With the time spent on console games, home entertainment and online education increasing against the backdrop of COVID-19, AR/VR devices are drawing more attention. Development of a killer consumer application is the key to theXR market’s growth. But prior to that, improvements are needed on the hardware side. Technical barriers and inconvenience in wearing AR/VR headsets remain. Therefore, R&D needs to be ramped up in this direction to minimize limitations in use.

Limits to AR/VR displays

AR/VR headsets should be good enough for an immersive experience. Also, they should be light in weight so that they can be worn for a long time. Further, AR/VR devices released so far may cause eye strains due to the low resolution of the displays. Also, low refresh rate delays screen updates, causing dizziness just by using it for a short time.

Technical requirements for AR/VR displays

- Fine Pixel Size

- High Refresh Rate

- High Resolution

AR/VR display must first be made to a very fine pixel size for accurate color and image reproduction. Also, a high refresh rate is important for AR/VR displays. Smartphones must have a high refresh rate of at least 120Hz to reduce motion blur on video, but even the most recent AR/VR devices, like the Oculus Quest 2, have a 72Hz refresh rate, which is far short and must be at least 120Hz. Resolution is also important. The average resolution of OLED smartphones is 550 ppi but AR/VR devices require about 3,500 ppi because they feature near-eye displays.

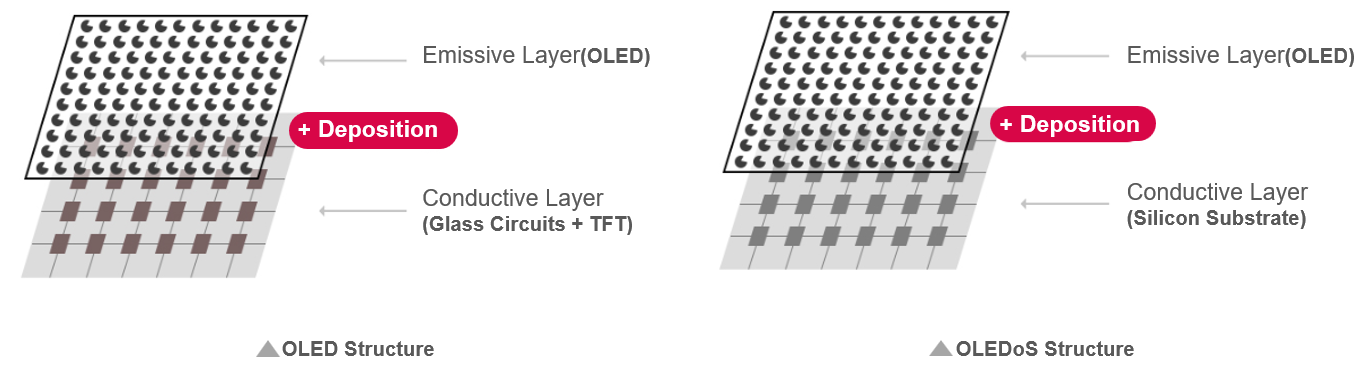

OLEDoS: Solution for ultra-high resolution

OLEDoS (OLED on Silicon) is a display panel that typically has a diagonal length of less than 1 inch and meets the 3000 ppi-4000 ppi resolution criteria of AR/VR device displays. Existing OLED displays use Low-Temperature-Poly-Silicon (LTPS) or Oxide TFT based on glass substrates. But OLEDoS uses silicon-wafer-based CMOS substrates. Using silicon substrates, ultra-fine circuit structures typically used in semiconductor processes can be reproduced, which in turn lead to the creation of ultra-high-resolution OLEDs when organic matter is deposited on them.

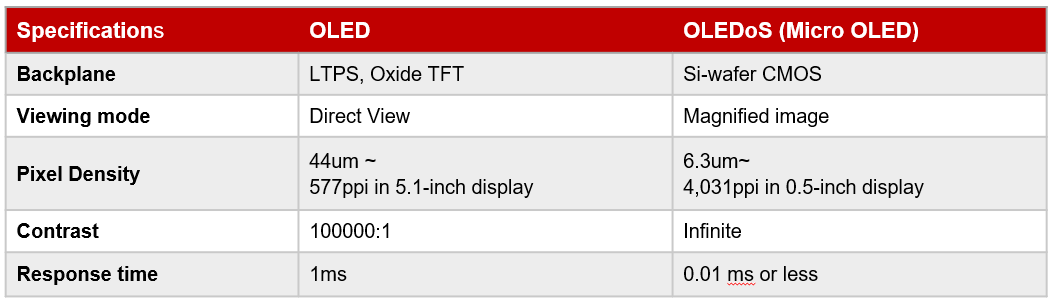

Specifications of OLED and OLEDoS

OLEDoS is also called Micro OLED in the market and features high efficiency, high luminance, infinite contrast, fast response and long LED life compared to OLED. Because the size is smaller than 1 inch, the user does not see the panel directly but sees the enlarged image through the optical lens. When used on AR/VR equipment, it shows high resolution in a small, lightweight wearable device.

Apple is also likely to install OLEDoS in its second-generation AR/VR product which is expected to enter the market around 2025. In addition, it is expected that augmented reality that meets the above technical conditions will be implemented as Meta is likely to install OLEDoS in its Meta Quest 3 device, expected to be released in 2023.

OLEDoS expected to achieve 28% share in 2025

Currently, OLEDoS faces high market entry barriers. This is because the technology is yet to ripen fully. The cost of production of the semiconductor substrate remains high even as the related value chain is yet to be completely formed. However, with Apple and Meta expected to introduce OLEDoS-based AR/VR equipment in the next two to three years, many manufacturers would actively adopt OLEDoS. More production will result in a lower per-unit cost, prompting more demand and increasing the share of OLEDoS to nearly one-third of the market by 2025.

Next big supplier of AR/VR displays

It is expected that two OLEDoS displays will be installed inside Apple’s first headset, and Sony will be the first supplier this time. LG Display is expected to supply general OLEDs that are applied to the external indicators. In the long run, however, Apple is expected to choose LG Display as a supplier of OLEDoS over Sony. Although Sony’s technology is somewhat ahead now, the company has its own gaming console, making it a potential competitor to Apple in the XR market, where having a killer application is the key. Once Apple enters the XR market, it is expected to grow at a rapid pace while Samsung Display is expected to catch up with arch-rival LG at a rapid pace. Once again, we will be able to see the fierce race between SDC and LGD in the XR market.