Global Connected Car Installed Base, 2021

- Global Cellular IoT Module Forecast, 2018 – 2030

- Global Cellular IoT Chipset Forecast, 2018 – 2030

- Global Cellular IoT Module and Chipset Tracker by Application, Q1 2018 – Q4 2021

- Global Cellular IoT Module and Chipset Tracker, Q1 2018 – Q4 2021

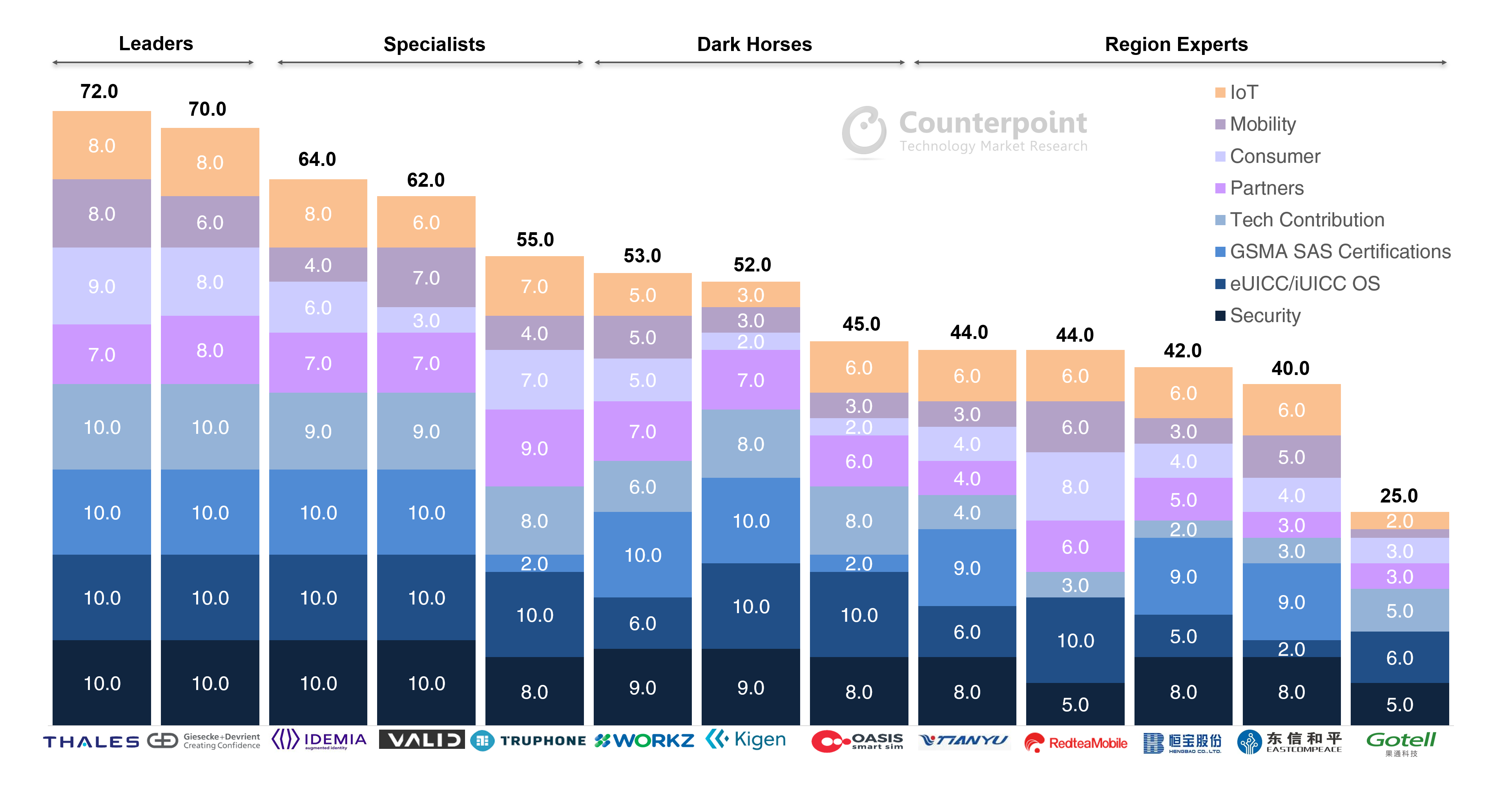

Source:eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

Source:eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020 Source:eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

Source:eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020